Control Framework Breakfast Group Presentation

advertisement

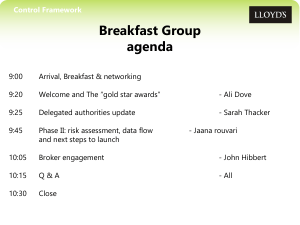

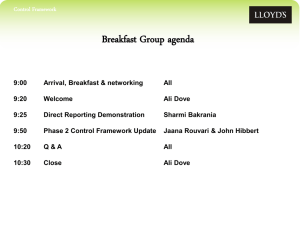

A warm Welcome to the December market Breakfast Group Control Framework Breakfast Group agenda 9:00 Arrival, breakfast & networking All 9:15 Festive welcome! Ali Dove 9:20 Canopius Coverholder Framework Jane Zonnenberg 9:40 Phase II project update Approach to Phase III Jaana Rouvari Ali Dove 10:00 Trading advice and compliance tools: Christmas update Giles Taylor 10:15 Q&A All 10:30 Close Control Framework Celebrating Success Ark Syndicate Management Ltd Beaufort Underwriting Agency Ltd Marketform Managing Agency Limited R&Q Managing Agency Limited 3 © Lloyd’s Canopius Coverholder Framework 2014 www.canopius.com Canopius Coverholder Framework 2014 The Canopius Journey, so far… Where Are We Currently? What’s Next? The Canopius Journey, so far… Steep learning curve Breaking the project down into bite-sized chunks Bite-Sized Chunks Identify risk factors Coverholder data iro the risk factors Application of the risk factors Overall rating mechanism for inherent risk Approach for assessing risk Audit results template Bordereaux gap analysis Update DA Audit Policy Design BAU process Risk Factors Number of territories in which the coverholder writes business Principal regional complexity (i.e. business written in Australia, Canada, Greece, Ireland, Italy or USA Multiple classes of business (specifically cargo or bloodstock) Method of introducing business (prior submit, coverholder discretion over pre-determined rates, no coverholder referral) Route of business (direct, via broker, via master coverholder) Overall rating mechanism for inherent risk C o v e r h o l d e r N a m e Excel spreadsheet High/Medium/Low per risk factor Assign values to H/M/L per risk factor R a t i n g Comments Located/ Domiciled Class of Underwriting Business/ Authority Sub Class Route of Business L o w M e d i u m H i g h Complexity of Complexity of Complexity of business written business written - business written NEW Risk rating: Risk rating: Risk rating: Method of Binding Principal Lines of Business introducing Authority Regional NEW: Class of business Single or Complexity Business Risk rating: multiple Prior Submit territories NEW Route of business Risk rating: Direct/Broker/S ub-delegated Coverholder writes Coverholder writes business in one Coverholder writes business in a single All risks are prior territory only. This is only reinsurance country which is not: submit or rates are also the business or only one Australia, Canada, set and coverholder Direct to underwriter coverholders line of business excl. Greece, Ireland, Italy discretion is not physical/ domiciled cargo and bloodstock or US permitted location Coverholder writes Coverholder has Pre-determined rates business in one of Coverholder writes offices in multiple exist but Coverholder the following multiple lines of locations and writes has authority to countries: Australia, business excl. cargo risks only in these exercise discretion Canada, Greece, and bloodstock territories within agreed Ireland, Italy or US parameters Coverholder writes business across borders and/or globally Coverholder writes business worldwide Coverholder writes multiple lines of Coverholder has full business including authority to set rates cargo and/or without referral bloodstock Complexity of Complexity of Complexity of business written business written - business written NEW Risk rating: Risk rating: Risk rating: Method of Binding Principal Lines of Business introducing Authority Regional NEW: Class of business Single or Complexity Business Risk rating: multiple Prior Submit territories NEW Route of business Risk rating: Direct/Broker/S ub-delegated Total Score Rating 7 10 7 2 4 30 Low Via Broker 14 20 14 4 8 60 Medium Via Master Coverholder(take from lead/follow) 21 30 21 6 12 90 High Approach for assessing risk Audit results template Bordereaux gap analysis Desktop review Audit results template Lloyd’s 2014 audit scope converted to a template to grade audit reports Converting the results of the audits into an assessed risk rating: • New reports received after template introduced • Retrospectively applied to reports received earlier in 2014 TOTALS & AUDIT SCORE Y N N/A 1 1.11.1. 0 0 0 0 0 No score EXECUTIVE SUMMARY The auditor is expected to provide an executive summary to the managing agent. These should provide details of the main findings and issues, an indication of the coverholder's general suitability, culture and openness and a review of any previous recommendations. Appendix 0 0 0 0 Covered in the Audit? Issue - Y, N or N/A Section Score Bordereaux gap analysis Bordereau template prepared based on data coverholder typically expected to provide Gap analysis performed on each bordereau per BA Simple yes/no answers on whether/not specific data is regularly provided Values assigned to each data field according to significance Total rating applied per binder Desktop review - used for adhoc performance monitoring or where rating is marginal Where Are We Currently? Delegated Authority Audit Policy has been updated Currently embedding the process of ongoing rating of a fluid coverholder population Scoping out Control Framework recording and reporting mechanisms on BDX What’s Next? Review of the audit scope – removing possible duplications, or questions that we (as the Managing Agent) can answer Identification of those cases where brokers are involved in the coverholders’ data Identifying any possible areas of overlap with Conduct Risk questionnaire Test and refine practical application of audit frequency decision process against backdrop of topical regulatory focus Control Framework Control framework Phase II Project Update Jaana rouvari 15 © Lloyd’s Control Framework Today… 1. 2014 round up 2. Market progress 3. Broker questionnaire 4. Lloyd’s support for Control Framework in 2015 5. Approach to Phase III – Open Market 16 © Lloyd’s Control Framework The 2014 Christmas Breakfast Group Quiz Q1: What cuts of pork make bacon? (Hint: two answers!) Q2: What is the traditional casing for a pork sausage? Q3: To the nearest 10 – How many bacon and sausage sarnies have we gone through in 2014? Q4: The history of the mince pie can be traced to the 13th century, what were the three key traditional fillings for this original pie? Q5: How many market breakfast meetings have we had in 2014? Q6: To the nearest 10 – How many people in total have attended the market breakfast group meetings? 17 © Lloyd’s Control Framework Achievements and progress… on a more serious note • Lloyd’s market support through nearly 300 managing agent and broker meetings • Celebrating a few more sign-offs today, with rest progressing well • Some delays experienced due to renewals, changes in staff, other regulatory initiatives Managing agent sign-off outlook Q4 2014 30% Q1 2015 50% Q2 2015 80% Q3 2015 90% 18 Q4 2015 100% © Lloyd’s Control Framework Broker questionnaire • Developed by LMA’s Delegated Authorities Operations Committee • Looks to make the processing an intermediary undertakes transparent • Acts as a conversation opener between managing agents and those brokers who undertake processing of tax and regulatory information • Lloyd’s role is to facilitate the process of requesting and disseminating information • Lloyd’s will not take a view on the information provided by brokers 19 © Lloyd’s Control Framework …to avoid 20 © Lloyd’s Control Framework Control Framework Support in 2015 For managing agents yet to sign off Your normal Lloyd’s Delegated Authorities contact Queries Track progress through 6-monthly review meetings and additional catch ups Communications For brokers Queries Martin Baker Broker questionnaire Communications 21 © Lloyd’s Control Framework What about Phase III- Open Market? • Analysis and market consultation carried out over the past 6 months • Control Framework evaluated in light of a number of existing initiatives • Consideration given to ongoing market modernisation initiatives changing open market process and controls • Everything in the context of taking a pragmatic approach • Further mitigation of the Control Framework risks addressed through building robust central services • Addressed at the same time as LMG market modernisation initiatives • Negates the need for a separate managing agent sign-off 22 © Lloyd’s < Picture to go here > Crystal/RLT update Control Framework Breakfast, 9th December Giles Taylor, Lloyd’s © Lloyd’s Key items ► Service standards and usage ► New content ► LITA vision & 2015 < Picture to go here > 24 © Lloyd’s Service standards & usage The headlines… • 12,000 Crystal pages • 15,000 Crystal users < Picture to go here > • c. 55,000 Crystal reports pcm • Still only 25% of users log in • c. 500 RLT reports 25 © Lloyd’s Service standards & usage < Picture to go here > 26 © Lloyd’s Non-US consumer information Subjects ► ► General Australia Canada* France Germany Pre-contractual notification and disclosure Italy Insurance documents New Zealand South Africa Spain Definition of ‘consumer’ Consumer protection legislation Insurance documentation ► Jurisdictions Processing and servicing of risks Cancellation and non-renewal Tacit renewal Claims handling Definition of ‘complaint’ Complaints handling (internal procedures) Details of ombudsman (external procedures) < Picture to go here > * At provincial level, Alberta, British Columbia, Manitoba, Ontario, Quebec 27 © Lloyd’s US consumer information Consumer complaints Posted: California, Florida, Illinois, Louisiana, Maryland, New Jersey, New York, North Carolina, South Carolina, Texas By y.e. 2014: Connecticut, Delaware, Kentucky, Pennsylvania, USVI < Picture to go here > 2015: All remaining states Homeowners Cancellation & Non-renewal Posted: California, Connecticut, Delaware, Florida, Georgia, Illinois, Louisiana, Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina, Texas Q1 2015: Massachusetts, Oklahoma, Virginia, Washington, Colorado, Tennessee, Ohio, Alabama, Missouri, Minnesota 2015: All remaining states Claims handling California, Florida, New York, Texas 28 © Lloyd’s Quick search < Picture to go here > 29 © Lloyd’s Intermediary licensing Completed for licensed territories Drafts prepared for following priority countries, but not ‘live’ • Argentina • Indonesia • Azerbaijan • Malaysia • Brazil • Mexico • Chile • Nigeria • China • Panama • Colombia • Paraguay • Czech Republic • Saudi Arabia • Ecuador • South Korea • Finland • Turkey • India • Vietnam < Picture to go here > Remaining unlicensed territories drafted up to ‘U’, but not live 30 © Lloyd’s LITA vision and 2015 Key topics to address… Risk Location Guidance – separate from coverholder approvals (Y4125) US Law & Jurisdiction – reaffirm guidance (Y3406) < Picture to go here > Renewal of online offering Review current robustness of Crystal IT infrastructure Consult with the market Develop business case to overhaul Crystal, Risk Locator LITA offering Expanded provision of advice Regulatory thought leadership Above all, forward looking 31 © Lloyd’s © Lloyd’s Control Framework Q&A 33 © Lloyd’s Control Framework AND THE WINNER IS… 34 © Lloyd’s Control Framework Further information on Control Framework controlframework@lloyds.com www.lloyds.com/controlframework 35 © Lloyd’s