Buy Side Sell Side UNM Lecture 11-19

advertisement

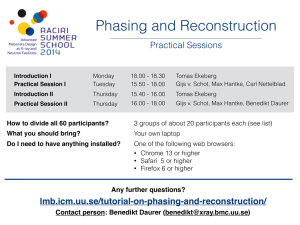

Buy Side & Sell Side Alexander Motola, CFA Alexander Motola, 2013 1 Sell Side Brokerage Syndicate Custody & Prime Brokerage/Lending Alexander Motola, 2013 2 Sell-Side/Brokerage 4 Positions ◦ ◦ ◦ ◦ Broker Sales Trader Trader Analyst Alexander Motola, 2013 3 Sell Side/Broker Broker is a Buy Sider’s primary contact at the investment bank Broker’s job is to: ◦ Understand client needs, what services they need/want, what kind of stocks and ideas they are interested in, provide information & ideas; bring analysts and management to buy sider clients ◦ Generate commissions for his firm Alexander Motola, 2013 4 Sell Side/Sales Trader Sometimes called “trader”, the real title is “sales trader”; sales traders don’t trade stocks but act as intermediaries between buy side traders and sell side traders (either floor or electronic traders) Job is more relationship based than technically based Alexander Motola, 2013 5 Sell Side/Broker Clients want: ◦ ◦ ◦ ◦ ◦ ◦ ◦ Idea generation Access to analysts & research Access to managements IPOs Swag & Benes Conference Access Travel Arrangements (Intl) Alexander Motola, 2013 6 Sell Side/Trader Employee of investment bank who either matches trades between clients, runs a book (P&L), or works on a floor or pad Does not talk with clients, just other sell side traders and prop traders Paid based on profits as agent but mostly as principal Alexander Motola, 2013 7 Sell Side/Analyst Paid via commissions and trading volume in stocks under his/her coverage Usually works in a team oriented around an industry There are associates and analysts Associates build models, listen to calls, field marketing calls, talk to management/companies, attend industry conferences, etc.; basically they are apprentice analysts Alexander Motola, 2013 8 Sell Side/Analyst Analysts manage 1 or more associates, control their product, perform higher level analysis, meet with management Analysts build their own “brand” (Johnson, Blodget, Cohen, Meeker); their franchise is often more important than their employer Analysts meet with clients, build relationships, and make “calls” Alexander Motola, 2013 9 Sell Side/Syndicate Syndicate is the investment bank’s new issue pipeline ◦ They handle IPOs, secondaries, follow-ons, bond issuance, etc. ◦ They market to the issuing companies, often using their analysts’ reputations ◦ They dictate pricing, distribution, and road show (in conjunction with management) ◦ Track distribution post offering and provide stabilization as necessary Alexander Motola, 2013 10 Sell Side/Custody, etc. A broker will also sell other services to buy siders, including: ◦ ◦ ◦ ◦ ◦ ◦ ◦ Custody Currency trading Derivatives and hedging Lending Borrowing Leverage Prime Brokerage Alexander Motola, 2013 11 Sell Side/I-Banking M&A and Syndicate ◦ They have their own Analysts and Associates (Associates are higher scale jobs than Analysts in I-banking) ◦ Little actual direct investing Alexander Motola, 2013 12 Buy-Side/Equity Research 4 Positions ◦ ◦ ◦ ◦ CIO/Investment Committee Portfolio Manager Analyst Trader Alexander Motola, 2013 13 Buy-Side/CIO CIO or IC ◦ Sets standards of research; might also oversee analyst staff ◦ Can make investment decisions Sometimes there is a “buylist” ◦ Approves research ◦ Sets economic direction or investment style direction ◦ Manages or oversees portfolio risk Alexander Motola, 2013 14 Buy-Side/PM Portfolio Manager ◦ Might oversee analysts (team approach) ◦ Makes investment decisions for their strategy ◦ Provides marketing for their strategy; client communication ◦ Likely to be involved in the design of their strategy or evolution of their strategy Alexander Motola, 2013 15 Buy-Side/Analyst Analyst ◦ Various levels of Analyst ◦ Key function is company and/or industry research Modeling, company contact, visits, industry evaluation, news, etc.; whatever is demanded by the strategy ◦ Possibly some marketing support Alexander Motola, 2013 16 Buy-Side/Trader Trader ◦ Implements PM decisions Timing Size Price Market action Liquidity supplier or demander Talks all day to sales traders and uses “the box” Alexander Motola, 2013 17 Buy-Side/Fixed Income PM/Analyst/Trader ◦ Most FI is specific, unlike stocks; with a stock, you can always go out and buy what you want, with FI you can usually only buy what’s available This usually means that the Trading role is integrated into the PM and Analyst role Alexander Motola, 2013 18 Typical Path (Analyst) Undergrad in a Technical Field (Computer Science, Finance, Engineering, Marketing) Work in the field, gaining industry expertise MBA, emphasis in Finance Associate (buy or sell side) Promotion to Analyst Possible Promotion to PM Alexander Motola, 2013 19 Buy Side Firm Structures Team Approach Segregated Star Driven Combinations of the above Alexander Motola, 2013 20 Compensation Sales & Trading Compensation ◦ ◦ ◦ ◦ Analyst $ 80K - $ 150K Associate $ 180K - $ 250K Vice Presidents $ 300K - $ 500K Managing Directors/Partners $1MM+ Per “Wall Street Oasis” Alexander Motola, 2013 21 Compensation Investment Banking Compensation ◦ Summer interns/associate: $71,300 (+$9,400) First year analyst: $85,300 (+$28,700) Third year analyst: $111,400 (+$51,600) First year associate: $120,000 (+$39,900) Third year associate: $149,000 ($60,700) Vice President: $255,700 (+$116,800) Managing Director: $273,400 (+$135,600) Per “Wall Street Oasis” Alexander Motola, 2013 22 Compensation Investment Banking Compensation ◦ Summer interns: $58,000 (+$3,100) First year analyst: $67,000 (+$21,000) Senior analyst: $82,100 (+$21,100) First year associate: $71,500 (+$33,000) Senior associate: $99,200 ($36,200) Vice President: $140,000 (+$100,700) Principal: $145,600 (+$157,500) Per “Wall Street Oasis” Alexander Motola, 2013 23 Compensation How much you make is very dependent on: ◦ What type of firm you work at (who owns it) ◦ Where the firm is located ◦ Size of firm ◦ Bonus philosophy This is in addition to the usual: your position, experience, etc. Alexander Motola, 2013 24 Other Aspects of the Job Mentally challenging, with many new problems to solve; constant learning environment Very long hours Very performance driven; you get a report card every day There is nothing additive to the production of goods; stock market is zero sum game for active investment Alexander Motola, 2013 25 Other Aspects of the Job CFA and/or MBA virtually required for many positions, just to get to the interview Can be a highly competitive environment (both within your firm and outside it) It’s difficult to get a definitive performance advantage Alexander Motola, 2013 26 Staying Ahead of the Competition Thursday ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ UBXN SW, SARIN SP CEO (CNOOC ADR) KRFT MCHP WM PFE CLX MCD Alexander Motola, 2013 28