Presentation - National Humanities Center

advertisement

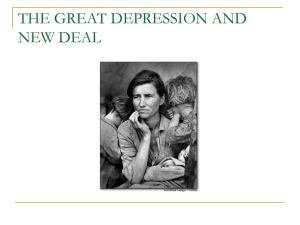

An Online Professional Development Seminar Edward J. Balleisen Associate Professor of History Duke University National Humanities Center Fellow nationalhumanitiescenter.org 1 The Crash of 1929 GOALS To analyze the immediate reactions to, and proximate and deeper causes of, the 1929 stock market crash. To consider the 1929 crash in light of the earlier regular occurrence of financial panics, the subsequent history of comparative financial stability, and the more recent return to financial instability. To suggest some teaching strategies for integrating textual and visual primary documents with quantitative evidence. nationalhumanitiescenter.org 2 The Crash of 1929 FROM THE FORUM Challenges, Issues, Questions How did the Crash come about? How did it affect the lives of ordinary Americans? How did the Crash affect the global economy? How does the Crash relate to the Great Depression? How does the Crash of 1929 compare to the Great Recession of 2008-11? Will we ever learn? nationalhumanitiescenter.org 3 The Crash of 1929 Framing Questions or Questions to Pose to Students before Viewing The Crash of 1929 Just how broad was the class of investors in the 1920s? How powerfully did speculation reshape popular culture? What prompted the boom in stocks during the 1920s? How did the pervasive use of leverage (investments based on debt) accentuate the upswing and the eventual collapse? What impact did the dramatic growth of modern consumer credit have on the 1920s boom as well the impact of the stock market crash on the wider economy? What accounted for the extraordinary confidence that economists and many politicians placed in American economic institutions and financial markets before, and even after, 1929? How did Americans initially respond to the 1929 Crash – personally, culturally, and politically? How does the crash of 1929 compare to earlier financial panics? Why did financial panics not recur in America during the several decades following World War II? How, if at all, do the events of the last few years place the Great Crash in a new analytical light? nationalhumanitiescenter.org 4 Edward J. Balleisen Associate Professor of History Duke University National Humanities Center Fellow 2009-10 Legal History Politics, Public Life and Governance Government and Markets: Toward a New Theory of Regulation (ed.) (2010) Navigating Failure: Bankruptcy and Commercial Society in Antebellum America (2001) Suckers, Swindlers, and an Ambivalent State: A History of Business Fraud in America (Forthcoming) nationalhumanitiescenter.org 5 Part 1: Emotional Response to Crisis The Crash in Numbers nationalhumanitiescenter.org 6 Part 1: Emotional Response to Crisis The Imperative of Maintaining Confidence nationalhumanitiescenter.org 7 Part 1: Emotional Response to Crisis The Imperative of Maintaining Confidence nationalhumanitiescenter.org 8 Part 1: Emotional Response to Crisis Personal Implications of the Crash From the interview with Arthur Robertson in Hard Times: “On Wall Street, the people walked around like zombies. It was like Death Takes a Holiday. It was very dark. You saw people who yesterday rode around in Cadillacs lucky now to have carfare.” nationalhumanitiescenter.org 9 Part 1: Emotional Response to Crisis Personal Implications of the Crash From the interview with Arthur Robertson in Hard Times: “In the early Thirties, I was known as a scavenger. I used to buy broken-down businesses that banks took over. That was one of my eras of prosperity. nationalhumanitiescenter.org 10 Part 1: Emotional Response to Crisis Extent of Stock Ownership nationalhumanitiescenter.org 11 Part 1: Emotional Response to Crisis The Depth of Denial From the New York Sun: “The Depression in Wall Street will effect general prosperity only to the extent that the individual buying power of some stock speculators is impaired.” “No Iowa farmer will tear up his mailorder blank because Sears-Roebuck has slumped. No Manhattan housewife took the kettle off the kitchen stove because Consolidated Gas went down to 100. Nobody put his car up for the winter because General Motors sold 40 points below the year’s high.” Irving Fisher, Yale professor, in The New York American: “Relatively speaking, the 1929 stock market has been stabilized at a high lever, and judging by the underlying conditions of business and industry, it bids fair to remain so. “After this experience the market should be largely purged of weak accounts. But unless I am wrong about the factors underlying the plateau to which the stock market has risen, there will be further tendency to rise rather than to fall as soon as the present conditions are stabilized.” “So long as American industry is on a sound basis we shall have prosperity.” nationalhumanitiescenter.org 12 Part 1: Emotional Response to Crisis The Moral Critique of Speculation nationalhumanitiescenter.org 13 Part 2: The Making of a Speculative Boom From “Gasoline Alley,” December 5, 1928 nationalhumanitiescenter.org 14 Part 2: The Making of a Speculative Boom Chicago Tribune, March 11, 1928 Buying Orgy Again Thrills Wall Street Pool Traps Short Interests. If Wall Street had any information today as to special developments affecting the Radio corporation it was not divulged. The most likely explanation of the rise, according to well informed interests, is that a well-equipped pool has trapped a large short interest and that the speculative element has easily been led into the market by the stock’s violent advances. From “Gasoline Alley,” December 5, 1928 nationalhumanitiescenter.org 15 Part 2: The Making of a Speculative Boom nationalhumanitiescenter.org 16 Part 2: The Risks of Speculating on Margin Interview with John Hersch, senior partner, Chicago investment house, from Hard Times: “When the break started, you had a deluge of selling, from weakened margin accounts. We had to stay up all night figuring. We’d work till one o’clock and go to the LaSalle Hotel and get up about five and get some breakfast and continue figuring margin accounts. ‘Cause everybody was in trouble. But everybody” nationalhumanitiescenter.org 17 Part 2: The Limits of Stock Ownership nationalhumanitiescenter.org 18 Part 3: Structural Causes: The Credit Economy The New Consumer Economy and the Engine of Debt This Installment Stuff Smith: Are you getting a new car this year? Jones: Yes. That is, as soon as I’ve paid for the one that I had before the one I’ve got now. From Life (1883-1936), February 15, 1929. nationalhumanitiescenter.org 19 Part 3: Structural Causes: The Credit Economy From Middletown: A Study in Contemporary American Culture, Robert S. Lynd and Helen Merrell Lynd, 1929. nationalhumanitiescenter.org 20 Part 3: Structural Causes: The Credit Economy The Rapid Expansion of Private Debt Total Farm Debt Total Consumer debt 1919 -- $43.9 billion 1919 -- $2.6 billion 1925 -- $59.6 billion 1929 -- $6.3 billion 1929 -- $72.9 billion 1927: 15% of all consumer durables bought on installment payments 60% of automobiles bought on installment payments 80% of radios bought on installment payments nationalhumanitiescenter.org 21 Part 4: Structural Causes: Faith in Market Economy Hedging Risk: The Wonder of Investment Trusts From “This Era of Investment Trusts” by Irving Fisher, 1929 “The investment trust principle acts to reduce risk by utilizing the special knowledge of expert investment counsel, and by diversifying investments among many kinds of common and preferred stocks and bonds, foreign and domestic. It also operates to shift risks from those who lack investment knowledge to those who possess it. As a consequence normally speculative properties gravitate into the hands of these skilled agencies which are better able to forecast their true future value.” . . . “Many corps of specialists employed by the investment trusts are watching out for these signs. They know about improved and cheapened processes beforehand, and discount them in their purchase of stocks and bonds. By their influence, the steeper declines or ascents are drawn into milder ones.” nationalhumanitiescenter.org 22 Part 4: Structural Causes: Faith in Market Economy Spreading Risk: Consumer Lending across the Country H.B. Lewis, Vice President, Chicago Commercial Credit Company: “It appears to me unthinkable that any ordinary recession can affect the installment business. The safeguards being taken to protect the accounts are effective and, not only these, but the tremendous geographical spread of business are great strengthening factors. Installment selling now covers this country and Canada, and depression, considering the present financial organization available to limit the effect of panics, is not likely to cover the entire country at once. There may of course be “black spots” here and there that must needs be taken into account, but these, according to past experience, will not show up seriously when taken in relation to conditions as a whole.” nationalhumanitiescenter.org 23 Part 4: Structural Causes: Faith in Market Economy Political Satisfaction with American Prosperity of the 1920s From “Rugged Individualism Speech,” Herbert Hoover, October 22, 1928 “By adherence to these principles of decentralization, self-government, ordered liberty, and opportunity and freedom to the individual our American experiment has yielded a degree of well-being unparalleled in all the world. It has come nearer to the abolition of fear and want than humanity has ever reached before. Progress of the past seven years is the proof of it. It furnishes an answer to those who would ask us to abandon the system by which this has been accomplished.” nationalhumanitiescenter.org 24 Part 5: The Great Crash in Long-Term Historical Perspective Looking Back: Major Financial Panics, 1800-1940 nationalhumanitiescenter.org 25 Part 5: The Great Crash in Long-Term Historical Perspective Bank Failures, Regulation, and Inequality in the United States nationalhumanitiescenter.org 26 Part 5: The Great Crash in Long-Term Historical Perspective Inequality and Instability: Correlation = Causation? Widening inequality and propensity to speculate. Widening inequality, keeping up with the Jones, and willingness to borrow for consumption. Widening inequality and supply of consumer credit. nationalhumanitiescenter.org 27 Part 5: The Great Crash in Long-Term Historical Perspective Regulation and Stability: Correlation = Causation? Interview with John Hersch, senior partner, Chicago investment house, from Hard Times: “You had no government control of margins, so people could buy on a shoestring. And when they began pulling the plug . . . You had a deluge of weakness. You also had short selling and a lack of rules. There were many cases of staid, reputable bankers making securities available on special deals—below the market price—for their friends. Anything went, and everything did go. Today, there are very few bankers of any repute who have objected to the Securities Exchange Commission. They believe that the regulation in 1933 was a very, very sound thing for business. In ’32 and ’33, there was no securities business to speak of. We played a lot of bridge in the afternoons on LaSalle Street. There was nobody to call or see. It was so quiet you could hear a certificate drop.” nationalhumanitiescenter.org 28 The Crash of 1929 Final slide. Thank You nationalhumanitiescenter.org 29