2012 AAPL ANNUAL MEETING SPONSORS

PLATINUM

GOLD

SILVER

BRONZE

SAN FRANCISCO SEMINAR

A wholly owned subsidiary of ExxonMobil

GOLF

MINERAL

VS.

ROYALTY DISTINCTION

Stan T. Ingram

BIGGS, INGRAM, SOLOP & CARLSON, PLLC

58th Annual Meeting - San Francisco

June 13-16, 2012

AAPL - Copyright © 2012. All Rights Reserved.

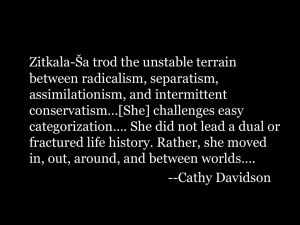

• “One of the most vexing oil and gas title questions for landmen,

lawyers and the courts is determining whether a deed creates a

mineral or a royalty interest.”

• The attributes incidental to either a mineral or royalty interest are

generally consistent across all states, but the resulting decisions

based such attributes is nothing close to consistent.

– “As we have had frequent occasion to observe, terms relating to

conveyances of oil and gas interests have often been loosely and

inaccurately used.”

– “The meaning of this and similar language in deeds has been the

subject of judicial consideration by a number of courts, with a lack of

harmony in the decisions.”

– “As we have frequently stated the term “royalty” is often rather loosely

and inaccurately used by men in the petroleum industry, those dealing

in oil, and gas holdings and at times by attorneys. …”

AAPL - Copyright © 2012. All Rights Reserved.

RULES OF CONSTRUCTION

1.

Four Corners Doctrine

2.

Earlier Clauses Prevail

3.

Doctrine of Merger

4.

Written Words Prevail over that Printed

5.

Typed-In Words Prevail over that Printed

6.

Construed Against Grantor

7.

Construed Against Preparer

8.

That which is not specifically reserved is conveyed

GENERAL CHARACTERISTICS OF

A MINERAL INTEREST

1. The mineral owner has the right of entering, occupying and making

such use of the surface as is reasonably necessary in the exploring,

drilling, mining, removing and marketing of the minerals;

2. Such a mineral interest is not free of the costs associated with

exploring, drilling, mining, removing and marketing of the minerals;

3. The mineral owner has the right to execute oil, gas and mineral

leases, thus conveying the right of exploring, mining, removing and

marketing to third parties.

4. The mineral owner has the right to receive all bonus and delay

rentals associated with executing oil, gas and mineral leases; and

5. The owner of minerals also owns the possibility of reverter of the

minerals in fee upon expiration of the lease

GENERAL CHARACTERISTICS OF

A ROYALTY INTEREST

1. The royalty owner has no right to explore, mine, remove or market

the minerals, thus no right of ingress and egress;

2. Such an interest in production is not charged with any of the costs

of exploring, mining, removing and marketing of the minerals;

3. The royalty owner has no right to grant oil, gas and mineral leases

to third parties; and

4. The royalty owner has no right to receive bonus and/or delay

rentals.

SPECIFIC TERMS OF CONSTRUCTION

1. Effect of words “Minerals”, Mineral Interest” or Mineral Acres”

•

Most courts construe such terms as a mineral interest.

•

However, it is well established that such a designation in and of itself is

not conclusive.

•

If the instrument references other characteristics which point to a

royalty interest, such characteristics may outweigh the “mineral”

reference resulting in a royalty construction.

2. Effect of words “in, on and under”

Generally, the grant or reservation of minerals “in and under” will create a

mineral interest if such a grant or reservation does not otherwise contain

contradictory provisions.

3. Effect of words, “in, on and under and that which may be produced”

This phrase, standing alone will generally create a mineral interest.

However, some courts have held “which may be produced” to create a

royalty.

.

4. Effect of words “produced and saved”

•

The combination of these words has consistently resulted in

interpretation of a royalty interest.

5. Effect of words “Royalty”, Royalty Interest” or “Royalty Acres”

•

In majority of the oil producing states, the use of such terms without

other conflicting characteristics, will create a royalty interest.

•

However, use of the word, “royalty” is not conclusive and where

followed by contradictory elements consistent with a mineral interest,

have swayed many of the courts to conclude the grant/reservation to

be that of a mineral interest.

6. Effect of words “share of profits”

•

Maybe construed to mean a royalty

7.

Effect of words “non-participating in bonus, rental and Executive

Right”

•

Mineral interest by character participates in the right to execute leases.

•

Therefore, the mineral owner receives the bonus, rental and royalty

under said lease.

•

In most jurisdictions, such rights create a mineral interest…

•

What happens when the conveyance of mineral interest is followed by

a reservation of the right to receive bonus, rental and the executive

right?

•

The courts have varied from state to state.

8. Effect of words “No Executive Right”

• A number of jurisdictions which recognize that the executive right, is a

separate interest in real property, subject to being conveyed and/or

separately reserved.

• A number of cases have held this to be a “non-executive mineral

interest.”

• But in some cases, a reservation of the executive right implies a

reservation of a right to receive bonus and rental.

10. Effect of conveying/reserving abnormally large royalty

• What happens where a grantor conveys or reserves an undivided ½

interest with rights generally attributable to that of a royalty interest?

• A number of situations were found wherein the courts ruled that the

abnormally large fraction would be indicative of a

conveyance/reservation of a mineral interest.

EXAMPLES OF CONTESTED GRANTS

OR RESERVATION

• When interpreting a grant or reservation, the characteristics of

the two (2) kinds of estates must be kept in mind.

• Each deed must be considered as a whole keeping in mind that

the owner of mineral rights may convey or reserve any one or

more of the separate elements or attributes.

Conveyance of:

“Eight and one-third percent (8 1/3%) of all oil, gas and other hydrocarbons

substances, and minerals, in, under and/or which may be hereafter

produced and saved from”

•

This was a 1935 conveyance. Ten years later grantor executed a mineral

lease which was ratified by the grantee. The lease provides for a 1/6 royalty.

Successors to the grantor claim the interest was a mineral, thus they receive

11/12 of the 1/6 royalty.

• Successors to the grantee claim a royalty interest equaling ½ of the 1/6 royalty

provided in the lease.

• The California Supreme Court ruled this to be a mineral interest. Little v.

Mountain View Dairies, Inc., 35 Cal.2d 232; 217 P.2d 416 (Cal. 1950)

•

It has been generally held…a grant of a fraction of all of the oil, gas and other

minerals in and under, “and that may be produced”…creates an expense –

bearing mineral fee rather than an expense – free royalty interest.

•

Were there is an existing mineral lease, it is not uncommon to interpret the

deed to grant not only the given fractional mineral interest “but also the same

fractional interest in the royalties payable under the lease.”

•

In the absence of extrinsic evidence or other controlling language in the deed,

a reference to “and saved” doesn’t alter mineral fee interest conveyed.

“…excepting and reserving out of the grant herein made to the grantors…an

undivided one-fourth interest in and to all oil, gas or other minerals lying in,

upon or under [land description], such reservation and exception being nonparticipating in any leases, participation being limited to royalties only

payable under said leases, and it shall not be necessary for said

grantors…to join in the execution of any leases.”

• grantee and its lessee claimed exclusive right to execute leases as to

100% of the minerals and retain all bonus and delay rental. Royalty v.

mineral was not an issue.

• The question was who held the executive rights and what benefits

were received therein.

• Grantors claimed because the grant did not include words of

inheritance, the executory rights was a personal right to the grantees

which upon their death such rights reverted to grantors.

The second question pertained to the alienability of the executory

rights.

• Colorado Court of Appeals (Division 3) held in Mull Drilling Company,

Inc. v. Medallion Petroleum Co., Inc., 809 P.2d 1124 (Colo. App. 1991),

that the executory right could be separately conveyed/reserved and by

virtue of the warranty, such right passed to the grantees, successors

and/or assigns.

Notable quote:

“ Although there are no Colorado cases discussing the right of an owner

of a fractional mineral interest…to convey the executive right to lease

such interest to another, such right has long been recognized in other

jurisdictions having a long history of oil and gas law.”

“…excepting and reserving with right of ingress and egress, an

undivided 1/4 of the landowners 1/8 royalty, or, 1/32 of the

interest in and to all oil, gas or other minerals (of every character

and kind) in or under the said land for a period of fifteen (15)

years from April 1, 1940 and as long thereafter as oil, gas or any

other mineral, is produced from said land, or operations for any

such mineral are being conducted thereon by grantees or grantor

(their Successors or assigns). The said royalty reservation shall

not be participating in bonuses or rentals, but shall be

participating in other rights, royalties and other benefits accruing

under any existing or future oil, gas or mineral lease...”

Estate of Shepherd v. John Hancock Mutual Life Insurance Co., 189 Kan. 125,

368 P.2d 19 (Kan. 1962)

•

Finding the reservation to be that of a mineral, the court reasoned:

1. The words, “with right of ingress and egress” gave the defendant the

right to use the surface and to “avail itself of the use and benefit of the

interest reserved.”

2. The language “in and to all oil, gas and other minerals”…is

diametrically opposed to the definition of royalty… .”

3. That the words “or operations or any such…conducted thereon by

grantees or grantor” would be “meaningless” if it did not constitute a

mineral interest.

4. Excluding the right to participate in bonus and rentals evidences only

an intent to exclude one benefit of the executive right

“Had the parties intended the defendant reserve only a royalty

interest, there would have been no necessity to make the interest

non-participating as to the bonus and delayed rentals… .”

Conveyance of certain property followed by:

“to have and to hold the same together with the surface of the land and 1/32 part of

royalty. It is further understood that the parties of the first part is only selling to

parties of the second part, the surface of said land and 1/32 part of all oil and gas

lying in and under said land, parties of the...first part reserves the right to release (release) in case the lease now enforced becomes null and void… .”

• at time of grant, lands were subject to a mineral lease providing 1/8

royalty.

• The Kentucky Court of Appeals in Texas Co. v. Bowen, 292 Ky. 676;

167 S.W.2d 822 S.W. (Ky. 1943) ruled the interest to be a 1/32

royalty and not a 1/32 mineral interest.

• the court applied a rule in construction that if the ambiguity is patent

and appears on the face of the deed, parole evidence cannot be

used to explain the ambiguity.

• While reference to “1/32 part of all oil and gas lying in and under

said land” is generally indicative of a mineral interest, reference to

the word “royalty” and reservation of all executive rights indicated

an intent to convey royalty only.

“Grantor…retains for himself…and reserves from this sale, a

perpetual royalty, equal to one-eighth of all minerals, including oil,

gas and sulphur, which may be found in, under, upon or beneath

the lands hereinabove described, together with perpetual and

exclusive rights to make and execute mineral leases on all or any

portion of said lands for the exploration…of any and all of said

minerals, and also including perpetual rights of ingress and egress

solely for said purpose of exploration…of said minerals at all times... .”

• Two years after execution of the above deeds, the grantor

granted a lease to Gulf Refining Company for a substantial

bonus. The grantee then claimed it was entitled to its share in

the bonus.

• No mention was made as to whether the grantee executed a

separate mineral lease to Gulf or other parties.

• The Supreme Court of Louisiana in Mount Forest Fir Farms of

American v. Cockrell, 79 La. 795; 155 So.228 (La. 1934)

• “there is no reason why, in disposing of his land, the landowner may not

reserve unto himself both of these sources.”

•

very confusing – only addressed rights to the bonus and did not

adjudicate whether the 1/8 was a royalty or fee.

• The court held that the grantor retain the exclusive right to lease which

includes all the benefits, i.e. bonus (grantee not entitled to any bonus).

•

The reservation of the “exclusive” right to execute mineral leases

covered “all or any portion of said lands.”

“We do hereby reserve for ourselves, our heirs and assigns, 1/8th of all the oil and

gas which may be produced from said lands to be delivered in tanks and pipelines in

the customary manner, and this shall be a covenant running with the land and all

sales and other conveyances of said lands shall be subject to this reservation and

easement.”

•

At the time of the above reservation, the lands in question were not subject to any oil and gas

lease.

•

The question - non-participating royalty or minerals in place?

•

The above reservation does not either expressly or by implication state the grantor’s 1/8

interest is free of costs of discovery or expiration.

•

The lower court held that it was a reservation of minerals in place. On appeal, the Mississippi

Supreme Court in Mounger v. Pittman, 135 Miss. 85; 108 So.2d 565 (Miss. 1959) affirmed.

•

The court held that the words “which may be produced from said lands to be delivered in

tanks and pipelines in the customary manner” was not conclusive to that of a royalty interest.

•

The court held that such words are not sufficient in themselves to compel an inference that

the grantors would receive the 1/8 free of all costs of discovery.

Deed conveys ½ mineral interest using a form customarily recognized as a

mineral deed, with the following intention clause:

“It is the intention of the grantors to convey, and they do hereby convey, twenty (20) full

mineral acres of land of said tract. Non-participating as to present or future lease

rentals and bonuses.”

•

The lower court found that this to be a conveyance of a non-participating royalty

interest only.

•

On appeal, the Mississippi Supreme Court in Thornhill v. System Fuels, Inc., 523

So.2d. 983 (Miss. 1988) reversed, holding that this was a mineral deed.

•

Held that a mineral owner may convey a mineral fee and reserve “certain

attributes of this mineral ownership”, which includes bonus and delay rentals.

•

Reversing a prior decision, the court held that the reservation of future rentals

and bonuses is not in and of itself a reservation of the executive right.

•

The grantee received a ½ mineral interest with the right to lease but no right to

share in rentals and bonuses.

Deed reserved all oil, gas and minerals…”except two percent (2%) of the

landowner’s royalty rights in and under all oil, gas and other minerals…in,

under and upon said premises…”

•

The above reservation was set forth in a contract for sale at a time when there

was no oil, gas and mineral leases covering the property.

•

At the closing, however, the warranty deed reserved all oil, gas and other

minerals “in, under and that may be produced from said lands” but the grantors

tendered a 2% royalty assignment. Both deeds were rejected and a law suit was

filed.

•

At the outset, the Montana Supreme Court in Stokes v. Tutvet, 134 Mont. 250;

328 P.2d 1096 (Mont. 1958) made the following observation:

“We can only observe that the case law in Montana on the subject leaves much to be

desired, and that the terms of the reservation and exception in the aforementioned

contract leaves much to be desired in the language used. The wording is susceptible of

several interpretations and we think reasonably so. The trial court was thrown into error

by his belief that the terms of the contract were not at all ambiguous.”

•

Court recognized that title to minerals in Montana is a part of the realty and may

be segregated in whole or in part from the rest of the fee simple title.

•

The court then went on to recite the five incidents of mineral v. royalty interests

identical to that set forth in the beginning of this paper.

•

The court, contrary to a previous ruling, stated that the courts must

emphasize the absence or presence of the words “in, under and upon”

as well as the presence of the words “produced and saved.”

•

The court further emphasized the importance of the use of the word

“royalty rights”

•

The court stopped short of concluding that the above deed was

a reservation of 98% of the oil, gas and other minerals, thus

conveying to the grantee a 2% mineral interest, holding that use of the

various terms was inconsistent, holding that the “reservation is

ambiguous and uncertain.”

•

The matter was referred back to trial court to take evidence as to the

parties’ intent.

A deed conveying an undivided 1/16 interest in, “all the oil, gas and other

minerals, in and under or that may be produced” from 40 acres of land

“together with the right of ingress and egress at all times for the purpose of

developing the same.”

“This conveyance is intended only as a Mineral Deed and to convey only an

undivided one half of the Royalty on the above described Forty Acres of

land to wit: An undivided one sixteenth of said Minerals thereunder or

which may be produced therefrom; but not so as to affect in any way the

title in fee simple to said ands nor to convey any interest whatever in or to

any rentals or future rentals of oil, or gas minerals in under or that may be

produced from said lands, but same is reserved unto grantor, specifically,

and the intention of this mineral deed is to convey, and it is so understood,

an undivided one half of the Royalty, or an Undivided one sixteenth (1/16)

of the Minerals thereunder.”

•

The New Mexico Supreme Court in Atlantic Refining Company v.

Beach, 436 P.2d 107 (N. M. 1968) interpreted the above deed as

conveying a 1/16 of 8/8ths royalty. In so doing, the court made a

number of interesting observations:

1. The captioned “mineral deed” is of little aid in constructing the instrument;

2. Creation of the right of ingress and egress, although generally indicating a

mineral interest, is not controlling;

3. Ordinarily a conveyance of a mineral interest “in and under” or

“thereunder” indicates a mineral interest; and

4. Reservation of the right to receive any part of the bonus or rentals indicates

an intent to convey royalty.

•

The court defined royalty as an interest in oil and gas as “a share of

the product or profits (ordinarily 1/8) reserved by the owner for

permitting another to develop his property.”

•

The recital of an intent to convey “an undivided ½ of the royalty on the

above described 40 acres” was consistent with this definition, i.e. ½ of

the usual 1/8.

“However, there is reserved and excepted from this conveyance,

one-half of one-eighth of all minerals in and under said land, the

same being reserved and excepted, and said royalty is nonparticipating in the lease or lease rentals.”

• At the time of the above reservation there were no oil, gas and other

mineral leases.

• The grantee, argued that the above reservation was that of a mineral

interest, while grantor argued reservation of a 1/16 of 8/8ths royalty.

• The Oklahoma Supreme Court in Jolly v. Wilson, 478 P.2d 889 (Ok.

1970), weighed the various characteristics of mineral v. royalty

ownership and concluded the above reservation was that of a mineral

interest. In so doing, the court made a number of interest observations:

1. Reference to “all minerals in and under said land” indicates a

mineral interest.

2. On the other hand if the interest conveyed is in “oil and gas to be

produced” a royalty interest may be the result.

3. If there is an oil and gas lease in existence at the time the deed is

made, the word “royalty” when used is usually interpreted to mean

royalty in the restricted sense as a share of production only.

4. In the absence of an existing lease the word “royalty” is likely to be

interpreted in its loose “broad sense” to mean a mineral interest.

•

But what about the recital that “said royalty is non-participating

in the lease or lease rental?”

• In response the court made the following interesting observation:

“Defendants [grantors] argue that under this proviso, the executive

rights as to leasing are conveyed [to Grantee] while the plaintiff

[grantee] contends the reservation contains no specific language by

which the right to execute an oil and gas lease is granted or

reserved.

There is merit to both arguments which makes

application of the second factor difficult and arduous. We then have

one factor clearly expressed and the other factor of doubtful

application. In such incidence, the fact which is clearly expressed is

more persuasive as showing the intent of the grantor. Therefore, as

between the two factors, a mineral interest is more clearly

manifested.”

“Grantor does hereby grant and sell…”an undivided one sixteenth (1/16) interest in

and unto all of the oil, gas and other minerals in and under and that may be produced

from the following described lands… but does not participate in any rentals or leases,

containing 348 acres, more or less, together with the rights of ingress and egress at

all times for the purpose of mining, drilling, exploring, operating and developing said

lands for oil, gas and other minerals…with the right or remove from said land all of

grantee’s property improvements.”

• The trial court ruled that the above was a conveyance of royalty only.

On appeal, the Texas Supreme Court in Altman v. Blake, 712 S.W.2d 117

(Tex. 1986) reversed and concluded the above was a conveyance of

mineral fee. In so doing, the Court observed the five characteristics of a

mineral interest:

1.

2.

3.

4.

5.

The right to develop (the right of ingress and egress);

The right to lease;

The right to receive bonus;

The right to receive delay rental; and

The right to receive royalty payment.

•

Because the above grant contains 3 of the 5 elements, the court concluded the

conveyance to be of the mineral fee.

•

Some discussion was had concerning the omission of the word “bonus” when

reciting the interest conveyed as non-participating in rentals and leases only.

The court stated:

“If ‘participation’ includes the right to receive bonus payments, why would it not

encompass all lease benefits, including the right to receive royalties and delay rentals?

The parties to the 1938 deed thought it necessary to expressly reserve to the grantor

the right to retain delay rental. This suggests that they did not define “participation’ so

broadly.”

•

This clearly indicates that Texas follows the general principal that the incidental

rights of mineral v. royalty can be separately conveyed and/or retained.

“That I, George Calvert…do grant, bargain, sell, convey, set over,

assign and deliver unto Capton M. Paul, an undivided fifty (50) acre

interest, being an undivided 1/656.17 interest in and to all of the oil,

gas and other minerals in, under and that may be produced from the

following lands… It is understood and agreed that this conveyance

is a royalty interest only and that neither the grantee or his heirs

shall ever have any interest in the delay or other rentals or any

revenue of monies received or the right from the leasing of said

land…and neither the grantee herein or his heirs…shall ever have

any control over the leasing of said land or any part thereof…which

is hereby specifically reserved in the grantor.”

• This is another case of the negative inference.

• The Texas Supreme Court in French v. Chevron construed the above

granting clause as conveying a 1/656.17 interest in minerals.

QUESTION: How can such a conclusion be reached?

•

Interpreted the transfer as a 1/656.17 mineral interest with reservation

of all developmental rights, leasing rights, bonuses and delay rentals.

•

While the initial grant recites that it is a royalty interest, the court held

that the “granting clause must be read in light of the rest of the

document.”

•

Great emphasis was placed on the fact that it was conveying a “50

acre interest”, that is, a 1/656.17 out of 32,808.5 acre tract, thus the

stated fractional interest “in all oil, gas and other minerals… .”

•

The court then states:

Paragraph 2 indicates that the interest in the minerals conveyed in

paragraph 1 is a royalty interest. The remainder of paragraph 2 is best

interpreted as explaining the consequences of the “royalty only”

description. It reserves in the grantor the right to receive delay or other

rentals on any revenue from the lease or from any renewal or extension of

any lease. This reservation would be redundant and would serve no

purpose whatsoever if the interest in minerals being conveyed was a

1/656.17 royalty interest.

“It is understood and agreed that said one sixteenth (1/16)

[reserved] interest is and shall always be a royalty and shall not be

charged with any of the costs which Grantee may incur in exploring,

drilling, mining, developing and operating wells for the production of

oil, gas and other minerals.”

“But there is reserved and excepted from this conveyance 1/8 of all

the oil and gas in and underlying said tract of land that may be

produced therefrom, and the right of ingress and egress for the

purpose of utilizing the same, and the parties of the second part

(grantees) are to pay annually accruing taxes upon the said land

hereby conveyed, including the reservation and rights here

reserved.”

“one-half interest of oil, gas and mineral rights”

“Reserving unto said Evelyn Katherine Picard a non-participating

20% royalty interest in and to the above-described lands and

premises during her lifetime only, it being specifically understood

that said Raymond Picard shall retain all control of said royalty

subject to full disclosure at any reasonable time…”