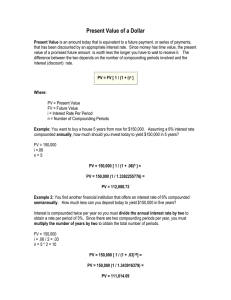

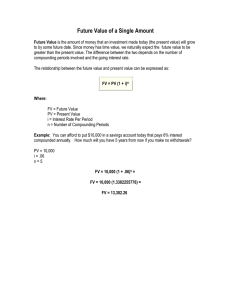

THE IMPORTANCE OF THE TIME VALUE OF MONEY The notion that money has a time value is one of the most basic concepts in investment analysis. Making decisions today regarding future cash flows requires understanding that the value of money does not remain the same throughout time. A dollar today is more valuable than a dollar in the future.: Reason 1: Cash flows occurring at different points in time have different values relative to any one point in time. One dollar one year from now is not as valuable as one dollar today. After all, you can invest a dollar today and earn interest so that the value it grows to next year is greater than the one dollar today. This means we have to take into account the time value of money to quantify the relation between cash flows at different points in time. Reason 2: Cash flows are uncertain. Expected cash flows may not mate rialize. Uncertainty stems from the nature of forecasts of the timing and the amount of cash flows. We do not know for certain when, whether, or how much cash flows will be in the future. This uncertainty regarding future cash flows must somehow be taken into account in assessing the value of an investment. Translating a current value into its equivalent future value is referred to as compounding. Translating a future cash flow or value into its equivalent value in a prior period is referred to as discounting. The amount that you are willing to lend today is the loan’s present value. The amount that you require to be paid at the end of the loan period is the loan’s future value. Therefore, the future period’s value is comprised of two parts: Future value = Present value + Interest DETERMINING THE FUTURE VALUE Suppose you deposit $1,000 into a savings account at the Surety Savings Bank and you are promised 10% interest per period. At the end of one period, you would have $1,100. This $1,100 consists of the return of your principal amount of the investment (the $1,000) and the interest or return on your investment (the $100). Let’s label these values: $1,000 is the value today, the present value, PV. $1,100 is the value at the end of one period, the future value, FV. 10% is the rate interest is earned in one period, the interest rate, i. To get to the future value from the present value: FV = PV +(PV × i)… i.e FV = PV(1 + i) FV = $1,000 + ($1,000 × 0.10) = $1,000(1 + 0.10) = $1,100 If the $100 interest is withdrawn at the end of the period, the principal is left to earn interest at the 10% rate. Whenever you do this, you earn simple interest. It is simple because it repeats itself in exactly the same way from one period to the next as long as you take out the interest at the end of each period and the principal remains the same. If, on the other hand, both the principal and the interest are left on deposit at the Surety Savings Bank, the balance earns interest on the previously paid interest, referred to as compound interest. Earning interest on interest is called compounding because the balance at any time is a combination of the principal, interest on principal, and interest on accumulated interest (or simply, interest on interest). To determine the future value with compound interest for more than two periods FV = PV(1 + i)N The value of N is the number of compounding periods, where a compounding period is the unit of time after which interest is paid at the rate i. The relation between present and future values for a principal of $1,000 and interest of 10% per period through 10 compounding periods. For example, the value of $1,000, earning interest at 10% per period, is $2,593.70, which is 10 periods into the future: FV = $1,000(1 + 0.10)10 = $1,000(2.5937) = $2,593.70 A common investment product of a life insurance company is a guaranteed investment contract (GIC). With this investment, an insurance company guarantees a specified interest rate for a period of years. Suppose that the life insurance company agrees to pay 6% annually for a five-year GIC and the amount invested by the policyholder is $10 million. The amount of the liability (that is, the amount this life insurance company has agreed to pay the GIC policyholder) is the future value of $10 million when invested at 6% interest for five years. PV = $10,000,000, i = 6%, and N = 5, so that the future value is FV = $10,000,000(1 + 0.06)5 = $13,382,256 Let’s use an example of a deposit of $1,000 in an account that pays interest at a rate of 12% per year, with interest compounded for different compounding frequencies. How much is in the account after, say, five years depends on the compounding frequency: 1. annual Suppose we invest $200,000 in an investment that pays 4% interest per year, compounded quarterly. What will be the future value of this investment at the end of 10 years? The given information is i = 4%/4 = 1% and N = 10 × 4 = 40 quarters. Therefore, FV = $200,000(1 + 0.01)40 = $297,772.75 Multiple Rates We can extend the calculation of a future value to allow for different interest rates or growth rates for different periods. Suppose an investment of $10,000 pays 9% during the first year and 10% during the second year. At the end of the first period, the value of the investment is $10,000 (1 + 0.09), or $10,900. During the second period, this $10,900 earns interest at 10%. Therefore, the future value of this $10,000 at the end of the second period is DETERMINING THE PRESENT VALUE The future value, FV = $5,000. The number of compounding periods, N = 2. The interest rate, i = 10%. We also know the basic relation between the present and future values: FV = PV(1 + i)N Substituting the known values into this equation: $5,000 = PV(1 + 0.10)2 Therefore, you would be willing to lend $4,132.25 to receive $5,000 one year from today if your opportunity cost is 10%. Suppose that the goal is to have $75,000 in an account by the end of four years. And suppose that interest on this account is paid at a rate of 5% per year, compounded semiannually. How much must be deposited in the account today to reach this goal? We are given FV = $75,000, i = 5%/2 = 2.5% per six months, and N = 4 × 2 = 8 six-month periods. Therefore, the amount of the required deposit is: Questions: Future Value Calculation (Annual Compounding) You invest $3,000 in an account that pays 7% interest annually. What will be the future value of the investment after 4 years? Present Value Calculation (Quarterly Compounding) You want to have $50,000 in 6 years. The interest rate is 5% annually, compounded quarterly. How much money do you need to deposit today to reach your goal? Future Value with Multi-Stage Interest Rates You invest $10,000. The interest rate is 6% for the first year and 8% for the second year. What will the future value of the investment be after 2 years? Present Value Calculation with Semi-Annual Compounding You need $40,000 in 5 years, and the interest rate is 6% per year, compounded semi-annually. How much money do you need to deposit today to reach this amount?