Chapter27 PowerPoint

advertisement

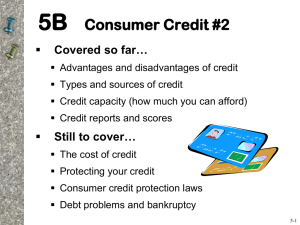

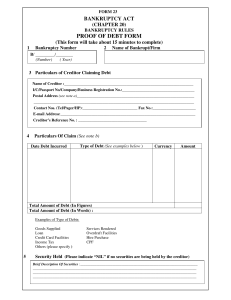

Chapter 27 Your Credit and the Law pp. 434-447 Learning Objectives 1. Explain how government protects credit rights. 2. Name federal laws that protect consumers. 3. Identify consumers’ credit rights. 4. Describe how to handle credit problems. Why It’s Important To maintain a good credit rating you have specific rights and protections under the law. Protecting Your Credit Rights To protect consumers, the federal and state governments control and regulate the credit industry. A law restricting the amount of interest that can be charged for credit is called a usury law. Consumer Credit Protection Act To make comparing credit costs easier, Congress passed the Consumer Credit Protection Act, also known as the Truth in Lending Law. Truth-in-Lending Disclosure All costs of borrowing must be made known to the consumer. These costs are provided in the truth-inlending disclosure that a creditor gives to a borrower. Truth-in-Lending Disclosure The two ways that the cost of credit must be expressed are: The dollar cost of credit, or the total finance charge The annual percentage rate (APR) Truth-in-Lending Disclosure The truth-in-lending disclosure also states the credit terms and conditions. Advertising Credit According to the Truth in Lending Law, a credit advertisement must tell the number of payments, the amount, and the period of payments. Protecting Card Owners The Truth in Lending Law states that If your credit card is lost or stolen and used by someone else, your payment for any unauthorized purchases is limited to $50. Protecting Card Owners The Truth in Lending Law also states that credit card companies are not allowed to send cards to consumers who didn’t request a credit card. Equal Credit Opportunity Act The Equal Credit Opportunity Act says that a credit application can be judged only on the basis of financial responsibility. Equal Credit Opportunity Act The three reasons for denying credit are: Low income Large current debts A poor record of making payments in the past Equal Credit Opportunity Act The Equal Credit Opportunity Act requires that all credit applicants be informed of whether their application has been accepted or rejected within 30 days. Figure 27.1 FEDERAL AGENCIES THAT ENFORCE THE LAW The law gives you certain rights as a credit consumer. What types of complaints about a creditor might you report to these government agencies? Fair Credit Reporting Act When you apply for and use credit, the information goes into a file at one or more credit bureaus. A credit file includes personal, employment, and financial information. Fair Credit Reporting Act The Fair Credit Reporting Act was passed because of concerns about the accuracy of credit file information. Right to Know • The Fair Credit Reporting Act gives you the right to know what’s in your credit file. If incorrect information is found, it must be removed from your file after the situation is examined. Right to Be Notified The Fair Credit Reporting Act states that you must be notified when an investigation is being conducted on your credit record. Right to Privacy According to the law, only authorized persons can see a copy of your credit report. Financial Flexibility Corporations also get credit ratings. Standard & Poor’s assigns ratings to corporations based on several factors. A company’s market position and how it will grow in the near future are considerations. continued Financial Flexibility The financial situation of a corporation is also important. Finally, Standard & Poor’s considers the risk associated with the company’s industry. Technology, for example, has a high degree of risk. continued Analyze Why do you think technology companies are considered risky? Fair Credit Billing Act The Fair Credit Billing Act requires creditors to correct billing mistakes brought to their attention. The law also requires that consumers be informed of the steps they need to take to get an error corrected. Notify the Creditor The first step in correcting errors is to notify the creditor in writing. If the creditor made the mistake, you don’t have to pay any finance charge on the amount in error. Stop Payment The Fair Credit Billing Act permits consumers to stop a credit card payment for items that are damaged or defective. Figure 27.2 WHAT IF YOU’RE DENIED CREDIT? Sometimes you can be denied credit because of information from a credit report. The law requires credit card companies to correct inaccurate or incomplete information in your credit report. Is it best to request changes of incorrect information by letter rather than by phone? Fair Debt Collection Practices Act A collection agent is a person or business that has the job of collecting overdue bills. Before this act, collection agents could use any method they chose to collect. Fair Debt Collection Practices Act The Fair Debt Collection Practices Act (FDCPA) regulates the practices of collection agents. Fair Debt Collection Practices Act Collection agents must identify themselves to the people whose bills they’re trying to collect. Fair Debt Collection Practices Act Collection agents can’t tell others about the debt. Collection agents can’t contact a person at work if the employer doesn’t permit it. Fair Debt Collection Practices Act If they use the phone, collection agents can’t keep calling all the time or pretend to be someone else. Fair Debt Collection Practices Act Collection agents can’t state the amount of a debt on a postcard that a neighbor or someone else might see. Graphic Organizer GraphicCredit Organizer Consumer Rights Consumer Credit Protection Act Right to know costs and terms of credit Equal Credit Opportunity Act Right to fair opportunity to obtain credit Fair Credit Reporting Act Right to know what’s in your credit file Fair Credit Billing Act Right to have billing mistakes resolved Fair Debt Collection Practices Act Right to be protected from collection agencies Making an Ethical Decision 1. Does a credit card company have the right to call customers whose payment is overdue? 2. How does the Fair Debt Collection Practices Act protect consumers? continued Making an Ethical Decision 3. Is a credit card company that uses recorded messages rather than live callers to collect late payments following the spirit of the law? Why or why not? Enforcing the Laws The Federal Trade Commission (FTC) is responsible for enforcing the laws on credit. The FTC also helps consumers with credit problems. Enforcing the Laws On the state level, you can contact your state banking department about credit problems. Enforcing the Laws A consumer protection division of your state attorney general’s office deals with complaints that other government agencies might not handle. Fast Review 1. What does the usury law do? 2. In what two ways must the cost of credit be expressed in a truth-inlending disclosure? continued Fast Review 3. What are the only three reasons a person can be denied credit according to the Equal Credit Opportunity Act? continued Fast Review 4. Name the three rights the Fair Credit Reporting Act guarantees. 5. What does the Fair Debt Collection Practices Act prevent collection agents from doing? Credit Counseling A credit counselor can help you revise your budget, contact creditors to arrange new payment plans, or help you find other sources of income. Consolidating Debts A consolidation loan combines all your debts into one loan with lower payments. Consolidating Debts The two problems with a consolidation loan are: There is usually a high interest rate because people who get such loans are considered poor credit risks. continued Consolidating Debts Because there is only one monthly payment, you might feel that the credit problem is under control and start charging new purchases Bankruptcy Bankruptcy is a legal process in which you are relieved of your debts, but your creditors can take some or all of your assets. Bankruptcy When bankruptcy is declared for reorganization purposes, the debtor, the creditor, and a court-appointed trustee come up with a plan to repay the debt on an installment basis. Bankruptcy You should avoid bankruptcy because it gives you a bad credit record. Recent changes in the law have made it harder to declare bankruptcy. Credit Services Some companies will provide credit even if your credit rating is poor or if you have been denied credit in the past. Credit Services Some companies charge a fee to “clean up” your credit rating but they’re seldom able to restore a bad credit rating. Credit Services If you need a credit counselor, you can check with your Better Business Bureau or Chamber of Commerce to recommend one to you. Fast Review 1. What are the two problems with a consolidation loan? 2. What effect does declaring bankruptcy have? How might identity theft affect your credit history? What should you do if your debit card is lost or stolen? continued If someone steals your credit card, by federal law, how much are you responsible to pay? continued How can you make sure all online transactions are secure? Key Words usury law Consumer Credit Protection Act truth-in-lending disclosure Equal Credit Opportunity Act Fair Credit Reporting Act Fair Credit Billing Act continued Key Words collection agent Fair Debt Collection Practices Act credit counselor consolidation loan bankruptcy End of Chapter 27 Your Credit and the Law pp. 434-447