catching up* / us tax and fbar compliance

advertisement

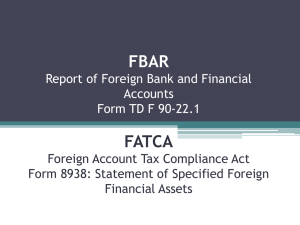

“CATCHING UP” / US TAX AND FBAR COMPLIANCE ACA Town Hall Meeting London 27 November 2013 Charles M Bruce Stéphane Lagonico Guillaume Grisel cmb@ilf.ch sl@ilf.ch gg@ilf.ch 8, rue du Grand-Chêne CH-1002 Lausanne For additional information, call Guillaume Grisel at +41 21 348 1188 (General) or +41 21 348 1178 (Direct) 1 Obligations to Report – Stating the Obvious • US citizens, “green card” holders, resident aliens • Have to file federal tax returns (if gross income, for ex., at least $9,750, under 65; varies by filing status; increases each year) • Have to file Foreign Bank Account Report (FBAR) (if aggregate value of foreign accounts exceeds $10,000) • All this regardless where they reside 2 Many Americans Abroad Are Not Compliant -- No Secret Here • • • • • Estimated 6 million-7 million American taxpayers abroad. Approximately 1 million file (450,000 file Form 2555 (Foreign Earned Income Form) and 550,000 file Form 1116 (Foreign Tax Credit Form). [2011 figures.] Almost certainly a significant number of non-filers (1.8 million or more?). Size of the “Tax Gap” (tax dollars not collected) approximately $5.4 billion. [Educated guess.] GAO study due by yearend may contain new estimates. Many things building pressure to do something rather than wait to get caught: Department of Justice’s prosecution of undeclared account holders and foreign banks; increased exchange of information; John Doe Summonses; “Whistleblower” Program; banks’ heightened due diligence/Know-YourCustomer practices; FATCA; others. 3 How Can I Catch Up? First Thoughts You should catch up for many reasons; Don’t procrastinate; Do your own research and then immediately get some advice; Shop around for advisors and, in the process, learn a lot; Don’t “vote” as to which approach to follow until you see or get a feel for your numbers – for tax liabilities, penalties, interest, FBAR penalty. 4 What Are My Alternatives? • Do nothing and hope you don’t get caught. Knowing that you must file, you are committing criminal tax fraud. If you try to lie your way out of the problem, you have committed additional felonies. Not a good idea. Don’t “augur” yourself. • Make a voluntary disclosure under the IRS 2012 Offshore Voluntary Disclosure Program. [Slides 6-11] See http://www.irs.gov/uac/2012Offshore-Voluntary-Disclosure-Program. – Squeeze within the 5% rule if you can – Opt out if the result is not palatable and you have good “reasonable cause” arguments • Or, if you can qualify, make a voluntary disclosure under the relatively new IRS “Streamlined” procedures. • Or, make a so-called “quiet disclosure”. But this is rolling the dice. Again, hope you don’t get caught. 5 Make a Voluntary Disclosure Next 6 Slides –This will be painful! • Who Is Eligible? US taxpayers residing anywhere. Can’t have serious other problems and can’t be previously disclosed to IRS. Normally, individuals but can be corporation, partnership, trust. Can’t be under examination. Must be element of undisclosed foreign income or accounts. Not for domestic cases; can be mixed foreign and domestic. • Married Couples: Can proceed separately or together. • Years Covered: Most recent 8 years as to which noncompliance. • Years of Tax Returns and FBARs: Most recent 8 years as to which noncompliance. 6 Make a Voluntary Disclosure • • • • Passive Foreign Investment Company (PFIC) Rules: Optional “shortcut” method is available. Pre-Clearance: Yes. Done to ensure that taxpayer will not be treated as ineligible. Acceptance: Criminal Investigation screens and ordinarily accepts usually within 45 days. Submission of Documents: Previously filed original returns omitting income, previously filed returns for any compliant years, delinquent returns, amended returns, Foreign Account or Asset Statement for each undisclosed foreign account or asset, Taxpayer Account Summary With Penalty Calculation (information drawn from FBARs and signed by taxpayer and representative), signed consents to extend the statue limitations for income tax and FBAR purposes, perhaps Statement on Dissolved Entities, copies of all offshore financial account statements for each of the covered years (required if any one year the aggregate highest account balance was $500,000 or more). 7 Make a Voluntary Disclosure • Special Issues Regarding Trusts and Underlying Corporations: Disclosure of these entail special forms, e.g., Form 3520, Form 3520-A, Form 5471. These entities, in effect, might be disregarded provided they are dissolved. • Examination: Normally, no comprehensive examination. "The normal process is to assign the voluntary disclosure to an examiner to certify the accuracy and completeness of the voluntary disclosure." • Closing: After submission and resolution of any questions or additional document requests, the IRS will present a Form 4549-A (Income Tax Discrepancy Adjustments) and the taxpayer will enter into a Closing Agreement (Form 906). • Switching from One Thing to Another: Can start “quiet” and switch to OVDP, provided examination has not started. 8 Make a Voluntary Disclosure • Tax Liability: Tax liability for each year calculated in normal way. Based on amended returns. (Shortcut method available for PFIC income.) • Tax, Penalties and Interest: Pay tax, interest and accuracy-related • Penalty (20%), and, if applicable the failure to file and failure to pay penalties (25%). • FBAR Penalties: 27.5% of "high water" aggregate account balance. Convert foreign currency by using yearend exchange rate. Include all accounts even small accounts not reportable on FBAR. Include business accounts for an active business. Penalty applies not only to financial accounts holding cash and securities, but also tangible assets (real estate and art) and intangible assets (stock or partnership interests in a US or foreign business). Assets acquired with after-tax funds or funds not subject to US tax and that are not income producing, are not affected. 9 Make a Voluntary Disclosure • • • • • • How Long Does It Take? Depends, but a good guess is one year. How Much Does It Cost? Cost of attorney and return preparer. Taxpayers who are compliant on tax reporting but not FBARs: Don’t file in OVDP. File delinquent FBARs with explanation; no penalties. Can’t Pay: If can’t pay, work out terms. File Form 433-A. Source of Additional Information: OVDP FAQs on IRS website. 5% FBAR Penalty Rule: Several different situations. One is: Taxpayer is foreign resident and meets all 3 of following conditions for all year. (a) Taxpayer resides in a foreign country; (b) taxpayer has made good faith showing that he/she has timely complied with all tax reporting and payment requirements in the country of residency; (c) taxpayer has $10,000 or less of U.S. source income each year. If met, the FBAR penalty will not apply to non-financial assets, such as real property, business interests, or artworks, purchased with funds as to which the taxpayer can show that all applicable taxes have been paid, either in the U.S. or in the country of residence. This exception only applies if the income tax returns filed with the foreign tax authority included the offshore-related taxable income that was not reported on the U.S. tax return. 10 Make a Voluntary Disclosure • Opt Out: Taxpayer can opt out (elect to have the case removed from the Program) if, for example, thinks the FBAR penalty as too severe. A complete examination can be expected. There is no protection from criminal prosecution. Specific Guidelines for Opt Out and Removal apply. 11 Make A Voluntary Disclosure Under The IRS “Streamlined” Procedures • • • • • • • Announced June 26, 2012 File 3 years back (income tax returns) and 6 years back (FBARs) Available for non-resident US taxpayers that have resided outside US since Jan 1, 2009 and have not filed a US tax return during this period (not for people that filed and now want to amend) For “Low Risk” taxpayers, expedited review and no penalties. Determined based on returns and information provided in a questionnaire. Less than $1,500 in tax due in each year—treated as “low risk”. For higher risk taxpayers, don’t get streamlined processing procedure. Risk level rises with existence for claim for refund; “material economic activity in the US; failure to declare income in home country; existence of financial interest or authority over a account(s) outside home country; financial interest in an entity(ies) outside home country; any U.S. source income; indications of sophisticated tax planning or avoidance. Does not provide protection from criminal prosecution. Once “streamlined” filing is made, can’t go into regular OVDP. 12 Additional Thoughts • Door may be closing on Offshore Voluntary Disclosure Program. My guess: When FATCA fully kicks in (July 2014? December 2014?), OVDP will be closed perhaps with an “Last Call” announcement allowing 6 months (?) • How long and how much? It all depends upon the facts of your case. The costs are return preparation and legal. Return preparation often will be the greater of the two. Ask for a flat fee per year for return and FBAR preparation. From beginning discussions with attorney filing of Closing Agreement, a guess is one year to complete. Legal costs generally tie to hours spent. You help yourself by shopping around and doing a good job of gathering documents. ACA WILL PUBLISH A DIRECTORY OF RETURN PREPARERS FOR OVERSEAS AMERICANS BY JAN. 31, 2014. • • Beware of application of FBAR penalty to not just bank account balances. What if I can’t pay or if paying will completely change my life? Inability to pay is not a bar to participation in the Program. The case, in effect, goes Collection. File Form 433-A at end of process. You might have to pay over some liquid assets. Normally you would not lose your house. Normally, some retirement assets are protected. Recall that assets located outside the US generally, but not always, are not reachable. • Different options are fraught with arbitrary “cliffs”. • New Information Document Request procedures create headaches . Hard to “buy time”. 13 QUESTIONS & ANSWERS Charles M Bruce Stéphane Lagonico Guillaume Grisel cmb@ilf.ch sl@ilf.ch gg@ilf.ch 8, rue du Grand-Chêne CH-1002 Lausanne For additional information, call Guillaume Grisel at +41 21 348 1188 (General) or +41 21 348 1178 (Direct) 14