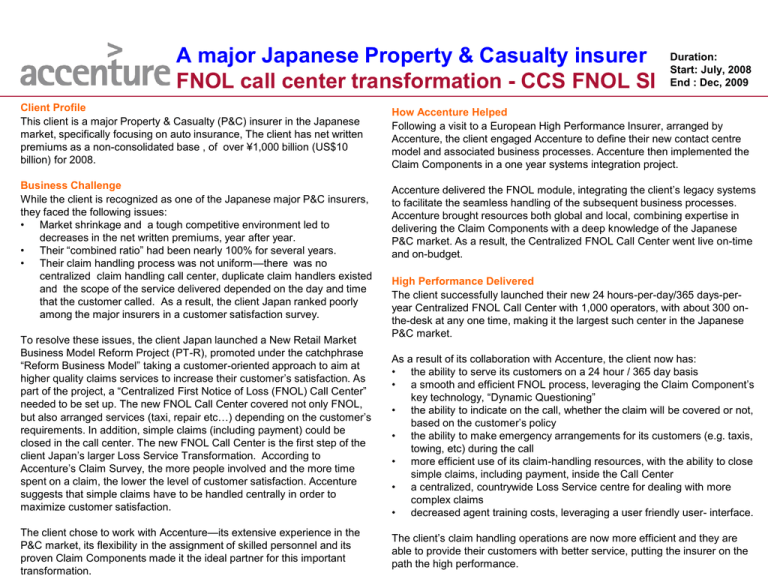

A major Japanese Property & Casualty insurer

FNOL call center transformation - CCS FNOL SI

Duration:

Start: July, 2008

End : Dec, 2009

Client Profile

This client is a major Property & Casualty (P&C) insurer in the Japanese

market, specifically focusing on auto insurance, The client has net written

premiums as a non-consolidated base , of over ¥1,000 billion (US$10

billion) for 2008.

How Accenture Helped

Following a visit to a European High Performance Insurer, arranged by

Accenture, the client engaged Accenture to define their new contact centre

model and associated business processes. Accenture then implemented the

Claim Components in a one year systems integration project.

Business Challenge

While the client is recognized as one of the Japanese major P&C insurers,

they faced the following issues:

• Market shrinkage and a tough competitive environment led to

decreases in the net written premiums, year after year.

• Their “combined ratio” had been nearly 100% for several years.

• Their claim handling process was not uniform—there was no

centralized claim handling call center, duplicate claim handlers existed

and the scope of the service delivered depended on the day and time

that the customer called. As a result, the client Japan ranked poorly

among the major insurers in a customer satisfaction survey.

Accenture delivered the FNOL module, integrating the client’s legacy systems

to facilitate the seamless handling of the subsequent business processes.

Accenture brought resources both global and local, combining expertise in

delivering the Claim Components with a deep knowledge of the Japanese

P&C market. As a result, the Centralized FNOL Call Center went live on-time

and on-budget.

To resolve these issues, the client Japan launched a New Retail Market

Business Model Reform Project (PT-R), promoted under the catchphrase

“Reform Business Model” taking a customer-oriented approach to aim at

higher quality claims services to increase their customer’s satisfaction. As

part of the project, a “Centralized First Notice of Loss (FNOL) Call Center”

needed to be set up. The new FNOL Call Center covered not only FNOL,

but also arranged services (taxi, repair etc…) depending on the customer’s

requirements. In addition, simple claims (including payment) could be

closed in the call center. The new FNOL Call Center is the first step of the

client Japan’s larger Loss Service Transformation. According to

Accenture’s Claim Survey, the more people involved and the more time

spent on a claim, the lower the level of customer satisfaction. Accenture

suggests that simple claims have to be handled centrally in order to

maximize customer satisfaction.

The client chose to work with Accenture—its extensive experience in the

P&C market, its flexibility in the assignment of skilled personnel and its

proven

Claim

Components

made

it the

ideal partner for this important

Copyright

© 2009

Accenture All

Rights

Reserved.

transformation.

High Performance Delivered

The client successfully launched their new 24 hours-per-day/365 days-peryear Centralized FNOL Call Center with 1,000 operators, with about 300 onthe-desk at any one time, making it the largest such center in the Japanese

P&C market.

As a result of its collaboration with Accenture, the client now has:

• the ability to serve its customers on a 24 hour / 365 day basis

• a smooth and efficient FNOL process, leveraging the Claim Component’s

key technology, “Dynamic Questioning”

• the ability to indicate on the call, whether the claim will be covered or not,

based on the customer’s policy

• the ability to make emergency arrangements for its customers (e.g. taxis,

towing, etc) during the call

• more efficient use of its claim-handling resources, with the ability to close

simple claims, including payment, inside the Call Center

• a centralized, countrywide Loss Service centre for dealing with more

complex claims

• decreased agent training costs, leveraging a user friendly user- interface.

The client’s claim handling operations are now more efficient and they are

able to provide their customers with better service, putting the insurer on the

1

path the high performance.