Most Trusted Advisors

advertisement

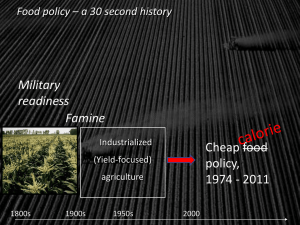

Al Mussell Overview The survey Farm optimism/attitudes What changes are they planning? How can service providers help? The Survey • Confidence in ag economy • Investment, with some emphasis on land • Planned adjustment to ag market conditions Purpose- to understand • Forthcoming farm economic attitudes, ownership/organization changes perceptions and intents Who Responded? 455 farmers, subscribers to Western Producer and Country Guide Mostly crop producers Mostly from 3 Prairie provinces Relatively larger, older, and more organized as corporations vs. census reference 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% Census 0.0% Survey 0.7 0.6 0.5 0.4Revenue Class Farm Census 0.3 Survey 0.2 70% 0.1 60% 0 under 35 years 50% 35 to 54 years 40% 55 years and over 30% Census 20% Survey 10% 0% Sole Partnership proprietorship with or without a written agreement Corporation Other operating arrangements Business Confidence and Planned Changes How would you rate the current state of economic conditions in the agriculture sector and in your own operation- today versus 12 months out? Thinking about your farm's situation right now, how comfortable are you with making a capital purchase or expenditure for your farm such as land, equipment or buildings? Compared to 12 months ago, are you now more or less comfortable making a major capital purchase or expenditure for your farm? Symmetry in Issues and Threats; Dichotomy in Confidence Other Access to professional service expertise Succession Planning / Asset Transfer Access to Capital Food Safety and Health Regulations Plant and Animal Health/Disease Climate Change Government Budgets Accessing/Retaining Human Capital Consumer Pressure Sustainability of Agricultural Practices Farm Practice Regulations Increasing interest rates Government policy changes Farm Debt Levels Trade Agreements Farmland Prices Price of Farm Inputs Weather Extremes Commodity Prices -30.0% -20.0% -10.0% 0.0% 10.0% Sector Own Farm Most Important Issues and Threats 20.0% 30.0% Changes Planned To adjust to lower price environment To succession issues Percentage of Responses Adjustments Planned in Cropping Practices 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% How are you making adjustments to reduced crop revenues vs. the last 5-6 years? Ownership/Succession 34% of respondents plan to make changes in ownership of farm 62% of those planning changes will be transferring ownership to member of immediate family or a partner 30% of those planning to transfer to family member or partner had a formal plan in place Most Trusted Advisors 45.0% 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Most Trusted Second Most Trusted Third Most Trusted Who do you rely upon as your most trusted business advisors? Family Farm Life Cycle Assets, Equity, Risk Succession Growth Acquisition Succession Growth Acquisition Making Sense of Land Prices Land prices paid as marginal costs, especially for larger farms Newer, larger machinery drives demand for land; and vice versa Ongoing process of restructuring toward fewer, larger farms; attracting people to work in farming But, remains a diversity of farm sizes- very few in survey indicated intent of selling land Decreasing Costs and Asset Capitalization $/acre Revenue Unit Cost Acres What Inferences Can be Drawn? More confidence in themselves that their sector- on the same issues 56% at least as confident making inevestments as last year, despite crop price changes They have retooled; few financial concerns But, additional investments may complicate succession issues left in the background What Inferences Can be Drawn? Technology, investment treadmill continuing to pressure farm structure But understanding land purchase behaviour remains elusive, complex Broad shifts to lower crop prices not expected What Inferences Can be Drawn? Technology, investment treadmill continuing to pressure farm structure Understanding land purchase behaviour remains elusive Broad shifts to lower crop prices not expected Business trust based upon knowledge, personal relationships, perceived integrity