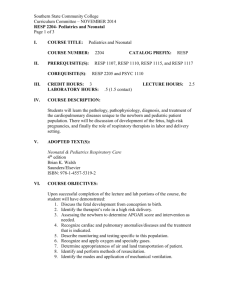

RESP

advertisement

WHO CAN HELP YOU SAVE FOR YOUR CHILDREN’S EDUCATION? A PARTNER YOU CAN TRUST. Would you like to ensure that your children or grandchildren have the necessary financial resources to go to university? Studies shows that a post-secondary education and training are increasingly important. In the 2000s: ◦ 65% of new jobs, or almost 2 out of 3, will require a post-secondary education. Source: Statistics Canada First three years of medicine, starting in 2008, dependent single student Choice #1 Choice #2 Choice #3 $21,450 $31,353 $18,972 Athletic Fees $0 $237 $246 Health Services Fees $1,011 $342 $468 Other Fees $777 $744 $573 Student Association Fees $408 $336 $384 Tuition /Program Fees Compulsary Fees : Books $2,613 $2,613 $2,613 Supplies $360 $360 $360 $26,619 $35,985 $23,616 Total Cost These amounts do not include lodging fees In fact, full-time students in Canada paid $14,500 on average to cover a year of post secondary expenses in 2003-2004. That's roughly $58,000 for a four-year program. Source:CanLearn Let your children go into debt to pay for their education Pay or borrow the amounts required while your child is at university Save now and be able to offer this opportunity to your child later on. The solution? The Registered Education Savings Plan, commonly known as the RESP, is the best solution to save for a child’s education. Anyone can open an RESP: Whether you’re parents, grandparents, legal guardians, family members or friends, you can open an RESP and offer a gift to a child! In addition, when you open an RESP, the child will receive a lovely certificate explaining that someone close to them is taking care of their future. ◦ ◦ ◦ ◦ ◦ To save for your children’s education To take advantage of the Education Savings (CES) Grants To accumulates in a tax sheltered plan To access your contributions To invest in high-performance investments The RESP is registered with the government of Canada so that the money saved for school can grow tax-free, until the person designated as the RESP beneficiary enrolls in a postsecondary school. RESP Contributions Grants Income How much can I save? For all RESPs for the same beneficiary: ◦ Per year: No annual plan contribution limit ◦ Lifetime limit for the plan: Maximum contribution plan limit of $50,000 For how long? Contributions can be made up to the plan’s 31st anniversary ◦ Plan duration: 35 years Once your RESP is opened, you have many investment possibilities: ◦ Guaranteed rate fixed-term investments ◦ Mutual funds: Bonds Canadian equities U.S. and international equities Our RESPs also include a guarantee for sums invested RESP Contributions Grants Income Since 1998 (or the year of the child’s birth) ◦ Each child accumulates $400 (prior to 2007) or $500 in grant room per year. Thereafter, regardless of whether or not an RESP is open in the child’s name. $400 / year 1998 $500 / year 2007 Main federal grant • 20% on the first $2,500 contributed (since 2007) • 20% on the first $5,000 if accumulated room Additional federal grant • on the first $500 contributed only * Family income for 2009 – Income bracket revised annually CLB • Child born after January 1, 2004 • Grant not related to contributions ACG (Alberta only) • Child born in 2005 or later • Grant not related to contributions QESI (Quebec only) • 10% on the first $2,500 Enhanced QESI (Quebec only) • Applicable on the first $500 of contributions only Net family income* lower than $38,832 Net family income* between $38,832 and $77,664 Net family income* over $77,664 20% 20% 20% 20% 10% $500 (first year) $100 thereafter $500 (first year) or, $100 (age 8, 11 and14) $500 (first year) or, $100 (age 8, 11 and14) $500 (first year) or, $100 (age 8, 11 and14) 10% 10% 10% 10% 5% RESP Contributions Grants Income Accumulated income on contributions and on grants: Non-taxable as long as there are no surrenders ◦ Will be taxable to the beneficiary when Educational Assistance Payments (EAP) are made (as income). If the child doesn’t go to university: ◦ Will be taxable to the subscriber when Accumulated Income Payments (AIP) are made. Contributions: Surrenders are non-taxable RESP Contributions Grants Subscriber Beneficiary Parents; Grand-parents Child; Grand-child Income • • Maximum contribution period = 31 years Maximum duration = 35 years End of contributions Close of plan Opening of plan Year 0 COTISATIONS 31 35 Investment in an RESP 70 000 $ Deposit: $2,000/year Interest rate: 6% Taxation rate: 50%* 60 000 $ 50 000 $ 40 000 $ 30 000 $ 20 000 $ 10 000 $ -$ 1 2 3 4 Non-registered 5 6 7 8 RESP 9 10 11 12 13 RESP+ CES grant 14 15 16 MY EDUCATION DIPLOMA MY EDUCATION Offered as an individual or family plan Minimum deposit of $100 Minimum PAC of $25 ($10 per beneficiary for the family plan) Investment funds available ADVANTAGES Flexible contributions allowed Eligible to government grants No annual contribution required Access to your capital at all times Tax-free withdrawal of contributions Possibility to change the plan’s beneficiary at any time DIPLOMA Offered as an individual plan only Minimum mandatory PAC of $25 per month until December 31 of the beneficiary’s 17th birthday Minimum lump-sum deposits of $100 Pre-determined investments ADVANTAGES Offer an education bonus of up to 15% of the contributions to the RESP will increase the income paid for education Eligible to government grants Access to your capital at all times Withdrawals of contributions are tax-free Possibility to change the plan’s beneficiary at any time $100/month Years 0 18 $100 x 216 months (18 years) x 15% (bonus according to age) = $3,240 You would like to increase your contributions, but your current budget does not allow it. Here is a solution that lets you increase the amounts available in your RESP and receive the maximum government grant, while staying within your budget! RESP LOAN Available for an amount equal to your contract’s current contributions (up to 100%) No interest or repayment required until the end of the plan ◦ However, it can also be repaid at any time How it Works RESP Your RESP loan: GRANT $1,000 $200 Your contribution: $1,000 $200 $2,400 By depositing $1,000, you obtain a $2,400 investment for your child’s studies! IA RESPs Financial institutions and fund companies No annual fees Annual administration fee (between $25 and $50) DIPLOMA and MY EDUCATION EAP eligibility in the first study session, with proof of registration EAP determined by the subscriber Possibility of AIP Scolarship Plans EAP eligibility in the second year of studies and at age 19, with proof of school success EAP determined by the foundation Accumulated income paid to the foundation EAP: Educational Assistance Payments AIP: Accumulated Income Payments The advantage of an IA RESP: FLEXIBILITY For the 20% (or more) grant For the education bonus of up to 15% (Diploma) For tax-sheltered accumulation To maximize the grant through the RESP loan To diversify your investments (My Education) For the flexibility of changing beneficiaries For the possibility to transfer investment income to your RRSP, if your child does not pursue a post-secondary education RESP is the ideal savings vehicle for THE children’s post-secondary education!