FEDERAL FUNDING ACCOUNTABILITY AND TRANSPARENCY ACT

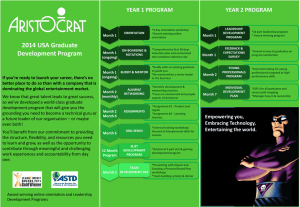

advertisement

FEDERAL FUNDING ACCOUNTABILITY AND TRANSPARENCY ACT (FFATA) FFATA • Requires information disclosure of entities receiving Federal funding through Federal awards such as Federal contracts and their sub-contracts and Federal grants and their sub-grants. • Requires disclosure of executive compensation for certain entities. • Requires the establishment of a publicly available, searchable website that contains information about each Federal award. • Requires agencies to comply with OMB guidance and instructions and assist OMB in implementation of website. 2 What new reporting is required? • Prime contract awardees of contracts $25K or more must report associated contract subawards. • Data collection will be phased with all required contract subawards reporting by March 2011 (See slide 6 for more details.) • Prime grant awardees of grants $25K or more must report associated grant subawards. • Executive compensation information for awardees. 3 Who is responsible for reporting? • Federal Agencies must report prime award information • Prime awardees (State of Illinois) must report subaward information 4 When does reporting begin? • Contracts subaward (sub-contracts only) reporting requirement will be phased in: • Phase 1: Reporting subawards of prime awards valued greater than $20M began in July 2010 • Phase 2: Reporting subawards of prime awards valued greater than $550K began October 1, 2010 • Phase 3: Reporting subawards of prime awards valued at $25K or more began March 1, 2011 • Grants subaward (sub-grants only) reporting is required for all awards made on or after October 1, 2010 for all prime grant awards $25K or more. 5 How do I report? • Federal Agencies must report prime grant award information through the Federal Assistance Award Database System Plus format (FAADS+) • Federal Agencies must report prime contract award information through the Federal Procurement Data System – Next Generation (FPDS-NG) • Prime contract and grant awardees (State of Illinois) must report subaward information through the FFATA SubAward Reporting Systems (FSRS) • Prime contract and grant awardees must register with the Central Contractor Registry (CCR) • If required, prime contract and grant awardees must report executive compensation through CCR 6 How long do I have to report? All awardees must report by the end of the month following the month the award or obligation was made • For example, if an award is made on July 10, 2010 the awardee would have until August 30, 2010 to report the award – all awards made during July will have until August 30, 2010 to report 7 Reporting Responsibility • DHS as the prime contractor/grantee is responsible for reporting for subaward (firsttier subawardee) information such as subaward entity information, description/title, and date of award. • New Federal, non-Recovery Act funded grant awards with an award date on or after October 1, 2010 and result first-tier subawards, are subject to the reporting requirements under the Transparency Act. • For new federal grants as of October 1, 2010, if the initial award is equal to or over $25,000, prime awardee (DHS) must report subaward and executive compensation, if required. • If the initial award is below $25,000 but subsequent grant modification results in a total award equal to or over $25,000, the award is subject to the reporting requirements, as of the date the award exceeds $25,000. • If the initial award amounts to or exceeds $25,000 but funding is subsequently deobligated such that the total award amount falls below $25,000, the award continues to be subject to the reporting requirements of the Transparency Act. 8 ARRA Reporting • Grant Awards, whether existing or new, as of October 1, 2010 that are funded by the Recovery Act will continue to report under ARRA reporting requirements through FederalReporting.gov. • Such Grant Awards are not subject to FFATA reporting requirements. 9 SUBAWARDS • For grants, a “subaward” means a legal instrument to provide support for the performance of any portion of the substantive project or program for which you received the award and that: The prime recipient awards to an eligible sub-recipient; or Sub-recipient at one tier awards to a sub-recipient at the next lower tier 10 Subawardee Responsibility • The prime grant awardee must report all information associated with a Federal grant, either regarding executive compensation data for the prime recipient or subawardees, or any other information associated with subawards. • The subawardee, however has an obligation to provide the prime grant awardee all information required for such reporting. • This includes subawardee entity information, DUNS number, subawardee parent DUNS number, if applicable, and relevant executive compensation data, if applicable. • If the subawardee is registered in the Central Contractor Registry (CCR), this information may be migrated into FSRS . 11 Data Reporting Requirements The Transparency Act’s section 2(b)(1) requires: • Name of the entity receiving the award; • Amount of the award; • Information on the award including transaction type, funding agency, the North American Industry Classification System code or Catalog of Federal Domestic Assistance number, award title descriptive of the purpose of each funding action; • Location of the entity receiving the award and the primary location of performance under the award, including city, State, congressional district, and country; • DUNS number of the entity receiving the award and the parent entity of the recipient, should the entity be owned by another entity; 12 Data Reporting Requirements • Names and total compensation of the five most highly compensated officers of the entity if the entity in the preceding fiscal year: Received 80 percent or more of its annual gross revenues in Federal awards; Received $25 million or more in annual gross revenues from Federal awards; The public does not have access to this information in periodic reports under Section 13(a) or 15(d) of the Securities Exchange Act of 1934, or Section 6104 of the Internal Revenue Code of 1986. 13 Exemptions from the Act • Existing or new grants as of October 1, 2010, that are funded by the Recovery Act. These grants will continue to report those awards and related subawards through FederalReporting.gov • Cooperative Research and Development Agreements as defined under 15 USC 3710a; • Federal awards to individuals who apply for or receive Federal awards as natural persons (i.e., unrelated to any business or non-profit organization he or she may own or operate in his or her name); • Federal awards to entities that had a gross income, from all sources, of less than $300,000 in the entities’ previous tax year. 14 Information Resources • For more information on FFATA requirements, please see the DHS Contracts website: http://www.dhs.state.il.us/page.aspx?item=56761 • To access the FFATA form (IL 444-0949) to be completed, please go to: http://www.dhs.state.il.us/OneNetLibrary/27897/documents/ Forms/IL444-0949.pdf • To submit the completed FFATA form, please email it to DHS.DHSOCA@illinois.gov • For questions, please contact Steven Shaw at Steven.E.Shaw@illinois.gov 15