Projects - Finance & Business Services

advertisement

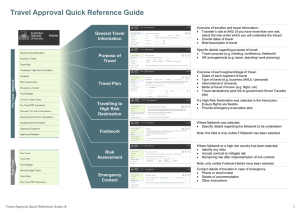

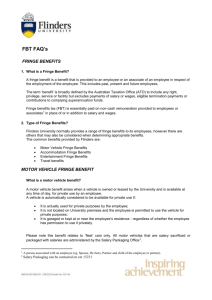

Finance Forum 20th March 2014 20 March 2014 Finance & Business Services AGENDA 1. Introduction (David Sturgiss, CFO) 2. Service Improvement Group – Overview (Karen Hill, Director) 3. Projects – Overview of Current Projects (Trevor Langtry, A/g Assoc.Director, Fin.Ops. & Systems) 4. Research Accounting – Presentation of SPF FRM (Victoria Allen, Finance Manager Science) Finance & Business Services 20 March 2014 2 AGENDA 5. Investments - Foreign Currency Transactions (Michael Peel, Treasury Manager) 6. Tax Unit – Tax Update (Jenny Park, Tax Accountant) 7. Corporate Finance – Personal Property Securities (Michael Lorenzato, Corporate Accountant) 8. General Question Time Finance & Business Services 20 March 2014 3 F&BS Organisational Structure Finance & Business Services 20 March 2014 4 Service Improvement at ANU Karen Hill - Director, Service Improvement Group 20 March 2014 Finance & Business Services 5 Background Universities are facing a number of challenges including financial constraints, increasing regulatory demands and increased competition. A range of activities have been undertaken to assess efficiency and effectiveness of administrative services: • • • • • • • Staff Survey (2011) Administration reviews (2012 – 2013) UniForum Benchmarking (2011 -2013) ANU Forms Audit (2013) Budget Solutions Process (2013) Administrative Services Survey (2013) Harnessing Service Capacity study (2013) Finance & Business Services 20 March 2014 6 Some quick stats… • Only 43% of staff perceived the ANU processes favourably (Staff Survey 2011) • 82% of 139 administrative activities had a high importance / low satisfaction rating (Administrative Services Survey 2013) • An average across the range of activity categories (correcting, checking, looking waiting, duplicating, unnecessary work) showed staff members spend approximately 16% of a 35 hour week on unproductive activity – approximate annual salary value of $25.5 million • Staff felt integration of IT systems would make administrative processes and activities more efficient and save an average of 6.6 hours (18.9%) in a 35 hour working week (Harnessing Service Capacity Study 2013) • 80% of forms identified in the audit were manual and paper based (Forms Audit 2013) Finance & Business Services 20 March 2014 7 The Service Improvement Group The Service Improvement Group partners with areas of the University to: Identify seek and support initiatives that deliver efficiencies Connect bring together areas to reduce duplication and leverage resources Challenge provide independent challenge to projects to achieve best results Simplify overcome barriers by simplifying complex problems Measure provide frameworks to monitor, measure and report on benefits Share communicate knowledge of successes and key learning's to continuously improve Compare understand our own service performance and learn from other universities. Finance & Business Services 20 March 2014 8 The Service Improvement Group Centrally governed and coordinated approach that focuses on promoting and driving change through core strategic projects aimed at: Access customers can access services at the right time, right place, in a manner that suits them Effectiveness effective service delivery outcomes for ANU Efficiency streamlining and simplifying processes and structures Clarity clear lines of responsibility and ownership – less duplication Integration enterprise wide processes, systems and services that align and integrate Capability empowering continuous improvement in service delivery and support Innovation recognising, advocating, sharing and fostering innovation. Finance & Business Services 20 March 2014 9 Our Expertise/Skills • • • • • • • • • • • • Program Management Project Management Business Analysis Information Analysis Business Process Mapping Business Process Improvement Service Redesign Change Management Communication Organisational Design Stakeholder engagement Benefits mapping The team brings a wealth of experience in sectors including: Higher Education, Immigration, Transport, Finance, Telecommunications, IT, Health, Defence, Manufacturing & Energy Postgraduate qualifications also include Business, Management and Communications. Prince2 and MSP Certified Finance & Business Services 20 March 2014 10 Trends in Industry/Sector CURRENT STATE (ANU) Manual and paper based Duplication Inconsistent customer experience High touch points Fragmented processes Resource intensive Disparate and out of date systems Multiple sources of information/data Inaccessible Finance & Business Services INDUSTRY/SECTOR TRENDS Automated and paperless Minimal touch points Self Service Customer driven Streamlined end to end processes Cost effective Integrated systems Supported by business intelligence Single online portal for services 20 March 2014 11 Vision Supporting excellence in education and research through seamless professional services Approach Approach Program management Finance & Business Services Project management Continuous improvement 20 March 2014 12 Program management Support visibility, transparency and accountability for service improvement projects through a program management approach Finance & Business Services • Oversee the Service Improvement Program containing 50+ projects and Program ‘Blue Print’ for current and future state • Implement a Program Management Framework (Managing Successful Programs) = interested in the benefits • Monitor Tier 1 Projects • Business process for the identification, prioritisation, selection and authorisation of service improvement projects • Monitor, track and report on progress / completion of projects within the program 20 March 2014 13 Project management Deliver service transformation projects on time, within budget and to the quality expectations of the customer and end user Finance & Business Services • Lead service transformation projects in partnership with the business owners (more later) • Provide project assistance and support to Tier 1 Projects • Business cases for agreed strategic projects in partnership with business owners • Project management capability within the University • Lessons Learnt, Post implementation reviews (PIR) and benefits tests (BT) for key projects 20 March 2014 14 Continuous improvement Provide a framework, information and data to support a continuous improvement culture at the University Finance & Business Services • Establish a continuous improvement framework and policy – feedback systems • Accessible methods to capture service improvement ideas • Lead the UniForum Benchmarking Exercise • Lead the Harnessing Service Capacity study (Unproductive Activity) • Establish opportunities for staff to become involved in the service improvement agenda 20 March 2014 15 Priority projects (Tier 1) Project Managed by the SIG Other T1 Projects ANU Gateway and Staff Intranet (MO) Strategic Procurement (Fleet and Travel) (FIN) CI Financial Reporting (FIN/RCH) Management Reporting (PPM) On Line Recruitment (HR) Workspaces (ITS) ERMS (SIG) Energy and Water (F&S) Budget Infrastructure (FIN) On Line Timesheets (HR) Maximo Upgrade (F&S) Multi User List (F&S) Parking (F&S) Archibus – Space Mgt System (F&S) Finance & Business Services 20 March 2014 16 New Policy: Project Management Project Management Policy, Procedure, Sizing Guidelines and Templates https://policies.anu.edu.au/ppl/index.htm http://sig.anu.edu.au/tools-and-templates Finance & Business Services 20 March 2014 17 More information Visit: sig.anu.edu.au Contact: Karen Hill, Director Director.sig@anu.edu.au Finance & Business Services 20 March 2014 18 Questions Finance & Business Services 20 March 2014 19 Projects Update Trevor Langtry – A/g Associate Director Financial Operations & Systems 20 March 2014 Finance & Business Services 20 Proposed New Projects Procurement to Pay: • Requisitioning – a simplified requisitioning with approval workflow – Specifications completed and costed by ITS – Pending Scheduling for development • Integration between Chemical Inventory System and P/Soft Financials – Replacement of CIS with P/Soft Functionality ???? Finance & Business Services 20 March 2014 21 Projects Update Cont…. Accounts Payable Workflow Rollout • At the tail end – approx 85% going through workflow • Post Implementation Issues OneStop Receipting (2014) • Commenced • Three Phases Finance & Business Services 20 March 2014 22 Projects Update Cont…. Travel System • Have experienced some delays • Pilot with CAP in 2 to 3 months Finance & Business Services 20 March 2014 23 Research Accounting – SPF FMR Victoria Allen, Finance Manager Sciences 20 March 2014 Finance & Business Services 24 SPF Financial Management Report Finance & Business Services 20 March 2014 25 Statement Tab Finance & Business Services 20 March 2014 26 Journals Tab – transaction listing Finance & Business Services 20 March 2014 27 Viewing all period transactions Finance & Business Services 20 March 2014 28 Sorting by budget class Finance & Business Services 20 March 2014 29 Project Tab Finance & Business Services 20 March 2014 30 Payroll Costing Tab Finance & Business Services 20 March 2014 31 SPF Financial Management Report Finance & Business Services 20 March 2014 32 SPF Financial Management Report Finance & Business Services 20 March 2014 33 Most commonly asked question – What is the balance on my account? Finance & Business Services 20 March 2014 34 Income Finance & Business Services 20 March 2014 35 Income details Finance & Business Services 20 March 2014 36 Expenditure Finance & Business Services 20 March 2014 37 Income vs expenditure Finance & Business Services 20 March 2014 38 Income vs expenditure Finance & Business Services 20 March 2014 39 Income vs expenditure Finance & Business Services 20 March 2014 40 Budget vs Actuals Finance & Business Services 20 March 2014 41 Budget vs Actuals Finance & Business Services 20 March 2014 42 Budget vs Actuals Finance & Business Services 20 March 2014 43 Finance & Business Services 20 March 2014 44 TEA BREAK Finance & Business Services 20 March 2014 45 Investment Office – Foreign Currency Transactions Michael Peel, Treasury Manager 20 March 2014 Finance & Business Services 46 Overview Transactions can be made at 1.Spot (today) 2.A future date (forward) Finance & Business Services 20 March 2014 47 Larger Foreign Currency Transactions • For transactions greater than $100,000 the Investment Office can assist • For spot (today) transactions, the Investment Office has access to wholesale market rates • For future transactions, the Investment Office is able to remove foreign currency uncertainty by: 1. By transacting at spot (at wholesale rates) and then placing the foreign currency in either a foreign currency term deposit or a foreign currency account (USD only) (Funds must be already available) 2. Entering into a Forward to lock in a rate today ( Funds must be available for settlement at an agreed future date) Finance & Business Services 20 March 2014 48 Removing foreign currency uncertainty • Why do we do this? – To protect the AUD position • When do we do this? – When there is a firm commitment or purchase order and funding is approved Finance & Business Services 20 March 2014 49 Option 1: Buy at Spot (Funds available now) • Summary Steps Involved: 1. Delegate Approves the transaction 2. Investment Office contact NAB FX Desk and buy Foreign Currency 3. Investment Accounting team arrange settlement 4. Funds are placed in Term Deposit or a Foreign Currency Account • • Interest received is slightly higher in a Term Deposit account Typically a Term Deposit is entered into when payment dates are known Finance & Business Services 20 March 2014 50 Option 2: Enter into a Forward Contract (Funds available at future settlement date) • Summary Steps Involved: 1. Finance Manager liaises with Investment Office who obtain forward quotes 2. Delegate Approves the transaction 3. Investment Office contact NAB and ANZ FX Desks to obtain final quotes and execute deal based on best rate 4. Investment Accounting Team arrange settlement at forward dates Finance & Business Services 20 March 2014 51 Case Study: • 30 May 2013 – Spot AUDUSD rate was 0.9669 – ANU wanted to sell AUD 10.0m forward and buy the equivalent USD forward, with settlement on 25 June 2014. – Although we had committed to send AUD $10.0m, the more USD we sent the better – The Investment Office obtained pricing from NAB and ANZ, and then entered into a forward to buy USD forward at a rate of 0.9423 (USD 9,423,000). • 19 March 2014 – Spot AUDUSD was 0.9130 – Current forward rate for settlement on 25 June 2014 was 0.9070 • Result – As of yesterday, ANU was ahead by $389k. Of course, the AUD could have strengthened over this time and we would have been behind. – The purpose of this hedge was to remove FX uncertainly – i.e. we locked in purchasing USD 9.4m. Finance & Business Services 20 March 2014 52 Finance & Business Services 20 March 2014 53 Reason for Difference: US and AUS Interest Rates Finance & Business Services 20 March 2014 54 AUDUSD Finance & Business Services 20 March 2014 55 AUDEUR Finance & Business Services 20 March 2014 56 Going Forward • Finance and Business Services are currently developing a Foreign Currency Transactions Policy • This is expected to be operational by June 2014 Finance & Business Services 20 March 2014 57 Contact Information Michael Peel Michael.peel@anu.edu.au 02 6125 8755 Finance & Business Services 20 March 2014 58 Finance and Business Services Tax Update Jenny Park – Tax Accountant 20 March 2014 Finance & Business Services 59 Tax Update • Meal Entertainment Fringe Benefits • 2013/2014 FBT Return Package • Changes in FBT Rates from 1 April 2014 Finance & Business Services 20 March 2014 60 Meal Entertainment Benefits • Each transaction must be looked at individually in terms of its nature and substance to determine whether FBT applies • Use either the light meal stamp where appropriate and add a brief description • or complete the Food and Drink FBT Declaration form (Excel ANU_005603 or Paper ANU_005602) • Ability to claim GST will vary with option chosen Finance & Business Services 20 March 2014 61 Meal Entertainment Benefits A. Business related morning / afternoon tea or light meals / refreshments on University premises (e.g. lunch at boardroom meeting) B. Business related light meals / refreshments not on University premises (less than $30 per head) (e.g. light meal at a cafe) C. Business related elaborate meals held on or off campus (e.g. “business” lunch or dinner) Employee N 5602 GST Claimable Y Associate Y 5582 Y Clients N 5602 Y Employee N 5602 N Associate N 5602 N Clients N 5603 N Employee Associate Clients Y Y N 5582 5582 5603 Y Y N D. Light meal/drinks incidental to “Eligible Seminar” (> 4hrs) (e.g. lunch at seminar, finger food, small amounts of alcohol after session) Employee N 5602 Y Associate Y 5582 Y Clients N 5602 Y Nature of Expenditure Finance & Business Services Attendee FBT Account 20 March 2014 62 Meal Entertainment Benefits Nature of Expenditure E. Elaborate meals / drinks incidental to an “Eligible Seminar” (> 4hrs) (e.g. gala dinner, pre-conference dinner with speakers) F. Event held predominantly for clients with only a few staff attending the event (e.g. BBQ for graduates, alumni dinner, public lecture) G. Meals (incl. drinks) consumed at a social function (e.g. staff farewell, Christmas function, etc) Finance & Business Services Attendee GST Claimable FBT Account Employee Y 5582 Y Associate Y 5582 Y Clients N 5603 N Employee N 5602 N Associate N 5602 N Clients N 5603 N Employee Y 5582 Y Associate Y 5582 Y Clients N 5603 N 20 March 2014 63 2013/2014 FBT Return Package • FBT Packs and spreadsheets to be published on the F&BS website by 26 March 2014. • Car Odometer Readings: – No cars in the FBT Packs – Details will come from SGFleet Finance & Business Services 20 March 2014 64 2013/2014 FBT Return Package • Important Key Dates Date Task 28 March – 3 April Drivers to fill up fuel and provide accurate odometer reading at time of fuel purchase. Otherwise, SGFleet will use the latest date (i.e. the last time they filled up) 1 April 2014 (Tue) Tax Unit commences the FBT Packs preparation 8 April 2014 (Tue) 18 April 2014 (Fri) Email spreadsheets with FBT account postings and LAFHA info to FBT Contacts FBT reports due to be submitted by Areas 9 May 2014 (Fri) Distribute reports to Areas re. FBT liability 30 June 2014 (Mon) Reconciliation of FBT accounts complete & journal posted Finance & Business Services 20 March 2014 65 Questions Contact: Jennifer Park X58734 taxunit@anu.edu.au Finance & Business Services 20 March 2014 66 Corporate Finance – Personal Property Securities (PPS) Act Michael Lorenzato – Corporate Accountant 20 March 2014 Finance & Business Services 67 Personal Property Securities Act What is the PPS Act and the PPSR? The PPS Act establishes a national system governing the use of personal property as security. Essentially an electronic register that operates as a ‘noticeboard’ of security interest. What is personal property? Property other than land and fixtures or a right, entitlement or authority granted by law and declared not to be personal property for the purposes of the PPS Act. What is a security interest? An interest in personal property that is provided for by a transaction that, in substance, secures payment or performance of an obligation. Finance & Business Services 20 March 2014 68 PPS Register & Perfection PPS Register Perfection Once a security interest is registered on the PPSR, considered perfected for the purposes of the PPS Act In most cases, it is the date of perfection which will determine the order of priority for creditors. Security interests are enforceable against third parties if attached and there is perfection by possession, control or registration Perfection by registration (most effective) Perfection by control and/or possession is only relevant for certain categories of finance products Finance & Business Services 20 March 2014 69 PMSI (Long-term Lease) example Race horse owner leases horse to ABC Pty Ltd for 18 months Liquidator returns horse to its owner. Liquidator search PPSR and find’s owner’s registration over horse. Race hose owner registers interest in ABC Pty Ltd as longterm lessor of personal property. ABC Pty Ltd goes into liquidation Without registration, horse would be sold by liquidator to cover debts of ABC Pty Ltd Finance & Business Services 20 March 2014 70 Importance for ANU Research Institutes must make sure their equipment and other property is properly protected Lending Equipment to third parties Selling Equipment to a third party on Deferred payment terms Scenario Register? Reason License your IP to a third party. No IP licenses are not security interests, can be register on relevant IP register. Outsourcing IT operations, you provide equipment to the outsourcer but you still own it. Yes By registering, you maximise your rights against third parties in case the outsourcer hits financial difficulties or improperly imposes of the equipment. Lend equipment to a third party Yes Example above. Sell equipment to a third party on deferred payment terms. Yes Example above. Obtain an option to purchase particular intellectual property. No Right is not required to be registered as not a security interest. Finance & Business Services 20 March 2014 71 Policies & Procedures Information to register interests will be obtained from each relevant College / Division Update at Next Finance Forum with deadlines and procedures required to register security interests on the PPSR Michael Lorenzato (michael.lorenzato@anu.edu.au) Corporate Accountant Finance & Business Services 20 March 2014 72