Lender Training Presentation - Housing Opportunities Commission

advertisement

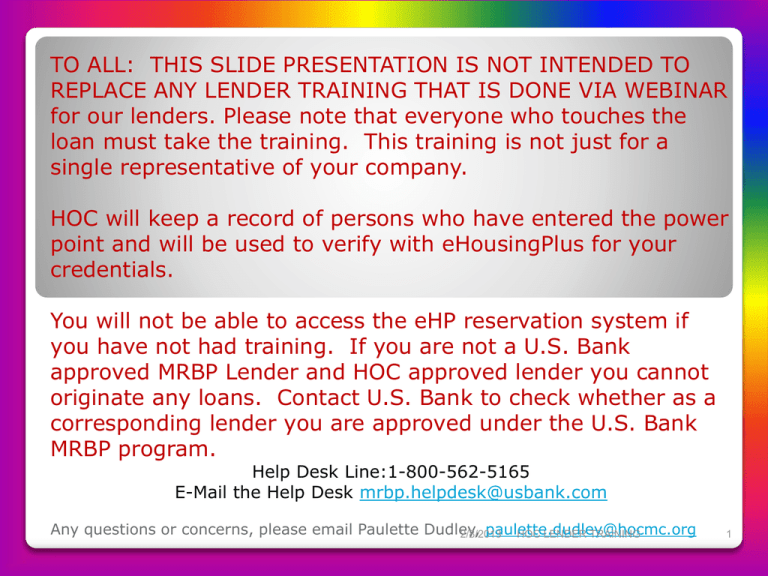

TO ALL: THIS SLIDE PRESENTATION IS NOT INTENDED TO REPLACE ANY LENDER TRAINING THAT IS DONE VIA WEBINAR for our lenders. Please note that everyone who touches the loan must take the training. This training is not just for a single representative of your company. HOC will keep a record of persons who have entered the power point and will be used to verify with eHousingPlus for your credentials. You will not be able to access the eHP reservation system if you have not had training. If you are not a U.S. Bank approved MRBP Lender and HOC approved lender you cannot originate any loans. Contact U.S. Bank to check whether as a corresponding lender you are approved under the U.S. Bank MRBP program. Help Desk Line:1-800-562-5165 E-Mail the Help Desk mrbp.helpdesk@usbank.com Any questions or concerns, please email Paulette Dudley, paulette.dudley@hocmc.org 2/8/2013 HOC LENDER TRAINING 1 Housing Opportunities Commission Montgomery County, Maryland Mortgage Purchase Program (MPP) MORTGAGE BACKED SECURITIES Lender Training Presentation February 8, 2013 2/8/2013 HOC LENDER TRAINING 2 Agenda • Welcome & Introductions • Change to MBS Format • General Information • Eligibility & Compliance • Property (General & MPDU) • Loan Products (Mortgage Options & Closing Cost Programs) • Origination & Documentation • Loan Closing Requirements • Post Closing/Loan Purchase • eHousingPlus Online Reservations 2/8/2013 HOC LENDER TRAINING 3 Mortgage Purchase Program Web Page www.hocmc.org (Click on Mortgage & Financing Programs) Updates by email through HOC NOTICES and/or eHousingPlus Bulletin Board and emails 2/8/2013 HOC LENDER TRAINING 4 HOC CHANGES TO MBS FORMAT The HOC Mortgage Purchase Program converted from a whole loan program to a Mortgage Backed Securities Program as of August 31, 2012. Prior to August 31, 2012, HOC purchased and retained the loans originated in the MPP. After August 31, HOC loans are purchased by a Master Servicer for pooling. U.S. Bank is Master Servicer. HOC began using an online reservation system through eHousingPlus, Inc. on August 31, 2012. 2/8/2013 HOC LENDER TRAINING 5 Basic Process Lender takes application 2. Reserves first mortgage (and HOC Purchase Assistance) with eHousingPlus 3. Reserves county closing cost with HOC (if applicable) 4. Lender submits pre-closing compliance file to HOC 5. Lender approves for credit 6. HOC approves for program compliance 7. Lender closes loan 8. Lender submits post-closing file to HOC 9. Lender submits closing file to U.S. Bank 10. U.S. Bank buys loan 1. 2/8/2013 HOC LENDER TRAINING 6 General Information HOC underwrites MBS loans for program compliance ONLY Lender underwrites for credit that conforms to FHA guidelines for purchase by U.S. Bank. Loans cannot close without HOC approval 2/8/2013 HOC LENDER TRAINING 7 General Information First Mortgage Program Requirements • US citizenship is not required • No requirement for current Montgomery County residency for MPP first mortgage • No requirement for working in Montgomery County for MPP first mortgage • Property must be owner occupied 2/8/2013 HOC LENDER TRAINING 8 General Information First Mortgage Program Requirements • No non-occupant co-signers • Rent back more than 30 days after settlement is not allowed • No more than 15% of property can be used for a business purpose • FHA Loans may be assumable only to another eligible borrower 2/8/2013 HOC LENDER TRAINING 9 General Information Loan Types All HOC loans have Thirty (30) Year Terms FHA Loans Only No VA Financing NOW (2-8-13) No Conventional Financing Available 2/8/2013 HOC LENDER TRAINING 10 General Information Power of Attorney • OK for Seller- does not require HOC Approval • POA for Borrowers requires HOC approval prior to settlement o Specific for Transaction o HOC requires at least one borrower at settlement • Use of borrower POA should be due to circumstances beyond borrower’s control 2/8/2013 HOC LENDER TRAINING 11 General Information Homebuyers Education Class At least one borrower in the household must attend first time homebuyer class/training Homebuyer Education required prior to reservation of funds Any certified housing counseling course accepted – free classes offered by Housing and Community Initiatives www.hcii.org 2/8/2013 HOC LENDER TRAINING 12 General Information Home Inspections HOC requires a Home Inspection for All Existing Properties, Except Condo conversions with renovation (including foreclosure sale • HOC does not require a copy of the full inspection report HOC Home Inspection Certification form completed and signed (by borrower and LO) and a copy of the invoice billing as evidence the inspection was completed 2/8/2013 HOC LENDER TRAINING 13 General Information Fees and Charges HOC has no separate fees for the first mortgage U.S. Bank/Master Servicer Fees – Loan Funding Fee - $150.00 – Tax Service Fee - $85.00 eHousingPlus charges $225 reservation fee per loan application that closes County Closing Cost Assistance loan “5 for 5” - HOC charges $100 application fee 2/8/2013 HOC LENDER TRAINING 14 Fees And Charges Lender Payment Schedule •Lender is paid upon loan purchase by U.S. Bank according to the following schedule TIMELINE AND PURCHASE SCHEDULE/LENDER COMPENSATION Lender compensation applies from the ORIGINAL loan reservation confirmation date Compensation 2% 1.5% 1% 0% After 150 days # of days from reservation date Loan Purchased within 60 days of the reservation date Loan Purchased within 61 - 90 days of the reservation date Loan Purchased within 91-120 days of the reservation date Loan Purchased within 121-150 days of the reservation date The loan will not be purchased 2/8/2013 HOC LENDER TRAINING 15 FHA and the HOC Loan Product • FHA GUIDELINES PREVAIL • LOANS MUST HAVE FHA AND HOC APPROVAL • HOC sets income limits and sales price limits • HOC can offer closing cost/down payment assistance as governmental entity • Borrower Contribution – 3.5% Can be a gift, Revolving Closing Cost Assistance Loan if Borrower works in Montgomery County, or HOC Purchase Assistance Loan • Seller Closing Cost Contribution – follow FHA guidelines 2/8/2013 HOC LENDER TRAINING 16 Underwriting MBS Loans Lenders will underwrite for credit according to FHA guidelines and U.S. Bank required guidelines. HOC will underwrite for compliance/eligibility prior to closing. HOC is not underwriting for credit in the MBS program. 2/8/2013 HOC LENDER TRAINING 17 Credit Underwriting • Will be covered by U.S. Bank • FICO SCORE • Automated underwriting • Ratio Limits 2/8/2013 HOC LENDER TRAINING 18 Eligibility/Program Compliance 2/8/2013 HOC LENDER TRAINING 19 Eligibility/Program Compliance • First Time Homeownership All adult occupants must be a first time homeowner. - Prior ownership = having an ownership interest in a primary residence anywhere during the last three years. - Last 3 years’ federal tax return and IRS transcript for all borrowers used to verify. - If an applicant currently owns real estate which has not been used as primary residence during the past three years, the applicant may still be eligible. The Commission will review each case INDIVIDUALLY. This needs to be determined at the start of your application. 2/8/2013 HOC LENDER TRAINING 20 Eligibility/Program Compliance • Citizenship Borrowers do not have to be a U.S. citizen. If other than U.S. citizen, it will be necessary to document status. HOC will not extend financing to borrowers with Diplomatic Immunity • Sales Price (Acquisition Cost) Cannot exceed the limits set by the Commission $429,619. HOC’s definition is different from FHA’s definition 2/8/2013 HOC LENDER TRAINING 21 Eligibility/Program Compliance • Income: Household income is total gross annual rate of income for all adult members of the household, whether used for qualifying or not. HH income cannot exceed the limits in effect at time of loan application. NOTE: HOC and MPDU income limits are not the same. MPDU buyer must not exceed MPDU income limits as of settlement. (If a borrower appears to be over-income during the application phase or verification process, call HOC’s underwriter so a decision can be made before the entire file is submitted for pre-closing compliance underwriting) 2/8/2013 HOC LENDER TRAINING 22 Eligibility/Program Compliance INCOME LIMITS AND SALES PRICE LIMITS are set by HOC – Income Limits Effective 1/23/12 1 Person 2 Person 3+ Person $ 89,160 $ 127,320 $ 148,540 MAXIMUM SALES PRICE: $ 429,619 2/8/2013 HOC LENDER TRAINING 23 Eligibility/Program Compliance Mortgage Purchase Program – MPP • Borrowers do not have to be a County Resident prior to purchase for the MPP • Borrowers do not have to be working in Montgomery County to use the MPP • HOWEVER, a borrower must be working in Montgomery County to be eligible for the “5 for 5” Closing Cost Assistance (RCCAP) • There is no asset test for the MPP or County Closing Cost Program. 2/8/2013 HOC LENDER TRAINING 24 PRE-CLOSING COMPLIANCE 2/8/2013 HOC LENDER TRAINING 25 Pre-Closing Compliance Package Submission Refer to MBS Pre-Closing Compliance Checklist Stacking Submission Order • • The appropriate party must sign the documents after information has been filled in. These forms are statements of the mortgagors or sellers, not the lender (except for the Participant’s Affidavit) and are necessary in order to comply with bond requirements. • Application and Origination Documents • Mortgage Purchase Program Disclosure of Information • Mortgagor’s Affidavit • Certificate of Mortgagor • FHA Notice to Buyers • Notice of Potential Recapture Tax (one page document) • Seller’s Affidavit 2/8/2013 HOC LENDER TRAINING 26 Pre-Closing Compliance Package Submission Files should be submitted to HOC’s Single Family Underwriting Department, located at: Housing Opportunities Commission Mortgage Finance Division Single Family Office 10400 Detrick Avenue Kensington MD 20895 Attention: SF Underwriter 2/8/2013 HOC LENDER TRAINING 27 HOC Pre-Closing Compliance/ Underwriting Pre-Closing Compliance package is sent to HOC for compliance/eligibility approval. Refer to the HOC Pre-Closing Compliance Checklist on the eHP website or the HOC website. - Turn-around time in Underwriting 1-2 business days (depending on volume) Out” basis HOC underwrites for compliance/eligibility prior to closing. HOC is not underwriting for credit in the MBS program. • Loan not considered approved until HOC has approved AND cannot close without HOC approval • Approval letter, pending and / or rejection notice are faxed or emailed to the lender by HOC once the file has been reviewed. - HOC also posts approval to eHP system under UW certification - Loans are underwritten on a “First in First • 2/8/2013 HOC LENDER TRAINING 28 HOC Pre-Closing Compliance/ Underwriting •HOC issues an approval letter to close with instructions, if applicable. HOC’s Approval Letter confirms the following: oInterest Rate oPoints oApproved Loan Amount oApproved Purchase Assistance (if applicable) oExpiration date of your Locked Financing Terms oTerms of Any Secondary Financing • Lender closes and funds the First Trust loan HOC funds purchase assistance loan - Purchase Assistance Loan, specific documents are required to be sent with the pre-closing compliance package, refer to the Secondary Financing Checklist on HOC website • 2/8/2013 HOC LENDER TRAINING 29 Pre-Closing Compliance SECONDARY FINANCING PROGRAMS Refer to HOC webpage for checklist Secondary Financing Checklist Documents Submission HOC underwrites the Secondary Financing Programs – submitted with the Pre-Closing Compliance Package - CLOSING COST DOCUMENTS – required for all SF loans - Additional documents required for specific Secondary Financing programs COUNTY’S CLOSING COST ASSISTANCE PROGRAM “5 FOR 5” REVOLVING CLOSING COST 3% PURCHASE ASSISTANCE” LOAN – FUNDED BY HOC HOUSE KEYS FOR EMPLOYEES (HK4E) 2/8/2013 HOC LENDER TRAINING 30 Property 2/8/2013 HOC LENDER TRAINING 31 Property HOC accepts any property, except co-ops, in Montgomery County (foreclosures are acceptable) Sales price cannot exceed the limits established by HOC Standard appraisal required HOC requires that all resale properties receive an indepth home inspection by a qualified contractor 2/8/2013 HOC LENDER TRAINING 32 Property • Project Approval • FHA project approval is necessary for a FHA Loan • HOC relies on the lender to determine if a project has FHA approval 2/8/2013 HOC LENDER TRAINING 33 Property • FHA Condominium Insurance Concentration applies • Investor concentration – FHA has said it will not regard units owned by a public housing agency in the investor category. Each situation requires waiver from FHA • Condominium submits request for waiver 2/8/2013 HOC LENDER TRAINING 34 Property • Both market units and MPDUs - (Moderately Priced Dwelling Unit) are acceptable • A MPDU is a property with a controlled sales price (sold below market value). The county controls the sales price based on a formula. When the owner is ready to sell, the county government will calculate the allowable resale price. Price control ends upon foreclosure. • MPDU has its own Income Limits. They are different from HOC Income Limits Website: www.montgomerycountymd.gov/dhca Call: (240) 777-3711 2/8/2013 HOC LENDER TRAINING 35 MODERATELY PRICED DWELLING UNIT (MPDU) MPDU PRE-QUALIFICATION LETTER Anyone wishing to enter the county’s MPDU program is required to get a pre-qualification letter from an HOC participating lender for a mortgage loan of at least $120,000. This letter is a prerequisite for the county’s acceptance of the applicant to the MPDU program. The county has created a format for the pre-qual letter it wants the lender to use. The pre-qual letter does not obligate the lender to making the loan. 2/8/2013 HOC LENDER TRAINING 36 FHA APPROVAL OF MPDU FINANCING MONTGOMERY COUNTY ONLY FHA deems units subject to the Montgomery County MPDU program as eligible for FHA insurance. FHA has stipulated: a. This approval only applies to Montgomery County’s MPDU program b. Each lender should keep a copy of the FHA approval letter in each loan underwriting file. 2/8/2013 HOC LENDER TRAINING 37 2/8/2013 HOC LENDER TRAINING 38 2/8/2013 HOC LENDER TRAINING 39 HOC LOAN PRODUCT 2/8/2013 HOC LENDER TRAINING 40 HOC LOAN PRODUCTS HOC SETS ITS OWN INTEREST RATES LENDER CANNOT CHARGE MORE POINTS THAN HOC QUOTE HOC DOES NOT SET SETTLEMENT COSTS 2/8/2013 HOC LENDER TRAINING 41 HOC Loan Products First Mortgage Interest Rate Option 1 30 Year Fixed Rate with 0 Points Without Purchase Assistance Lender Cannot charge points in excess of HOC’s quoted rate Interest rates and points are subject to change 2/8/2013 HOC LENDER TRAINING 42 HOC Loan Products First Mortgage Interest Rate Option 2 30 Year Fixed Rate with 0 Points WITH 3% Purchase Assistance 2/8/2013 HOC LENDER TRAINING 43 HOC Loan Products Option 2 Refer to HOC website, www.hocmc.org click on Mortgage & Financing Programs, HOC First Mortgage With 3% Purchase Assistance Purchase Assistance is secured, secondary financing which may be used to cover points, down payment, closing costs, escrows, or other prepaid expenses – no cash back. HOC will directly fund the Purchase Assistance loan to comply with FHA. 2/8/2013 (revised 1-24-13) HOC LENDER TRAINING 44 HOC Loan Products Option 2 HOC Purchase Assistance Terms LOAN AMOUNT: 3% of the sales price. (No maximum, a flat 3% of sales price) INTEREST RATE: Zero percent (0%) per annum TERMS: Secured Five (5) year deferred loan effective from the settlement date. No interest shall accrue on the Loan and no monthly installments shall be due. Pro rata due upon sale or refinance during first five years. The loan will be forgiven after five (5) years. 2/8/2013 HOC LENDER TRAINING 45 HOC Loan Products Option 2 REPAYMENT: If first mortgage loan prepays within five years of its origination, borrower is required to repay the unamortized balance of the Purchase Assistance loan. CANNOT BE SUBORDINATED Purchase Assistance loan is not included in the principal balance of the first Mortgage Loan; however, the Mortgagor pays a higher rate of interest on the Mortgage Loan than is paid by Mortgagors not receiving such assistance HOC sets the first mortgage rate specifically to be used with the Purchase Assistance. All terms and conditions of the HOC First Trust Mortgage Program apply 2/8/2013 HOC LENDER TRAINING 46 HOC Loan Products Option 2 Borrower does not have to work in Montgomery County to qualify for the First Mortgage loan with the Purchase Assistance Can be combined with the Revolving County Closing Cost Assistance Loan “5 for 5”. BUT….the borrower must work in Montgomery County to combine both MAY be used with other HUD approved closing cost and/or downpayment programs (i.e. FHLBB) 2/8/2013 HOC LENDER TRAINING 47 HOC Loan Products Option 2 General Requirements Not intended to pay off debts NO CASH OUT– excess funds will be used as a principal curtailment to the first loan Seller contributions within FHA acceptable guidelines Total debt ratio not to exceed 45% Maximum CLTV is 104.5% No asset test is required All terms and conditions of the HOC First Trust Mortgage Program apply 2/8/2013 HOC LENDER TRAINING 48 Housing Opportunities Commission Mortgagee Clause USE FOR “5 for 5” Revolving County Closing Cost Assistance Loan and Purchase Assistance Loan The Housing Opportunities Commission Of Montgomery County, Its Successors And Assigns As Their Interest May Appear 2/8/2013 HOC LENDER TRAINING 49 Closing Cost Assistance 2/8/2013 HOC LENDER TRAINING 50 Employer Identification Number (EIN) 52-0859090 Effective 10-1-08 lenders are required to report to HUD the EIN of all government, state, county, city municipalities and nonprofits providing secondary financing assistance grants or gifts to the borrower when receiving an FHA first mortgage. 2/8/2013 HOC LENDER TRAINING 51 Closing Cost Assistance Programs HOC First Mortgage Rate with Purchase Assistance – Option 2 (HOC Funded) Revolving County Closing Cost Assistance Program (RCCAP) – “5 for 5” (HOC funded) House Keys 4 Employee (HK4E) (State program) (Administered and funded by HOC from “5 for 5” Closing Cost Program) 2/8/2013 HOC LENDER TRAINING 52 Revolving County Closing Cost Assistance Program (RCCAP) Source of Funding: Montgomery County Government RCCAP administered by HOC “5 for 5” Funds disbursed by HOC, serviced by Bogman, Inc. 2/8/2013 HOC LENDER TRAINING 53 Revolving County Closing Cost Assistance Program “5 for 5” • • • • Max Loan = 5% of Sales Price – up to $10,000 Secured Mortgage – second lien 10 year term at 5% - amortized over 10 years Must be used with HOC First Mortgage -EXCEPTION: HK4E Program used with CDA Maryland Mortgage Purchase Program •Allowed with FHA Financing – Direct funding by governmental agency 2/8/2013 HOC LENDER TRAINING 54 Revolving County Closing Cost Assistance Program “5 for 5” • At least one Borrower or Co-Borrower MUST BE WORKING IN Montgomery County •Regular work location is in the county; company headquarters does not have to be here •Part-time means at least 20 hours/week spent working in the county; 12 months employment history for part time work required 2/8/2013 HOC LENDER TRAINING 55 Revolving County Closing Cost Assistance Program “5 for 5 •Borrower applies through HOC Participating Lender •Lender reserves funds with HOC - Use the current “5 for 5” Reservation Form; (on HOC website) - Email or fax to HOC --- not ehousing plus - Lender will receive confirmation from HOC 2/8/2013 HOC LENDER TRAINING 56 RESPA REQUIREMENT FOR THE REVOLVING COUNTY CLOSING COST LOAN PROGRAM - HOC will provide the borrower with the initial GFE & TIL for the Secondary Financing (Revolving County Closing Cost Loan and HK4E) - Lender must complete the “Closing Cost Good Faith Information Form” for HOC to can get the information. LOG ON TO: www.hocmc.org, Mortgage and Finance Programs “FOR LENDERS” - Print A Copy For Your File. (to be submitted w/ Secondary Financing PreClosing Compliance Package) 2/8/2013 HOC LENDER TRAINING 57 Revolving County Closing Cost Assistance Program “5 for 5” • $100 application fee collected from Borrower • Automatic Withdrawal from Checking or Savings Account Required • The loan is due at time of sale or refinancing of property. • Subordination: will review on case by case basis – no cash out • There is no “prepayment penalty” • The property must be owner occupied and remain owner occupied while the loan is outstanding 2/8/2013 HOC LENDER TRAINING 58 Revolving County Closing Cost Assistance Program “5 for 5” • LENDER should inform settlement agent of secondary financing • HOC will prepare the closing documents and Instructions to the Settlement Attorney for the county closing cost loan • HOC disburses funds by check to settlement • HOC will notify settlement agent and Lender when check is ready. Checks should be picked up by lender or settlement agent at: HOC Mortgage Finance Department 10400 Detrick Avenue Kensington MD 20895 (240) 773-9193 (Liz Zadeng) 2/8/2013 HOC LENDER TRAINING 59 REVOLVING CLOSING COST LOANS Settlement Instructions Closed Loan Submission All Closing Cost documents are to be returned to HOC within five (5) days of settlement NOT with the Post Closing Compliance package or to U.S. Bank • Bogman, Inc. services the county closing cost loans 2/8/2013 HOC LENDER TRAINING 60 House Keys 4 Employees HK4E State Program- refer to flyer •HK4E is a state program in which employers may contribute assistance to their employees for purchasing a first home and the state provides matching assistance up to $3,500 (subject to MD CDA policy) HK4E Match SK4E “Bonus” - $2,500 - $1,000 - Must be HOC/CDA Lender - Must use CDA First Mortgage-Maryland Mortgage Program - State Income limits apply 2/8/2013 HOC LENDER TRAINING 61 House Keys 4 Employees HK4E Montgomery County is the Employer (includes several county agencies/commissions – see list on HOC website) • A borrower must be County employee-(see list) * Signed Verification of Partner Contribution by appropriate HR dept. First time Homebuyer County’s participation is the RCCAP “5 for 5” • Lender reserves HK4E/RCCAP w/HOC. All terms of the RCCAP apply HOC disburses the County funds • Other documents required for an approval by HOC • - (refer to Secondary Financing Programs Document Checklist) 2/8/2013 HOC LENDER TRAINING 62 Settlement and Loan Closing 2/8/2013 HOC LENDER TRAINING 63 Required HOC Settlement Documents • Seller’s Affidavit • Mortgagor’s Affidavit • Certificate of Mortgagor • Occupancy Addendum to Deed of Trust • FHA Addendum to Deed of Trust • Information Regarding Potential Recapture Tax (most recent edition: form is revised annually) 2/8/2013 HOC LENDER TRAINING 64 Required HOC Settlement Documents Explanation HOC FORMS TO BE COMPLETED AND SIGNED AT SETTLEMENT • Seller’s Affidavit – Signed first at application. Signed AGAIN and notarized at settlement – By the Seller. The ORIGINAL is submitted to HOC with closed loan package for purchase review. • Mortgagor’s Affidavit – Signed first at application. Signed AGAIN and notarized at settlement. The ORIGINAL is submitted to HOC with closed loan package for purchase review. • Certificate of Mortgagor – Borrower(s) and adult members of household sign. Signed first at application. Signed AGAIN and notarized at settlement. • The ORIGINAL is submitted to HOC with closed loan package for purchase review. 2/8/2013 HOC LENDER TRAINING 65 Required HOC Settlement Documents Explanation HOC FORMS TO BE COMPLETED AND SIGNED AT SETTLEMENT • Occupancy Addendum to Deed of Trust – To Be Recorded with First Deed of Trust o o Completed, signed and notarized at closing for all HOC loans. A copy is submitted with the copy of the Deed of Trust in the closed loan package for purchase. • FHA Addendum to Deed of Trust – To Be Recorded o o o Re-discloses to the borrower(s) the additional restrictions during the lifetime of the loan as to use and occupancy as well as sale by assumption etc. with regard to their FHA-HOC loan. The original is recorded with the First Deed of Trust. A copy is submitted with the copy of the Deed of Trust in the closed loan package for purchase. 2/8/2013 HOC LENDER TRAINING 66 Required HOC Settlement Documents Explanation HOC FORMS TO BE COMPLETED AND SIGNED AT SETTLEMENT • Information Regarding Potential Recapture Tax • The current edition (changes yearly) must be given to all borrowers at settlement. This document provides them with instructions for determination of their potential tax liability when they sell their home. • The borrower (s) receive a copy and the ORIGINAL is sent to HOC with the closed loan file for purchase. 2/8/2013 HOC LENDER TRAINING 67 POST CLOSING REVIEW AND LOAN PURCHASE 2/8/2013 HOC LENDER TRAINING 68 Post Closing and Loan Purchase Post-closing compliance review is done by HOC. Final approval by U.S. Bank. Closed loan files for Post closing review must be submitted within 10 days of settlement to HOC Lenders send the required post-closing compliance documents to HOC, as per the HOC Post-Closing Compliance Checklist. Refer to HOC website for the checklist HOC will review closed loan files for completeness, advise lender of any missing/incomplete documents NOTE: eHousingPlus fee of $225.00 in the form of a check made 2/8/2013 HOC LENDER TRAINING payable to eHousing Plus must accompany the Post-Closing Compliance package. 69 Post Closing and Loan Purchase A closed loan file goes to U.S. Bank, as per U.S. Bank FHA Loan Delivery Chklist. Help Desk: mrbp.helpdesk@usbank.com Help Desk Line: 1-800-562-5165 HOC’s post-closing compliance review and U.S. Bank’s review of the file will be done simultaneously. Any exceptions noted from either side will be worked through with the lender. HOC will notify U.S. Bank thru eHousingPlus when HOC approves the Post-Compliance package. 2/8/2013 HOC LENDER TRAINING 70 Post Closing and Loan Purchase When all exceptions are cleared between the lender and U.S. Bank on the closed loan file AND HOC’s compliance approval date is reflected in the U.S. Bank system and eHP system, U.S. Bank will buy the loan from the lender and commence servicing of the loan. In order for loans to be approved and purchased, loans must be delivered with all of the proper documents. The First Trust loan will be purchased by U.S. Bank. U.S. Bank will net all fees/compensation. Lender fee paid at this time. 2/8/2013 HOC LENDER TRAINING 71 HOC Contacts Tom DeBrine, Single Family Manager 240-773-9199 Tom.debrine@hocmc.org Paulette Kee-Dudley, Program Specialist 240-773-9196 paulette.dudley@hocmc.org Gabriela Merida, Underwriter 240-773-9194 gabriela.merida@hocmc.org Liz Zadeng, Closing Cost Assistant 240-773-9193 liz.zadeng@hocmc.org 2/8/2013 HOC LENDER TRAINING 72 eHousingPlus (eHP) Online Reservations Reservations/Extensions/Cancellations First Mortgage and Purchase Assistance Loan is reserved with eHousingPlus (eHP), not with HOC. Option 1 and Option 2 w/Purchase Assistance • Reservation window: Daily 10:00a.m to 8:00 p.m. • INTEREST RATE LOCK IN • The interest rate reserved will be locked in for 60 DAYS. Settlement must take place within 60 Days from the Reservation Date with eHP. 2/8/2013 HOC LENDER TRAINING 73 eHousingPlus (eHP) Online Reservations Effective 2-7-2013: EXTENSIONS: ◦ Settlement after 60 days from the reservation date: a) A ONE-TIME 15 DAY EXTENSION to settle at the SAME RATE WILL BE GRANTED, approval by HOC and eHP needed (use Extension Form on eHP website) b) SETTLEMENTS BEYOND THE 15 DAYS AND UP TO DAY 30 will be granted at the higher of the original rate or the rate at time of extension c) IF SETTLEMENT DOES NOT TAKE PLACE WITHIN THIS 90 DAY PERIOD YOU WILL NOT BE ABLE TO RERESERVE UNTIL 60 DAYS AFTER THE 90 DAY PERIOD. eHP’s system will lock the loan if not settled within this time frame. 2/8/2013 HOC LENDER TRAINING 74 eHousingPlus (eHP) Online Reservations • PLEASE NOTE: The lender compensation is based on the ORIGINAL RESERVATION DATE and not the settlement date. Lender Compensation Fees are affected by these extensions. • CANCELLATION AND RE-RESERVE: Loans cannot be cancelled and re-reserved. A loan that cancels can only be reserved 60 days after the expiration of the applicable settlement date period. There is a $225 per loan reservation fee paid to eHousingPlus. The fee is earned only if the loan closes. This fee will be submitted to HOC upon the delivery of the Post Closing Compliance file required for review prior to purchase. (Post Closing Compliance Checklist should be followed) 2/8/2013 HOC LENDER TRAINING 75 eHousingPlus System Training Offered on a weekly basis every Friday LEARN HOW TO •Register a loan •Check your pipeline •Apply for user credentials •Find the current rate in the program •Navigate eHousingPlus Lender Portal Click on this link: http://ehousingpl.us/hoc Then click on the TRAINING tab (see below) to register for system training 2/8/2013 HOC LENDER TRAINING 76 MBS Program General Information U.S. Bank is HOC’s master servicer for the MBS program U.S. Bank will purchase and retain loans from HOC participating lenders U.S. Bank will securitize loans for HOC 2/8/2013 HOC LENDER TRAINING 77 2/8/2013 HOC LENDER TRAINING 78