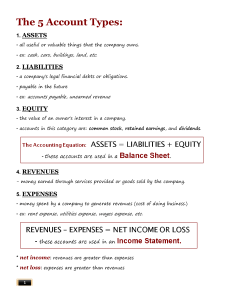

Introductory Financial Accounting I Class 3 | Operating Decisions and the Accounting System Professor Andrea Down Fall 2024 Let’s Start with a Laugh ☺ Announcements ▪ Midterm Exam: Wednesday, October 16th @ 17:00 – 19:00 • More details closer to exam • Last class before exam will be review Announcements ▪ Accounting Orientation Day (see details on Quercus) • Registration has now started; deadline = October 11 @ 11:59PM • This is a mandatory event for all accounting students • You will receive 1 bonus mark for one of the accounting courses you are taking this term • You can access to the registration via Quercus under the course shell 'Accounting Events 2024 Fall – Years ½ and Years ¾’ • The form is listed under the module 'Accounting Orientation Day' Recap ▪ Two things in this class will ALWAYS be true: 1. Assets = Liabilities + Owners’ Equity 2. Debits = Credits Recap: Balance Sheet Assets LIABILITIES ASSETS OWNERS’ EQUITY Liabilities or Owners’ Equity Recap: Balance Sheet Recap: Journal Entries ⬜ ASSET = LIABILITIES + OWNERS’ EQUITY ⬜ DEBITS = CREDITS Agenda ▪ ▪ ▪ ▪ Operating cycle Cash basis and accrual accounting Revenue recognition Matching process The Operating Cycle ▪ The operating cycle (or cash-to-cash) cycle is the time it takes for a company to pay cash to suppliers, sell those goods and services to customers, and collect cash from customers The Periodicity Assumption ▪ To provide timely information for decision makers, we report financial information for relative short periods (e.g., monthly, quarterly, annually) ▪ Two types of issues arise when reporting periodic net earnings: • Recognition issues: When should the transactions be recognized, classified, and recorded? • Measurement issues: What amounts should be recognized and recorded for the transactions? Classified Statement of Earnings ▪ The statement of earnings includes a number of sections and subtotals to aid the user in identifying the company’s earnings from operations for the year, and to highlight the effect of other items on net earnings Classified Statement of Earnings Net sales − Cost of sales = Gross profit − Operating expenses = Earnings from operations +/− Non-operating revenues/expenses and gains/losses = Earnings before income taxes − Income tax expense = Earnings from continuing operations +/− Earnings/loss from discontinued operations = Net earnings Classified Statement of Earnings Example: Dollarama Classified Statement of Earnings Income Statement T-Accounts Revenues and Gains Expenses and Losses (many accounts) (many accounts) - + + - DEBIT CREDIT DEBIT CREDIT Income Statement T-Accounts Revenues and Gains Expenses and Losses + with Credits + with Debits Accounts have CREDIT balances Accounts have DEBIT balances Balance Sheet Assets LIABILITIES ASSETS CONTRIBUTED CAPITAL RETAINED EARNINGS Liabilities or Owners’ Equity Cash Basis Accounting ▪ Some small businesses use cash basis accounting ▪ Revenues are recorded when cash is received and expenses are recorded when cash is paid ▪ The cash basis also does not necessarily reflect all assets and liabilities of a company on a particular date ▪ A cash basis is often adequate for small businesses, which usually do not have to report to external users Accrual Accounting ▪ Required by IFRS and ASPE ▪ Revenues and expenses are recognized when the transaction that causes them occurs, not necessarily when cash is received or paid ▪ Revenues are recognized when they are earned and expenses when they are incurred ▪ The revenue recognition principle and the matching process determine when revenues and expenses are to be recorded under accrual basis accounting Revenue Recognition Principle ▪ Specifies both the timing and amount of revenue to be recognized during an accounting period ▪ It requires that a company recognize revenue when goods and services are transferred to customers in an amount it expects to receive ▪ Revenue is earned when the business delivers goods or services, although cash can be received from customers • In a period before delivery • In the same period as delivery • In a period after delivery Example 1: Revenue Recognition ▪ Cash is received before the goods or services are delivered Debit Credit On receipt of $1,000 cash deposit Cash 1,000 Deferred revenue 1,000 On delivery of ordered goods Deferred revenue Sales revenue 1,000 1,000 Example 2: Revenue Recognition ▪ Cash is received in the same period as the goods or services are delivered Debit Credit On delivery of purchased goods for $300 cash Cash Sales revenue 300 300 Example 3: Revenue Recognition ▪ Cash is received after the goods or serviced are delivered Debit Credit On delivery of purchased goods for $500 on account Accounts receivable 500 Sales revenue 500 On receipt of cash after delivery Cash Accounts receivable 500 500 The Matching Process ▪ Requires that expenses be recorded when incurred in earning revenue ▪ All of the resources consumed in earning revenues during a specific period must be recognized in that same period ▪ A matching of costs with benefits Recording Expenses vs Cash Payments ▪ As with revenues and cash receipts, expenses are recorded as incurred, regardless of when cash is paid ▪ Cash may be paid before, during, or after an expense is incurred ▪ An entry is made on the date the expense is incurred and another one on the date of the cash payment, if at different times Example 1: The Matching Process ▪ Cash is paid before the expense is incurred to generate revenue Debit Credit On payment of $200 for office supplies Office supplies 200 Cash 200 On subsequent use of half of the supplies Supplies expense Office supplies 100 100 Example 2: The Matching Process ▪ Cash is paid in the same period as the expense is incurred to generate revenue Debit Credit On payment of $500 for using a repair service Repairs expense Cash 500 500 Example 3: The Matching Process ▪ Cash is paid after the cost is incurred to generate revenue Debit Credit On the use of $4,000 of employees’ services during the period Salaries expense 4,000 Salaries payable 4,000 On payment of cash after using employees’ services Salaries payable Cash 4,000 4,000 Key Takeaways ▪ Most companies use accrual accounting ▪ We recognize revenues when goods and services are transferred to customers • Cash payment could occur before, at the same time, or after ▪ We record expenses when they are incurred • Cash payment could occur before, at the same time, or after ▪ Revenue accounts have credit balances ▪ Expense accounts have debit balances