China`s Investment Treaty Policy

advertisement

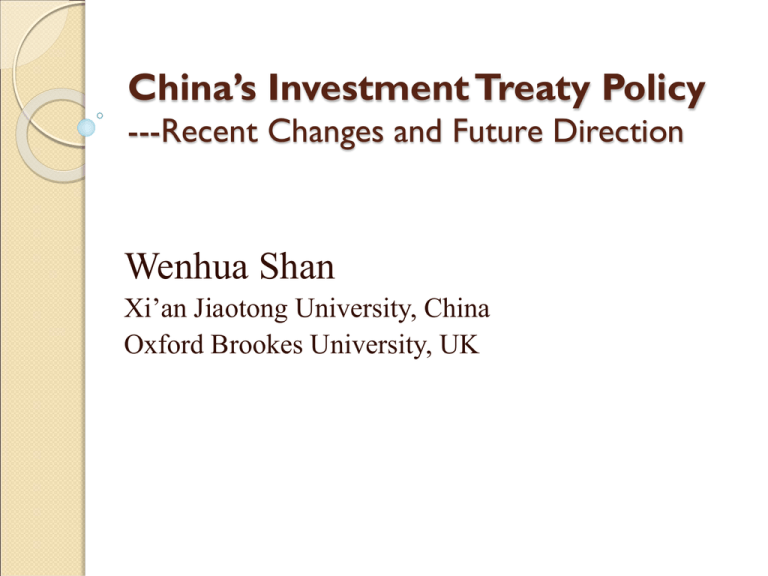

China’s Investment Treaty Policy ---Recent Changes and Future Direction Wenhua Shan Xi’an Jiaotong University, China Oxford Brookes University, UK Contents: I. II. III. IV. China’s Investment Treaty Programme: Three Generations The Third Generation Investment Treaties: Key Changes (eg Mexico BIT 2008) Implication for Investment Arbitration: Renta 4 v Russia Future Direction: the New Model BIT Draft I. China’s Investment Treaty Programme: Three Generations ◦ Tests: National Treatment, and Investor-State Arbitration (ICSID), ◦ 1982-1989: The Launch of the BIT Programme and the First generation BITs ◦ 1990-1997: ICSID Accession and the Second Generation BITs ◦ 1998-present: The Canadian BIT Talks and the Third generation BITs ◦ Current BIT Talks: USA, Canada etc. 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 19 99 19 98 19 97 19 96 19 95 19 94 19 93 19 92 19 91 19 90 19 89 19 88 19 87 19 86 19 85 19 84 19 83 19 82 Annual Growth of BITs 1982-2007 16 14 12 10 8 6 4 2 0 79 19 20 20 20 20 20 20 20 20 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 07 06 05 04 03 02 01 00 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 19 -1 9 FDI In China (1979-2007) Unit: $ 100 Million 800 700 600 500 400 300 200 100 0 Chinese outward investment 1990-2007 (unit: $ 100 million) 200 180 160 140 120 100 80 60 40 20 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 19 80 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 China's Forex Reserve 1980-2007 (unit: $ billion) 1800 1600 1400 1200 1000 800 600 400 200 0 -200 II. The Third Generation Investment Treaties: Key Changes 1. National treatment 2. Transfer 3. Investor-state dispute resolution 1. National Treatment: From “Best Effort” soft NT to “Grandfathered” hard NT UK BIT 1986: Best effort NT “…either Contracting Party shall to the extent possible, accord treatment in accordance with the stipulations of its laws and regulations to the investment of nationals or companies of the other Contracting Party the same treatment as that accorded to its own nationals or companies.” Mexico BIT 2008: Grandfathered NT ARTICLE 3 National Treatment 1. Without prejudice to its laws and regulations at the time the investment is made, each Contracting Party shall accord to investors of the other Contracting Party treatment no less favorable than that it accords, in like circumstances, to its own investors with respect to the operation, management, maintenance, use, enjoyment or disposal of investments. 2. Without prejudice to its laws and regulations at the time the investment is made, each Contracting Party shall accord to investments of investors of the other Contracting Party treatment no less favorable than that it accords, in like circumstances, to investments of its own investors with respect to the operation, management, maintenance, use, enjoyment or disposal of investments. NZ FTA Ch 11 2008: Grandfathered NT with more details Article 138 National Treatment Each Party shall accord to investments and activities associated with such investments, with respect to management, conduct, operation, maintenance, use, enjoyment or disposal, by the investors of the other Party treatment no less favourable than that accorded, in like circumstances, to the investments and associated activities by its own investors. Article 141 Non-Conforming Measures ◦ 1. Article 138 does not apply to: ◦ (a) any existing non-conforming measures maintained within its territory; ◦ (b) the continuation of any non-conforming measure referred to in subparagraph (a); ◦ (c) an amendment to any non-conforming measure referred to in subparagraph (a) to the extent that the amendment does not increase the non-conformity of the measure, as it existed immediately before the amendment, with those obligations. 2. The Parties will endeavour to progressively remove the nonconforming measures. 2. Transfer Reduced restrictions From ‘in accordance with the applicable laws and regulations’ (of the host state) to “Without prejudice to any applicable formalities pursuant to its laws and regulations” (of the host state) Korea BIT 1992 “Article 8 1. Investors of either State shall, in accordance with the applicable laws and regulations of the other State, be guaranteed in respect of the investment, the transfer out of the territory without delay in any freely convertible currency of, in particular, though not exclusively; …” Mexico BIT 2008 Article 8 Transfers “ 1. Without prejudice to any applicable formalities pursuant to its laws and regulations, each Contracting Party shall guarantee to an investor of the other Contracting Party that all payments related to an investment in its territory may be freely transferred into and out of its territory without delay. Such transfers shall include, but not be limited to:…” 3. Investor-State Dispute Resolution From “ad hoc” arbitration for “amount of compensation for expropriation” (AOC disputes) (first generation) To ICSID arbitration for AOC dispute (second generation); and To ICSID arbitration for all/any (investorstate) disputes (third generation) Netherlands BIT 1985 “3. Disputes concerning the amount of compensation to be paid when measures of expropriation, nationalisation or other similar measures have been taken which cannot be settled according to the provisions of paragraph 1 of this Article within a period of six months from the date either party requested amicable settlement shall if the investor so wishes be submitted either to the competent court of law of the Contracting Party receiving the investment or to international arbitration.” (further details in Protocol) Peru BIT 1994 3. If a dispute involving the amount of compensation for expropriation cannot be settled within six months after resort to negotiations as specified in Paragraph 1 of this Article, it may be submitted at the request of either party to the international arbitration of the International Center for Settlement of Investment Disputes (ICSID), established by the Convention on the Settlement of Investment Disputes between States and Nationals of Other States, signed in Washington D.C., on March 18, 1965. Any disputes concerning other matters between an investor of either Contracting Party and the other Contracting Party may be submitted to the Center if the parties to the disputes so agree. The provisions of this Paragraph shall not apply if the investor concerned has resorted to the procedure specified in Paragraph 2 of this Article. Germany BIT 2003 Article 9 Settlement of Disputes between Investors and one Contracting Party (1) Any dispute concerning investments between a Contracting Party and an investor of the other Contracting Party should as far as possible be settled amicably between the parties in dispute. (2) If the dispute cannot be settled within six months of the date when it has been raised by one of the parties in dispute, it shall, at the request of the investor of the other Contracting State, be submitted for arbitration. (3) The dispute shall be submitted for arbitration under the Convention of 18 March 1965 on the Settlement of Investment Disputes between States and Nationals of Other States (ICSID), unless the parties in dispute agree on an ad-hoc arbitral tribunal to be established under the Arbitration Rules of the United Nations Commission on the International Trade Law (UNCITRAL) or other arbitration rules. NZ FTA Ch 11 Article 152 Consultation and Negotiation Any legal dispute arising under this Chapter between an investor of one Party and the other Party, directly concerning an investment by that investor in the territory of that other Party, shall, as far as possible, be settled amicably through consultations and negotiations between the investor and that other Party, which may include the use of nonbinding third-party procedures, where this is acceptable to both parties to the dispute. A request for consultations and negotiations shall be made in writing and shall state the nature of the dispute. Article 153 Consent to Submission of a Claim 1. If the dispute cannot be settled as provided for in Article 152 within 6 months from the date of request for consultations and negotiations then, unless the parties to the dispute agree otherwise, it shall, by the choice of the investor, be submitted to: (a) conciliation or arbitration by the International Centre for the Settlement of Investment Disputes (“ICSID”) under the Convention on the Settlement of Disputes between States and Nationals of Other States, done at Washington on March 18, 1965; or (b) arbitration under the rules of the United Nations Commission on International Trade Law (“UNCITRAL”); provided that the investor shall give the state party 3 months’ notice prior to submitting the claim to arbitration under paragraph 1(a) or 1(b). Mexico BIT 2008 ARTICLE 13 Arbitration: Scope and Standing and Time Periods 1. An investor of a Contracting Party may submit to arbitration a claim that the other Contracting Party has breached an obligation set forth in Chapter II, and that the investor has incurred loss or damage by reason of, or arising out of, that breach. 2. An investment may not make a claim under this Section. 3. A disputing investor may submit the claim to arbitration under: the ICSID Convention, provided that both the disputing Contracting Party and the Contracting Party of the investor are parties to the ICSID Convention; the ICSID Additional Facility Rules, provided that either the disputing Contracting Party or the Contracting Party of the investor, but not both, is a party to the ICSID Convention; the UNCITRAL Arbitration Rules; or any other arbitration rules, if the disputing parties so agree. III. Implications for Investment Arbitration For both foreign investors (v Chinese Government) and Chinese investors (v foreign government): ◦ The changing international legal landscape: ◦ ◦ ◦ ◦ Maffizini Plama Rosinvest Renta 4 More likely for ODI than for FDI ◦ Other elements (for FDI in China): ◦ Economic ◦ Political ◦ Structural/cultural ◦ Other elements (for ODI from China) Dramatic increase High risk destinations Sinosure Country Risk: of the 67 states encouraged to invest, 70% with high or very high risk (34 Grade D (very high), 11 (high)) Tza Yap Shum v. Republic of Peru (ICSID Case No. ARB/07/6): First Chinese BIT case, pending IV. Future Direction: the New Model BIT Draft ◦ More or less active in BIT negotiations? ◦ One or two or more Models? ◦ More Liberal or Restrictive? A refined but not reversed Model BIT Draft An alternative “balanced” model (see Gallagher & Shan, China Investment Treaties: Policies and Practice, OUP 2009) ◦ The US BIT negotiations: a long march? Thank you!