Engineering Economics: Interest & Equivalence - ECO 130

advertisement

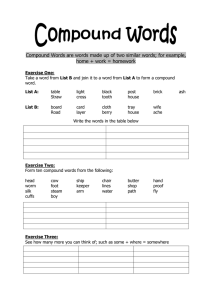

ENGINEERING ECONOMICS ECO - 130 Lecture # 3 Interest & Equivalence Cash Flow Diagram Simple & Compound Interest Time Value of Money Present Value Outline/Sequence • Intrest rates (Simple & Compound) • Compound intrest rates (Present value of money) • Compounding (Quaterly Compounding & Semi annually Compounding) • Economic Eqivalancy INTEREST RATE/ TIME VALUE OF MONEY Question: Would you prefer Rs. 5000 today or after 1 year? • We know that receiving Rs. 5000 today is worth more than in the future. This is due to OPPORTUNITY COSTS (Foregone resource). Interest Rate is always positive • Opportunity cost of receiving Rs. 5000 in the future is the interest as it is the compensation for we could have earned if we had received the Rs. 5000 sooner. “using money/ uncertainties • There is a time value of money. Money is an asset, & people related to the future value of would pay to have money available for use. The charge for its money. use is called “Interest Rate”. TYPES OF INTEREST SIMPLE INTEREST It is the interest that is computed on the original sum and entire duration of loan. For example, if the loan amount is “P=Present Vale”, the duration of loan is “n” years and rate of interest is “i %”, then after “n” years the lender will have an amount “F = Future Value” F = P + n × (i P) = P (1 + i n) given as: Example: If an amount of Rs 5000/- is given on loan for 5 x years on simple interest of 8% per year. Calculate the amount the lender have after 5 x years. The lender will have F= 5000(1+0.08 x 5) =7000/- Analysis of Simple Interest: The interest and the principle amount are paid at the end of the loan period and the amount of interest that should actually be due after each year is used by the borrower free of cost. For Example: The interest on Rs 5000/ after 1st year of borrowing should be = 0.08x5000= Rs 400/-. Being simple interest the borrower do not give interest on this amount to the lender & continue using it for next 4 x years End of Year Beginning Balance (Rs) Interest (Rs) 0 Ending Balance (Rs) 5,000 1 5000 400 5400 2 5400 400 5800 3 5800 400 6200 4 6200 400 6600 5 6600 400 7000 F = P (1 + i n), There are 4 variables, if 3 are given the 4th can easily be calculated P = $1,000 i = 8% N = 3 years what will be the ending balance that has to be returned at the end of 3 years? End of Year Beginning Interest Balance earned 0 Ending Balance $1,000 1 $1,000 $80 $1,080 2 $1,080 $80 $1,160 3 $1,160 $80 $1,240 TYPES OF INTEREST COMPOUND INTEREST It is the interest charged on the original sum and un-paid interest. For example, if the loan amount is “P”, the duration of loan is “n” years and rate of interest is “i %” per year, then after “n” years the lender will have an amount “F” given as: Single Payment Compound Interest F = P (1+i)n Example: If an amount of Rs 5000/- is given on loan for 5 x years on compound interest of 8% per year. Calculate the amount the lender have after 5 x years. The lender will have F= 5000(1+0.08)5 =7346.64/n = 0:P n= 1: F1= P (1+i) End of Year Beginning Balance (Rs) Interest (Rs) Ending Balance (Rs) n= 2: F2= F1(1+i) = P(1+i)2 0 n= 3: F3= F2(1+i) = P(1+i)3 1 5000 400 5400 2 5400 432 5832 3 5832 466.56 6298.56 4 6298.56 503.88 6802.44 5 6802.44 544.2 7346.64 n= 4: F4= F3(1+i) = P(1+i)4 n= 5: F5= F4(1+i) = P(1+i)5 n= n: Fn= Fn-1 (1+i) = P(1+i)n 5,000 Cash Flow Diagram F = P (1+i)n , There are 4 variables, if 3 are given the 4th can easily be calculated You put $500 in a bank for 3 years at 6% compound interest per year.What will be the amount at the end each year? F = P (1+i)n At the end of year 1 you have (1+0.06) 500 = $530 At the end of year 2 you have (1+0.06) 530 = $561.80 At the end of year 3 you have (1+0.06) $561.80 = $595.51 Note: $595.51 = (1.06) 561.80 = (1.06) (1.06) 530 = (1.06) (1.06) (1.06) 500 = 500 (1.06)3 COMPOUND INTEREST – PRESENT VALUE Example: If you want to have $800 in savings at the end of four years, and compound interest of 5% interest per year, how much do you need to put into the savings account today? F = P (1+i)n P =F/ (1+i)n P = 800/(1.05)4 = 800 x 0.8227=$658.16 P = F (P/F,i,n) This value is available in the compound interest table P = 800(P/F, 5%,4) = 800 x 0.8227= $658.16 TABLE LOGIC F=P (1+i)n F/P = (1+i)n P/F = 1/ (1+i)n Compound Amount Factor: For generally used interest rates “i" tables with various values of “n” have been developed to readily provide the value of (1+i)n to the user to find F by multiplying it with P Present Worth Factor: Similarly P/F or 1/ (1+i)n to readily calculate the present value by multiplying it with “F” COMPOUND INTEREST – PRESENT VALUE Example: In 3 years, you need Rs 400 to pay a debt. In two more years, you need Rs 600 more to pay a second debt. How much should you put in the bank today to meet these two needs if the bank pays an annual compound interest of 12% per year? P = 400/ (1+0.12)3 +600/ (1+0.12)5 = 284.72 + 340.44 = Rs 625.16/- P = 400 x 0.7118 + 600 x 0.5674 = 284.72 + 340.44 = Rs 625.16/- COMPOUND INTEREST – INTEREST RATE & NUMBER OF YRS Example: $800 is needed after F/P = 1.2155 i = (1.2155, i%, 4) four years. What interest rate per P/F = 0.8227 i = (0.8227, i%, 4) against n=4 year you should be looking for if Check any of these values in tables Or use the formula i= [(1/(P/F))1/n -1] x 100 you have $658.16 for investment:F/P = 1.2155 n = (1.2155, i%, n) Example: Investing $658.16 at the P/F = 0.8227 n = (0.8227, i%, n) compound interest rate of 5% per Check any of these values in tables against i=5% Or use the formula n= (ln F/P)/ln (1+i) year. How many years will it take to have $800 in your account :- QUARTERLY COMPOUND INTEREST Example: You put Rs 500 in a bank for 3 years at 6% compound interest per year. Interest is compounded quarterly. Find the amount after 3 years. F = P (1+i)n What’s i = ??? Whats n =??? i = 6/4 = 1.5% / 3 months n = 3 x 4 = 12 F = 500 ( 1+0.015)12 = Rs 597.81 COMPOUND INTEREST – NUMBER OF YRS Example: How long will it take for $1,000 to double in value, at an interest rate of 5% compounding semi annually? F = P (1 + i)n 2000 = 1000 (1.025)n 1.025 n = 2 Taking ln on both sides n ln(1.025) = ln (2) n = 28.07 As it is compounding semi annually, it will take 14.5 years but amount will be a bit higher than Rs 2000 COMPOUND INTEREST – NUMBER OF YRS Example: How long will it take for $1,000 to double in value, at an interest rate of 5% compounding annually? F = P (1 + i)n 2000 = 1000 (1.05)n 1.05n = 2 Taking ln on both sides n ln(1.05) = ln (2) n = 14.2067 It will take 15 years but amount will be a bit higher than Rs 2000 ECONOMIC EQUIVALENCE Which one would you prefer? • $20,000 today • $50,000 ten years from now • $8,000 each year for the next ten years We need to compare their economic worth! Example: Ali borrowed Rs 5,000 from a bank at 8% interest rate and have to pay it back in 5 years. There are many ways the debt can be repaid. • Plan A: At end of each year pay Rs 1,000 principal plus interest due. Economic equivalence exists between cash • Plan B: Pay interest due at end of each year and flows if they have the same economic effect principal at end of five years. Which depends on • Interest rate • Amounts of money involved • Time Period BOTH SYSTEMS SHOULD HAVE SAME TIME VALUE OF MONEY • Plan C: Pay Rs 1250/- in five end-of-year payments. • Plan D: Pay principal and interest in one payment at end of five years. ECONOMIC EQUIVALENCE Plan A: Pay Rs 1,000 principal + interest (Yrly) Plan B: Pay Yrly interest & principal after 5 yrs Plan C: Pay in five endof-year payments PLAN A PLAN B Total Payment Yr Amt Owed Int Owed Total Principal Owed Payment 1,000 1,400 1 5,000 400 5,400 852 1,252 4,320 1,000 1,320 2 4,148 332 4,480 920 1,252 240 3,240 1,000 1,240 3 3,227 258 3,485 994 1,252 2,000 160 2,160 1,000 1,160 4 2,233 179 2,412 1,074 1,252 1,000 80 1,080 1,000 1,080 5 1,160 93 1,252 1,160 1,252 5,000 6,200 SUM 5,000 6,260 Yr Amt Int Total Principal Owed owed Owed Payment 1 5,000 400 5,400 2 4,000 320 3 3,000 4 5 SUM Plan D: Pay principal + interest after five years 1,200 1,261 Total Payment ECONOMIC EQUIVALENCE Plan A: Pay Rs 1,000 principal + interest (Yrly) Plan B: Pay Yrly interest & principal after 5 yrs Plan C: Pay in five endof-year payments PLAN C PLAN D Amt Owed Int Owe d Total Principal Total Owed Payment Payment 1 5,000 400 5,400 0 400 2 5,000 400 5,400 0 400 3 5,000 400 5,400 0 4 5,000 400 5,400 5 5,000 400 5,400 Yr SUM 2,000 Plan D: Pay principal + interest after five years Yr End of Yr payment Amount Owed 1 0 5,000 2 0 5,400 400 3 0 5,832 0 400 4 0 6,299 5,000 5,400 5 7,347 6,802 5,000 7,000 SUM 7,347 29,333 ECONOMIC EQUIVALENCE Example: Ali borrowed Rs 5,000 from a bank at 8% interest rate and have to pay it back in 5 years. There are many ways the debt can be repaid. • Plan A: At end of each year pay Rs 1,000 principal plus interest due. • Plan B: Pay interest due at end of each year and principal at end of five years. • Plan C: Pay in five end-of-year payments. • Plan D: Pay principal and interest in one payment at end of five years. SUMMARY OF PAYMENT PLAN a b c d Plan Amount Total Area Under Curve Ratio Paid Interest (Amount OWED) b/c A 6,200 1,200 15,000 0.08 B 7,000 2,000 25,000 0.08 C 6,260 1,260 15,767 0.08 D 7,347 2,347 29,333 0.08 What is the common property in all Plans? It is Interest Rate=Total Interest/Area under the curve Or Total Interest = Interest Rate x Area under the curve Ratio .08 is constant – all payment methods are equivalent – equivalence is established between all alternatives Example: Assuming both the cash flows to be same calculate the value of ‘C’ assuming an interest rate of 12%. $300 $100 0 1 $300 $300 $C $100 2 3 4 Time Value of Money 100/1.12 + 100/ 1.12^2 + 300/1.12^3 + 300/1.12^4 + 300/1.12^5 = $743 5 0 1 2 $C $C $C 3 4 5 Time Value of Money 743 = C/1.12 + C/1.12^2 + C/1.12^4 + C/1.12^5 743 = 0.8928C + 0.7971C + 0.6355C + 0.5674C 743 = 2.8928C C= $257 ? Any Questions