Advance Pricing Agreement Safe Harbour Thin Capitalisation CA

advertisement

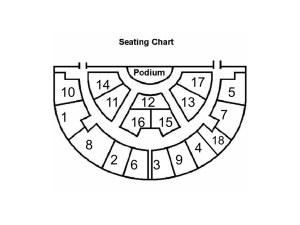

Advance Pricing Agreement / Safe Harbour / Thin Capitalisation 27 October 2012 Presentation by: CA Yashodhan D. Pradhan Presentation Overview • Advance Pricing Agreement (APA) – Introduction • APA: International Scenario • APA Scheme in India • Safe Harbour Provisions • Thin Capitalisation Advance Pricing Agreement (APA) Introduction to APA... • An APA is a contract • Usually for multiple years • Between a taxpayer and at least one tax authority • Mainly to prospectively resolve real or potential transfer pricing issues • Involving transactions between related parties Slide 4 ...Introduction to APA • Once APA has been entered into, the ALP will be determined only in accordance with the APA • The APA process is voluntary • Supplements appeal and other DTAA mechanism for resolving transfer pricing disputes • Provides greater certainty on the transfer pricing method adopted • Mitigates the possibility of disputes • Facilitates the financial reporting of potential tax liabilities • Reduces the incidence of double taxation, and the costs associated with both audit defense and documentation preparation Slide 5 Types of APA Type Nature Unilateral APA APA entered into between a taxpayer and the tax administration of the country where it is subject to taxation Bilateral APA APA entered into between the taxpayers, the tax administration of the host country and the foreign tax administration Multilateral APA APA entered between the taxpayers, the tax administration of the host country and more than one foreign tax administrations Slide 6 Advantages of APA • Provides certainty of tax treatment by relevant tax authority • Investment decisions regarding overseas operations clarified: Projection of future tax liabilities possible • Mitigates risk of a difficult potential TP audit/ future litigation • Substantially reduces possibility of future double taxation (bilateral or multilateral APA) • APAs have the potential to cover most TP issues including: - Tangible goods pricing. - Services - Intangibles issues involving royalties - Cost-sharing issues • Taxpayer has participation in the process (unlike MAP) Slide 7 Disadvantages of APA • Increases the risk of audits and adjustments in the related party country (in case of unilateral APA) • Cost of implementation is high - However, it’s likely that APA costs ≦ audit defense fees - However, high cost involved in preparing APA application makes it economically justifiable only when there is large volume of transactions • May reduce tax planning opportunities • Immediately draws attention to an entity’s tax planning in different nations • Usefulness of APA diminished if no agreement reached until period proposed to be covered almost expires • Potential reluctance of taxpayers to disclose information unless confidentiality is assured Slide 8 Example • Indian subsidiary engaged in machinery distribution, had very high profits over a number of years • Concern about exposure of foreign parent to adjustment by its tax authority • Earlier assessment: both foreign parent tax authority and Indian TP authorities adjusted income, resulting in double taxation • Goal: Obtain tax authority approval for resetting transfer prices • Strategy: Obtain bilateral APA, adjust to closest point in the range (high end) Slide 9 APA: International Scenario • More than 30 Countries allow APA • Almost 20 years ago, only a few countries (e.g. the United States, Canada and Australia) were front-runners in the implementation of formal APA schemes • Up to 2010, the United States had signed the highest number of APAs (over 950) in the world • Following the introduction of the OECD guidelines on APAs in 1995, a number of countries began to enter into APA schemes • The experiences of these countries (especially the Asian countries due to economic similarities) in the implementation of APA schemes, can be used by India to implement a robust APA regime Slide 10 APA: International Scenario Country Year of introduction Type of APA Term of agreement Pre-filing Japan 1987 Unilateral & Bilateral 3-5 years Optional USA 1991 Unilateral, Bilateral & Multilateral 3-5 years Mandatory UK 1999 Unilateral, Bilateral (No distinction in bi and multilateral 18 to 21 months Optional China 2004 Unilateral, Bilateral & Multilateral 3-5 years Mandatory India 2012 Unilateral, Bilateral & Multilateral Upto 5 years Mandatory Slide 11 APA Scheme in India… • The APA regime was initially slated to be a part of the Direct Taxes Code • However, the scheme has been released in advance with its introduction through the Union Budget 201213, and has been woven into the existing set of Regulations • Although the operating guidelines were spelled out very recently i.e. on 30 August 2012, the Finance Ministry had already taken some administrative steps, including the appointment of an APA team, for the implementation of the scheme • Introduced through sections 92CC and 92CD and Rules 10F to 10T Slide 12 …APA Scheme in India • At present, a parallel mechanism exists i.e. advance rulings from the Authority for Advance Rulings (AAR) • AAR is empowered to examine a prospective contract of a resident taxpayer with a non-resident in order to determine the taxability thereof • The main difference: under the APA scheme, the tax authorities may determine/quantify the value of the international transaction or profits, whereas the Authority for Advance Rulings does not have a power to do so Slide 13 Significant Features of the APA Framework in India… • The use of existing prescribed methodologies with necessary adjustments/variations or any other method to determine the arm's length price One may choose any method in addition to the methods prescribed in the Regulations This gives flexibility to agree upon a method that may be more suitable This also makes the APA regime more attractive to those MNEs that are dealing with difficult scenarios where the prescribed methods may not best reflect an arm’s length outcome Slide 14 …Significant Features of the APA Framework in India… • The duration (i.e. term) of an APA would be limited to a maximum of five consecutive fiscal years Coverage of five years is consistent with the coverage of APAs in other countries A period of three to five years is considered adequate as regards the cost of the APA process, expected changes to the business and various conditions affecting the transactions covered Slide 15 …Significant Features of the APA Framework in India… • APAs are binding on the taxpayer and the tax authorities unless there is a change in the law or facts of the case This will give certainty to both taxpayers and the tax authorities. However, care should be taken to ensure that minor changes in the course of business due to market dynamics do not render the APA void. Slide 16 …Significant Features of the APA Framework in India… • Approval of the Central Government will be necessary This suggests that the government intends to monitor and possibly even control the APA process Other than its obvious effects, this will ensure that the APA process is completed within a reasonable time frame Slide 17 …Significant Features of the APA Framework in India… • An APA applies to the determination of the arm's length price in respect of prospective transactions only even if the transaction is a continuing one The APA process is a forward-looking exercise and is applicable only with regard to prospective transactions that are either being contemplated to be undertaken or those which are continuing transactions that will be carried out in the following year by the taxpayer Further, as APA will involve the determination of the arm’s length price, a detailed transfer pricing audit by a transfer pricing officer will not be undertaken for the term of the agreement, however, the taxpayer will need to satisfy the transfer pricing officer as regards the compliance with the terms of the agreement, critical assumptions, correctness of the supporting data and consistency of the applications of the transfer pricing method Slide 18 …Significant Features of the APA Framework in India… • The fees prescribed for the APA ranges from INR 1 million to INR 2 million depending upon the amount of international transactions under consideration Amount of International Transaction entered into or proposed to be undertaken in respect of which agreement is proposed during the proposed period of agreement Fee (INR) Amount not exceeding Rs. 100 Crores 10 lacs Amount not exceeding Rs. 200 Crores 15 lacs Amount exceeding Rs. 200 Crores 20 lacs Slide 19 …Significant Features of the APA Framework in India • APA shall not be binding if there is a change in law or facts relating to the agreement • Void-ab-initio if agreement is obtained by fraud or misrepresentation of facts • If ROI already filed, the same can be modified after APA is entered into • Assessment if already completed , the officer should assess or reassess as per the APA Slide 20 APA Rules… Rule Description 10F Meaning of expressions 10G Person Eligible to apply 10H Pre-filing Consultation 10I Application for advance pricing agreement 10J Withdrawal of application for agreement 10K Preliminary processing of application 10L Procedure 10M Terms of the agreement 10N Amendments to Application 10O Furnishing of Annual Compliance Report 10P Compliance Audit of the agreement 10Q Revision of an agreement 10R Cancellation of an agreement 10S Renewing an agreement 10T Miscellaneous Slide 21 …APA Rules… Rule / Form 44GA Description Procedure to deal with requests for bilateral or multilateral advance pricing agreements Forms 3CEC Application for a pre-filing meeting 3CED Application for an Advance Pricing Agreement 3CEE Application for withdrawal of APA request 3CEF Annual Compliance Report on Advance Pricing Agreement Slide 22 …APA Rules… • Eligibility: applicable to all “persons” undertaking international transactions or contemplating to undertake international transactions • Pre Filing Consultation: Mandatory Detailed information required Option to keep the names ‘anonymous’ Request to DGIT in form no. 3CEC Neither binding on the Board nor the taxpayer to enter into an APA Objective is to enable both parties to: determine the scope of the agreement identify transfer pricing issues determine the suitability of international transaction for the agreement discuss broad terms of the agreement • Application for APA: To be filed in Form no. 3CED Slide 23 …APA Rules… • Withdrawal: Applicants can withdraw any time before the finalisation of the terms However, the fee which has been paid would not be refunded Form 3CEE prescribed • Preliminary processing and procedure: includes vetting the application for any deficiencies If the application is allowed in the preliminary processing phase, the main processing of applications would be conducted by the APA team in the following manner: holding meetings with applicant calling for additional documents/ information/material from the applicant visiting applicant’s business premises making inquiries as may deems fit in the circumstances of the case • Agreement and terms: Approval of the Central Government required Should include – International transactions covered, agreed methodology, ALP if any, critical assumptions, time period, definition of terms and other conditions if not covered in the prescribed APA scheme Slide 24 …APA Rules… • Annual Compliance Report: To be furnished in quadruplicate to DGIT for each of the years covered in the agreement One copy each would be sent by the DGIT to the CA India, to the jurisdictional CIT and one copy to the TPO To be filed within thirty days of the due date of filing the income tax return for that year, or within ninety days of entering into an agreement, whichever is later • Compliance audit: The TPO to carry out the compliance audit of the APA for each of the year covered in the agreement required to furnish his report within six months from the end of the month in which the annual compliance report is received by him Covered transactions under the APA scheme would not be audited by the TPOs under the routine transfer pricing assessment procedure The compliance audit is not a general feature internationally Slide 25 …APA Rules • Revision of an APA: An APA can be revised in case of: change in critical underlying assumptions change in such law other than that which renders it non-binding request from CA in the other country The revision order is required to be in writing citing reasons of revision required and: revisions can be initiated by the Board / DGIT/ CA/ taxpayer opportunity of being heard to be provided non-agreement by the taxpayer on the proposed revisions may result in cancellation of the APA • Miscellaneous: Mere filing of a application for an agreement under these rules shall not prevent the operation of Chapter X of the Act for determination of arms‟ length price under that Chapter till the agreement is entered into Slide 26 What is Lacking? or What is Just Not Right? • No provisions for rollbacks • No mention of timeframe to conclude • No provisions re confidentiality safeguards • Cancellation of agreements may not work in bilateral / multilateral scenario • Provisions regarding critical assumptions need to be explained further Slide 27 Processes Bilateral / Multilateral APA CBDT Approval CBDT Approval DGIT Competent Authority in India APA Team Agreement Agreement Unilateral APA Discussions Competent Authority Of AE’s Country Agreement APA Team Discussions Taxpayer AE Taxpayer India Outside India Slide 28 Way Forward • Obtaining an APA involves extensive negotiation between the taxpayer and the tax authorities in a mutual environment • Indian tax authorities need to develop an environment conducive to the success of a continuous negotiation process • An APA scheme has the ability to deliver significant benefits including savings in compliance and administrative costs • However, the law must clarify certain aspects such as secrecy of business information to safeguard the interests of the taxpayer Slide 29 Safe Harbour Introduction to Safe Harbour • Safe Harbour Rules are the circumstances under which tax authorities automatically accept the transfer prices declared by the taxpayer • Provides certainty and compliance relief • Could be in the form margin threshold or exclusion of certain classes of transactions from TP regulations • Safe Harbour and Presumptive Taxation provisions (Similar in nature) Slide 31 Why are Safe Harbour Rules so Important to India? • India is a globally preferred country for outsourcing of services • However, the outcomes of the TP assessments concluded in the last couple of years have increased the uncertainty over taxation issues • Safe Harbour Rules once introduced, will provide some certainty to MNEs • Captive service providers in India to benefit Slide 32 Industries / Transactions that Need Immediate Attention • Indian IT/ITeS industry • Management Service Charges • Royalties Slide 33 Global Scenario • Safe Harbour provisions are being practiced by several mature practices across the globe • in Australia and New Zealand, a 7.5 per cent markup on cost is generally accepted as an arm’s length margin for the non-core services • US has prescribed a Safe Harbour for routine services. Here the services charged at cost (without mark-up) are considered to be at an arm’s length • Brazil have introduced safe harbour provisions in respect of exports Slide 34 Safe Harbour Provisions in India • Contained in Section 92CB • No Rules prescribed by CBDT yet and hence, no clarity • Awaited since 2009 • Risky from double taxation perspective • Harmful in case of genuine business losses and downturns Slide 35 Advantages and disadvantages of Safe Harbour Rules • Reduces litigation burden • Provides a measure of predictability • Significantly reduced compliance • Administrative simplicity • Risk of double taxation • Difficult balancing act Slide 36 Thin Capitalisation The Concept of Thin Capitalisation • A company is said to be thinly capitalized when its capital is made up of a much greater proportion of debt than equity • In other words, when its gearing or leverage, is too high • This is perceived to create problems for two classes of people consumers and creditors bear the solvency risk of the company, which has to repay the bulk of its capital with interest; and revenue authorities, who are concerned about abuse by excessive interest deductions Slide 38 The Concept of Thin Capitalisation • Specific rules aimed to discourage thin capitalization often require that the debt-to-equity ratio meet a specific ratio in order for the company to be allowed to deduct interest expenses • Thin capitalization refers in some countries to the situation where a company has excessive debt in relation to its arm’s length borrowing capacity • Here, the rules do not specify the debt-to-equity ratio, but do specify that in order to claim interest deductions, a company must ensure – and be able to document from a transfer pricing perspective – that the terms and conditions of its intercompany financing are comparable to those it could have obtained from third-party lenders (for example, in the United Kingdom) Slide 39 Why is Thin Capitalisation Considered as a Problem? • Thin capitalization is a problem from a tax perspective because the returns on equity capital and debt capital are treated differently for tax purposes • Returns to shareholders on equity investments are not deductible for the paying company, being distributions of profit rather than operating expenses • On the other hand, returns to lenders on debt – most commonly in the form of interest – are normally deductible for the payer in arriving at profits assessable to corporate tax • This can result in attempts by multinational enterprises to present what in substance is equity investment in the form of debt, and thereby receive more favourable tax treatment Slide 40 Why is Thin Capitalisation Considered as a Problem? • As of now, India does not have any Thin Capitalisation Rules • Direct Taxes Code proposes to introduce this concept • Income tax department is seriously thinking of applying thin capitalization rules in India • This will allow them to classify some parts of the interest paid as dividend Slide 41 Conclusion • APA is a step in a right direction, however, concerns relating to confidentiality of information etc. need to be addressed • Safe Harbour Rules are eagerly awaited by MNEs. However, the taxpayers are wary of possible double taxation issues • Thin Capitalisation is yet to be formally introduced in India. Its introduction will depend on the adoption of Direct Taxes Code Slide 42 Yashodhan D Pradhan Principal Consultant Vispi T. Patel & Associates Contact No.: +91 9820888009 Email: yashodhanpradhan@yahoo.co.uk ,yashodhan@vispitpatel.com