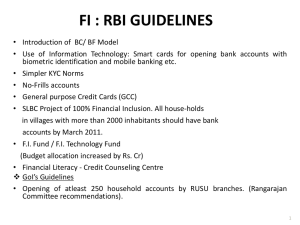

NRLM 16.02.11

advertisement

ROLE OF BANKS in NRLM 1 BACKGROUND Positive experience in lending to women’s self help groups by Banks. Expertise of banks in Training & Skill Building through RSETIs Successful implementation of Financial Inclusion by Banks 2 2 BACKGROUND RBI defines financial inclusion as providing access to appropriate financial products and services to the most vulnerable group of the society in a fair, transparent and cost-effective manner by the mainstream financial institutions. Making poor the preferred clients of the banking system is core to the NRLM financial inclusion strategy. Mobilization of bank credit is crucial for accomplishing investment goals under NRLM. 3 Role Of Banks WHEN: Right from inception of the program. WHAT: Open Savings Accounts for all beneficiaries Providing all kind of Banking Services Finalisation of KYC norms through SLBC Providing desired finance at affordable price with suitable repayment Providing continuous finance to SHGs their federations & 4 Role Of Banks HOW: To follow financing norms applicable to SHGBank linkage programme as agreed in SLBC Maintain minimum subsidy-loan ratio of 1:2 Capital Subsidy is front end subsidy & to be applied alongwith Bank Loan Interest subsidy being the difference between the interest rate charged by the bank and 7% p.a. to BPL SHGs who are regular in repayment of bank dues. 5 Role Of Banks Salient Features of Bank Finance: NRLM to be treated as mainstream business opportunity and view SHGs formed under the program as business clients by Banks To adopt a Rating Index (like the index developed by NABARD) as appraisal tool for assessing credit worthiness of Self Help Groups, which broadly covers the Panchasutras. 6 Role Of Banks Salient Features of Bank Finance: Financing under NRLM in two forms. 1.Direct credit assistance to Self Help Groups or through their federations against their Micro Investment Plans covering variety of livelihoods activities, including social needs. 2.Financing SHGs or their Federations for specific economic activities on cluster basis. SLBC may bring consensus on eligibility of groups, size & tenor of loans Bank loans under NRLM will be treated as advances to weaker sections 7 Role Of Banks Sanction and disbursement : Bank to decide the loan quantum and other conditions of the loan in a transparent manner after discussing with group members the Micro Investment Plan prepared by them. Loan to be sanctioned in a reasonable period of time (15days) from the date of receipt of applications. The loan disbursements shall be made in cash. Post disbursement scrutiny and monitoring: Bank linkage will monitor repayment of bank loans. Banker will also undertake periodic visits to Self Help Groups. 8 Role Of Banks Special Roles for Banks under NRLM: Transforming unemployed youth into confident self employed entrepreneurs through a short duration experiential learning program followed by systematic long duration hand holding support. Trainings to build entrepreneurship qualities improve self confidence, reduce risk of failure and develop them into change agents. Complete involvement of the banks in selection, training and post training follow up stages. NRLM will encourage public sector banks to set up Rural Self Employment Training Institutes (RSETIs) in all districts of the country 9 Role Of Banks Special Roles for Banks under NRLM: Financial literacy and business counselling services Improving the service quality of bank branches to poor clients by positioning dedicated customer relationship managers (Bank Mitra) Specialized teams for business development and origination services, monitoring and recovery of loans to SHGs and Federations Developing and delivering new savings, credit, remittance and insurance products with and through institutions of the poor. 10 Role Of Banks Special Roles for Banks under NRLM: Extending banking outreach to all villages with population exceeding 2,000 by leveraging IT and mobile based financial technologies and using institutions of poor as business facilitators and business correspondents Business process re-engineering to take advantage of Core Banking Solutions and other financial technologies. Networking electronic payment points with branch network or backed by call centres and business processing cells Creating specialized NRLM Cells for review and coordination in each controlling office of the participating bank 11 Role Of Banks SLBC –Sub Committee for SHG-Bank linkage & implementation of NRLM including planning, coordination, monitoring & review of FI DLCC – 1. Monitoring and review of the overall progress in physical and financial terms 2. Sorting out inter-agency differences and to prepare items for consideration of SLBC 3. Assessing training needs of beneficiaries and also to review the arrangements for training including identification of appropriate institutions 4. Monitor the recovery position bank-wise and block-wise so as to initiate corrective measures where necessary. 12 13