Legal Aspects of Start-Ups

advertisement

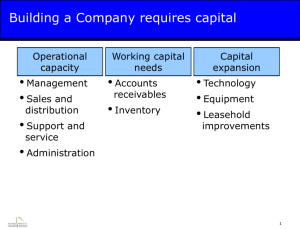

LEGAL ASPECTS OF START-UPS Jeffrey C. Robbins, Esq. Messerli & Kramer P.A. May 23, 2013 ©2013 Messerli & Kramer P.A. THE IDEAL START-UP OPPORTUNITY • Unique and protected technology • Substantial economic value to real customers • Experienced management team • Enough capital • Alignment of the stars LAW TO ALIGN YOUR STARS • • • • Intellectual Property Protection Company Formation Attracting and Retaining Talent Fundraising PROTECTING IP • Patents – Identify all inventors and their rights, including those of any research institution or the government – File before publication or other public disclosure – New “first to file” rules effective in March 2013 – Accelerated review ($2,400 for small entities) – Avoid joint ownership – Consider foreign protection – Get license for third-party patents PROTECTING IP • Domain Name (pay attention to who owns it) • Copyrights and Trademarks (federal, state and common law) • Trade Secrets • Confidentiality Agreements INVENTION ASSIGNMENTS • Cover both employees and consultants (work for hire) • Legal exclusions • Pay for the assignment NON-COMPETITION AGREEMENTS • • • • Reference in any employment offer letter Type of employee Geographic area and time period of restriction Payment for the agreement (continued employment is usually inadequate) • Some states won’t enforce BUSINESS ENTITY SELECTION • Use of a Business Entity – Limited liability – Facilitates equity ownership – Tax advantages • Types of Business Entities – Corporation – C versus S – Limited Liability Company • Timing for Forming a Business Entity • Where to Form a Business Entity MANAGEMENT • Shareholders /Members • Board of Directors /Managers – Duties of loyalty and care • Officers • Employees STOCK • Common Stock – each share has equal economic and voting rights • Preferred Stock – contractually defined economic and voting rights – Special voting rights – Dividends – Liquidation preferences – Anti-dilution protection – Redemption rights • Par value • Rights set out in Articles of Incorporation CONVERTIBLE NOTES • Often used in early rounds when valuation is uncertain • Investor typically gets to convert into the next round security at a price discount • Mandatory versus option conversion NEGOTIABLE DEAL POINTS • • • • • • • Preemptive rights Cumulative voting rights Board/ shareholder action in writing Tag Along/ Drag Along rights Rights of First Refusal Registration Rights Buy-Sell Agreements EQUITY INCENTIVES • Allows employees, consultants and directors to share in upside of business growth • Aligns business objectives • Can act as a “golden handcuff ” to help in retention of key personnel • May allow income (and tax) deferral to later date • May convert ordinary income into capital gains (taxed at lower rates) EQUITY INCENTIVES • Incentive Stock Options – Employees only – Exercise price = fair market value – $100,000 vesting maximum per year – Maximum 10-year term – 90 days to exercise after leaving employment • Non-Qualified Options • Cashless Exercise • Restricted Stock – Section 83(b) election FUNDRAISING 101 WHAT IS A SECURITY? WHAT IS A SECURITY? WHAT IS A SECURITY? Investment of Money Common Enterprise Expectation of Profits Efforts of Others CROWDFUNDING IS HERE! But What Does That Mean? CROWDFUNDING V1 CROWDFUNDING V2 THE NEW JOBS ACT FIVE THINGS TO KNOW Offering Limit: $1 million in 12 months FIVE THINGS TO KNOW Investor Limits: Annual income/net worth < $100,000, limit is greater of $2,000 or 5% Annual income/net worth ≥ $100,000, limit is lesser of $100,000 or 10% FIVE THINGS TO KNOW Funding Portals: Companies must sell through a portal Registered with the SEC Handles funds for the company Posts company disclosure information FIVE THINGS TO KNOW Company Requirements: Disclosure, including annual reporting Financial information: -- tax return/financials ≤ $100,000 -- reviewed financials ≤ $500,000 -- audited financials > $500,000 Only can direct investors to the portal FIVE THINGS TO KNOW Timing: SEC had 9 months to issue crowdfunding regulations CROWDFUNDING IN SUMMARY Can’t raise much money Expensive audit and reporting requirements Too many shareholders Not Angel Investor or Entrepreneur Approved HELLO TO GENERAL SOLICITATION OF ANGEL INVESTORS THE CURRENT WORLD THE ACCREDITED INVESTOR • Net Worth -- $1MM Excluding Home • Three-Year Income -- $200,000 • Three-Year Joint Income -- $300,000 THE PRIVATE PLACEMENT Unlimited Dollar Amount Unlimited Accredited Investors Maximum of 35 Non-Accredited Investors No Public Solicitation of Investors Potentially No Mandated Disclosure (but risk factor disclosure is important) Only a Notice Filing with the SEC THE JOBS ACT NEW WORLD ORDER But only for accredited investors (proposed regulations) IF EVERYONE KNOWS IF EVERYONE DOESN’T KNOW TIMING Angel Dollars Invested Q3 2012 NETWORKING EVENTS Presentation may constitute public solicitation Talk about your business and not about financing Follow-up only with investor prospects that are “accredited” investors MN ANGEL TAX CREDIT 25% MN individual income tax credit for Qualified Investments in Qualified Companies by Qualified Investors or Qualified Funds Qualifying Is Key!! MN ANGEL TAX CREDIT Qualified Investments: -- Cash only -- At least $10,000 ($30,000 if a fund) in a single calendar year -- Purchase equity or mandatorily convertible debt -- Three-year holding period MN ANGEL TAX CREDIT Qualified Companies: -- Headquarters in MN -- 51% of employees and payroll in MN -- Under 25 employees -- Pay minimum qualifying wages -- Business in qualifying high tech/proprietary fields -- Not more than 10 years of operations -- Not more than $4MM of prior equity investments that qualified for the credit MN ANGEL TAX CREDIT Qualified Investors: -- Must be an individual -- Must be certified by the State -- Can be either an “accredited” or “non-accredited” investor -- $10,000 minimum investment MN ANGEL TAX CREDIT Qualified Funds: -- Must have at least three members -- Must be organized as a pass-through entity -- Must be certified by the State -- $30,000 minimum investment MN ANGEL TAX CREDIT Company Administrative Requirements: -- Must pre-clear investment -- Must report investment -- Must do annual reporting Failure = Company Giveback of Credit MAKE SURE The company is registered The investor registered The proposed investment is registered The actual investment is reported The company complies and reports annually TOO LATE FOR 2013 Businesses: Investors: Funds: 2010* 2011 certified/invested certified/invested certified/invested certified 112 / 67 75 / 258 5/4 176 / 113 623 / 563 21 / 21 190 / 117 511 / 465 19 / 17 175 362 19 $63.2M $15.8M $46.2M $11.4M $50.8M $12.7M Amount invested: $28M Credits issued: $7M 2014: 2012** $12.0M credits available * 2010: July launch-Dec ** 2012: January-July 24 *** 2013: January-May 9 2013*** YOUR QUESTIONS? For further information, contact: Jeffrey C. Robbins, Esq. Messerli & Kramer P.A. 100 South Fifth Street, Suite 1400 Minneapolis, Minnesota 55402 (612) 672-3706 office (612) 940-6660 cell (612) 672-3777 fax jrobbins@messerlikramer.com