Graduate Finance Curriculum:

What’s New and

What to Review

P.V. Viswanath

Graduate Program Chair

November 6, 2013

What we will talk about today

Courses recently introduced into the curriculum

Recent Topics Courses that are candidates for later inclusion in the curriculum

Recent Travel Courses

Switch Electives: Going Across the Aisle

How to use FIN 692Q effectively

The New MS Program in Financial Risk Management

Recent Innovations in the Finance Department

Overview of the Curriculum

Recently Introduced courses

MBA 673: Applications of Finance Concepts to Strategic Decision Making

Prerequisites: MBA 648

This course introduces various aspects of finance that stem from

developments in finance theory. Topics that are valuable for the general

corporate manger such as capital structure, risk management and real option

analysis will be taught from a strategic and value-additive point of view.

Discounted Cashflow approaches to firm valuation will be introduced as a

means of exploring the role of strategy in value maximization.

Instructor: P.V. Viswanath

Programs: MBA/MS in Financial Management

To be offered in Fall 2014

Recently Introduced courses

FIN 687: Applied Investment Management and Policy

Prerequisites: FIN 652 and 6 credits Advanced Fin courses

This course integrates and advances the knowledge of investments. Its practical

orientation will help those poised to begin a career in the investment area. This

course takes the micro investment knowledge from more basic investment analysis

courses and the macro analysis material from portfolio management courses to

provide a higher level of relevant material that investment practitioners are called

upon to utilize. Students will be offered extensive case study material and

problems and working in groups they will manage and present the results of their

own investment portfolios.

Instructor: Lew Altfest

Programs: MBA/MS in Investment Management

To be offered in Fall 2014

Recently Introduced courses

FIN 673: Real Estate Finance

Prerequisites: MBA 648

This course covers various subject matters within the world of real estate finance

including the capitalization (debt and equity) of real property. It will discuss the

procedures involved in underwriting and in investing in real estate including

mortgage loans and single family home ownership. It will introduce students to the

role of government in the financing of commercial and residential real estate and

cover direct and indirect ownership of real estate assets. Finally, it will provide an

overview of how real estate markets work, including the valuation of real estate.

Instructor: Seth Kestenbaum

Programs: MBA/MS in Investment Management

To be offered: Fall 2014

Recently Introduced courses

FIN 671: Behavioral Finance

Prerequisites: MBA 648

This course introduces students to the field of Behavioral Finance and

Economics. It will discuss behavioral aspects of the decision making of

professional investors, traders, strategy consultants, as well as senior

managers in the corporate world, NGOs, and academia. The course will

emphasize behavioral biases and their impact on decision making. In

addition, the course will explore how behavioral theories could explain

market anomalies, such as excess volatility.

Instructor: Pavel Fraynt

Programs: MBA/MS in Financial Management

Recently Introduced courses

FIN 655: Financial Econometrics for Risk Modeling

Prerequisites: MBA 646

This course teaches estimation and forecasting of time series models in

finance. Students will learn how to measure and forecast financial volatility

and correlations and become proficient with GARCH type models and

historical volatilities. These methods will be used to measure risk and analyze

alternative approaches to calculating Value at Risk, dynamic portfolio

selection and risk control. The course also examines implied volatilities from

options, variance swaps, credit risk models, market (in)efficiency, dynamic

relationships between global financial markets and high frequency volatility.

The course teaches estimation, Monte Carlo simulations and programming

methods.

Instructor: Elena Goldman

Programs: MBA/MS in FM/IM

To be offered in Fall 2014

Recent Topics courses

FIN 678: Contemporary Topics in Investment Management: Hedge Fund Strategies

Prerequisites: MBA 648

This course introduces students to the two trillion dollar field of Hedge Funds. The

class will cover the origins of the industry as well as several broadly defined

strategies, such as Long Short Equity, Global Macro, Emerging Markets, etc. Students

will also be introduced to the issues associated with operational setup, risk

management and marketing of hedge funds. In addition class will cover topics related

to Funds of Hedge funds investing, due diligence and benchmarking. Guest speakers

currently working in this area will be invited to discuss the latest developments in the

field.

Instructor: Pavel Fraynt

Programs: MBA/MS in FM/IM

To be Offered in Spring 2014

Recent Topics courses

FIN 678: Contemporary Topics in Investment Management: Law of Finance

FIN 677: Contemporary Topics in Financial Management: Law of Finance

Prerequisites: MBA 648

This section will cover the following topics: U.S. and international corporate

governance; securities laws and regulations; Swaps; investment adviser and

broker-dealer regulation; mergers and acquisitions; corporate reorganization;

banking, real estate, and insurance regulation; and consumer protection and

personal finance. The course will include both Chinese and European Union laws

and regulations pertaining to the subject matter under discussion.

Instructor: Rosario Girasa

Programs: MBA/MS in FM/IM

To be Offered in Spring 2014

Recent Topics courses

FIN 677: Contemporary Topics in Financial Management: From Stressed to

Distressed: Turnaround and Restructuring of Troubled Companies

Prerequisites: MBA 648

This year, the course will focus on the financial and operational issues faced by

troubled companies and the impact on its various constituents. Students will learn to

recognize the signs of distress, operational, strategic and financial turnaround and

workout analysis and strategy, and to analyze out-of-court agreements and

bankruptcy exit strategies, including Plans of Reorganization and sales pursuant to

section 363 of the Bankruptcy Code. Designed for those who want to learn why

companies become troubled, how to identify warning signs, and analyze methods and

strategies to work through problems with an appreciation of the players’ fiduciary

duties and risks associated with proposed actions.

Instructor: Judy Wolf

Programs: MBA/MS in FM/IM

To be Offered in Spring 2014

Recent Topics courses

FIN 678: Contemporary Topics in Investment Management: Microfinance:

Conceptual and Applied

FIN 677: Contemporary Topics in Financial Management: Microfinance:

Conceptual and Applied

Prerequisites: MBA 648

This course will focus on microfinance. Students will learn why microfinance is

important, how microfinance organizations work, and the social impact of

microfinance in the US and around the world. Emphasis will be given to the

practice of microfinance in the US.

Instructor: P.V. Viswanath

Programs: MBA/MS in FM/IM

Last Offered in Spring 2013

Travel courses

FIN 680V: International Field Study: The Practice of Microfinance in India, Spring 2014

Prerequisites: MBA 648

This international field study course will focus on the practice of microfinance in India. We will visit two different

locales: one urban, Mumbai and one rural, the state of Kerala. In both places, we will visit microfinance

institutions that are involved in bringing different kinds of financial services to people at the bottom of the

pyramid -- loans, savings vehicles, insurance, payment services etc. We will hear from the people running these

institutions, as well as make field visits; students will thus get an opportunity to hear and see first-hand the issues

involved in the financial lives of the poor. Since many aspects of the problems and solutions are society-specific,

we will also make it a point to learn about their physical and social context. Cultural visits -- many of them in

beautiful locales -- will thus have a dual function, both entertainment and educational.

Pre- and Post-Trip meeting dates: Feb. 5, Feb. 19, Feb. 26, Mar. 5, Apr. 2, Apr. 16.

Trip Destination: Mumbai and several locations in Kerala

Trip Dates: 3/14/2014-3/23/2014.

Trip Cost: $3,500 in addition to tuition (approximate, and subject to change and fuel surcharge). Any required

travel visas will be an additional cost. A $500 deposit is due by December 2, 2013. Total payment is due by January

31, 2014. For more information, please contact Prof. P.V. Viswanath at pviswanath@pace.edu or go to

http://webpage.pace.edu/pviswanath/class/680India/syllabus/spring2014.html. Scholarships available: For

further information and to apply online, visit www.pace.edu/Lubin/travelscholarships

Instructor: P.V. Viswanath and Burcin Col

Programs: MBA/MS in FM/IM

Travel courses

FIN 680V: International Field Study: Turkey at the Doorstep of the European Union

Prerequisites: MBA 648

This international field study course will focus on the financial environment, political influences,

economic progress, and cultural and ethnic diversities of Turkey. While visiting Turkey, students will

attend seminars given by corporate and investment bankers, government officials, and other

financial executives.

Pre-Trip meeting dates: 2/6, 2/20, 3/13, 4/10, and 5/1.

Trip Destination: Istanbul and Izmir

Dates: 5/24/14 - 6/3/14

Trip Cost: $3,600 in addition to tuition (approximate, and subject to change and fuel surcharge).

Any required travel visas will be an additional cost. A $500 deposit is due by December 2, 2013.

Total payment is due by January 31, 2014. For more information, please contact Prof. Niso Abuaf at

nabuaf@pace.edu or Prof. Iuliana Ismailescu at iismailescu@pace.edu.

Scholarships available: For further information and to apply online, visit

www.pace.edu/Lubin/travelscholarships.

Instructor: Niso Abuaf and Iuliana Ismailescu

Programs: MBA/MS in FM/IM

To be Offered in Spring 2014

FIN 692Q: Research Project

Use FIN 692Q as a last resort; we have a lot of electives that instructors have

put a lot of work into.

Choosing FIN 692Q can be valuable if you have a special topic that is closely

related to your career interests and if there is a particular professor at Pace

University that has special knowledge of this area.

Otherwise, it’s like creating your own course on the fly. Chances are it won’t

deliver what you are looking for. Also, potential employers when they look at

your transcript won’t have a good idea as to what you did, and what you

learnt.

Switch Electives: Expanded choice from

across the aisle

We realize that Financial Management and Investment Management are not

completely unrelated from each other. Hence, students who are specializing in one

of the areas may want to take a course from the other area.

To facilitate this, we have allowed MS/MBA students specializing in Investment

Management to take one – but no more than one course – from an approved list of

Financial Management electives.

Similarly, MS/MBA students specializing in Financial Management are allowed to take

one – but no more than one course – from an approved list of Investment Management

electives.

However, we have to maintain the integrity of each degree. Hence, students will not

be able to take more than one course from across the aisle. If they do, it will be

considered a course taken in excess of degree requirements.

No exceptions will be made. Hence it is desirable that you should consider your

course planning ahead of time. Graduate Advisors will be happy to help you.

Innovations

Last term, for every course offered, we made course syllabi available. These

syllabi were accessible on Schedule Explorer under Section Comments, or in

Banner under the Link “Click here for the Syllabus.”

Where possible, we made the particular instructor’s course syllabus available. It

is important to know that while all instructors teaching a specific course will

cover the basic topics, teaching styles and some optional content could vary.

Hence you should investigate the course and the instructor to make sure that

there is a match with your needs.

We plan to make the syllabus available for the Spring 2014 term, as well.

However, they may not be available for another week or so.

Course pre-requisites are online on my website, in addition to the course

descriptions on the Lubin website.

In 2013, I put up the Tentative Schedule for the year on my website. I will try to

continue this for next year. Click here for more information.

MS in Financial Risk Management

The MS in Financial Risk Management program gives you a thorough

understanding of all aspects of financial risk management, whether in a

financial institution or in a non-financial institution, beginning from a proper

understanding of equity, bond and derivative markets and continuing to an

appreciation of the management of portfolios and the measurement and

management of risk in those portfolios. You also learn about the global aspects

of risk analysis.

The MS in Financial Risk Management will help students prepare for the FRM

certification offered by GARP.

It’s a much more compact and tighter program than the MS in Investment

Management. It consists of only 30 credits, in addition to MBA 640 and MBA

646.

On the other hand, it is very focused and is best for students who are

motivated and sure of what they want to do.

On the plus side, there seem to be a lot of job opportunities in the field.

MS in Financial Risk Management

Preliminary Skill & Prerequisite Courses (0 - 7)

BUS 043 Business Writing__________________________

MBA 640 Accounting for Decision Making

4

MBA 646 Data Analysis for Decision Making

3

0__

Required Core Courses (9)

FIN 632 Introduction to Financial Decision-Making (MBA 640 Rec) 3 __

FIN 654 Risk Management and Capital Markets (MBA 646, FIN 632) 3

FIN 661 Corporate Financial Risk Management (MBA 646, FIN 632) 3

Specialization Courses (18)

ECO 646 International Risk Analysis (MBA 646, FIN 632)

3

FIN 650 Applied Analytical Methods in Finance (MBA 646)

3

FIN 653 Portfolio Management (MBA 646, FIN 632)

3

FIN 655 Financial Econometrics for Risk Modeling (MBA 646)

3

FIN 672 Strategies in Investments, Options, and Futures (MBA 646) 3

FIN 679 Fixed Income Markets (MBA 646, FIN 632)

3

Capstone Course (3)

FIN 686 Capstone in Fin. Risk Mgmt. & Policy (FIN 632, FIN 654, FIN 661) 3

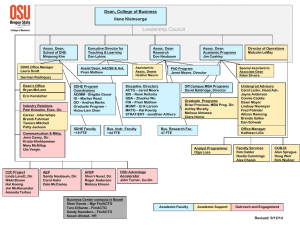

MS – Financial Management: Core

Preliminary Skill & Prerequisite Courses (3 - 16)

BUS 043 Business Writing

MBA 640 Accounting for Decision Making

MBA 644 Macroecon in a Global Environment

MBA 646 Data Analysis for Decision Making

MBA 648 Managerial Finance (MBA 640)

MBA 672 Man. Econ. for Dec. Making (MBA 644)*

* Cannot be waived

0

4

3

3

3

3

Core Courses (15)

ACC 645 Theory & Anal. of Fin. Stat. (MBA 640)

FIN 647 Adv Corp Finance (MBA 646, MBA 648)

FIN 649 Int’l Corp Finance (MBA 648)

3

FIN 667 Valuation of the Firm (ACC 645, FIN 647)

FIN 689 Fin. Anal & Policy (FIN 647, 6 cr. Adv. FIN)

3

3

3

3

MS – Financial Management: Specialization Electives

(15) CHOOSE 5

ECO 630 Game Th for Bus. Dec (MBA 644, MBA 672) 3

FIN 634 Entr Fin. (FIN 647 or MBA 648 & MGT 632) 3

FIN 644 Money & Capital Markets (MBA 644)

3

FIN 648 Mergers & Acquisitions (FIN 647)

3

FIN 661 Corp Fin Risk Mgmt. (MBA 646, FIN 647)

3

FIN 671 Behavioral Finance (MBA 648)

3

FIN 677 Con.Topics in FM (MBA 648, instr. perm.) 3

FIN 692Q Res Proj (9 cr. Adv. FIN, instr perm)

3 Specialization Electives in Investment Management (0-3)

MBA 673 Appl Fin Mod to Manag Dec (MBA 648)

3 You may take up to one of the following, but none are

FIN 680V Field Study (MBA 648, Instr. Perm.)

3 required.

FIN 631 Sec. Regulation in Fin. Mkt. (MBA 648)

3

FIN 651 Int’l Banking & Fin Markets (FIN 644)

3

FIN 652 Investment Analysis (MBA 648)

3

FIN 672 Investments, Options & Futures (MBA 646)

3

FIN 673 Real Estate Finance (MBA 648)

3

FIN 674 Personal Financial Management (MBA 648)

3

FIN 678 Cont. Top Inv. Mgmt. (MBA 648, Instr perm.) 3

MS – Investment Management: Core

Preliminary Skill & Prerequisite Courses (0 - 13)

BUS 043 Business Writing

MBA 640 Accounting for Decision Making

MBA 644 Macroecon in a Global Environment

MBA 646 Data Analysis for Decision Making

MBA 648 Managerial Finance (MBA 640)

0

4

3

3

3

Core Courses (15)

FIN 650 Applied Analytical Methods (MBA 646)

3

FIN 652 Investment Analysis (MBA 648)

3

FIN 653 Portfolio Management (MBA 646, FIN 652)

3

FIN 654 Risk Mgmt. & Cap Markets (MBA 646, FIN 652) 3

FIN 672 Investments, Options & Futures (MBA 646)

3

FIN 679 Fixed Income Markets (MBA 646, FIN 652)

3

FIN 687 App. Inv. Mgmt. & Pol (FIN 652, 6 cr. Adv. FIN) 3

MS – Investment Management: Specialization Electives

(9) CHOOSE 3

FIN 631 Securities Reg in Fin. Mkt. (MBA 648)

3

FIN 644 Money & Capital Markets (MBA 644)

3

FIN 651 Int’l Banking & Fin Mkts (FIN 644)

3

FIN 674 Personal Fin Management (MBA 648)

3

FIN 678 Cont. Top Inv. Mgmt. (MBA 648, Instr perm.) 3

FIN 692Q Res. Project (9 cr. Adv. FIN, instr perm)

3

FIN 667 Valuation of the Firm (ACC 645, FIN 647) 3

FIN 680V Int’l Field Study (MBA 648, Instr. Perm.)

3

FIN 671 Behavioral Finance (MBA 648)

3

FIN 673 Real Estate Finance (MBA 648)

3

ACC 645 Theory & Anal Fin. Stat. (MBA 640)

3

Specialization Electives in Financial Management (0-3)

You may take up to one of the following, but none are

required.

MBA 673 Appl Fin Mod to Manag Dec (MBA 648)

3

FIN 647 Adv Corp Fin (MBA 646, MBA 648)

3

FIN 649 Int’l Corp Fin (MBA 648)

3

FIN 677 Con Top Fin. Mgmt. (MBA 648, instr. perm.) 3

MBA – Financial/Investment Management: Core

Preliminary Skill (0)

BUS 043 Business Writing

0

Foundation Courses (0-19)

MBA 640 Accounting for Decision Making

4

MBA 642 Marketing Management

3

MBA 644 Macroeconomics in a Global Environment

3

MBA 646 Data Analysis for Decision Making

3

MBA 647 Decision Modeling for Management (MBA 646) 3

MBA 648 Managerial Finance (MBA 640)

3

Professional Core Courses (15)

MBA 670 Organizational Behavior and Leadership Skills 3

MBA 674 Globalization, New Economy and Ethics

3

MBA 676 Managing Business Operations (MBA 646)

3

MBA 678 Managing Innovation

OR

MBA 679 Value Creation and Competitive Adv in Global Markets (MBA 642)

MBA 672 Manag. Eco. for Dec. Making (MBA 644)

3

OR

MBA 673 Appl Fin Mod to Managerial Decision Making (MBA 648) 3

3

3

MBA – Financial Management: Specialization Electives

(6) CHOOSE 2

ECO 630 Game Th for Bus. Dec (MBA 644, MBA 672) 3

FIN 634 Entr Fin. (FIN 647 or MBA 648 & MGT 632) 3

FIN 644 Money & Capital Markets (MBA 644)

3

FIN 648 Mergers & Acquisitions (FIN 647)

3

FIN 661 Corp Fin Risk Mgmt. (MBA 646, FIN 647)

3

FIN 667 Valuation of the Firm (ACC 645, FIN 647) 3

FIN 671 Behavioral Finance (MBA 648)

3

FIN 677 Con.Topics in FM (MBA 648, instr. perm.) 3 Specialization Electives in Investment Management (0-3)

FIN 680V Field Study (MBA 648, Instr. Perm.)

3 You may take up to one of the following, but none are

FIN 692Q Res Proj (9 cr. Adv. FIN, instr perm)

3 required.

FIN 631 Sec. Regulation in Fin. Mkt. (MBA 648)

3

FIN 651 Int’l Banking & Fin Markets (FIN 644)

3

FIN 652 Investment Analysis (MBA 648)

3

FIN 672 Investments, Options & Futures (MBA 646)

3

FIN 673 Real Estate Finance (MBA 648)

3

FIN 674 Personal Financial Management (MBA 648)

3

FIN 678 Cont. Top Inv. Mgmt. (MBA 648, Instr perm.) 3

MBA – Investment Management: Specialization Electives

(6) CHOOSE 2

FIN 631 Securities Reg in Fin. Mkt. (MBA 648)

3

FIN 644 Money & Capital Markets (MBA 644)

3

FIN 648 Mergers & Acquisitions (FIN 647)

3

FIN 650 Applied Analytical Methods (MBA 646)

3

FIN 651 Int’l Banking & Fin Mkts (FIN 644)

3

FIN 654 Risk Mgmt. & Cap Markets (MBA 646, FIN 652) 3

FIN 667 Valuation of the Firm (ACC 645, FIN 647) 3

FIN 671 Behavioral Finance (MBA 648)

3

FIN 672 Investments, Options & Futures (MBA 646) 3

FIN 673 Real Estate Finance (MBA 648)

3

FIN 674 Personal Fin Management (MBA 648)

3

FIN 678 Cont. Top Inv. Mgmt. (MBA 648, Instr perm.) 3

FIN 679 Fixed Income Markets (MBA 646, FIN 652)

3

FIN 692Q Res. Project (9 cr. Adv. FIN, instr perm)

3

FIN 680V Int’l Field Study (MBA 648, Instr. Perm.)

3

Specialization Electives in Financial Management (0-3)

You may take up to one of the following, but none are

required.

FIN 647 Adv Corp Fin (MBA 646, MBA 648)

3

FIN 649 Int’l Corp Fin (MBA 648)

3

FIN 677 Con Top Fin. Mgmt. (MBA 648, instr. perm.) 3

Student Issues

I can’t get into a class because it’s closed; but I need it/I want it/I have to have it.

My instructor is not getting back to me quickly regarding my final grade, regarding

assignments etc.

Talk to Graduate Advisement; they will most likely have the answer to your question. If not,

they will contact me or somebody else to get you the answer.

Personal Questions, complaints about your specific case.

Work with your instructor; remind him/her about your question – there may be many reasons

why s/he’s not responding. If you’re not getting a satisfactory/timely action, write me with

all the details and I will make sure you get a quick response.

I am not sure whether a particular course will satisfy my degree requirements

Plan ahead; work with Graduate Advisement. This is the best solution. If it’s too late to work

with Advisement, then contact Carmen Urma, the departmental coordinator

(curma@pace.edu, 212-618-6531).

Come and see me; I am generally around at least a few hours, most days.

Any other general questions, complaints, suggestions.

I recommend that you first contact the Lubin Graduate Club or Lubin Finance Club. They can

make a proposal to me or to the Department Chair, Aron Gottesman. If, for whatever reason,

that’s not an option for you, write me an email or come see me.

Thanks for watching!

If you have any questions, email me at pviswanath@pace.edu, or call me at

212-618-6518.

Prof. P.V. Viswanath