DAB+ business case and critical success factors

advertisement

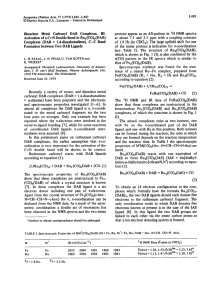

DAB+ business case and critical success factors Patrick Hannon Poznan: 10th April 2014 Contents 1. Introduction to WorldDMB 2. Radio today 3. Business case 4. Critical success factors 1 WorldDMB – who we are • Not-for-profit membership organisation • Developed DAB technical standards • Promote digital radio (DAB / DAB+) around the world 2 Over 80 members from 22 countries Broadcasters Networks / regulators Technology Devices / equipment Automotive 3 We work with players across the radio ecosystem Policy makers and regulators Broadcasters Network operators Silicon providers Devices Automotive Retailers 4 Contents 1. Introduction to WorldDMB 2. Radio today 3. Business case 4. Critical success factors 5 For broadcasters, the competitive landscape is changing Online music services • Digital music services • Smart devices • Competition for FM radio 6 Younger audiences are listening less Changes in youth per capita listening hours, 2006-101 -17% -14% -13% USA Italy -9% -7% -7% Germany France Spain -27% Sweden UK Note: (1) Definition of youth varies by market; e.g. Sweden (9-19s), UK (15-24s); US data 2006-08 & 2009-11 (new methodology in 2009). Source: EBU (Europe), Arbitron (US). 7 In many markets, FM spectrum is full – difficult to innovate • Overloaded airwaves • No capacity for new services • Difficult to innovate 8 A digital radio wave is moving across Europe Norway Sweden Denmark Ireland NL UK Bel Germany Poland Czech Slovakia France Switzerland Austria Hungary Slovenia Italy Portugal Spain 9 Four core markets: UK, Norway, Denmark and Switzerland Established markets Norway Sweden Denmark Ireland NL UK Bel Germany Poland Czech Slovakia France Switzerland Austria Hungary Slovenia Italy Portugal Spain 10 Followed by Germany (2011) and Netherlands (2013) Established markets New markets Norway Sweden Denmark Ireland NL UK Bel Germany Poland Czech Slovakia France Switzerland Austria Hungary Slovenia Italy Portugal Spain 11 Several potential markets Established markets New markets Norway Sweden Denmark Ireland NL UK Bel Germany Poland Czech Slovakia France Switzerland Austria Hungary Potential markets Slovenia Italy Portugal Spain 12 Poland: first services on air Established markets New markets Norway Sweden Denmark Ireland Poland? NL UK Bel Germany Poland Czech Slovakia France Switzerland Austria Hungary Potential markets Slovenia Italy Portugal Spain 13 DAB+ distribution costs about 10% of FM for a single service Annual cost of transmission1, $k FM DAB+ 1645 -92% 925 -89% 385 -82% 68 98 Owned site Regional site 128 Metro site Source: Harris Broadcast Note: (1) Opex costs; on DAB+, assumes 18 services on multiplex 14 DAB / DAB+ radios now mass market Prices from $29 15 Digital radios now consume 20% less power than FM devices Power consumption of in-use devices, W 20% lower 4.69 3.75 FM radio DAB radio Source: DCMS / Intertek Technical Report, March 2013 16 Automotive brands offering DAB – increasingly as standard 17 Contents 1. Introduction to WorldDMB 2. Radio today 3. Business case 4. Critical success factors 18 How can digital radio build value for broadcasters? Innovation 1 2 Increase audiences Increase revenues 19 How can digital radio build value for broadcasters? Innovation 1 2 Increase audiences Increase revenues 20 Benefits for listeners Benefits of DAB / DAB+ Sound quality Choice Additional features 21 Sound quality and choice are top two benefits UK, % benefits of digital radio 65% 59% 35% Sound quality Wider choice Easy tuning 24% 23% Text information Extra features Source: Ofcom 22 Specialist music services – for niche audiences UK Australia Germany Classic Rock Unsigned bands Electronic music Decade Country Classical 23 Specialist speech services – e.g. sports or archive Sport • Germany: live football • Up to 5 matches simultaneously Science • Germany: higher education for younger audiences Drama & comedy • UK: archive from the BBC 24 Strong brands – key to success 25 Potential to extend geographic reach Energy on FM Energy on DAB+ Hamburg Berlin Rhein-Main Nuremberg Stuttgart Munich 26 Extend the brand portfolio Analogue and digital Digital-only services 27 Absolute’s listening hours - up 95% Weekly listening hours, m Absolute Radio (core service) Absolute digital-only services 25.3 +95% 22.8 18.8 15.8 13.0 1.7 11.3 Q4 09 10.2 13.0 7.6 6.4 9.5 11.2 12.6 12.3 Q4 10 Q4 11 Q4 12 Q4 13 Source: RAJAR 28 Rebranding as “Radio 4 Extra” added 37% listening Weekly listening hours, m • Radio 7 (DAB), sister station to Radio 4 (FM) • Rebranded as 4 Extra in 2011 9.2 5.8 6.7 +37% 6.7 9.2 Q1 10 Q3 10 Q1 11 Q3 11 Source: RAJAR 29 How can digital radio build value for broadcasters? Innovation 1 2 Increase audiences Increase revenues 30 Sponsorship opportunities – youth audiences 31 Branded stations take sponsorship to new level • Branded channels – aimed at housewives target audience 32 Pop up stations – for range of events 33 Sponsorship opportunities – music tour & digital radio station 34 Sponsorship opportunities – music tour & digital radio station 35 Colour screen devices create new opportunities Revo Pixis 36 Colour images for additional information 37 Hybrid radios with Bluetooth connectivity – from €59 John Lewis Spectrum Duo 38 New song • Hear new song on radio • Hit button - for info - add to playlist - share with friends 39 Advertising • Hear ad on radio / see visual display • Tag to interact - access more information - register interest 40 Contents 1. Introduction to WorldDMB 2. Radio today 3. Business case 4. Critical success factors 41 Critical success factors Policy and regulation Coverage Content Consumer devices Retailers Cars Consumers 42 Policy and regulatory framework Policy • Clear vision and commitment to a digital future from Government / regulators Public radio • Success of digital radio depends on active support of major broadcasters – needs to be funded Private radio • Link between commitment to DAB+ and renewal of FM licences • For digital services, reduce regulation (fewer restrictions) 43 Coverage – work together to create cost-effective plan Government Network providers Regulator • Start on major population centres • Define strategy for major roads Commercial broadcasters Public broadcasters 44 Digital content proposition must be stronger than FM Sydney analogue services Sydney digital services 17 services on AM and FM Over 40 on DAB+ 45 Devices available from wide range of suppliers 46 Marketing activities must be co-ordinated and sustained • Consumer advertising encourages footfall and inspires confidence in retailers Consumer marketing Retail activity • Retail (with the right product, point of sale and trained sales people) delivers sales 47 TV ads, heavy FM promotion and device give-aways Source: BBC and Bayerische Rundfunk 48 Devices available in-store • Must have strong retail support for DAB+ radio • Devices on shelves • Training for staff • Post-code checker • Repeaters MediaMarkt, Berlin, March 2013 49 Automotive – work with manufacturers to fit DAB+ as standard • Educate local importers and dealers - consumer benefits - coverage plans - long term commitment to DAB+ • Work with international partners 50 Key to success is collaboration Policy makers and regulators Broadcasters Network operators Devices Retailers Automotive Consumers Industry stakeholder body 51 Thank you For further information, please contact: www.worlddab.org 52 In UK, 45% of new cars have DAB as standard 50% Standard Cost Option 45% 40% 35% 30% 22% 20% 10% 10% 4% 0% Q1 10 Q4 10 Q1 12 Q1 13 Q1 14 Source: CAP/SMMT 53