Financial Literacy 101 PowerPoint

advertisement

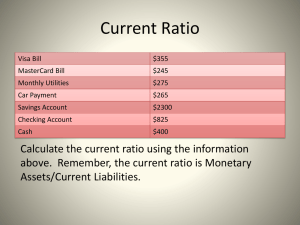

Financial Literacy 101 St. Paul, Minn. | www.wmitchell.edu Practical Wisdom Back to the Basics • Budgeting – Tracking Income and Expenses – Reducing Expenses • Credit as a Consumer – Credit Reports – Credit Scores – Improving Credit • Power Pay Debt Budgeting 101 Benefits: maximize assets, minimize debt Step 1: Calculating Income Step 2: Calculating Expenses - Tracking Step 3: Develop a Spending Plan Step 4: Minimize Expenses - Distinguish: necessities and luxuries Calculating Income, Basics – – – – Always underestimate income Include subsidies (insurance, housing, food) Income fluctuates by # hours or days worked Include financial aid, but deposit into draw account • Deposit lump sum into account and withdraw monthly “pay” – Miscellaneous income: VA payments, child support, disability payments Income FA Draw Pay 1 Pay 2 Misc. Week 1 Week 2 Week 3 Week 4 Week 5 Total Tracking Expenses, Basics - Determine where the money goes - Goal: get your money to last longer - Methods: - Keep receipts Balancing a checkbook Notebook or ledger Calendar Software or websites Envelops with Money Tracking Necessity Expenses Expenses rent/mortgage gas/electric water/sewer phone car costs gasoline groceries household items internet debt payments insurance Week 1 Week 2 Week 3 Week 4 Week 5 Total Tracking Luxury Expenses Expenses cable TV meals out clothing cigarettes entertainment vacation hobbies pets Week 1 Week 2 Week 3 Week 4 Week 5 Total Ways to Reduce Spending • Standard of living expectations – Live large now with debt, live smaller later and longer – Eliminate or reducing eating out – Studio apt v. 1-bedroom apt – Living with roommates – Smart phone v. cellphone • Shop with Lists Increasing Income for Students • Full-time students: work 20 hours or less – FT: 12 credits or more – On-campus or off-campus • Part-time students: work 40 hours or less – PT: 11 credits or less – Downside: May add time to graduation – Benefits: • Time for more work experience for resume • Earning income to reduce need for financial aid debt • Lower cost per credit at 11 credits Credit Reports Purpose: to determine whether you will pay your debts in the future by looking at your past and current debt and payment history *** Created by Creditors for Creditors*** Credit Report v. Credit Score Credit Reports: list of debt obligations with new obligations fist - Free from www.annualcreditreport.com - Transunion (Midwest), Experian (west coast), Equifax (east coast) - Used to calculate credit score Credit Score: numerical value of your credit risk - the higher the number, the less risk you are - Utilizes 45 data points from credit report Making the Most of Your Credit Report Information includes: - Employment & Address History - Number & Types of Inquiries - Payment History on All Debt - Amount, Age, and Types of Debts - Public Records: evictions, bankruptcies, court judgments - Negative information lasts 7 or 10 years Improving Credit # 1 Correct Errors - Send updates on addresses to credit bureaus - Contact credit for errors in payment history # 2 Pay Off Debts or Collections - Get payment plans or settlements in writing - Payments on collections will refresh for an additional 7 years Paying Down Debt • Standard: paying minimum payments • Accelerated: paying more than the minimum payments – Tip: Once 1 debt is paid off, use that payment towards the next debt – Tip: Pay extra to only 1 debt • Saves most money: highest interest debt • Most rewarding visually: lowest balance Power Pay with Student Loans • Benefit of payoff of student loans: few bankruptcy options and few limits on collectability • Advantageous to pay down private student loans before federal loans • Generally less flexible repayment terms, variable interest rates, and few discharges in the event of death or permanent disability • Thinking about ICR or IBR? – Have to balance interest rates with possible loan forgiveness eligibility – Federal student loans have flexible payment amounts, impacted by income: most debt has fixed payment Payment Example: Debt Type Debt Amount Debt Payment Interest Rate Repayment Term Stafford Loans $61,500 $426 6.8% 25 years Plus Loan $90,000 $689 7.9% 25 years Mortgage $237,000 $1309 5.25% 30 years Credit Card #1 $5,000 $65 14.97% Variable Credit Card #2 $2,000 $50 21.97% Variable Car Payment $21,000 $384 3.9% 5 years Total Debt: $416,500 Total Monthly Payment: $2923 Total Payments without Power Pay: $848,475 and takes 30 years Total Paid with Power Pay, highest interest: $734,558 and takes 21 years Total Paid with Power pay, lowest balance: $739,405 and takes 21 years, - $109, 070 in savings or 13% If an extra $100 is paid per month: $701,821 and takes 19 years - $146,654 in savings or 17% Questions? Email: finaid@wmitchell.edu Call: 651-290-6403 Want a free spreadsheet to track your debt? Coming Attraction: October 23 and October 27 Financial PLP on Federal Loans and Public Service Loan Forgiveness