Exercise 4 – Ratios - FAB

advertisement

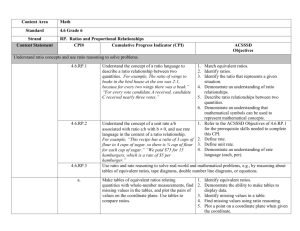

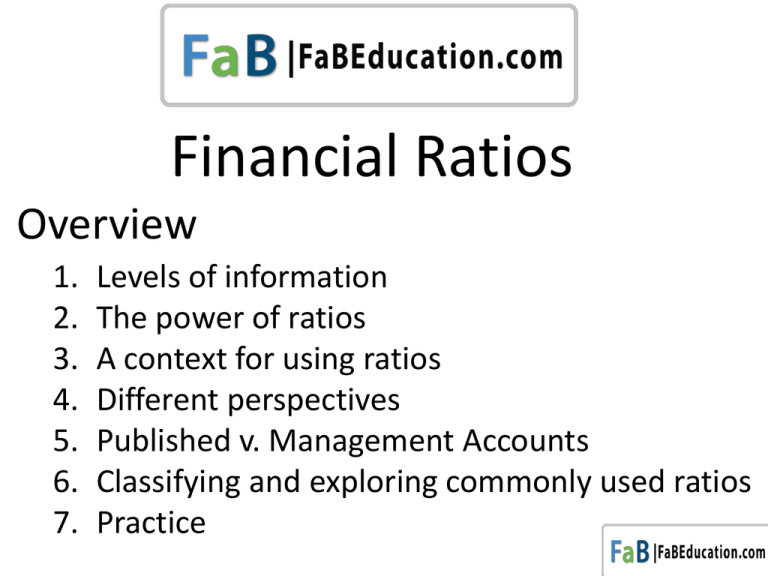

Financial Ratios Overview 1. 2. 3. 4. 5. 6. 7. Levels of information The power of ratios A context for using ratios Different perspectives Published v. Management Accounts Classifying and exploring commonly used ratios Practice Levels of information Not easily obtained for private companies We will cover in detail Ratio Comparison The average for our industry is 7% Trend And grew from 3% to 6% to 10% over the last 3 years That was 10% of sales We made €20k net profit last year The Power of Ratios There is so much more to the story of a business than the absolute values of the assets, liabilities, revenues and expenses. The real fun and power in finance is finding the answer to questions such as… • Will we have enough money to pay our debts? • Do we risk losing control because we depend too much on borrowings? • Or are we holding the business back by not borrowing for more rapid expansion • Are our profit margins high enough? • Do we make use of the fixed assets we employ in the business ? • Are we carrying too much stock? • Do we collect money from our debtors effectively? • Are we generating an adequate return on the shareholders’ investment ? Adding ratio analysis to your skills will rocket-boost your ability to contribute to decision making and problem solving. A context for using Ratios Planning Profitability Stability Utilisation Reviewing Different Perspectives Focus on different things BANKER MANAGER Published v. Management Accounts Studying “Listed” companies will require different ratios to private ones We need to focus on management as they show all the elements of the business model Classifying and exploring ratios Profitability Will show how the ratio is calculated Creditor days Stability Will explain the ratio and identify the actions that can be taken to improve it Asset Utilisation Exercise 4 – Ratios Reload the file from the “Business Model Exercise” and answer the questions and study the in This exercise applies a comprehensive ratio analysis to the business model developed in the previous segment and explores the business actions that can be taken to improve them. It builds on the Financial Perspective to show how ratio analysis can pinpoint important issues relating to the three core goals of Profit; Stability and Asset Utilisation that would not be so obvious from analysis of the absolute figures appearing in the financial statements. It provides the blueprint for managers to use FaBLinker to practice and explore until they have developed an easy familiarity with what ratios reveal about a business and the actions managers can take to improve them. FaBAssessor Live demo Exercise 5 – Trend Exercise This exercise introduces our second financial simulator which uses the same structure as FaBLinker but extends the time frame to five years. This is a superbly challenging exercise which projects the business model used in the previous exercises over five years with significant changes in the assumptions and analyses the emerging trend under sixteen key ratios. You are asked to: • Interpret the trend • Identify the causes • Assess the implications and • Indicate corrective actions (if any) required It follows the style of the previous exercise i.e. It sets challenges and offers solutions but this time the solutions are not clear-cut and there is the same scope for debate as there would be in real business situations The trend exercise is an ideal challenge to test all the knowledge and skills developed over the four modules and a perfect situation for small group learning and more formal tutor-led group discussion where possible. Practice 10 – Reinforcing the Ratio calculations Set up your own business model and go through the ratios one at a time. • Practice the calculation on paper or using a spread sheet • Read the information about the ratio in the glossary • Explore the improvement tactics suggested in the glossary • Practice, practice and practice until you can instinctively understand what each ratio is saying about the business and the “triggers” that influence it