New England`s Power System: At a Crossroads

advertisement

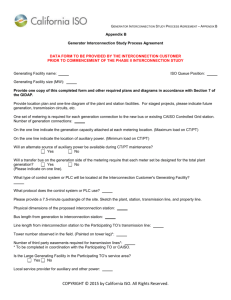

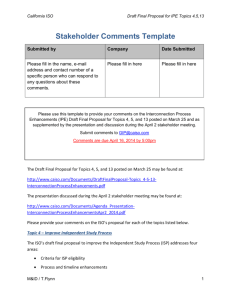

JUNE 16, 2014 | STOWE, VT New England’s Power System: At a Crossroads – Again! NECPUC Symposium: Governors’ Infrastructure Initiative Panel Stephen Rourke VICE PRESIDENT, SYSTEM PLANNING Overview of Presentation • Historical Perspective • Strategic Planning Initiative Update • Recent Planning Tools • Integrating Renewables • Resource Performance and Flexibility • Retirements • Gas Dependence 2 Familiar Doctor’s Office Pain Chart Will Help Us Assess Grid Challenges Today No Pain 0 Distressing Pain 1 2 3 4 5 Unbearable Pain 6 7 8 9 10 Choose the Face that Best Describes How You Feel 0 No Hurt 2 Hurts Little Bit 4 Hurts Little More 6 Hurts Even More 8 Hurts Whole Lot 10 Hurts Worst 3 Difficult Grid Conditions Are Not New New England’s system faced and overcame painful times • 1970s & 1980s: Oil embargos • 1980s: Rapid load growth plus resource performance issues and capacity shortages • 1990s: Nuclear shutdowns and emergency actions • 2000s: Southwest CT reliability problems, gap RFP and reliability agreements; cold snap 4 ISO New England’s Strategic Planning Initiative Focused on developing solutions to the region’s top reliability risks Reliability requires a flexible, high-performance fleet: • Natural Gas Dependency – • Power Plant Retirements – • “Just-in-time” fuel delivery presents an immediate risk to reliability New England will need new ways to meet peak demand as aging plants close Renewable Resource Integration – Balancing variable generation with reliability will require changes in system operations 5 ISO Forecasting Solar and Energy Efficiency Anticipating impacts of state policy priorities PV Forecast Shows Significant Growth MW EE Flattens Annual Energy Use GWh 2,000 155,000 1,800 1,800 150,000 1,600 1,400 145,000 1,200 1,000 140,000 800 600 135,000 500 400 130,000 200 0 Thru 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2013 125,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 RSP14 RSP14-FCM-EEF RSP14-FCM 6 ISO is Implementing Enhancements to Modeling of Capacity Zones • ISO will model up to 5 capacity zones in the next Forward Capacity Auction (FCA 9), in February 2015 – CT, NEMA and SEMA/RI will be evaluated as potential import-constrained zones – Maine will be evaluated as a potential export-constrained zone Maine Rest of Pool (NH, VT, WCMA) NEMA CT SEMA/RI 7 Market Resource Alternatives ISO conducted studies analyzing alternatives to transmission • Studies looked at a mix of generation, load reduction and transmission upgrades • Vermont and New Hampshire (2011) – About 900 MW of supply-side resources needed to resolve thermal issues in six of the nine NH/VT study sub-areas • Greater Hartford (2012) – The supply-side MRA analysis shows that approximately 950 MW of generation is required to resolve all the identified thermal needs • Southeastern Massachusetts and Rhode Island (2014) – Approximately 941 MW of generation/load reduction would be required to resolve all the identified N-1 thermal needs – Process updated to utilize a hybrid of small transmission fixes along with generation and demand resources 8 Variable Resources are Trending Up Wind (MW) Solar (MW) 2,000 Interconnection Issues: 1,807 700 Wind resources often interconnect in remote areas, on weak transmission lines, and must grapple with congestion 499 Existing Proposed Nameplate capacity of existing wind resources and proposals in the ISO-NE Generator Interconnection Queue; megawatts (MW). PV thru 2013 PV in 2023 State PV interconnection standards and lack of control or visibility are concerns for ISO 2014 Final Interim ISO-NE Solar PV Forecast, based on state policies. MW values represent nameplate ratings 9 Gas Units Fell Below Their Capacity Obligations This Winter • System ran with only 3,000 MW of gas-fired generation out of 11,000 MW with obligations in the capacity market • Assuming winter 2013/14 weather, this condition existed on 20 days 10 Generator Non-Price Retirement Requests Almost 3,400 MW of generation plan to retire within the next five years Major Retirement Requests: • Total MW Retiring in New England* Connecticut Salem Harbor Station (749 MW) – 4 units (coal & oil) Maine • Vermont Yankee Station (604 MW) – 1 unit (nuclear) New Hampshire • Norwalk Harbor Station (342 MW) – 3 units (oil) Rhode Island Brayton Point Station (1,535 MW) – 4 units (coal & oil) Total • Other Retirements Looming Massachusetts Vermont 348 MW 37 MW 2,360 MW 1 MW 13 MW 634 MW 3,393 MW *Megawatts based on relevant Forward Capacity Auction (FCA) summer qualified capacity (NOTE: total includes full and partial generator Non-Price Retirement (NPR) requests for Capacity Commitment Period (CCP) 2013-2014 through CCP 2017-2018; does not include NPRs for demand response (DR) resources) Source: Status of Non-Price Retirement Requests; October 23, 2013 11 Generator Proposals in the ISO Queue Almost 7,000 MW By Type Pumpedstorage hydro, 50, 1% Biomass, 138, 2% By State Solar, 10, 0% Oil, 245, 4% Hydro, 12, 0% Wind, 2,067, 30% MA, 3,367, 49% VT, 191, 3% NH, 154, 2% Natural gas, 4,340, 63% Note: Some natural gas include dual-fuel units (oil) ME, 1,437, 21% CT, 1,713, 25% Source: ISO Generator Interconnection Queue (April 2014) FERC Jurisdictional Only 12 Conclusions Some good news Some not so good news • State policies are bringing energy efficiency and renewables onto the system • New England has a growing reliability problem due to natural gas availability constraints and declining resource performance • A lot of activity in the interconnection queue • Transmission for reliability helps ease some retirement concerns • New England has a proven history of overcoming energy and capacity challenges • Expected non-gas retirements will increase demands on an already constrained natural gas system • Major market enhancements and energy infrastructure improvements are years away 13 14