Winegrape Supply and

Market Outlook

Jeff Bitter

Allied Grape Growers

May 7, 2014

Allied Grape Growers, 2014. All rights reserved.

Today’s presentation utilizes information

obtained via Allied Grape Growers’ (AGG)

annual Nursery Survey combined with

critical evaluation of reports and data made

available by the State of California. Wine

shipment data is courtesy of the Gomberg

Fredrikson Report. AGG’s internal

operations data along with numerous pieces

of anecdotal evidence was also used in the

formulation of conclusions.

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions…….

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #1:

How did the 2013 crush size up?

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

How did the 2013 crush size up?

California Production

Statewide Grape Crush 2005-2013

Tons

(in Millions)

5.00

4.39

4.33

4.09

4.50

3.67

3.67

3.67

3.49

4.00

3.50

3.98

4.02

3.76

3.70

3.14

3.00

3.25

4.69

3.58

4.23

3.34

3.06

2.50

2.00

1.50

1.00

0.50

0.00

2005

2006

2007

2008

Other Crush

2009

2010

2011

2012

2013

Winegrape Crush

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

How did the 2013 crush size up?

A regional look at production, stated in tons crushed

Region

North Coast

Central Coast

Lodi/Clarksburg

Central Interior

Other

Total

2013

583,012

588,399

942,546

2,025,989

90,621

4,230,567

% Change

Three-Year

from 2012

Average

1%

518,760

7%

508,036

3%

847,038

8% 1,904,643

1%

85,353

5% 3,863,831

Allied Grape Growers, 2014. All rights reserved.

% Above

Average

12%

16%

11%

6%

6%

9%

Answering Some Key Industry Questions

How did the 2013 crush size up?

A look at average yields statewide

Average

Winegrape

Yield

Crop

Year

Winegrape

Tons Crushed

or Projected

AGG Estimated

Bearing

Winegrape Acres

2009

3,703,031

495,000

7.48

2010

3,588,985

505,000

7.11

2011

3,342,689

515,000

6.49

2012

4,018,237

530,000

7.58

2013

4,230,567

545,000

7.76

Average per acre yield from 2009-2013:

7.28

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #1:

How did the 2013 crush size up?

Answer:

Clearly larger than recent

averages, in total production as

well as in per acre yields

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #2:

How many acres do we really have?

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

How many acres do we really have?

Range of Potential California Winegrape

Acres Planted (Current Year 2013/2014)

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

-

Three Years

Ago

Two Years One Year Ago Currently

Ago

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

How many acres do we really have?

State Reported

State Estimated

DPR Permitted

AGG Estimated

2014 AGG Estimate

2013 Acreage Data Comparison

Bearing

Non-Bearing Total

469,062

25,131

494,192

525,000

45,000

570,000

N/A

N/A

620,837

545,000

75,000

620,000

555,000

90,000

Allied Grape Growers, 2014. All rights reserved.

645,000

Answering Some Key Industry Questions

Question #2:

How many acres do we really have?

Answer:

Much more than the state has

historically reported or estimated

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #3:

What are growers planting today?

(other than almonds)

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

What are growers planting today?

29%

White

2013 Winegrape Vines Sold by California Nurseries

Chardonnay

13.7%

Cabernet

Sauvingon

29.4%

Pinot Grigio

5%

71%

Red

French Colombard

6%

Muscat

Alex/Canelli

1.4%

Sauvignon Blanc

<1%

Other White

2%

Other Whites Include:

Gewurztraminer

Riesling

Viognier

Other florals

Other Red

6%

Petite Verdot

Rubired

2%

2.7%

Merlot Petite Sirah

5%

3.5%

Zin/Primitivo

10%

Pinot Noir

12.5%

Allied Grape Growers, 2014. All rights reserved.

Other Reds Include:

Grenache

Cab Franc

Syrah

Malbec

Tannat

Answering Some Key Industry Questions

Question #3:

What are growers planting today?

(other than almonds)

Answer:

Cabernet Sauvignon….

and a few other varieties

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #4:

What about the drought?

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

What about the drought?

Drought impacts different regions in different ways:

•North Coast

•Central Coast

•Northern San Joaquin Valley (Lodi)

•Central and Southern San Joaquin Valley (east side)

•Central and Southern San Joaquin Valley (west side)

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

What about the drought?

Viticulturally, what does it mean for 2014 and beyond?

•Functional root zone reduction (root flush minimized)

•Potential for bud necrosis

•Restricted spring growth

•Nutrient deficiencies and/or toxicities

•Potential lack of frost protection

•Vine stress, increased pest and disease pressure

•Water quality concerns

•Potential canopy/crop load reduction

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #4:

What about the drought?

Answer:

The drought will undoubtedly cause

concern and loss for California

winegrape growers. Production will

likely be negatively impacted.

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #5:

Will our domestic supply depress

import growth?

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Exchange Rates (Value to $1 U.S.), January 2008 - December 2013

Chilean

Peso

Aust $

Arg Peso

Euro & Pound

1300

6.50

1200

6.00

1100

5.50

1000

5.00

900

4.50

800

4.00

700

3.50

600

3.00

500

2.50

400

2.00

300

1.50

200

1.00

100

0.50

0

Jan 08

Jul 08

Jan 09

Chilean Peso

Jul 09

Jan 10

Jul 10

Argentine Peso

Jan 11

Jul 11

Jan 12

Australian Dollar

Jul 12

Euro

Jan 13

Jul 13

0.00

Jan 14

British Pound

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Imported Wine - Bottled and Bulk

(In Millions of Cases)

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Total

-1%

-5%

Total

+12%

-2%

Total

+0%

+7%

Total

+7%

+3%

Total

+16%

Total

-5%

+5%

-2%

+71%

-24%

+92%

-20%

+26%

+27%

2008

2009

Data obtained via the Gomberg Fredrikson Report

2010

2011

Bottled Imports

2012

Bulk Imports

Allied Grape Growers, 2014. All rights reserved.

2013 Tracking

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Millions

of Tons

California Grapes Crushed for Wine vs. California Wine Shipments

2005-2012

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2005

2006

California Wine Shipment Data Source:

The Gomberg Fredrikson Report.

2007

2008

2009

2010

Grapes Crushed for Wine

2011

2012

Wine Shipments

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Imported Wine - Bottled and Bulk

(In Millions of Cases)

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Total

-1%

-5%

Total

+12%

-2%

Total

+0%

+7%

Total

+7%

+3%

Total

+16%

Total

-5%

+5%

-2%

+71%

-24%

+92%

-20%

+26%

+27%

2008

2009

Data obtained via the Gomberg Fredrikson Report

2010

2011

Bottled Imports

2012

Bulk Imports

Allied Grape Growers, 2014. All rights reserved.

2013 Tracking

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Imported Wine - Bottled and Bulk

(In Millions of Cases)

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Total

-1%

-5%

Total

+12%

-2%

Total

+0%

+7%

Total

+7%

+3%

Total

+16%

Total

-5%

+5%

-2%

+71%

-24%

+92%

-20%

+26%

+27%

2008

2009

Data obtained via the Gomberg Fredrikson Report

2010

2011

Bottled Imports

2012

Bulk Imports

Allied Grape Growers, 2014. All rights reserved.

2013 Tracking

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Millions

of Tons

California Grapes Crushed for Wine vs. California Wine Shipments

2005-2012

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2005

2006

California Wine Shipment Data Source:

The Gomberg Fredrikson Report.

2007

2008

2009

Grapes Crushed for Wine

2010

2011

2012

Wine Shipments

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Will our domestic supply depress import growth?

Imported Wine - Bottled and Bulk

(In Millions of Cases)

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

Total

-1%

-5%

Total

+12%

-2%

Total

+0%

+7%

Total

+7%

+3%

Total

+16%

Total

-5%

+5%

-2%

+71%

-24%

+92%

-20%

+26%

+27%

2008

2009

Data obtained via the Gomberg Fredrikson Report

2010

2011

Bottled Imports

2012

Bulk Imports

Allied Grape Growers, 2014. All rights reserved.

2013 Tracking

Answering Some Key Industry Questions

Question #5:

Will our domestic supply depress

import growth?

Answer:

Yes. Based on market behavior in the

recent past, it should.

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #6:

What are the regional planting

trends?

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

What are the regional planting trends?

Regional Allocation of Major Winegrape Vines Sold, 2013

Cabernet

Sauvignon

High End

Mid Range

Value

A high percentage of the “Value” plantings are in Lodi

Chardonnay

Pinot

Noir

Zinfandel/

Primitivo

Petite Sirah

Merlot

French

Colombard

Pinot

Grigio

Muscats

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

What are the regional planting trends?

Breakdown of vines sold by category

Five major varieties, 2010-2013

25,000,000

20,000,000

15,000,000

High & Mid

10,000,000

Value

5,000,000

2010

2011

2012

2013

Varieties charted are Chardonnay, Cabernet Sauvignon, Merlot, Pinot Noir and Zinfandel.

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #6:

What are the regional planting

trends?

Answer:

Coastal planting of major varietals

has increased substantially. Interior

planting has shifted north to Lodi.

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #7:

Are we headed for surplus,

balance or shortage?

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Are we headed for surplus, balance or shortage?

Crop

Year

Winegrape

AGG Estimated

Tons Crushed

Bearing

or Projected Winegrape Acres

Average

Winegrape

Yield

2009

3,703,031

495,000

7.48

2010

3,588,985

505,000

7.11

2011

3,342,689

515,000

6.49

2012

4,018,237

530,000

7.58

2013

4,230,567

545,000

7.76

2014

3,774,000

555,000

6.80

2015

4,132,500

570,000

7.25

2016

4,343,500

595,000

7.30

2017

4,581,250

625,000

7.33

Allied Grape Growers, 2014. All rights reserved.

Average Statewide

Yield = 7.28 TPA

Assumes no

escalation in the

current rate of

annual vineyard

removals…….

(<2% per year).

Answering Some Key Industry Questions

Are we headed for surplus, balance or shortage?

Millions

of Tons

California Wine Shipments and Grape Production (for wine only)

2009-2013 with estimates and projections thru 2017

5.0

Forecast shows production growth

outpacing shipments in the near future

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

2009

2010

2011

2012

Wine Shipments

2013

2014

Est.

2015

Est.

2016

Est.

Grapes Crushed for Wine

Allied Grape Growers, 2014. All rights reserved.

2017

Est.

Answering Some Key Industry Questions

Are we headed for surplus, balance or shortage?

Estimated California Bearing Winegrape Acres

From 1990 with projections

700,000

600,000

500,000

400,000

300,000

200,000

100,000

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Are we headed for surplus, balance or shortage?

Estimated California Bearing Winegrape Acres

From 1990 with projections

700,000

600,000

Forecast shows acreage growth beginning

to outpace the trendline by 2017.

500,000

400,000

300,000

200,000

100,000

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17

Allied Grape Growers, 2014. All rights reserved.

Answering Some Key Industry Questions

Question #7:

Are we headed for surplus,

balance or shortage?

Answer:

We are not forecasting a shortage

in the foreseeable future

Allied Grape Growers, 2014. All rights reserved.

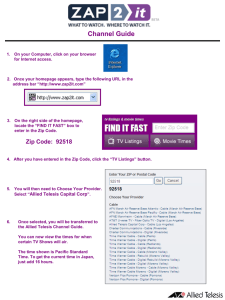

Questions?

You may download or view a copy of

this presentation at:

www.alliedgrapegrowers.org

Allied Grape Growers, 2014. All rights reserved.