Banker vs Customer

advertisement

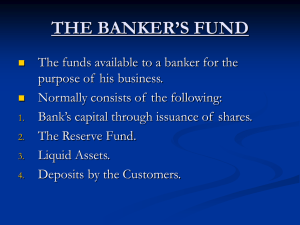

CHAPTER Three Banker & Customer Relation Muhammad Ibrahim Sohel BBA Department of Business Administration International Islamic University Ctg (Dhaka Campus) Customer – Definition: “To constitute a customer there must be some recognizable course or habit of dealing in the nature of regular banking business” - John Paget It is known as “Duration theory” Features of Customer - Have an account in a bank - Dealing with a bank - Dealing must be in the nature of banking business - Dealing may be of short or long duration Relationship between a banker and customer Relationship General Special Relationship Relationship General Relationship General Relationship Primary Secondary Primary Relationship Debtors & creditors relationship: - Demand for payment - Demand at proper time - Demand in proper manner Secondary Relationship 1. Trustee & Beneficiary relationship (at the time of keeping valuables): - Bankers does not get ownership - It does not compensate the creditors at the time of bank’s liquidation - Deposits carry any standing instruction – (trustee & beneficiary) and vice versa - cheque deposits for collection (trustee & beneficiary) and vice versa. Obligation of the banker 1. Obligation to honour the Cheques: - Sufficiency of funds - Applicability of funds - Proper requirements for payment - No garnishee or attachment order 2. Obligation to maintain secrecy of accounts: a. Legal necessity – it will disclose if it is required by; - Income tax act Companies act RBI act Banking regulation act Gift tax act Order to court Foreign regulation act Garnishee Order The obligation of a banker to honour his customers cheque is extinguished on receipt of on order from the court known as trhe garnishee order If a debtor fails to pay the debt due to his creditor, the creditor may apply to the debtors bank to issue this order so that the bank account is frozen. 4/13/2015 10 Parts of Garnishee Order 1.Order Nisi :Directs the banker to freeze the debtors account or seeks the banker to explain why the funds in the account should not be used for payment to the creditors. 2.Order Absolute: Directs the banker to pay either the whole or part of the funds lying in the account. 4/13/2015 11 Features of Customer - Have an account in a bank - Dealing with a bank - Dealing must be in the nature of banking business - Dealing may be of short or long duration 4/13/2015 12 b. Banking Practice: 1. Disclosure with customer’s consent - Express consent (customer can instruct) - Implied consent (guarantor) 2. Disclosure for banker’s own interest - To bankers lawyer (recovery of dues) 3. Disclosure of request by other banks - Can furnish data except the actual figures 4. Disclosure for public interest - When it helps to find a criminal - Person involves in Illegal activities Consequences of wrong disclosure: Liability to the customer: Banker should compensate the loss due to the wrong disclosure Liability to the third party: Banker should compensate the loss for the wrong disclosure Rights of a banker 1. Right of lien: - Lien is a right of the person who can retain the goods of another in his position until a debt due to him is paid. - Particular lien – on particular property. - General lien – Any property can be retained. Conditions to be satisfied in lien: - Banker must property/security. possess - Property/security must be in the name of the customer alone. - The possession legally. obtained by the banker Exception to the right of lien: - - - - Valuable accepted for safe custody. Bill of exchange/other documents deposited for other purposes. Money deposited for special purposes like purchase of securities Documents/valuables left with the banker by mistake Trust a/c operated by the customer against his personal a/c. Securities lodged with a banker for getting a loan before sanctioning such loan 2. Right of Set Off: - Banker can exercise the right by setting off a debit balance in one a/c with the credit balance in another a/c maintained by the same customer. Right of set off subject to the following conditions: - No agreement contrary to this right. - Formal notice to the customer. - Capacity of the customer must be same in all the a/c’s. - Different branches of bank will constitute one entity. - Banker has the option (customer can’t compel the banker). - Banker can do this even after the receipt of garnishee order. 3. Right of Appropriation: - Appropriation of amount will arise when a customer; - Owes several debts to a banker and - His payment is not discharge all his debts. sufficient to 4. Right of charge interest, incidental charges etc: - Banker has the right to charge interest on due from customers - It has the right to charge incidental charges on customers a/c