Presentation

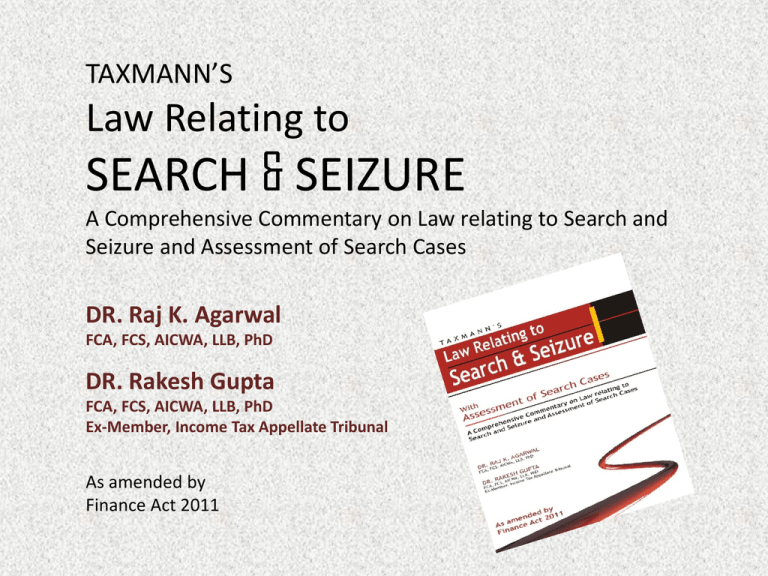

advertisement

TAXMANN’S Law Relating to SEARCH & SEIZURE A Comprehensive Commentary on Law relating to Search and Seizure and Assessment of Search Cases DR. Raj K. Agarwal FCA, FCS, AICWA, LLB, PhD DR. Rakesh Gupta FCA, FCS, AICWA, LLB, PhD Ex-Member, Income Tax Appellate Tribunal As amended by Finance Act 2011 This book makes an in depth analysis of the various provisions of law relating to Search and Seizure, with the support of various judgments rendered by different courts. This book has been written more from practical point of view addressing various practical issues which keep on haunting a person undergoing the action of search. Frequently Asked Questions (FAQs),certain checklists for handling income tax search and assessments and gist of leading case laws have been given in the beginning of the book which may be handy and useful to the readers of the book. Direct Tax Code Bill, 2010 has been introduced in the Parliament. This book will remain equally useful and relevant even after enactment of Direct Tax Code. A separate chapter has been devoted in the book making comparative analysis of the provisions under the existing Act and the proposed Code. Dr. Raj K. Agarwal FCA, FCS, AICWA, LLB, PhD Dr. Rakesh Gupta FCA, FCS, AICWA, LLB, PhD, Ex-Member, Income Tax Appellate Tribunal Dr. Raj K. Agarwal has been meritorious throughout his academic career. He has done M.Com, LL.B. and Ph.D. and is Fellow member of ICAI and ICSI and Associate member of ICWAI. Having practised as Chartered Accountant for more than 25 years as senior partner in M/s Rakesh Raj & Associates, presently he is practicing as an advocate at Delhi High Court. He has wide experience of handling Income Tax search cases and has poured his practical experience in the form of this well researched book. He has been associated with the academic activities of the Institute of Chartered Accountants of India representing various committees of the Institute and with the Institute of Company Secretaries of India representing its Northern India Regional Council as Chairman in the year 2003. He has been contributing articles and addressing various seminars on topics relating to income tax, accounting and auditing. Dr. Rakesh Gupta is a law graduate and Fellow member of ICAI and ICSI and Associate member of ICWAI. He has done Ph.D. He was awarded gold medal in LL.B. examination by the University. He along with Dr. Raj started practicing as chartered accountant in the year 1984 in the firm M/s Rakesh Raj & Associates. He was selected as Member of Income Tax Appellate Tribunal in the year 2000 & thereafter he resigned from the service and started practicing as an advocate as senior partner of M/s RRA TaxIndia at Delhi representing income tax cases before various High Courts and before Supreme Court of India. He is a prolific speaker and has been contributing to the profession by addressing various seminars on regular basis on legal and practical topics relating to Income Tax. He has been contributing articles in various professional magazines, writing column in newspapers and making appearances at T.V. channels. • • • • • • • • • • • • • • • • • • Chapter 1 : Chapter 2 : Chapter 3 : Chapter 4 : Chapter 5 : Chapter 6 : Chapter 7 : Chapter 8 : Chapter 9 : Chapter 10 : Chapter 11 : Chapter 12 : Chapter 13 : Chapter 14 : Chapter 15 : Chapter 16 : Chapter 17 : Chapter 18 : Search and Seizure- Nature of Provisions Circumstances When Search Can Be Initiated Authorization of Search Validity of Search- Writ Jurisdiction Actual Conduct of Search Operations Seizure of Books of Account, Documents and Assets Restraint Order- Section 132(3) and Section 132(8A) Recording of Statement- Section 132(4) Presumption under Section 132(4A) Section 132(8)/ 132(10)/ 132(9)/ 132(9A) Section 132A Assessment Handling of Assessment in Search Cases Wealth Tax Penalty and Prosecution in Search Cases Application to Settlement Commission in Search Cases Precautions before Facing Search Action Direct Taxes Code Bill 2010 On the Go :• Significant Check Lists on Various Issues Relating To Handling of Search & Assessment of Search Cases • Reckoner of Leading case laws on significant issues • Frequently Asked Questions (FAQ’s) • An attempt has been made in this book to comprehend and address various practical aspects relating to search and seizure, apart from discussing and analyzing various complicated and controversial legal issues. • Significant judgments of Supreme Court, different High Court and benches of Tribunal have been discussed and analyzed at appropriate places. • An attempt has been made in this book in case of controversial issues to give both the views so as to bring on surface the different dimensions of the controversy and wherever deemed appropriate, own opinion has been expressed by the authors also. • A chapter has been devoted regarding precautions to be taken by the assessees in managing their financial affairs so as to face any action of search in a proper manner. The authors have discussed the menace of black money prevalent in the society and the causes as well as remedies of the same. • Income Tax Act, 1961 is in the process of being replaced by new Direct Tax Code very shortly. A separate chapter has been devoted in the book making comparative analysis of the provisions under the existing Act and the proposed Code. • An attempt has been made to enlighten the desired amendments/clarification required on various controversial issues relating to authorization and conduct of search, release of assets, assessments, penalty, etc. • Frequently Asked Questions (FAQs), gist of significant landmark judgments of various courts and checklists for the guidance of the assessees while handling income tax search and seizure action. Such material may be quite handy and may provide readily available solution to certain practical issues. • This book may be useful to the practicing tax consultants, taxpayers being individuals or Corporate, senior executives working with the corporate world, academicians and students and at the same time to the tax administrators as well.