functioning of board and role of directors under the companies act

Ramaswami Kalidas

VP &Company secretary

Reliance Power Ltd.

The definition of Board of Directors is given in Section 2(10) of

Companies Act, 2013 corresponding to Section 2(6) of Companies Act,

1956.

As per the new definition it refers to “ a collective body of the Board ”

Chief Executive Officer (CEO) refers to an officer of a company who has been designated as such by it.

As per Clause 49 ,CEO is MD or Manager appointed under the

Act.

Whether CEO is part of the Board unless he is appointed to the

Board?

Definition of Director as given in Section 2(34) of

Companies Act, 2013 corresponds to section 2(13) of Indian

Companies Act, 1956:

“Director refers to one who has been appointed as such by the Board”

“Means “ Definition and hence restrictive .

Definition in old Act being inclusive and hence illustrative.

Could refer to anyone occupying the position of director by whatever name called. Shadow directors/pseudo Directors on whose behest Board accustomed to act included.

As per the new definition given in Section 2(51) Key Managerial

Personnel includes Chief Executive Officer (CEO), Managing

Director (MD), Manager, Company Secretary (CS), Chief Financial

Officer (CFO), Whole Time Director (WTD) and any other officer as may be prescribed.

Per Section 203 (not yet notified)full time KMP a must in every

Company with paid up capital of Rs 5 Crore or more.(Draft Rules for appointment and remuneration of Managerial personnel)

The definition of Managing Director as given in Section 2(54) of

Indian Companies Act 2013 corresponds to Section 2(26) of

Indian Companies Act, 1956.

Major shift in Role-MD does not have to function under supervision, control and direction of Board

The definition of Whole-Time Director is given in Section

2(94) of Companies Act 2013 corresponds to explanation under Section 269.

“Whole Time Director includes the Director who is in whole time employment of the Company”

Even one not so called would come within definition

Section 162 of Companies Act, 2013 corresponds to Section 263 of

Companies Act,1956.

This Section deals with “ Appointment of Directors to be voted individually ”

Section 164 to 175 of Companies Act 2013 dealing with :

Disqualifications of Directors (Section 164)

Number of Directorships (Section 165)

Duties of Directors

Vacation of office

(Section 166)

(Section 167)

Resignation of Directors

Removal of Directors etc

(Section 168)

(Section 169)

All these Sections have not yet been notified .

Loan to Directors or to any other person in whom director is interested as in Section 185 corresponding to Section 295 of Indian Companies Act,

1956 has been notified. Also covers provision of guarantee or security.

Except for loans given as part of condition of service for Managing

Director/Whole Time Director or as per any scheme approved by Members by Special Resolution no loans can be given to directors even if Central

Government approves.

Loan to Directors shall also include “a loan represented by a book debt”

Notified provision.

Restricts non-cash transactions involving directors by which any acquisition of Assets by company from director of Holding,

Subsidiary or Associate company or any person connected with him and vice versa for consideration other than cash shall not be allowed until approved by shareholders.

This Section applies to both Public and Private Companies.

Arrangement in violation voidable at option of company unless restitution impossible and Company has been indemnified by others.

This section prohibits forward contracts in securities by Director or any Key Managerial personnel in Holding, Subsidiary or Associate

Company. Includes Right to call for delivery or to make delivery at specified price/time.

Does not cover transactions done indirectly.

Relevant securities refer to shares and debentures of Company and its subsidiaries.

Penalty - Rs five lacs or imprisonment for two years or both

This section has been notified.

Any Director or Key Managerial Personnel is prohibited from doing

Insider Trading. Refers to direct involvement not through relatives.

Definition of “ Price Sensitive Information ” doesn’t correspond to definition in SEBI [Insider Trading] Regulations.

Explanation under definition in Regulations which amplifies definition deleted.

Penalty includes disgorgement to the extent of three times the profit made.

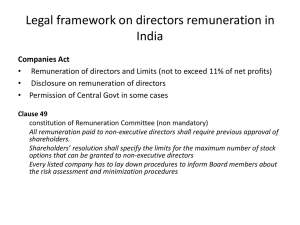

Section 196 to Section 201 dealing with :

Appointment of MD, Whole Time Director or Manager ,Remuneration of Managerial Personnel, Limits on Remuneration etc has not yet been notified .

Draft Rules in place for debate

.

Section 149 of Indian Companies Act, 2013 provides for at least one woman Director.

Per Draft RulesFor listed Companieswithin one year of Notification. Other public Companies with paid up capital of 100 Crore or turnover of 300 Crore within 3 years.

Section 149(4) - one-third of total number of Directors should be

Independent Directors. provision in Listing Agreement provides for half of the board to be Independent Directors in certain situations.

SEBI in consultative paper have stated that this composition in

Clause 49 will not be disturbed.

Draft Rules suggest that listing agreement shall prevail.

Section 149- Cont. :

Definition of Independent Director – Not in sync with Listing Agreement.

SEBI have confirmed that there will be congruence.

Nominee Director – Nominee Director not an independent director.

Section 150 -S election of Independent Directors . Data

Bank to be maintained by Central Government thru

Institute/Association authorized.

Section 150(2 ) –Appointment of Independent Directors in

General Meeting and Explanatory Statement to provide justification for choice. Question-Whether he can be appointed as Additional Director/to fill casual vacancy. To be read conjointly with Section 161

Section 151 – Listed Company to have one director appointed by small shareholders .Notice from 500 or 1/10 th of Members lower. Not liable to retire by rotation.term-3 years

This section states that if the Director is absent from all meetings held in 12 months with or without leave of absence.

Draft rules on Board Meetings provide that Director shall attend at least one meeting in person.

To act as per Articles of the company.

Act in good faith to promote objects of the company for benefit of its members as a whole and in the best interest of company, employees, stakeholders, community and environment.

Exercise his duties with due & reasonable care, skill and diligence and independent judgement.

He must not have any conflict of interest.

No attempt to seek undue advantage or gain either to himself or his relatives.

No assignment of office.

Punishment for contravention of above will be fine not less than one lac which may extend to five lacs.

Section 179 corresponds to section 292 of Indian Companies Act, 1956.

The following cannot be exercised unless approved at board meeting :

• Power to issue securities including in and outside India (previously only debentures)

• To grant loans, give guarantees, security for loans;

• Approve financial statement and Board’s Report;

• Diversify business;

• Approve amalgamation/merger/reconstruction;

• To take over company or acquire controlling or substantial stake in another company.

As per Draft rules :

To make political contributions;

To fill casual vacancy in Board;

Enter into Joint Venture, Technical or financial collaboration;

Commence new business;

Shifting of plant/factory or Registered office;

Appointment/Removal of Key Managerial Personnel and one level below level of KMPs;

Acceptance of Public Deposits;

Sell Investment (other than trade) beyond 5% of paid up capital and free reserves of Investee . Will include subsidiary investments as well

Appointment of Internal Auditors;

Approval of quarterly / half yearly /annual results.

Powers Exercisable with Shareholder Approval: [Section 180 corresponding to Section 293 of Indian Companies Act, 2013]

Approval by Special Resolution;

Does not speak about previous approval of Members;

Sale/disposal of undertaking

Undertaking is defined as – Investment exceeds 20% of Net Worth or 20% of Total Income;

Invest other than in trust securities compensation arising from

Merger/Amalgamation;

Borrowings in excess of paid up capital and free reserves other than temporary borrowings

Temporary borrowings includes cash credit, bill discounting and other short term loans excluding loans for capital expenditure.

Contribution to charitable funds given in section 181 of Companies

Act, 2013 corresponds to 293(1)(e) of Companies Act, 1956.

Prior permission of members where contribution exceeds 5% of net profit of last three years.

Type of resolution whether special/ ordinary not stated. Needs clarity

Facility of attending Meeting through Audio/Video;

Chairman with Company Secretary to arrange for video facilities, safekeeping of tape recordings and other electronic recording mechanism. Why responsibility with Chairman?

Notice for meeting;

Chairman to take roll call before transacting every item;

From commencement till conclusion of meeting no person other than chairman, directors, secretary and other person legally required to be present to have access to meeting/video facility.

Draft minutes to be drawn up and circulated within 7 days of meeting;

Director to provide comments within 3 days.

Facility now available of seeking approval through E-mail transmission.

If 1/3 rd of Board desire that the resolution shall be only passed at

Board Meeting, approval by circulation not possible.

Resolution so passed to be noted at next Meeting and made part of Minutes of the Meeting.

Additional disclosures :

Extract of the Annual Return;

Number of Meetings of Board (part of CG Report)

Declaration of Independent directors and policy on director’s remuneration, qualifications, positive attributes;

Explanations/comments of Board on any qualifications made by the

Company Secretary in practice his Audit Report;

Particulars of loans, guarantees or investments;

Particulars of contracts with Related parties;

Statement regarding development and implementation of risk management policy;

Policy developed and implemented on CSR;

For listed companies and others as prescribed manner of annual evaluation of Board’s/committee performance.