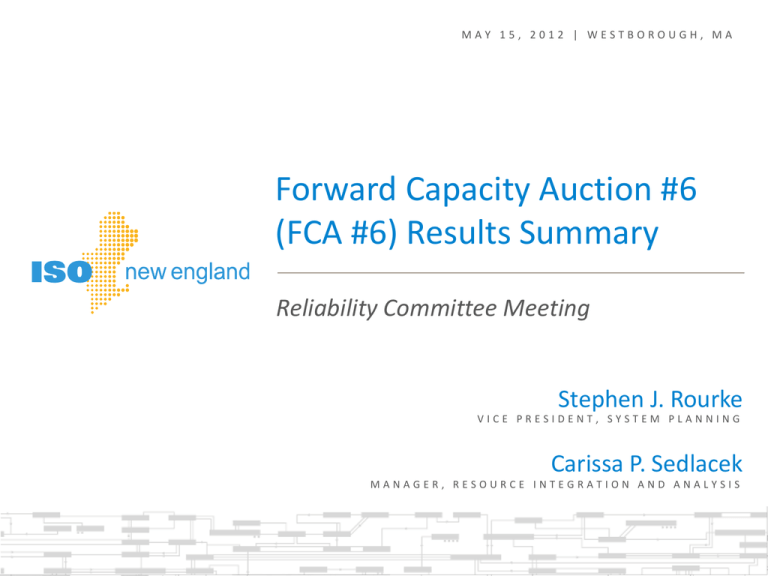

A9 FCA 6 Results Summary

advertisement

MAY 15, 2012 | WESTBOROUGH, MA Forward Capacity Auction #6 (FCA #6) Results Summary Reliability Committee Meeting Stephen J. Rourke VICE PRESIDENT, SYSTEM PLANNING Carissa P. Sedlacek MANAGER, RESOURCE INTEGRATION AND ANALYSIS Highlights • The sixth Forward Capacity Auction (FCA #6) was held April 2-3 and successfully procured resources to satisfy the region’s Installed Capacity Requirement (ICR) for the 2015/2016 Capacity Commitment Period (CCP) • Approximately 38,601 MW of qualified resources competed to provide the needed 33,456 MW of capacity (Net ICR) • Of the qualified new resources, about 84% (or 2,041 MW) of new resources (generation, imports, demand resources) cleared the auction and have a Capacity Supply Obligation (CSO) • Approximately 1,889 MW of de-list bids submitted were approved. Those not approved and retained for reliability were in the NEMA/Boston load zone • A dynamic de-list bid for Vermont Yankee (604 MW) was accepted • The ISO filed results of FCA #6 with FERC on April 30 2 FCA #6 Overview • There were seven rounds in which Participants could submit bids and offers • Starting price was $11.446/kW-mo • Ending price was $3.434/kW-mo • Cleared MW will receive a prorated payment of $3.129/kW-mo unless they elect to prorate their MW obligation • FCA #6 results FERC Filing made on April 30 is available at: – http://www.iso-ne.com/regulatory/ferc/filings/2012/apr/er12-___-000_04-3012_6th_fca_results_filing.pdf • The resource proration election window was April 9-11 and results were provided to Participants (via MIS report) in early May – No resources in the NEMA/Boston load zone were allowed to prorate due to the fact some resources were retained for reliability 3 FCA #6 Auction Details • ICR for June 1, 2015 through May 31, 2016 is 34,498 MW – After accounting for 1,042 MW of Hydro-Québec Installed Capacity Credits, 33,456 MW remained to be procured (Net ICR) • Approximately 38,731 MW of resources qualified to participate in FCA #6 at the time of the Informational Filing – However, due to new resource termination and/or withdrawal from Critical Path Schedule monitoring, only 38,601 MW of qualified resources actually did participate – Qualified Existing Resources (36,174 MW) • 32,076 MW of Generating Capacity, including Intermittent* • 315 MW of Import Capacity • 3,783 MW of Demand Resources – Qualified New Resources (2,427 MW) • New Supply Resources (1,953 MW) – 133 MW Generating Capacity – 1,820 MW Import Capacity • New Demand Resources (474 MW) * Includes new RTEG which receives existing treatment in the auction 4 FCA #6 Auction Details, cont. • Approximately 617 MW (uncapped by Maximum Capacity Limit (MCL) and Real-Time Emergency Generation (RTEG)) remained at the floor price – Existing Resources (34,285 MW)* • 30,954 MW of Existing Supply Resources – 30,678 MW of Generation Capacity – 276 MW of Import Capacity • 3,331 MW of Existing Demand Resources – New Resources (2,041 MW) • New Supply Resources (1,727 MW) – 79 MW of Generation Capacity – 1,648 MW of Import Capacity** • New Demand Resources (314 MW) • Approximately 36,309 MW (capped by RTEG) total capacity was used to calculate the effective payment rate * Accounts for Non-Price Retirements and includes new RTEG ** Capped by Interface Limits 5 New Capacity Resources by State Demand Resources* 314 MW VT 9% Generation 79 MW NH 12% CT 16% RI 17% MA 28% NH 5% ME 7% MA 46% ME 60% * Includes 8% T&D Gross-up and new RTEG 6 New Demand Resources by Type 314 MW Total Seasonal Peak 13% Real Time EG 1% Real Time 21% On Peak 65% Includes approximately 247 MW of New Energy Efficiency Projects 7 New Generation by Type 79 MW Total Combined Cycle 13% Hydraulic Turbine 14% Photovoltaic 1% Wind Turbine 72% 8 Trends in New Capacity Resources 3500 3000 MW 2500 2000 1500 1000 500 0 FCA #1 FCA #2 FCA #3 FCA #4 FCA #5 FCA #6 FCA New Cleared Capacity Generation Imports Demand Response 9 FCA #6 De-list Details • A total of 191 de-list bids (approximately 1,968 MW) were received from resources in all six New England states. Approximately 96% were accepted – Permanent, static, exports and administrative export bids were submitted prior to the auction at prices greater than 0.8 X Cost of New Entry (CONE) • 10 resources submitted (approximately 351 MW) – All 351 MW were accepted – Additional static de-list bids were submitted by the ISO on behalf of the Participant due to the inability to qualify winter MW (“low winter flag”) • Submitted for 31 resources representing 122 MW (22 MW in NEMA) – All 122 MW were accepted – Dynamic de-list bids are submitted during the auction at prices less than 0.8 X CONE (or below $4.758/kW-mo) • 150 dynamic de-list bids (approximately 1,495 MW) – 1,416 MW accepted – 79 MW denied (6 dynamic de-list bids in the NEMA/Boston load zone) 10 Approved Submitted De-list Bids by State 1,889 MW Total CT 29% VT 34% Imports 2% RI 3% NH 2% ME 6% MA 24% 11 FCA #6 De-list Details, cont. • A dynamic de-list bid for Vermont Yankee (604 MW) was accepted for FCA #6 based on completion of various system upgrades in MA and VT that resolve identified reliability concerns – • De-list bid submittal trends are starting to emerge – – – – – • A dynamic de-list bid was also submitted in FCA #4 & 5 but the resource was retained for reliability in those auctions AES Thames • Cleared a Dynamic De-list bid for the unit in FCA #5 & 6 West Springfield 3 • Cleared a Dynamic De-list bid for the unit FCA #5 • Cleared a Static De-list bid for the unit FCA #6 Bridgeport Harbor 2 • Cleared a Dynamic De-list bid for the unit in FCA #4, 5, & 6 Somerset Jet 2 • Cleared a Static De-list bid for the unit in FCA #3, 4, & 5 • Cleared a Permanent De-list bid for the unit in FCA #6 • Retired effective 4/20/2012 Somerset 6 • Cleared a Static De-list bid for the unit in FCA #1, 2, 3, 4, & 5 • Cleared a Permanent De-list bid for the unit in FCA #6 • Retired effective 4/18/2012 Resources are also exiting the market via Annual Reconfiguration Auctions and Bilaterals 12 Example – Real Time Emergency Generation Change in Capacity Supply Obligations (CSOs) 1000 900 800 700 600 500 400 300 200 100 0 FCA 1 FCA 2 FCA 3 FCA Cleared CSO FCA 4 FCA 5 FCA 6 Latest CSO 13 Resources Retained for Reliability • Few resources retained for reliability previous auctions – Norwalk Harbor Unit 1 in FCA #1 • Unit #2 was later allowed to de-list – Salem Harbor Units 3 & 4 for FCA #3, 4 and 5 • Area transmission upgrades ongoing • Restudy results for the fourth Capacity Commitment Period being discussed later today – Vermont Yankee for FCA # 4 and 5 • Area transmission upgrades ongoing • Restudy results for the fourth Capacity Commitment Period being discussed later today • These resources were retained for local reliability reasons 14 Trends in De-list Bids Submitted 3,000 581 MW Rejected Megawatts 2,500 1,191 MW Rejected 604 MW Rejected 2,000 1,500 79 MW Rejected 330 MW Rejected 0 MW Rejected 1,000 500 0 FCA #1 FCA #2 DR FCA #3 Generator FCA #4 FCA #5 FCA #6 Import 15 Resources Retained for Reliability in FCA #6 • There were six dynamic de-list bids (79 MW) rejected – All in the NEMA/Boston load zone – Five demand resources – One partial de-list from the Kendall Steam generating facility Price ID Resource Name De-list Bid Amount (MW) Round Resource Type $4.577 $4.577 $4.292 $4.291 $4.291 $3.863 37871 37040 37997 37986 17301 37991 RTDR_50017_Boston (7507) KENDALL STEAM RTEG_50017_North Shore (7508) RTDR_RTEG_50689_North Shore (7508) - Grp A RTEG_50689_North Shore (7508) RTEG_50017_Boston (7507) -38.866 -27.379 -4.830 -2.526 -3.500 -1.512 5 5 5 6 6 6 DR GEN DR DR DR DR • Restudy of these rejected de-list bids will begin this summer with the hope of allowing these resources to de-list based on changes in load forecast and other assumptions 16 Next Steps for the Rejected De-list Bid • A presentation to the RC is expected to be made in June to discuss in detail the resources that were retained for reliability (de-list bid rejection) • In accordance with Planning Procedure No. 10, Section 7.5.1., an advisory RC vote regarding concurrence with how the analyses for the rejected De-list Bids was conducted is required and expected in June – “…The Reliability Committee shall provide formal input and advice to the ISO with regard to rejected de-list bids after the relevant FCA through an advisory vote….” • Pursuant to Market Rule 1, Section III.13.2.5.2.5.1(a)(ii), these resources will continue to be re-evaluated prior to June 1, 2014 to determine if it may be allowed to de-list 17 MAY 15, 2012 | WESTBOROUGH, MA Forward Capacity Auction #6 (FCA #6) Results Summary – Appendix Reliability Committee Meeting Summary of Auction Rounds with Excess Supply and Price Changes Round Start Price End Price Delta $ Excess Start1 Excess End1 Delta MW 1 11.446 6.868 4.578 4656.835 4372.869 283.966 2 6.868 5.723 1.145 4372.869 4280.766 92.103 3 5.723 5.151 0.572 4280.766 4197.273 83.493 4 5.151 4.578 0.573 4197.273 4151.505 45.768 5 4.578 4.292 0.286 4151.505 2956.207 1195.298 6 4.292 3.863 0.429 2956.207 2840.203 116.004 7 3.863 3.434 0.429 2840.203 2821.658 18.545 1 capped by Import Interface Limits and MCL 19 Results of New England’s FCA #6 Price at beginning of auction: $11.446/kW-Mo (2 X CONE) Qualified Resources Entering the Auction: 38,601 MW Existing Resources: 36,174 MW Demand: 3,783 MW New Resources: 2,427 MW Demand: 474 MW Price at end of auction: $3.434/kW-Mo (Floor price: 0.6 X CONE) Need in 2015 (NICR): 33,456 MW Existing: 30,678 MW Excess Capacity: 2,853 MW (Total cleared minus net ICR capped by RTEG) Resources cleared (uncapped) in the auction at the floor price: 36,326 MW Generating Resources: 30,757 MW Imports: 315 MW Generating: 133 MW Imports: 1,820 MW Rejected: 79 MW Generating: 1,398 MW Approved: 1,889 MW Import: 39 MW Cleared Imports: 1,924 MW Existing: 276 MW Existing: 3,331 MW On Peak Seasonal Peak Generating: 32,076 MW RTEG: $3.044 Demand Resources: 3,645 MW New: 79 MW MW from existing resources requesting to de-list 1,968 MW Effective Payment Rate ($/kW-Mo): $3.129 Resources Capped by RTEG 36,309 MW Real Time Real Time EG New: 1,648 MW New: 314 MW 1,288 MW 355 MW 1,385 MW Capacity Zones: One No Price Separation 617 MW Demand: 452 MW 20