FSAFEDS PowerPoint Presentation

advertisement

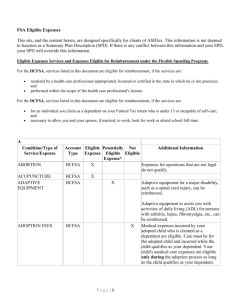

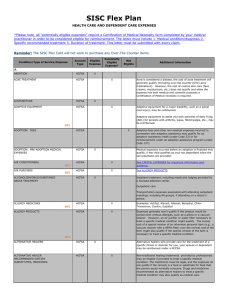

FSAFEDS THE FEDERAL FLEXIBLE SPENDING ACCOUNT PROGRAM MORE MONEY IN YOUR POCKET! 2015 Program Overview THAT’S MORE MONEY IN MY POCKET! What is a Flexible Spending Account? An account where you contribute money from salary BEFORE taxes are withheld A way to save money on day care and health care services and items for you and your family A Fed-friendly tax break Key Benefit: More Money in Your Pocket! 3 April 9, 2015 How does FSAFEDS work? 1. Estimate your expenses and determine your annual contribution from salary, pre-tax 2. Enroll in a Health Care, Limited Expense Health Care or Dependent Care FSA 3. Incur eligible expenses 4. Submit your claims* 5. Get reimbursed FAST *A few exceptions, discussed later 4 April 9, 2015 How do you save money with FSAFEDS? Your contributions to FSAFEDS are deducted from your salary BEFORE taxes…just like Thrift Savings Plan contributions. • You’re going to have these expenses, so why pay more in taxes than you have to? • The average person will save about 30% each year • A Fed earning $50,000 and contributing $2,000 to an FSAFEDS account will have around $600 more to spend • PUTS MORE MONEY IN YOUR POCKET! 5 April 9, 2015 Savings Illustration 6 April 9, 2015 Three types of FSAs 1. Health Care FSA (HCFSA) - For eligible health care expenses not paid by FEHB, FEDVIP or any other insurance $100 minimum election per year $2,550 maximum election per year – this IS NOT a household limit, your spouse may have a separate account 7 April 9, 2015 Three types of FSAs (cont.) 2. Limited Expense Health Care FSA* (LEX HCFSA) - For those enrolled in or covered by a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA) *Limited to only eligible dental and vision expenses not paid by FEHB, FEDVIP or any other insurance $100 minimum election per year $2,550 maximum election per year – this IS NOT a household limit, your spouse may have a separate account 8 April 9, 2015 Three types of FSAs (cont.) 3. Dependent Care FSA (DCFSA) - For eligible non-medical day care expenses (childcare, eldercare) so you (or your spouse) can work, look for work or attend school full-time. $100 minimum election per year $5,000 maximum election per year – this IS a household limit and includes any child care subsidy amounts and other FSA dependent care accounts Note: You (and spouse) must have earned income during the year, even if looking for a job. 9 April 9, 2015 Eligibility for FSAFEDS Must be employed by an Executive Branch Agency or another organization offering FSAFEDS HCFSA • Must be FEHB eligible • Participants do not have to be enrolled in FEHB LEX HCFSA • Must be FEHB eligible • Must be enrolled in or covered by a HDHP with a HSA 10 April 9, 2015 Eligibility for FSAFEDS (cont.) DCFSA • Do not need to be FEHB-eligible or enrolled in FEHB • Ineligible: intermittent employees expected to work fewer than 180 days/year 11 April 9, 2015 Administrative Fees All agencies pay the fees for their employees Employees do not pay fees to participate PUTS EVEN MORE MONEY IN YOUR POCKET! 12 April 9, 2015 Eligible Expenses USING FSAFEDS IS EASY AS PIE HCFSA Eligible Expenses Health care expenses not paid by FEHB or FEDVIP or any other insurance Expenses incurred by you and/or your dependents* are eligible *Tax dependents, including adult children, through the end of the calendar year in which they turn 26 14 April 9, 2015 Typical HCFSA Expenses Co-payments, co-insurance and deductibles (but not insurance premiums) Chiropractic care Contact lenses, solutions, cleaners and cases Dental care (Including crowns, endodontic services, implants, oral surgery, periodontal services, sealants, etc.) Diabetic supplies First aid kits 15 April 9, 2015 Typical HCFSA Expenses (cont.) Flu shots Foot care (e.g., athlete’s foot products, arch supports, callous removers, etc.) Hearing aids (including batteries) Home diagnostic test and kits (e.g., cholesterol, colorectal screenings, etc.) Home medical equipment (wheelchairs *, oxygen, respirators, etc.) Massage Therapy Orthodontia 16 April 9, 2015 *With Letter of Medical Necessity Typical HCFSA Expenses (cont.) Over-the-counter non-medical items, such as, but not limited to band aids, braces & supports and reading glasses Over-the-counter drugs and medicines WITH a prescription – insulin is the exception Physical therapy Prescription drugs Prosthetics Psychiatric services and care 17 April 9, 2015 Typical HCFSA Expenses (cont.) Substance abuse treatment Transportation expenses related to medical care Vision care (including eyeglasses, prescription sunglasses, refractions and vision correction procedures) For a complete list of eligible expenses, go to www.FSAFEDS.com and click on “Eligible Expenses Juke Box” under the “Quick Links” drop-down menu 18 April 9, 2015 Ineligible HCFSA Expenses Day care expenses Cosmetic procedures (unless required to restore appearance or function due to disease of illness) Expenses you claim on your income tax return Expenses reimbursed by other sources, such as insurance Fitness programs (unless medically necessary*) *With Letter of Medical Necessity 19 April 9, 2015 Ineligible HCFSA Expenses (cont.) Hair transplants Insurance premiums, including COBRA, Tricare, dental, vision and long term care insurance Over-the-counter drugs and medicines (except insulin) unless prescribed by a physician Physician retainer fees including boutique and concierge practice membership fees Weight loss programs and drugs for general well-being 20 April 9, 2015 LEX HCFSA Eligible Expenses ONLY Dental and Vision expenses • Not paid by FEHB, FEDVIP or other insurance Expenses incurred by you and/or your dependents including: • Dental – cleanings, fillings, crowns, orthodontics and over-thecounter items such as denture care products, but not toothpaste • Vision – eyeglasses, refractions, vision correction procedures, contact lenses, solutions, cleaners and cases 21 April 9, 2015 DCFSA Eligible Expenses Day care expenses that let you (and your spouse): • Work • Look for work • Attend school full-time For children under age 13 and any dependent who is mentally or physically incapable of self-care Services cannot be provided by your dependent If you or a spouse have looked for work, you must have found a job and have earned income at some point during the year. If a spouse is a full-time student or incapacitated, he or she does not to have any earned income during the year. 22 April 9, 2015 Typical DCFSA Expenses Child care at a daycare center, day camp, sports camp, nursery school or by a private sitter Late pick-up fees Before and after-school care (but not tuition) Adult day care expenses Au Pair placement fees and weekly stipend Expenses for a housekeeper who also cares for an eligible dependent 23 April 9, 2015 Ineligible DCFSA Expenses Health care expenses Education or tuition fees Late payment fees Overnight camps Sports lessons, field trips, clothing Transportation to/from care provider Expenses incurred after March 15, 2015 24 April 9, 2015 Benefit Period – HCFSA & LEX HCFSA Employees must enroll each Open Season to participate in the following benefit period Enrollments do not carry over year-to-year Benefit Period = January 1 through December 31, 2015 25 April 9, 2015 Benefit Period - DCFSA Employees must enroll each Open Season to participate in the following benefit period Enrollments do not carry over year-to-year Benefit Period = January 1 through March 15 (of the next year) Salary contribution deducted equally among pay dates during the calendar year (January 1 – December 31) 26 April 9, 2015 Online Calculator Interactive savings calculator available online at www.FSAFEDS.com • • • • 27 April 9, 2015 Enter salary and tax information Enter FSAFEDS contribution amount Enter estimated expenses Calculate potential annual tax savings Payroll Deduction Process Employee identifies employing agency during enrollment FSAFEDS submits enrollment information to BENEFEDS BENEFEDS coordinates payroll deductions with your payroll provider BENEFEDS provides FSAFEDS with confirmed allotment information. FSAFEDS updates participant accounts. 28 April 9, 2015 Availability of Funds DCFSA: only amount of current account balance is available for claim reimbursement HCFSA & LEX HCFSA: total annual election is available once agency information is confirmed 29 April 9, 2015 “Use-or-Lose” Rule You must forfeit money unspent at the end of the Benefit Period • IRS Rule (Section 125 of IRS Code) • No exceptions IMPORTANT DEADLINE! • All claims must be submitted no later than April 30, 2016 to be eligible for reimbursement Plan carefully when making elections 30 April 9, 2015 Grace Period and Carryover *NEW* CHANGES FOR 2015! Grace Period for DCRA Only - Incur eligible expenses from January 1st – March 15th of the following year; 14 ½ months to spend your election - Your effective date for incurring expenses is determined by when you enroll; Open Season elections begin January 1st. Carryover Account for HCFSA and LEX - Incur eligible expenses from January 1st – December 31st - “Carry over” up to $500 of unspent funds to the next year - Any amount over $500 for which a claim is not incurred by December 31st and submitted no later than April 30th will be forfeited 31 April 9, 2015 *NEW* Carryover Account The Basics of Carryover • The carryover option was announced in October 2013 as a new option for health care FSA plans and impacts HCFSA/LEX only • OPM chose to implement the new carryover option, which will replace the grace period for HCFSA and LEX effective for 2015 • The carryover amount is limited to $500 and cannot ever exceed this amount even if there is more than a $500 balance remaining • You must re-enroll for the next Benefit Period to have access to your carryover balance • You must be an active employee making allotments through December 31st • The carryover cannot be waived, it will be set up automatically 32 April 9, 2015 Tracking Account Balances Secure online account access via My Account Summary www.FSAFEDS.com Call toll-free 1-877-FSAFEDS (372-3337) TTY line: 1-800-952-0450 Reimbursement Statement sent when claims processed Account Statements sent in January, March and October 33 April 9, 2015 Federal Benefits Open Season Enroll November 10 – December 8, 2014 Enroll early to avoid the last minute rush! THAT’S MORE MONEY IN MY POCKET! Enroll Online Go to www.FSAFEDS.com Follow the simple enrollment process Receive personalized confirmation • Will appear at the end of the enrollment process • Will automatically be emailed to you if you provide an email address during enrollment • Will be available via My Account Summary 35 April 9, 2015 Enroll By Telephone FSAFEDS Benefits Counselors • Toll-free 1-877-FSAFEDS (372-3337) • TTY line: 1-800-952-0450 • Monday – Friday, 9:00 a.m. – 9:00 p.m. ET 36 April 9, 2015 Enrollment Requirements Must meet eligibility requirements for FSAFEDS participation Must agree to Electronic Funds Transfer (EFT) • Fast reimbursement 37 April 9, 2015 Enrollment Options – HCFSA Only Paperless Reimbursement (PR) • • • • • Available with many (not all) FEHB plans Claim filed with FEHB plan FEHB plan forwards out-of-pocket expenses directly to FSAFEDS Often no out-of-pocket payment Payment made directly to you from FSAFEDS account via Electronic Funds Transfer • Some dental and vision claims require manual submission – please check the website 38 April 9, 2015 PR - Participating Plans Aetna Medical Plan APWU Health Plan Blue Cross and Blue Shield Service Benefit Plan Compass Rose Health Plan (formerly ABP) Foreign Service Benefit Plan GEHA Humana Mail Handlers Benefit Plan 39 April 9, 2015 PR - Participating Plans (cont.) M.D. Individual Practice Association Inc. NALC Health Benefit Plan SAMBA Health Benefit Plan UnitedHealthcare Insurance Co., Inc. 40 April 9, 2015 PR - Participating Plans (cont.) FEDVIP Plans Aetna Dental Plan Aetna Vision Plan FEP BlueDental FEP BlueVision GEHA Dental Humana Dental 41 April 9, 2015 PR – Participating Plans (cont.) Metlife Dental United Concordia Dental Vision Service Plan (VSP) 42 April 9, 2015 New Employee Enrollment New employees have 60 days to enroll Must enroll before October 1 Otherwise, must wait for next Federal Benefits Open Season 43 April 9, 2015 Enrollment Changes May change election(s) at any time during Open Season Qualifying Life Event (QLE) required outside Open Season 44 April 9, 2015 Qualifying Life Event QLEs defined by IRS: • Change in marital status • Change in number of dependents • Change in dependents’ eligibility (e.g., child turning age 13) • Change in cost or coverage (DCFSA only) (e.g., day care fee increase) • Change in employment or residence • Change in military duty status 45 April 9, 2015 Qualifying Life Event (cont.) Requested change must be consistent with event that prompts change For example: • Increase DCFSA or HCFSA election after birth or adoption of child • Decrease DCFSA election if spouse stays home with child 46 April 9, 2015 Qualifying Life Event (cont.) Must notify FSAFEDS of QLE from 31 days before to 60 days after event To submit a request online, login to “My Account Summary” and access the “Qualifying Life Event” section. Follow the simple instructions to submit your request online If you prefer to print a QLE form and save a copy for your records, the QLE form is still available under “Forms” at www.FSAFEDS.com 47 April 9, 2015 Qualifying Life Event (cont.) Fax or mail your form to FSAFEDS You may submit your request either online or by form, but you may not do BOTH FSAFEDS will verify that event was a QLE and process requested election change QLE for birth/adoption of child is retroactive to date of event; all others are prospective Can only reduce elections to the amount already on deposit or reimbursed 48 April 9, 2015 Separation/Retirement No further allotments DCFSA balance, at separation, is available for eligible expenses incurred until end of Benefit Period or until balance is depleted • No refund available HCFSA terminates at separation • Only expenses incurred before separation are eligible for reimbursement • No refund available 49 April 9, 2015 Leave Without Pay (LWOP) Agencies will not withhold allotments during non-pay status Options: • Pre-pay elections through accelerated allotments • Freeze account until return to pay status (Allotments recalculated across remaining pay dates) If LWOP is due to a QLE, participant can cancel or reduce annual election, if consistent with the QLE 50 April 9, 2015 Claims & Reimbursement USING FSAFEDS IS EASY AS PIE Claim Forms Available online www.FSAFEDS.com Request by telephone or email • 1-877-FSAFEDS (1-877-372-3337) • TTY line: 1-800-952-0450 • FSAFEDS@adp.com FAX or mail claim to FSAFEDS • 1-866-643-2245 (toll-free, inside U.S. only) or • 1-502-267-2233 52 April 9, 2015 Required Documentation: HCFSA and LEX HCFSA Completed and signed claim form AND Explanation of Benefits form (EOB) • From FEHB or FEDVIP or other insurance • Must indicate type of service, date(s) of service, amount owed 53 April 9, 2015 Required Documentation: HCFSA and LEX HCFSA (cont.) OR Detailed receipts • Must indicate type of service, date(s) of service, amount paid None, with Paperless Reimbursement 54 April 9, 2015 Required Documentation: DCFSA Completed and signed claim form AND Copies of bill or signed receipt OR Have provider complete Part III of claim form Include provider’s tax ID or SSN on all claims 55 April 9, 2015 Online Claim Submission (NEW!) Go to www.FSAFEDS.com Select “Online Claim Submission” Enter and save claim information as directed Upload appropriate claim documentation as a .PDF, .JPG or .TIF file Check the box and select the “I Certify” button to submit the claim 56 April 9, 2015 Reimbursement Reminders Expenses are incurred on date of service, not when expense is paid (Orthodontia is an exception) Expense must be incurred AFTER effective date of enrollment AND during the Benefit Period All claims must be postmarked or faxed by April 30, following end of Benefit Period Unclaimed funds are forfeited and used to offset administrative costs of the FSAFEDS program 57 April 9, 2015 Contact Us www.FSAFEDS.com FSAFEDS@adp.com 1-877-FSAFEDS (372-3337) TTY line: 1-800-952-0450 Benefits Counselors are available Monday through Friday, 9:00 a.m. to 9:00 p.m., ET 58 April 9, 2015