Mr. Salman Ali Bokhari

advertisement

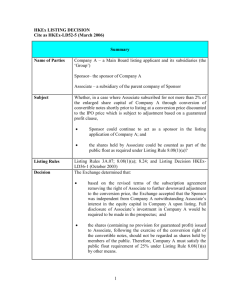

IPOs & Exchange Listing Regulatory Requirements & Compliance Presented at: Presented by: Mr. Salman Ali Bokhari Head of Corporate Finance Pakistan IPO Summit April 29, 2013 Regulatory Framework » Ordinances/Acts » SECP-Securities and Exchange Ordinance » SECP-Listed Companies (Substantial Acquisition of Voting Shares and Take-overs) Ordinance » SECP Rules » SECP-Code of Corporate Governance » SECP-Companies (Buy-Back of Shares) Rules » SECP-Companies (Issue of Capital) Rules » SECP Guidelines » Issue of Commercial Paper » Issue of TFCs » Prohibition of Insider Trading » Exchange » Provisionally Trading Company » Listing Regulations 2 PRE-LISTING MATTERS & REQUIREMENTS 3 Listing Eligibility LSE’s Listing Regulations » Public Limited Company » Minimum Paid-up Capital: Rs. 200 Million » Company’s Equity has NOT been eroded by more than 40% P P P Issue offered to public must be subscribed by a minimum of 500 Applicants Listing Eligibility LSE’s Listing Regulations » NOT Associate of a Listed Company in default of Listing Regulations » NOT Subsidiary of a Listed Company in default of Listing Regulations » Promoters/Sponsors/Controlling directors are NOT Promoters/Sponsors/Controlling directors of a company in default of Listing Regulations » CEO had not,been a CEO of a company in default of Listing Regulations P P P P Offer Allocation » For Initial Public Offers: Rs. 100 million or 25% of the total Paidup Capital whichever is higher » For Offer by Existing Shareholders: Rs. 100 million or 25% of the total Paid-up Capital whichever is lower » Allocation of Offered Shares » Upto 20% may be allocated to overseas Pakistanis » Upto 5% may be allocated to employees of the Company » The allocation of shares to: » Sponsors in excess of 25%; and » Allocation of shares, under Pre-IPO placement including employees of the companies/group companies etc., shall not be saleable for a period of 6 months from the date of public subscription. Listing Process Application for Listing Complete Documents Received by Exchange along with Prospectus Checked by Exchange Application for Approval of Prospectus from SECP Application for Trading Symbol to NCCPL Application for Prospectus Publication + Subscription Date 8 Approval by Company Affairs Committee Listing Process(Cont’d) Application for Prospectus Publication + Subscription Date Publication of Prospectus IPO 9 Checked by Exchange Approval Provisional Listing in case of Public Offer of Rs. 150 Million or above Listing Process(Cont’d) Underwritten by Underwriters if Under-subscribed IPO Results Notification to Exchange Balloting in case of Over Subscription Application for NOC and release of funds along with Auditors’ Certificate in case of under-Subscription Dispatch of Physical and CDC Shares Advertisement in Newspapers FORMAL LISTING ON EXCHANGE 10 Live in CDC Approval On-Going Compliance » Dividends: Information to be sent to exchange prior to release » Communication of price sensitive information » Sending copies of annual reports 21 days before meeting of shareholders » Sending copies of quarterly accounts » Annual meeting within 4 months of closing of annual financial year » Furnish certified copies of minutes of AGM and EOGM in 60 days » Compliance of Code of Corporate Governance » Quality of Audit & Appointment of Auditors 11 Suspension and Defaulters’ Counter » A listed company may be placed in Defaulters Segment, suspended or delisted for any of the following reasons:» (a) if its securities are quoted below 50 percent of face value for a continuous period of three years. » (b) if from three years of the date of formal listing, it has not started commercial production in the case of a manufacturing company or has not commenced business in the case of any other company. » (c) if it has failed to hold its annual general meeting for a continuous period of two years. » (d) if it has gone into liquidation either voluntarily or under court order; » (e) if it has failed to pay the annual listing fees as prescribed in these regulations payable to the Exchange for a period of 2 years or penalty imposed under these regulations or any other dues payable to the Exchange; » (f) if it has failed to comply with the requirements of any of the listing regulations; » (g) if the company for any reason whatsoever refuses to join the CDS after its securities have been declared eligible securities by the CDC. 12 Delisting » Voluntary Delisting: Any company intending to seek voluntary de-listing from the Exchange shall intimate to the Exchange, immediately, of the intention. Minimum purchase price proposed by the sponsors will be the highest of the benchmark price based on any of the following: a. Market Price b. Average Market Price (Annualized) c. Intrinsic value per share (estimated net realizable value of assets of the company) d. Earnings Multiplier approach (for profitable companies) e. The maximum price at which the Sponsors had purchased these shares from the open market in the preceding one year. 13 Listing Fee Structure » Initial Fee: 0.1% of PUC maximum of 2.5 Million » Additional Fee: 0.1% of PUC or 0.4% of actual capital » Annual Fee: 15 16