SALGA Councillors Remunerations PresentationCllr Rem June `11

advertisement

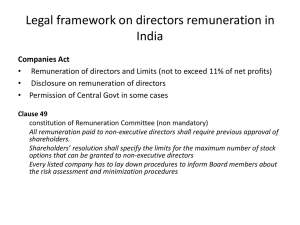

www.salga.org.za COUNCILLOR SALARIES, ALLOWANCES AND BENEFITS 1 www.salga.org.za Presentation Outline 1. Introduction 2. Legislative Framework 3. Prescribed Processes 4. Implementation 4.1 Grading 4.2 Total Remuneration Package 4.3 Motor Vehicle Allowance 4.4 Salary 4.5 Additional Benefits 4.6 Section 8(1)(d) Tax Allowance www.salga.org.za Introduction Recognition • In terms of relevant legislation (Public Office bearers Act, Income Tax Act) councillors are recognised as Public Office Bearers. • Remuneration system as it relates to municipal councillors, besides being financed directly from municipal income, is different from that of Public Office bearers in other spheres of government. www.salga.org.za Legislative Framework Constitution of the RSA • Section 219(1) of the Constitution stipulates that an Act of Parliament must establish a framework for determining the upper limits of salaries, allowances and benefits of POBs. Relevant National Legislation • In an attempt to deal with the remuneration of Public Office Bearers as envisaged in the constitution, parliament enacted:– Independent Commission for the Remuneration of Public Office– Bearers Act of 1997, that establishes the Commission, which is to make recommendations concerning the salaries, allowances and benefits of public office-bearers; and – the Remuneration of Public Office Bearers Act No.20 of 1998, which provides the framework for remuneration of public office-bearers. www.salga.org.za Legislative Framework Municipal Finance Management Act of 2003 (MFMA) • Section 167 has a major impact on the remuneration of political office bearers. - It stipulates that political office-bearers may only be remunerated within the framework of the Remuneration of Public Office Bearers Act and Section 219 (4) of the Constitution. - It declares that any payment, whether in cash or kind, made outside this framework would be regarded as an irregular expense. www.salga.org.za PROCESS TO DETERMINE SALARIES, BENEFITS AND ALLOWANCES FOR PUBLIC OFFICE BEARERS NAT & PROV Independent Commission Promulgates Recommendation President Determines through promulgation in Govt Gazette Implementation Vis-à-vis LOCAL Independent Commission Promulgates Recommendation Minister issue draft followed by Final Notice in Govt Gazette 1.Council 2.MEC Concurrency 3. Implementation Process for determination of salaries, benefits and allowances of Councillors curiously differs from other public office bearers. www.salga.org.za Implementation Upper Limits are published annually and deals with the following: 1. Grading of municipalities for purposes of the remuneration scales; 2. Upper Limits of total remuneration packages of full-time and part-time councillors; 3. Upper Limits of allowances of full-time and part-time councillors; 4. Upper limits of remuneration or allowances in respect of appointed councillors (district councillors); 5. Upper limits of cellphone allowances; 6. Upper Limits of pension fund contributions and medical aid benefits of councillors; and 7. Tax Allowance: Section 8 (1)(d) of Income Tax Act. www.salga.org.za IMPLEMENTATION : GRADING Number of Total Population in Area? Municipal Income for previous financial year? GRADE of Municipality (1 – 6) EXAMPLE 170 000 = 25 points R 150 m = 25 points 50 points Grade 3 www.salga.org.za DM COUNCIL COMPOSITION Appointed Councillors Proportional Representative Councillors REMUNERATION - LM, total rem package -DM, difference or sitting allowance + trav District Municipality District Municipal Councillors www.salga.org.za TOTAL REMUNERATION PACKAGE SALARY MOTOR VEHICLE ALLOWANCE TOTAL REMUNERATION PACKAGE DEFINITION - housing; - pension fund; - medical aid; - basic salary NOT more than 25 % of total package Additional to Total Remuneration Package:1. 2. 3. Travel reimbursement Out of pocket expense and Cellphone allowances Salary + Motor vehicle allowance www.salga.org.za TYPES OF MOTOR VEHICLE ALLOWANCE & BENEFITS Type 1. 25 % ALLOWANCE: incl. 500km travelled per month on official Business kilometres travelled above 500km may be claimed. Type 2. 25 % ALLOWANCE + MAYORAL VEHICLE Type 3. NO ALLOWANCE USE OF MUNICIPAL OWNED VEHICLE FOR OFFICIAL PURPOSES Type 4. NO ALLOWANCE AMOUNT FORMS PART OF SALARY COMPONENT www.salga.org.za SALARY COMPONENT HOUSING ALLOWANCE PENSION FUND CONTRIBUTION 15% Calculated on the Basic Salary Component SALARY MEDICAL AID BENEFIT 2/3 of membership premium or fee with maximum of R 1 440 per month BASIC SALARY COMPONENT Includes a Tax allowance of up to R 120 000 per annum www.salga.org.za Basic Salary Component • Basic Salary component includes the Tax Allowance in terms of the Income tax Act The “basic salary” is the component of the salary that includes the Tax allowance as permitted by Section 8(1)(d) of the Income tax Act, 1962 but specifically excludes a housing allowance as provided in items 6(b) and 9(b), the municipal contribution to a pension fund as provided in item 11(a) and the municipal contribution to a medical aid scheme as provided in item 11 (b). • NOT IN ADDITION TO THE TOTAL PACKAGE. www.salga.org.za Section 8(1)(d) Tax Allowance DEFINITION Allowance granted to the holder of a public office to defray expenditure incurred in connection with his /her office, to have been expended to the extend that the expenses were actually incurred for the purpose of his/her office in respect of :1. Secretarial or duplicating services, stationery, postage or telephone calls; 2. The hire and maintenance of office accommodation; 3. Travelling; 4. Hospitality extended at any official function; 5. Subsistence and incidental costs incurred. www.salga.org.za Section 8(1)(d) Tax Allowance IMPLICATIONS OF THE TAX ALLOWANCE 1. 50% of allowance is taxable 2. Part-time public office bearers - 50% of allowance is taxed at 25% 3. Full-time public office bearers – tax tables to be applied 4. Full allowance (100%) will be shown on IRP5 certificate – code 3708 5. Proof of expenses should be produced when requested by SARS 6. Expenses not covered under section 8(1)(d), can still be reimbursed for out of pocket expenditure. www.salga.org.za Example Section 8(1)(d) Grade 5 (Part-Time) SALARY (A) Housing 159 471 (13 290) 0.00 Medical Aid 17 280 (1 440) Pension Fund 18 547 (1 546) Basic Salary Sec 8(1)(d) Vehicle (B) Total Package (A + B) 123 644 (10 304) 120 000(10 000) 53 157 (4 430) 212 628 (17 720) www.salga.org.za TOTAL REMUNERATION PACKAGE SALARY MOTOR VEHICLE ALLOWANCE TOTAL REMUNERATION PACKAGE DEFINITION - housing; - pension fund; - medical aid; - basic salary NOT more than 25 % of total package Additional to Total Remuneration Package:1. 2. 3. Travel reimbursement Out of pocket expense and Cellphone allowances Salary + Motor vehicle allowance www.salga.org.za ADDITIONAL TO TOTAL REM PACKAGE Additional to Total Remuneration Package:1. Travel reimbursement Kilometres travelled over and above the 500km for official business to be claimed from municipality in terms of Dept of Transport Tariffs 2. Out of pocket expense Actual Expenses incurred during performance of official duties. 3. Cellphone allowances Monthly allocation made in terms of Notice:• Grade 6 Mayors – R 2 997 • Other Mayors and Full-time Councillors – R 1 496 www.salga.org.za Participation in MCPF • Participation open to all Municipalities with eligibility for membership being restricted to Councillors of a participating Municipality. • Total contributions:- 28.75% of pensionable allowances, meaning that in addition to the 15% contribution included in Total Package councillor must contribute 13.75%. • Contributions payable are to be deducted from their total remuneration package by the municipality concerned and paid to the Fund by that Municipality on the members’ behalf. www.salga.org.za 2009/10 Grade 4 Part Time INCOME SALARY DEDUCTIONS 10805.09 TAX 1658.49 TRAVEL ALLOWANCE 3601.67 UIF 124.78 CELL PHONE 889.00 PENSION (15%) 1409.36 PENSION (13.75%) 1291.91 COUNCIL SUNDRY INCOME 15295.76 DEDUCTIONS TOTAL EARNINGS 227.44 4711.96 10583 www.salga.org.za THE END THANK YOU 21