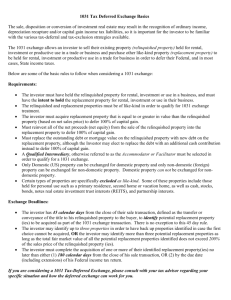

1031 Exchange Rules in California What Is a 1031 Exchange? A 1031 Exchange is a tax-deferral strategy that allows real estate investors to sell one property and reinvest the proceeds into a like-kind property, deferring capital gains taxes. This exchange can be a game-changer for real estate investors in California, as it helps preserve more capital for further investments. Steps to Complete a 1031 Exchange in California To complete a 1031 Exchange in California, follow these basic steps: first, sell your property. Next, hire a qualified intermediary to handle the funds from the sale, ensuring that the exchange is structured correctly. Within 45 days of the sale, identify potential replacement properties, and then complete the purchase of one or more of these properties within 180 days. What Property Types Qualify for a California 1031 Exchange? Not all property types qualify for a 1031 Exchange California. To be eligible, the property must be used for business or investment purposes—think commercial properties, rental properties, or vacant land. Primary residences and vacation homes don’t meet the requirements, though there are exceptions if the property is rented out for a significant amount of time. Types of 1031 Exchange Structures in California There are several structures of 1031 Exchange California: 1.Simultaneous Exchange, where the sale and purchase happen on the same day. 2.Delayed Exchange, where the sale and purchase are separated by time, as long as the replacement property is bought within 180 days. 3.Reverse Exchange, where you acquire the new property first and then sell the old one. 4.Construction Exchange, where improvements are made to the new property with the proceeds from the old one. Each structure has its own rules and timeline requirements. California 1031 Exchange Time Limits The time limits for a 1031 Exchange in California are strict. Once you sell your property, you have 45 days to identify potential replacement properties. This identification period is crucial, as it sets the foundation for completing the exchange. After identification, you must close on the replacement property within 180 days of the sale of the original property. Thank You Visit: www.altfn.com