2 - myroyalmail

advertisement

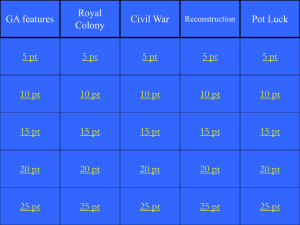

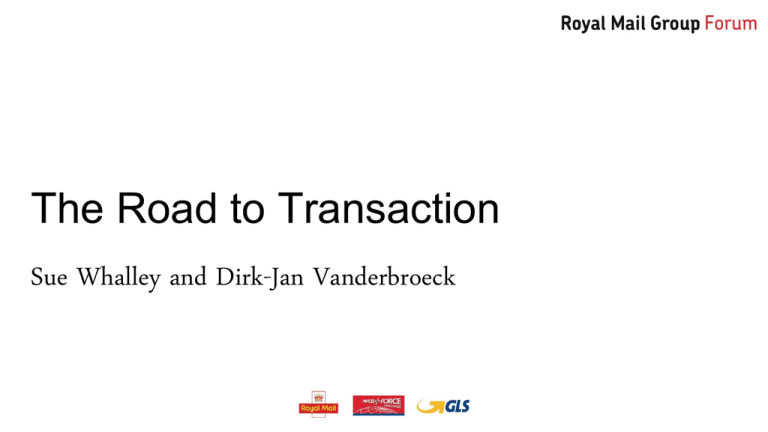

The Road to Transaction Sue Whalley and Dirk-Jan Vanderbroeck Four key messages There’s a lot going on to prepare the company for a potential IPO. We will give you as much information as we can 1. Access to capital through the right investors underpins our future 2. The journey to IPO confirms our strategy is the right one for growth 3. Under new ownership, many things stay the same but we control our destiny 4. Your involvement and leadership are critical 2 A reminder of why we need to privatise The Hooper Report 2008: 4 Policy recommendations Accelerated modernisation “The company urgently needs commercial confidence, capital and corporate experience to modernise quickly and effectively.” Improved industrial relations “Royal Mail must develop a more constructive working relationship in which both are engaged in the long-term strategic future of the company.” Government should tackle the historic pension deficit Regulatory reform “..amongst the largest of any UK company.” Hooper Report Update Private sector capital will inject private sector disciplines into the company and will reduce the risk of political intervention in commercial decisions, thus accelerating modernisation. “A new regulatory reform is needed to place postal regulation within the broader context of the communications market.” “Now the time has come for Government to step back from Royal Mail and allow its management to focus wholeheartedly on growing the business and planning for the future. This Government will give Royal Mail the real commercial freedom that it has needed for a long time” Michael Fallon, MP 3 Recent Comments " A Royal Mail freed from Government control will be able to innovate and compete for new business. Parliamentary report " 4 " " The company now needs the commercial disciplines associated with external shareholders and the long-term ability to access flexible private capital Parliamentary report " But Royal Mail in the public sector has its hands tied in a way its competitors here and in Europe do not. It cannot be right for Royal Mail to come cap in hand to Ministers each time it wants to invest and innovate. The public will always want government to invest in schools and hospitals ahead of Royal Mail. " The key objective of our reforms to the postal market is to protect the one price goes anywhere, six days a week service that businesses and communities throughout the country rely upon. Vince Cable " " Sale of shares: Final step to implementing Postal Services Act 2011 June 2011 Postal Services Act • To secure the future of Royal Mail Group and Post Office Limited by: • Creating a framework for RMG to gain ongoing access to external capital • Regulatory reform • Planned pension transfer • Planned separation from POL 5 March 2012 2013/14 • Historical pension deficit transferred to HMG • Strong financial results in 2012/13 gives us a platform for IPO • New regulator: Ofcom • Potential sale of shares of Royal Mail Group • New regulatory framework • Separation from POL • New long term agreements • 10% of the shares to be set aside for employees, on or before Government’s shareholding falls to zero 6 7 Choosing the appropriate 'capital' for Royal Mail Different Forms of Capital Private Loan Public Bond Royal Mail Focus • Has to be repaid • Contractual cost (interest) • Limited Governance • Limited benefit from Royal Mail growth • Minimise financial risk to Royal Mail • Provide long-term access to capital Unlisted Shares Listed Shares 8 • No need to be repaid • No contractual payments (dividend) • Governance rights • Strong benefit from Royal Mail growth • Seek stable and supportive investors Finding the appropriate shareholder base for Royal Mail Many different shareholders Pension Funds Royal Mail focus • Long term investors • Good understanding of our Company Insurance Companies • Aware of industry challenges and opportunities Other Asset Managers • Supportive of our ongoing strategy Individuals • Committed to the success of Royal Mail Employees 9 Support large UK companies Preparing the company for an IPO is a valuable process Competitive dynamics Strategic priorities Deliver operating KPIs Financial performance We have successfully articulated our strategy, better aligned the business and are balancing our improved profitability with ongoing need for investment 10 A Royal Mail transaction will be unique • First major UK privatisation by way of IPO since the early 90s • Largest free share scheme to employees in any major UK privatisation • Complexity of our business requires us to educate investors and analysts • Other European postal companies have or are looking to move from Government ownership • Increased internal communications activity as we seek to educate our own people The size, importance and visibility of Royal Mail will put us in the spotlight once again 11 We will also be subject to some new policies and processes • Higher external scrutiny • Increased attention through share price • Balance stakeholder interests • Public statement of targets • More regular financial reporting • Listing rules and regulations • New policies 12 From Government to private ownership Many things will remain the same • • • • Level of job security Terms and conditions Pension risk Strategy • Growing parcels • Managing decline in letters • Customer experience • Same USO • 6 days • One price goes anywhere • High service standards • Universal Service 13 From Government to private ownership Many things will remain the same • • • • Level of job security Terms and conditions Pension risk Strategy • Growing parcels • Managing decline in letters • Customer experience • Same USO • 6 days • One price goes anywhere • High service standards • Universal Service 14 Some will be different • Shareholders focused only on the company • Different lens on what we should do – we are all owners • Signals future is in our hands • No room for spending time on what’s not important or controversies What we need from you as leaders What we need from you • Raise the questions you have so we can get answers • Specific briefing packs will be provided • Break down the concerns you have • Further information and training where applicable will be provided nearer the time • Communicate information to your teams • Lead – leadership needs to replace administration and management 15 What we will give you • Ongoing updates to communicate and answer questions from teams Four key messages There’s a lot going on to prepare the company for a potential IPO. We will give you as much information as we can 1. Access to capital through the right investors underpins our future 2. The journey to IPO confirms our strategy is the right one for growth 3. Under new ownership, many things stay the same but we control our destiny 4. Your involvement and leadership are critical 16