BANKING

NOVEMBER 18, 2014

Cassa Depositi e Prestiti S.p.A.

COMPANY PROFILE

Rome, Italy

Company Overview

Table of Contents:

COMPANY OVERVIEW

FINANCIAL HIGHLIGHTS

(AS REPORTED)

BUSINESS ACTIVITIES

DISTRIBUTION CAPACITY AND

MARKET SHARE

OWNERSHIP AND STRUCTURE

COMPANY MANAGEMENT

COMPANY HISTORY

PEER GROUP

RELATED WEBSITES AND

INFORMATION SOURCES

MOODY’S RELATED RESEARCH

1

2

2

4

4

5

7

9

9

9

Analyst Contacts:

LONDON

+44.20.7772.5454

Cassa Depositi e Prestiti S.p.A. (CDP), an Italian joint-stock company under public control,

specialises in financing developmental infrastructure projects. As of 31 March 2014, CDP

reported a 47.8% share among public entities and public-law bodies active in lending in Italy.

As of 30 June 2014, it had total consolidated assets of €366.7 billion.

CDP mainly provides specialist services concerning the financing of developmental

infrastructure projects, including financial resources for public investments, infrastructure

schemes and large-scale public-sector projects. It services the Italian government, local

authorities and various other public entities. Furthermore, through the banking system, CDP

grants long-term loans to small and medium-size enterprises (SMEs) and businesses.

CDP was established by the Italian government in 1850 to finance public-sector projects.

Furthermore, since 1875, it has accepted retail savings deposits collected by the Italian post

office network (Post Italiane). In 2003, CDP became a joint-stock company, with a majority

of its shares owned by the Italian state. As of 19 May 2014, the Ministry of Economy and

Finance (MEF) owned an 80.1% stake in CDP.

Source: Company Reports (annual report Dec 2013, semi-annual report June 2014, base prospectus May 2014), Company

data, Moody’s research

This report, exclusively provided to you by

Moody’s, presents a convenient summary of

as reported, publicly available information.

The information is not adjusted for Moody’s

analytic purposes. For Moody’s Ratings,

Opinion and Analytics on this company,

please [Click here]. To access the latest

Moody’s Credit Opinion on this company,

please [Click here].

BANKING

Financial Highlights (as Reported)

Note: The financials presented below are those reported by the entity and are not adjusted for Moody’s

analytic purposes. For Moody’s generated ratios on Cassa Depositi e Prestiti S.p.A., please see

<Cassa Depositi e Prestiti S.p.A. page on moodys.com>.

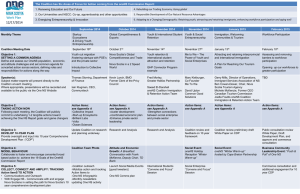

EXHIBIT 1

Latest Full-Year Results

Cassa Depositi e Prestiti S.p.A.

(in € Million)

31-Dec-13

31-Dec-12

31-Dec-11

Total Assets

% Change

13/12

% Change

12/11

340,467

328,912

287,143

3.51

14.55

Total Shareholders’ Equity

23,501

21,056

18,349

11.61

14.75

Shareholders’ Equity Excluding Minority Interest

19,295

18,186

15,525

6.10

17.14

Net Income

2,899

3,235

2,345

(10.38)

37.96

Net Income Attributable to Equity Holders

2,501

2,927

2,167

(14.54)

35.04

Note: Consolidated figures are considered for all financials

Source: Moody’s research

EXHIBIT 2

Latest First-Half Results

Cassa Depositi e Prestiti S.p.A.

(in € Million)

30-June-14

30-June-13

% Change

14/13

Total Assets

366,689

339,907

7.88

Total Shareholders’ Equity

23,725

22,511

5.39

Shareholders’ Equity Excluding Minority Interest

19,484

18,538

5.10

1,180

1,641

(28.10)

964

1,435

(32.81)

Net Income

Net Income Attributable to Equity Holders

Note: Consolidated figures are considered for all financials

Source: Moody’s research

Business Activities

Since its inception, CDP has financed infrastructure projects carried out for the purpose of

development. Apart from providing services to the Italian government, local authorities and other

public entities, CDP grants long-term loans to strategically important SMEs. Since 1875, it has also

accepted retail savings deposits collected by the Poste Italiane network.

This publication does not announce

a credit rating action. For any

credit ratings referenced in this

publication, please see the ratings

tab on the issuer/entity page on

www.moodys.com for the most

updated credit rating action

information and rating history.

2

NOVEMBER 18, 2014

In 2003, CDP became a joint-stock company. One key change accompanying the transformation was

the creation within the same legal entity of two separate business areas: the Gestione Separata,

comprising all CDP’s public-interest activities; and the Gestione Ordinaria, comprising the financing

of infrastructure for public services (i.e., project finance), for which CDP competes in the open

market.

Concerning its Gestione Separata activities, CDP is charged with the following: financing publicsector entities; managing the postal savings of Italian citizens, which are guaranteed by the state;

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

managing strategic equity stakes transferred by the state to CDP; and participating in funding of

various domestic development programmes and other public-interest projects on behalf of the

government.

As for its segment reporting, CDP’s activities are organised into the following two business units:

Business and Finance Areas; and Equity Investments and Miscellaneous.

Business and Finance Areas: This segment, which accounted for 64.2% of CDP’s operating income in

the financial year ended 31 December 2013 (2013), includes the following areas:

»

The Public Entities area, which provides lending products and services to public entities and other

legal bodies through ordinary loans, flexible specific-purpose loans and unsecured loans.

»

The Finance area, which manages CDP’s treasury operations and funding activities. It engages in

sourcing, investing and monitoring liquidity for the company. It also contributes to strategic asset

liability management and manages financial risk at the operational level, noting however that

CDP is not active in trading activities.

»

The Public Interest Lending area, which provides financial services for public projects sponsored

by public bodies for which the financial sustainability has been verified.

»

The Financing area, which provides investment financing for work, plant, infrastructure and

networks used for public services or in reclamation projects (including energy, local public

transport, multi-utilities and health care).

»

The Economic Support area, which manages subsidised credit instruments established by specific

legislation and economic support instruments.

Equity Investments and Miscellaneous: This segment comprises the bank’s activities related to

investment and divestment of investment fund units and shareholdings, and transactions for the

rationalisation of the investment portfolio. It also includes the costs of other functions. In 2013, this

segment accounted for 35.8% of CDP’s operating income.

Source: Company Report (annual report Dec 2013), Company data, Moody’s research

EXHIBIT 3

Business Unit

(% of Operating Income, unconsolidated, for 2013)

Equity Investments and

Miscellaneous

35.8%

Business and Finance Areas

64.2%

Source: Company Report (annual report Dec 2013, Pg: 336)

3

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

Distribution Capacity and Market Share

CDP operates throughout Italy and abroad to support the export activities of Italian companies. As a

state-owned entity with a public-interest mission, CDP is a frequent lending counterparty for publicsector organisations.

As of 31 March 2014, CDP reported a 47.8% share among the public entities and public-law bodies

engaged in lending in Italy (31 December 2013, 47.1%).

Source: Company Report (semi-annual report June 2014), Moody’s research

Ownership and Structure

As of 19 May 2014, CDP was a joint-stock company under public control, with 80.1% of its shares

owned by the MEF. As of that date, 18.4% of CDP’s share capital was owned by several banking

foundations (fondazioni), and the remaining 1.5% stake was held in treasury shares. As of 19 May

2014, CDP reported 296,450,000 ordinary shares in issue.

According to Italian law, majority ownership of CDP must remain with the Italian government, while

fondazioni and other public and private entities are allowed to hold only minority stakes. Furthermore,

CDP statutes specify that “only banks and other supervised financial intermediaries approved by the

board of directors” can become minority shareholders, and stipulate that any shareholder (other than

the government) can hold only 5% or less of CDP shares.

CDP is the parent company of the CDP Group, which comprises CDP, CDP GAS Srl, CDP RETI

S.p.A. (CDP RETI), SACE S.p.A., Fintecna S.p.A., CDP Immobiliare Srl, Quadrante S.p.A., Simest

S.p.A., CDP Investimenti SGR S.p.A. (CDPI SGR), Terna S.p.A. and Fondo Strategico Italiano

S.p.A. (FSI), and their subsidiaries and associates.

Source: Company Reports (annual report Dec 2013, base prospectus May 2014, semi-annual report June 2014), Moody’s research

Subsidiaries and Associates

As of 30 June 2014, CDP’s equity investments were as follows:

EXHIBIT 4

Cassa Depositi e Prestiti S.p.A.

Company

Registered Office

% Held

Listed Companies

Eni S.p.A.

Rome

25.76

Terna S.p.A.

Rome

29.85

SACE S.p.A.

Rome

100.00

CDP RETI S.p.A.

Rome

100.00

Fintecna S.p.A.

Rome

100.00

Fondo Strategico Italiano S.p.A.

Milan

77.70

CDP GAS Srl

Rome

100.00

CDP Immobiliare Srl

Rome

100.00

Unlisted Companies

4

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

EXHIBIT 4

Cassa Depositi e Prestiti S.p.A.

Company

Registered Office

% Held

Simest S.p.A.

Rome

76.00

Quadrante S.p.A.

Rome

100.00

Sinloc S.p.A.

Turin

11.29

Istituto per il Credito Sportivo

Rome

2.21

F2i SGR S.p.A.

Milan

16.52

CDP Investimenti SGR S.p.A.

Rome

70.00

Fondo Italiano d’Investimento SGR S.p.A.

Milan

12.50

Europrogetti & Finanza S.p.A. in liquidazione

Rome

31.80

Inframed Infrastructure societè par actions simplifièe à capital variable (Inframed Fund)

Paris

38.92

Galaxy S.àr.l. SICAR

Luxembourg

40.00

2020 European Fund for Energy, Climate Change and Infrastructure SICAV-FIS Sa (Marguerite Luxembourg

Fund)

14.08

Other Equity Investments

European Energy Efficiency Fund SA, SICAV-SIF (EEEF Fund)

Luxembourg

A units

12.90

B units

2.04

F2i - Fondi Italiani per le Infrastrutture

Milan

A units

8.10

C units

0.04

Fondo Italiano d'Investimento

Milan

20.83

Fondo Investimenti per l'Abitare

Rome

49.31

F2i - Secondo Fondo Italiano per le Infrastrutture

Milan

13.25

Fondo Immobiliare di Lombardia - Comparto Uno (formerly Abitare Sociale 1)

Milan

6.11

PPP Italia

Turin

14.58

FIV Plus

Rome

100.00

FIV Extra

Rome

100.00

Source: Company Report (semi-annual report June 2014)

Company Management

Company Management

Current Title

Giovanni Gorno Tempini

CDP: Chief Executive Officer and Managing Director;

Fondo Strategico Italiano S.p.A.: Chairman;

CDP RETI: Administrator;

Collegio San Carlo (Milan): Board Member;

AIFI (Italian Private Equity and Venture Capital Association): Member of the General Council

of Private Equity;

Ca 'Foscari International College: Member of the Scientific Committee;

Ca 'Foscari Foundation: Member of the Strategic Board;

MP3 Observatory of Bocconi (PPP Monitor): Member of the Steering Committee;

SDA Bocconi School of Management’s MBA Program: Professor of Public-Private Partnership

Andrea Novelli

CDP: General Manager;

Snam S.p.A.: Member of the Board of Directors

As of 14 Oct 2014

5

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

Board of Directors

Affiliation

Franco Bassanini

CDP: Chairman of the Board of Directors;

Fimpa S.p.A. and Risberme S.p.A.: Director;

Astrid Servizi Srl: Director and Managing Director;

InfraMed Infrastructure Fund: Vice Chairman of the Investor Board;

Metroweb Italia S.p.A.: Chairman;

Metroweb S.p.A.: Member of the Board;

Societa’ Italiana Condotte per l’Acqua S.p.A.: President of the Supervisory Board;

2020 European Fund for Energy, Climate Change and Infrastructure SICAV-FIS SA

(Marguerite Fund): Member of the Supervisory Board;

European Long Term Investors Association: Vice Chairman

Giovanni Gorno Tempini

See above

Maria Cannata

CDP: Member of the Board of Directors;

MEF: General Director of the Public Debt Department;

Scuola Archeologica Italiana di Atene and ANAS S.p.A.: Board Member

Mario Nuzzo

CDP: Member of the Board of Directors;

Foundation of Cassa di Risparmio della Provincia di Teramo: Chairman;

Associazione Casse di Risparmio Italiane and Sinloc S.p.A.: Member of the Board of

Directors

Olga Cuccurullo

CDP: Member of the Board of Directors;

IPZS S.p.A., Fondazione Centro Sperimentale di Cinematografia and InvImIt SGR S.p.A.:

Board Member

Francesco Parlato

CDP: Member of the Board of Directors;

Finmeccanica S.p.A.: Member of the Board of Directors

Antimo Prosperi

CDP: Member of the Board of Directors;

MEF: Director General of Directorate VI, Financial Transactions – EU litigation, of the

Treasury Department;

Ferrovie dello Stato Italiane S.p.A., IPZS S.p.A., Concessionaria Servizi Informativi

Pubblici (CONSIP) S.p.A. and Investimenti Immobiliari Italiani Società di Gestione del

Risparmio (InvImIt SGR) S.p.A.: Member of the Board of Directors appointed by MEF

Alessandro Rivera

CDP: Member of the Board of Directors;

Poste Italiane S.p.A.: Member of the Board of Directors and Chairman of the

Compensation Committee;

STMicroelectronics: Member of the Board of Directors and Member of the Nominating

and Corporate Governance Committee and of the Compensation Committee

Marco Giovannini

CDP: Member of the Board of Directors;

CONFINDUSTRIA Alessandria, Guala Closures S.p.A., Guala Closures Mexico, Guala

Closures Brasil Ltda, Guala Closures Argentina SA, Guala Closures Bulgaria AD, Guala

Closures Tools AD and Pharma Trade Srl: President;

Solar Investment Group Srl, Goglio S.p.A., Mperience Srl, SWAN Srl, Guala Closures

International BV, Guala Closures India Pvt Ltd., Guala Closures UK Ltd., Guala Closures

New Zealand Ltd., Guala Closures China BV, Guala Closures Australia Holdings Pty Ltd.

And Beijing Guala Closures Ltd.: Member of the Board of Directors;

Consorzio Proplast within the Guala Closure Group: Member of the Board;

Guala Closures Ukraine LLC and Guala Closures North America Ltd.: Chairman of the

Board of Directors

Additional Directors

6

NOVEMBER 18, 2014

Vincenzo La Via (General

Manager of the MEF)

CDP: Member of the Board of Directors;

MEF: Director General

Roberto Ferranti (Additional

Director on behalf of the

General Accountant of the

Republic of Italy)

CDP: Member of the Board of Directors;

Board of Statutory Accounts, Registro Italiano Navale, Agenzia Nazionale per la

Sicurezza del Volo and Agenzia delle Entrate: Chairman;

Federazione Italiana Nuoto: Member of the Supervisory Board

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

Board of Directors

Affiliation

Piero Fassino

CDP: Member of the Board of Directors;

Turin: Mayor;

ANCI Piedmont, ANCI, Teatro Regio and Fondazione per la Cultura: Chairman;

Torino Città Capitale Europea: Honorary Chairman;

Associazione Torino Internazionale: Co-Chairman;

Foundation Venaria Reale and Foundation ISI: Advisor to the Board of Directors

Massimo Garavaglia

CDP: Member of the Board of Directors;

Lombardia Informatica S.p.A.: Chairman of the Supervisory Board

As of 2 July 2014

Supervisory Board appointed pursuant to Legislative Decree No. 231 of 8 June 2001 (Decree 231)

Giuseppe Cannizzaro

CDP: Chairman of the Supervisory Board

Vincenzo Tommaso Milanese

CDP: Member of the Supervisory Board

Vincenzo Malitesta

CDP: Member of the Supervisory Board

As of 19 May 2014

Board of Statutory Auditors

Affiliation

Angelo Provasoli

CDP: Chairman of Board of Statutory Auditors

Luciano Barsotti

CDP: Standing Auditor

Andrea Landi

CDP: Standing Auditor

Ines Russo

CDP: Standing Auditor

Giuseppe Vincenzo Suppa

CDP: Standing Auditor

Angela Salvini

CDP: Alternate Auditor

Giandomenico Genta

CDP: Alternate Auditor

As of 2 July 2014

Source: Company Report (base prospectus May 2014), Company data

Company History

CDP was established by the Italian government in 1850 to finance public-sector investments. In 1863,

CDP acquired similar institutions elsewhere in Italy, establishing a new business unit to grant loans to

Italian local governments to finance infrastructure projects and to provide financial support for debt

restructuring.

Since 1875, CDP has accepted retail savings deposits collected by the Post Italiane network. In 1928,

CDP’s role was extended to include the provision of finance to local public-sector organisations in

regions, provinces and municipalities.

In 1983, CDP was granted full organisational autonomy, and in 1993, it became a separate legal

entity.

In 2002, CDP established Infrastrutture S.p.A., a wholly owned subsidiary, to finance infrastructure

and other major public works-related projects in cooperation with the wider banking system. In 2003,

CDP became a joint-stock company with majority shares owned by the Italian state. As of 19 May

2014, the MEF owned an 80.1% stake in CDP.

7

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

In September 2005, CDP acquired a 29.99% share in Terna S.p.A., the parent company of Terna

Group. Terna S.p.A. transmits and distributes electricity throughout Italy. In 2009, CDP established

CDPI SGR in cooperation with Associazione delle Fondazioni bancarie e Casse di Risparmio S.p.A.

and the Italian Banking Association to support the Italian social housing sector. As of 30 June 2014,

CDP owned a 70.0% stake in CDPI SGR.

In August 2011, CDP established FSI, a holding company in which CDP Group held an 80% stake as

of 19 May 2014, with the aim of investing in companies that are strategically important for the Italian

economy. In December 2011, CDP acquired an 89% stake in Trans Austria Gasleitung GmbH, the

exclusive operator of the Austrian segment of the gas pipeline connecting Russia and Italy, through its

wholly owned subsidiary CDP GAS Srl.

In October 2012, CDP, through its wholly owned investment vehicle CDP RETI, acquired a stake of

30% plus one share of Snam S.p.A. from Eni S.p.A. for approximately €3.5 billion. In November

2012, CDP acquired a 100% stake in SACE S.p.A., a 100% stake in Fintecna S.p.A., and a 76% stake

in Simest S.p.A. from the MEF.

In July 2014, CDP signed an agreement to sell 35% of its stake in CDP RETI to State Grid

Corporation of China. The transaction is expected to be completed by the end of 2014.

In September 2014, an agreement was signed to transfer the stake held in Trans Austria Gasleitung

(TAG), through CDP’s wholly owned subsidiary CDP GAS, to Snam. The transfer operation will be

executed through a share capital increase of Snam, reserved in favor of CDP GAS, that will transfer, as

compensation, its holding in TAG.

Source: Company Reports (annual report Dec 2012, semi-annual report June 2014, base prospectus May 2014, financial statements

Dec 2011 and Dec 2010, group financial statements Dec 2010), Company data, Moody’s research

8

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

Peer Group

»

Caisse Des Depots et Consignations

»

Kreditanstalt fuer Wiederaufbau

Related Websites and Information Sources

For additional information, please see:

»

the company’s website: www.cdp.it

»

the regulator’s website: www.bancaditalia.it

MOODY’S has provided links or references to third party World Wide Websites or URLs ("Links or References") solely for your

convenience in locating related information and services. The websites reached through these Links or References have not

necessarily been reviewed by MOODY’S, and are maintained by a third party over which MOODY’S exercises no control.

Accordingly, MOODY’S expressly disclaims any responsibility or liability for the content, the accuracy of the information, and/or

quality of products or services provided by or advertised on any third party web site accessed via a Link or Reference. Moreover,

a Link or Reference does not imply an endorsement of any third party, any website, or the products or services provided by any

third party.

Moody’s Related Research

Credit Opinion:

»

Cassa Depositi e Prestiti S.p.A.

To access any of these reports, click on the entry above. Note that these references are current as of the date of publication of

this report and that more recent reports may be available. All research may not be available to all clients.

9

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.

BANKING

Report Number: 177444

© 2014 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. (“MIS”) AND ITS AFFILIATES ARE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF

ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODY’S (“MOODY’S

PUBLICATIONS”) MAY INCLUDE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE

SECURITIES. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET

VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY’S OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL

FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY

MOODY’S ANALYTICS, INC. CREDIT RATINGS AND MOODY’S PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS

AND MOODY’S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS

NOR MOODY’S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS AND

PUBLISHES MOODY’S PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND

EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS AND MOODY’S PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS FOR RETAIL INVESTORS TO CONSIDER

MOODY’S CREDIT RATINGS OR MOODY’S PUBLICATIONS IN MAKING ANY INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL

ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR

OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH

PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other

factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit

rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY’S is not an auditor and cannot

in every instance independently verify or validate information received in the rating process or in preparing the Moody’s Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special,

consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if

MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited

to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or

damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by

law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers,

arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR

OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

MIS, a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including corporate and municipal bonds,

debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees

ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MIS’s ratings and rating processes. Information

regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an

ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading “Shareholder Relations — Corporate Governance — Director and Shareholder Affiliation

Policy.”

For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors Service Pty Limited ABN 61

003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to “wholesale clients”

within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY’S that you are, or are accessing the

document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to “retail clients”

within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities

of the issuer or any form of security that is available to retail clients. It would be dangerous for “retail clients” to make any investment decision based on MOODY’S credit rating. If in doubt you

should contact your financial or other professional adviser.

10

NOVEMBER 18, 2014

COMPANY PROFILE: CASSA DEPOSITI E PRESTITI S.P.A.