file

advertisement

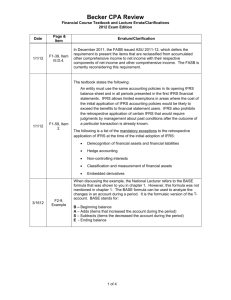

Financial Risk Management – A New Accounting Perspective Chay Yiowmin Partner and Head of Financial Services Moore Stephens LLP Singapore DID: (65) 63292709 Fax: (65) 62213815 chayyiowmin@moorestephens.com.sg Agenda • Introduction • Introduction to IFRS 9 • Question & Answer Introduction Introduction • In a major project to replace IAS 39 in its entirety by the end of 2010, the International Accounting Standards Board issued International Financial Reporting Standard (IFRS) 9 in November 2009. • IFRS 9 incorporates Phase 1 of the financial instruments’ project to replace the classification and measurement requirements on financial assets in IAS 39 Financial Instruments: Recognition and Measurement. Introduction • The new standard, when adopted in Singapore, will have major implications for reporting entities, auditors, analysts and investors. Introduction to IFRS 9 Introduction to IFRS 9 Introduction • New classification and measurement requirements for financial assets. • New criteria for amortised cost measurement. • New measurement category – fair value through other comprehensive income. • No more available-for-sale and held-to-maturity assets. Introduction to IFRS 9 Introduction (continued) • No more embedded derivatives in financial assets. • No more unquoted equity investments measured at cost less impairment. Introduction to IFRS 9 Effective Date • Effective from 1 January 2013 with early adoption permitted. • Expected to be applied retrospectively. • Entities adopting the new Standard, with an initial application date before 1 January 2012, will be exempt from the requirement to restate prior periods. Introduction to IFRS 9 Debt Instrument • Conditions for measurement at amortised cost: a) Business model test – Hold financial asset to collect contractual cash flows, rather than to sell the asset prior to contractual maturity; and b) Cash flow characteristics tests – Contractual terms of financial assets give rise on specified dates to cash flows that are solely payment of principal and interest on the principal outstanding. • All other debt instruments must be measured at fair value through profit or loss (“FVTPL”). Introduction to IFRS 9 Debt Instrument (continued) • Examples that satisfy this criterion: a) A variable rate loan with a stated maturity date that permits the borrower to choose to pay three months LIBOR for a three month term or one month LIBOR for a one month term b) A fixed term variable market interest rate bond whereby the variable interest rate is capped; and c) A fixed term bond whereby the payments of principal and interest are linked to an unleveraged inflation index of currency in which the instrument is issued. Introduction to IFRS 9 Debt Instrument (continued) • Examples that do not satisfy this criterion: a) A bond that is convertible into equity instruments of the issuer; and b) A loan that pays an inverse floating interest rate (e.g. 8% minus LIBOR). • Available-for-Sale and Held-to-Maturity categories excluded in IFRS 9. Introduction to IFRS 9 Equity Instruments • To be measured at fair value in the balance sheet. • All fair value changes recognised in profit or loss. • No “cost exception” for unquoted equities. • If equity not held for trading, irrevocable election at initial recognition to measure at fair value through other comprehensive income (“FVTOCI”). • Dividend income recognised in profit or loss. Introduction to IFRS 9 Derivatives • All derivatives, including those linked to unquoted equity investments, are measured at fair value. • Embedded derivatives, previously separately accounted for at FVTPL under IAS 39, will no longer be separately accounted for under IFRS 9. • Instead contractual cash flows are assessed in their entirety, and the financial asset is measured at FVTPL as a whole if any cash flows do not represent payments of principal and interest. Introduction to IFRS 9 Impact of IFRS 9 • Ability to measure certain debt instruments (e.g. Government and Corporate Bonds) at amortised cost, which under IAS 39 would have been measured at fair value, due such bonds quoted in an active market. • Hybrid financial assets with separated embedded derivatives at FVTPL, will instead be measured at FVTPL in their entirety. Introduction to IFRS 9 Overall Summary Financial Asset IAS 39 Classification Impairment Testing Required? IFRS 9 Classification Impairment Testing Required? Debt Instrument Available-forSale Yes Amortised Cost Yes Loan and Receivable Yes FVTPL No Held-toMaturity Yes FVTPL No Introduction to IFRS 9 Overall Summary (continued) Financial Asset IAS 39 Classification Impairment Testing Required? IFRS 9 Classification Impairment Testing Required? Equity Investment Available-forSale Yes FVTOCI No Cost less Impairment Yes FVTPL No FVTPL No Introduction to IFRS 9 In the Pipeline Phase 1 - Classification and Measurement • IFRS 9 Financial Instruments for financial assets was published in November 2009. • The IASB is now addressing the classification and measurement of financial liabilities. • An exposure draft on the topic Fair Value Option for Financial Liabilities was published in May 2010. Introduction to IFRS 9 In the Pipeline (continued) Phase 2 – Impairment Methodology • The exposure draft Amortised Cost and Impairment was published in November 2009, awaiting for comments. Introduction to IFRS 9 In the Pipeline (continued) Phase 3 – Hedge Accounting • IASB expects to publish an exposure draft in time to allow for finalisation by the second quarter of 2011. Question & Answer Financial Risk Management – A New Accounting Perspective Chay Yiowmin Partner and Head of Financial Services Moore Stephens LLP Singapore DID: (65) 63292709 Fax: (65) 62213815 chayyiowmin@moorestephens.com.sg