PowerPoint-Präsentation

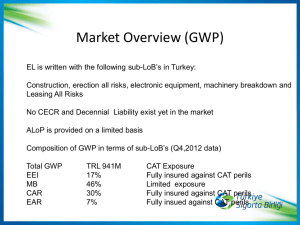

advertisement

“How does the Insurance Securities (ILS) Market digest the current Demand?” Presentation to the CFA Society Switzerland 22nd October 2013 For professional/qualified investors use only, 22nd October 2013 Contents ILS Market Overview Recent observations ILS investing, underwriting (information asymmetry) Market outlook Conclusions 2 ILS Market Overview Terminology Term Explanation ILS Insurance linked securities, refers to tradable (cat bonds) and less tradable (collateralized reinsurance) investments. In the latter case, preferred shares of the cell company are the securities (private ILS) Broker «Reinsurance broker», an intermediary between insurance and reinsurance or reinsurance and retrocessionaire; i.e. not an execution broker Limit, line, capacity Premium The dollar amount «traded» between counterparties, i.e. the protection sold/purchased (principal) The dollar amount owed to the Not a delta to a reference rate (e.g. CAPM) protection seller for the capacity. Rate on Line (ROL) Premium expressed in relation to the limit, first indication of return on investment (excluding time value of money or cash flow considerations) Private ILS ILS Transactions which are agreed between two parties. Fully collateralized, investor owns shares of a protected cell company or notes of a private cat bond IBNR Incurred but not reported; an estimate of the liability for claim-generating events that have taken place but have not yet been reported to the insurer. The sum of IBNR losses plus incurred losses provides an estimate of the total eventual liabilities for losses during a given period ILW Industry loss warranty, a transaction type which uses as trigger mechanism any industry wide loss information. The protection buyer incurs basis risk as the payout of the transaction is not directly linked to its suffered loss. Examples are PCS or PERILS as trigger agents 3 ILS Market Overview Insurance Market Overview Retrocession Private ILS Reinsurance Private ILS Cat Bonds Primary Insurance Cat Bonds Broker Broker Policyholders: (home insurance) Risk is ceded upwards 4 Source: Twelve Capital. As on 30th September 2013. ILS Market Overview ILS Market Size • • • • • • The worldwide market for catastrophe reinsurance (the most lucrative reinsurance business) is some USD 250bn in size (pizza) The largest chunk is still traditional reinsurance (i.e. not collateralized), selling capacity on a credit rating Catastrophe limits worldwide: USD 250 billion 26 18 The convergence market; cat bonds and collateralized reinsurance, is rapidly growing now (pizza slice) Since January 2012 some USD 5 to 6bn in new capital has entered the cat bond market, USD 3bn of which in the last 6 months only Traditional reinsurance Cat bonds Collateralized Reinsurance 206 Sourcing cat bonds in the secondary market can mean entering a winners curse race is the pizza slice growing only or is the pizza getting larger, too? Source: Guy Carpenter, Twelve Capital. As on 31st August 2013. 5 ILS Market Overview ILS Market size: Cat Bonds Issue Volume Outstanding Cat Bond Volume, 2003-2013 20,000 17,513 18,000 16,155 14,923 16,000 USD million 13,249 12,911 14,000 13,167 11,504 12,000 10,000 8,000 6,608 6,000 4,000 3,005 3,876 4,741 2,000 0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 YTD 2013 Source: Swiss Re Capital Markets. As of 9th July 2013. Cat Bonds versus US Wind Bonds Volume since 2007 21 12% 18 10% USD billion 15 8% 12 6% 9 4% 6 2% 3 0% Jan '07 Jul '07 Jan '08 Jul '08 Jan '09 Jul '09 Jan '10 Jul '10 Jan '11 Jul '11 Jan '12 Jul '12 Jan'13 Jul'13 Other perils US wind bonds Coupon of all cat bonds Coupon of US wind bonds 6 Source: Twelve Capital. As of 31st July 2013. ILS Market Overview US Wind Historical Returns A Story of Marriage…. Swiss Re US Wind Price Return Index SRUSWPRC 103 102 101 100 99 98 97 96 95 1 8 15 2002-2011 • • • 22 29 2012 36 43 50 Week 2013 Cat Bonds are built on an long lasting, established reinsurance market What happens to the reinsurance market affects the smaller Cat Bond market Investors know the implications and draw conclusions Source: Swiss Re. as of 13th September 2013. 7 ILS Market Overview Investors Overview Cat Bonds Investors Breakdown: 2007 versus 2012 Investors Snapshot 2007 7% Investors Snapshot 2012 Dedicated Fund 1% Dedicated Fund 14% Reinsurer Reinsurer AM 11% Hedge Fund Insurer AM 4% Hedge Fund 3% Insurer Bank Pension Funds 12% 56% 61% 1% 13% • • • 17% More “sticky” money today, more sophistication The market has become more mature The collateralized reinsurance market is also developing in that direction Source: Swiss Re Capital Markets. As od 31st December 2012. 8 ILS Market Overview Investors Overview: Pension Funds USD 800bn USD 45bn Pension Funds Estimated Market Potential Investment Size for Pension Funds ILS Market Size USD 20'000bn • Assumptions − 5'600 European insurances investing 4% average of their assets − Conservative estimation of the Pension Funds Market Size of USD 20tn Source: Mercer Survey as of 20th May 2013 “European Asset Allocation Survey – LDI Strategies and Alternatives in Focus”. Data in USD billion. 9 Recent Observations All Cat Bonds - July 2013 versus April 2012 14 12 Multiples (Spread/EL) 10 8 All Cat Bond - Apr 2012 6 All Cat Bond - Jul 2013 1 Trendline - Apr 2012 1 Trendline - Jul 2013 4 2 0 100 200 300 400 500 600 700 800 Expected Loss (EL) in bps 1 Method: using the exponential trendline functionality in Excel Source: Twelve Capital. 10 Recent Observations Market Cycles by Class Managing the Soft Market • Comparing different underlying asset classes within the ILS market we see that different pricing cycles are observed 300 US Cat reinsurance 280 Internat. Cat Reinsurance 260 Property reinsurance 240 Marine Hull 220 Offshore energy 200 180 160 140 120 100 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Jan Jun 2013 2013E • Looking at a broader range of underlying insurance asset classes allows us to enter niche markets as pricing improves • During 2013 we have sourced transactions in classes where pricing has increased substantially as an after effect of losses our investors did not pay: Australia/New Zealand, US Crop, Marine Source: Amlin plc. renewal rating index; June 2013 renewals estimates by Twelve Capital. 11 Recent Observations Private ILS versus All Cat Bonds – July 2013 18 16 Multiple (Spread/EL) 14 12 10 Private ILS - Jul 2013 All Cat Bond - Jul 2013 8 Trendline - Private ILS 6 1 Trendline - All Cat Bond 1 4 2 0 0 1 200 400 600 Expected Loss (EL) 800 1000 1200 1400 Method: using the exponential trendline functionality in Excel Source: Twelve Capital. 12 Recent Observations Examples of Recent Transactions Closed Selected Private ILS closed in Q2 2013 Private ILS Crop Insurance Private ILS Terrorism Cover Private ILS Dual Trigger US Wind Risk assumed Agricultural crop insurance in the USA Risk assumed Physical damage to property due to terrorism worldwide Risk assumed Damage to oil exploration platforms due to hurricanes Transaction basis Indemnity reinsurance contract Transaction basis Swap Trigger Losses to underlying portfolio exceeding a certain level Trigger Trigger 1: Hurricane Cat 3 in defined geographic location Trigger 2: Total loss of certain oil exploration platforms Tenor 6 months Economics Approx. 13% return (0.8% EL) Collateral IBRD note Transaction basis Indemnity reinsurance contract Trigger Abnormal weather causing physical damage to crop combined with yield produced is less than estimated at the time of planting Tenor 12 months Tenor 12 months Economics Approx. 17% annual return (5.0% EL) Economics Approx. 10% annual return (3.3% EL) Collateral US T-bills Collateral IBRD note Transaction rationale: Transaction benefits from increased premiums in the crop insurance market post last year’s losses. Source: Twelve Capital. Transaction rationale: transaction represents a well paying diversifier. Transaction rationale: Transaction benefits from attractive multiple due to highly tailored coverage for a corporate. 13 ILS investing, underwriting Investment Process Cat Bonds Sourcing Analysis Process: Investment Case, Rating Framework • Each bond is analyzed according to multiple attributes, among which: − − − − Collateral structure Portfolio Construction Pricing Packaging Selection of a Cat Bond • Investment cases form the basis for the selection of bonds. Each bond is allocated either: attractive, cautious or decline which will define the weighting in the funds: Trigger mechanism − Risk measures (loss probabilities) Decline these bonds will never be bought − Redemption features, reset mechanism Cautious market weight or underweight − Attractive PM can overweight but not more than 1% more than market − Attractive Position is not larger than 2.5% of NAV of vehicle • Diversification of bonds in the fund is key for sustainable performance. We use several levels of diversification: − Perils diversification, very high reduction of draw down risk − Type of triggers, high reduction of risk of unexpected reserve development in indemnity bonds − Sponsor of bond reduction of available bonds as retreat of sponsor reduces available securities − Repurchase counterparty, high reduction of collateral loss due to counterparty default − Number of transactions, very high reduction of risk of unknown structural flaws 14 ILS investing, underwriting Underwriting and Pricing Underwriting, What is It? • Collection of data to allow for best possible risk judgment • Analysis of data, preparation of data for analysis • Determination of risk measures (expected loss, VaR, Standard Deviation…) • Review of legal wording • Interaction with cedant and broker • Engaging in structuring and closing the transaction together with Legal Dept. • Preparation of renewals (review data quality, close gaps, assess profitability...) Underwriter should have a rather good level of information of an insurance company 15 ILS investing, underwriting Underwriting and Pricing Pricing a “Risk” Expected Loss − Stochastic − Burn − Exposure −Profit Loading Risk Loading − Unmodeled − Uncertainty for modeled − Add load for profitability Other Loads − Add load for brokerage Quote What we are offering to the broker (i.e. our price) Determination of “known” risk premium Technical rate; determination of total risk premium Net price; determination of long-term profitability Gross price; Load for other transaction costs e.g. brokerage 16 ILS investing, underwriting Cycle management The State of the Market: Two Fundamental Cycles drive Market Pricing over Time • Supply and Demand of Capacity Capacity is scarce Relative Price Abundant capacity Time • Annual seasonality of windstorms in peak regions: US Hurricane, European Winter Storm, Typhoon − − Storm season forecasts affect protection buyer’s appetite and protection seller’s pricing Prices will increase after major losses as protection sellers seek pay-back Source: Twelve Capital. 17 ILS investing, underwriting Information asymmetry Forms of information asymmetry… ... and ways out of it • • Insurance is opaque: − − − • Long tail business is not (yet) lending itself well for collateralized reinsurance Development of reserves In-depth knowhow of IBNR • For short tail business: „submission pack“ provides in-depth information on the company at stake Premium development, acquisition costs Only bad business is given to the financial market (cession bias) − − − − Due diligence depth, data Asking the right questions is the skill...(underwriting) Renewal process is key trust This is a „normal“ process systematic tendency to reduce asymmetry • Reinsurers buy protection only if they have to (bias to retain) − − − − Luck is not skillful Processes and systems make it almost impossible to carve out bad business Underwriter decides on business Who says its bad? is there the right price for it? 18 Outlook Current Market Outlook The Pricing Cycle: Where are We Today? • Supply and demand of capacity − − • Abundant capital is available in the market However, the new capital is mostly targeting specific areas which are easiest to access and require least underwriting skill (US Wind ILWs) Annual seasonality of windstorms in peak regions − − Recent years have been relatively loss free in peak markets despite Hurricane Sandy Pay-back pricing is available in niche markets but is difficult to access without contacts and underwriting skills • Therefore, overall pricing is softening in property lines • Specialty lines are either at lows but others may hold more firm 19 Outlook Current Market Outlook What contributes to the Attractiveness…. • • • • • • Insurance is opaque for most observers ( premium, alpha?) (Re)insurance is a market which is established, rules are clear…. (trust, renewals) Returns from cat bonds are weakly correlated to financial markets (Lehman, Government yields chart) Collateralized reinsurance is uncorrelated to financial markets “Big” events result in higher spreads, more than a promise (e.g. Katrina, Tohoku, Deepwater Horizon) Sophistication of market: we should be expecting innovation Chart: timeseries 31 May 2013 – 8 Sept 2013: • • Recent interest rates increases had a strong effect on high yield bonds (volatility!) Return -0.9% , Volatility 5.4% Twelve ILS fund was not affected at all by this Return +0.9% , Volatility 0.5% Source: Bloomberg, Twelve Capital. 20 Twelve Capital ILS Strategy Conclusions ILS Market will grow • Current and expected economy fosters ILS as attractive asset class • Large demand will bring supply to market • Supply/Demand meet innovation (Pizza to grow) • Innovation novelty premium Asymmetry • The size of the asymmetry hill is not insurmountable (underwriting) • Traditional reinsurance builds on trust Attractive Market • Risk adjusted spreads are attractive • Collateralized reinsurance for underwriters • Cyclicality provides “guarantees” to come back to par post event 21 Disclaimer The products and services described herein are not available nor offered to US persons and may not (and will not) be publicly offered to persons residing in Switzerland, or any other country restricting the offer of such products or services. including the possible loss of the amount invested as described in detail in the offering memorandum(s) for these instruments which will be available upon request. Investors should understand these risks before reaching any decision with respect to these instruments. Past performance is no indication or guarantee of future performance. This material has been furnished to you solely upon request and may not be reproduced or otherwise disseminated in whole or in part without prior written consent from Twelve Capital AG. The information herein may be based on estimates and may in no event be relied upon. Twelve Capital AG does not assume any liability with respect to incorrect or incomplete information (whether received from public sources or whether prepared by itself or not). This material does not constitute a prospectus, a request/offer, nor a recommendation of any kind, e.g. to buy/subscribe or sell/redeem investment instruments or to perform other transactions. The investment instruments mentioned herein involve significant risks Twelve Capital AG Dufourstrasse 101 8008 Zurich, Switzerland Phone +41 (0) 44 5000 120 info@twelvecapital.com www.twelvecapital.com 22