tax - CA Sri Lanka

advertisement

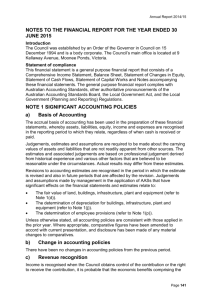

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF SRI LANKA POSTGRADUATE DIPLOMA IN BUSINESS AND FINANCE 2013/201 PRINCIPLES OF FINANCIAL AND COST ACCOUNTING Nadeeshani Dissanayake B.Sc. Accounting (Sp), First Class, ACA, ACMA, CPA (Aust) EVENTS AFTER THE REPORTING PERIOD LKAS 10 Events after the end of the reporting period are those events, favourable and unfavourable, that occur between the end of the reporting period and the date when the financial statements are authorised for issue. TYPES OF EVENTS Two types of events after the end of the reporting period adjusting events―those that provide evidence of conditions that existed at the end of the reporting period non-adjusting events―those that are indicative of conditions that arose after the end of the reporting period Adjusting events—adjust the amounts recognised (and update disclosures made) in its financial statements Non-adjusting events—do not adjust the amounts recognised in its financial statements. However, disclose: the nature of the event, and an estimate of its financial effect, or a statement that estimate cannot be made Ex 1: On 31/12/20X5 A assessed its warranty obligation as Rs. 100,000. Before its 20X5 financial statements were authorised for issue, A discovered a latent defect in one of its lines of products. It reassessed its warranty obligation at 31/12/20X5 at Rs. 150,000. Adjusting event―latent defect existed at 31/12/20X5. Measure warranty provision at Rs. 150,000 at 31/12/20X5. Ex 2*: On 28/2/20X1 A’s 31/12/20X0 FS authorised for issue. At 31/12/20X0 the fair value of A’s investment in B’s publicly traded shares = Rs. 20,000. On 28/2/20X1 fair value of shares = Rs. 25,000. Non-adjusting event―the change in the fair value results from conditions that arose after 20X0. A does not adjust the amounts recognised in its financial statements. However, it must give additional disclosure INCOME TAX AND DEFERRED TAX Some exceptions to this Taxable income (TI) – tax deductions (TD) = Taxable profit Accounting Standards and the Companies Act are key sources that determine the appropriate accounting treatment of transactions The Income Tax Act determines the tax treatment of transactions Accounting profit does not equal taxable profit • Difference caused by different “rules” used for accounting vs tax purposes • ITEM ACCOUNTING TAX Passive revenue received in advance Recorded as liability . Recognised as TI Recognised as revenue when cash received when earned. Depreciation (accelerated for acctg) Recognised as expense based on useful life of asset Bad/doubtful debts Allowance raised and expense recorded when debt considered doubtful Recognised as TD based on predetermined rates Possible for accounting useful life to be shorter than tax useful life Employee benefits – eg annual leave Liability raised and expense recorded when debt owing to employee Recognised as a TD when debt physically written off Recognised as TD when payment made to employee Accounting for income taxes – general principles The tax consequences of transactions that occur for accounting purposes during a period should be recognised as income or expense during the current period, regardless of when the tax effects will occur This requires identifying the current and future tax consequences of items recognised in the balance sheet Two separate calculations are performed each year: 1. 2. current tax liability movements in deferred tax balances CALCULATION OF CURRENT TAX LIABILITY Accounting profit/(loss) - acctg revenue not assessable for tax + acctg expenses not deductible for tax +/(-) differences between acctg revenue and TI +/(-) differences between acctg expenses and TDs = Taxable profit x tax rate % = Current tax liability (CTL) CALCULATION OF CURRENT TAX LIABILITY EXAMPLE All amounts are in Rs. millions • • • • • • Rs. 60 allowed as a tax deduction for plant. Interest has not yet been received. Bad debts of Rs. 20 were written off during the year. Payments of Rs. 30 were made to employees in relation to annual leave taken during the year. The tax rate is 30% Required: Calculate the current tax liability of ABC Ltd for 2012 CALCULATION OF CURRENT TAX - EXAMPLE Accounting profit before tax 300 Government grant (80) Goodwill impairment exempt income 20 Interest not yet receivednot deductible (40) Adjustment for plant depreciation (10) Adjustment for bad debt write-offs 10 Adjustment for annual leave paid (20) Taxable profit 180 Current tax liability (CTL) (30%) 54 Acctg depn 50 Tax depn (60) Adj req (10) B/debts expense-acctg 30 B/debts w/off- tax (20) Adj req 10 A/L expense- acctg 10 Paid- tax (30) Adj req (20) In the previous example the CTL would be recorded as: Dr Income tax expense (current) Cr Current tax liability 54 54 DEFERRED TAX LIABILITIES AND ASSETS Arise when the period in which revenue and expenses are recognised for accounting is different from the period in which items are recognised for tax Arise principally due to the accruals vs cash basis of recognising transactions. Differences either result in: 1. The company paying more tax in the future Taxable temporary differences (TTDs) Result in deferred tax liabilities (DTLs) 2. The company paying less tax in the future Deductible temporary differences (DTDs) Result in deferred tax assets (DTAs) CALCULATION OF DEFERRED TAX The existence of temporary differences results in the carrying amounts of an entity’s assets and liabilities being different from the amounts that would arise if a balance sheet was prepared for tax authorities Carrying amount (CA)- asset and liability balances (net of accumulated depreciation, allowances etc) based on accounting balance sheet. Tax base (TB)- asset and liability balances that would appear in a “tax balance sheet”. Temporary differences are calculated as follows: CA – TB = TTD/(DTD) CALCULATING THE TAX BASE Calculating the tax base for an asset CA – future taxable amounts + future deductible amounts = TB Calculating the tax base for a liability CA + future taxable amounts - future deductible amounts = TB BORROWING COST LKAS 23 Borrowing costs are interest and other costs that an entity incurs in connection with a borrowing of funds. Qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. CAPITALISING BORROWING COSTS An entity shall capitalize borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. An entity shall recognize other borrowing cost as an expense in the period in which it incurs them. LEASES LKAS 17 A lease is an agreement whereby the lessor conveys to the lessee in return for a payment or a series of payments the right to use an asset for an agreed period of time. A finance lease is a lease that transfers substantially all the risk and rewards incidental to ownership of an asset. Title may or may not eventually be transferred. An operating lease is a lease other than a finance lease. finance lease – become an asset operating lease – rent will be charged to P/L as an expense