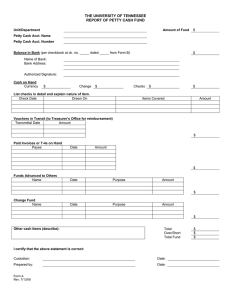

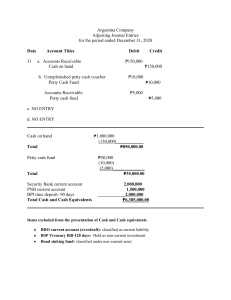

CASH AND CASH EQUIVALENTS Cash includes money and any other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. To be reported as cash, an item must be unrestricted in use. This means that the cash must be readily available in the payment of current obligations and not be subject to any restrictions. Bank Deposits • Savings - Demand deposit Current/Checking (cash) • - Demand deposit (cash) • Time - Not a demand deposit (not cash) - May be considered as cash equivalent Relevant Standards Financial Instruments Standards • • • • depositor 4. Antedated checks (checks dated on past date) – part of cash and cash equivalents provided that they are to be encashed or deposited to the bank six months following the date of the check. 5. Stale checks (checks long outstanding) – not part of cash and cash equivalents because it is deemed to be expired. Checks must be deposited or encashed six months following the date of the check. PAS 32 – Presentation PAS 39 – Recognition and Measurement PFRS 7 – Disclosures PFRS 9 – Financial Instruments (01.01.18) Other Standards • • Types of checks: 1. Post-dated checks - not part of cash and cash equivalents 2. Not sufficient fund (NSF) checks – not part of cash and cash equivalents 3. Certified checks – part of cash and cash equivalents because it is certified and insured by the bank to have sufficiency of fund backed in the check. Examples of certified checks include: a. Manager’s check – certified by the manager of the bank b. Cashier’s check – certified by the teller or cashier of the bank c. Traveller’s check – certified for travel purposes of the PAS 1 – Presentation of FS PAS 7 – Statement of Cash Flows What is Cash? - Includes cash on hand and other negotiable instrument payable in money and acceptable by the bank for deposit and immediate credit - Cash include currency and coins, petty cash fund, change fund and negotiable instruments like checks and bank drafts - To be reported as cash, items must be readily available and not restricted for use in the payment of current obligations. Included in cash: • Coins and bills in legal tender by BSP • Checks (subject to certain conditions) • Bank drafts • Money orders (money market funds) Cash comprises cash on hand and demand deposits. (PAS 7) Cash on hand includes undeposited coin and currency, petty cash funds, change funds, and negotiable instruments such as personal checks. Demand deposits are unrestricted funds that can be withdrawn upon demand from a bank where they have been deposited. Example Analysis of a Check The date of the check is on October 15, 2014 and has an amount of P15,000. The check is not certified by the bank. Therefore: ▪ Before October 15, 2014, the check is post-dated and the maker should have at least P15,000 in his account. ▪ On October 15, 2014, if the maker has failed to have at least P15,000 in his account, the check would bounce or marked as NSF check. Once the check is deposited to the bank, the drawer will receive a notice of DAIF (drawn against insufficient funds) ▪ After October 15, 2014, assuming the check has sufficient funds, it will be an antedated check. ▪ On April 15, 2015 (six months after the check date), assuming the check has not been deposited nor encashed, it is deemed as expired and it will become a stale check. The following cash items are included in “cash.” • Cash on hand – cash collections and cash items (checks, bank drafts and money orders) awaiting bank deposit • Cash in bank – demand or savings deposit, or checking account which are unrestricted as to withdrawal • Cash fund – cash set aside for current purposes (petty cash fund, payroll fund, dividend fund. Cash equivalents- short-term and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rates. [PAS 7 (Statement of Cash Flows) definition] Included in cash equivalents: ▪ Three-month BSP treasury bill ▪ Three-year BSP treasury bill purchased three months before maturity date ▪ Three-month bank deposit ▪ Three-month money market instrument ▪ Preference shares with specified redemption date and acquired three months before redemption date ▪ Certificates of deposit (having original maturities of 90 days or less) Items Not Cash or Cash Equivalents 1. Time certificates of deposit (if original maturity over 90 days) 2. IOU’s from officers 3. Sinking Fund Cash 4. NSF checks and post-dated checks- it should be reverted back to A/R 5. Postage stamps 6. Cash in closed bank –classify realizable value as other receivables Bank Overdraft Measurement ▪ Cash is measured at face value. ▪ Cash in foreign currency is measured at current exchange date (balance sheet date) ▪ Cash is measured at estimated realizable value if bank is in financial difficulty or bankruptcy and if recoverable amount is lower than face value (currently, cash account is insured up to P500,000) Classification for investments ▪ If term is three months or less, classified as cash equivalents ▪ If term is more than three months but within one year, classified as marketable securities, or short-term investments, and are separate current assets in the financial statements ▪ If term is more than one year, classified as long-term investments which are non-current assets. Cash in a foreign bank ▪ If not subject to foreign exchange restriction, they are included as cash. ▪ If subject to foreign exchange restriction and material, they are reclassified as cash restricted in foreign bank which are non-current assets. _____________________________________________ Unrestricted - Reported as part of cash in their Philippine peso equivalents as of the end of the reporting period. Current – Other current assets Noncurrent – Other noncurrent assets Cash fund set for a purpose ▪ For use in current operations – classified as current asset. Examples include: petty cash fund, payroll fund, travel fund, interest fund, dividend fund, and tax fund. ▪ For use in non-current operations – classified as long-term investment. Examples include sinking fund, contingent fund, fund for acquisition of PPE, etc. If the fund is set aside for use within one year after the reporting period, it will be reclassified as current asset. When cash in bank account has a credit balance. ▪ It is classified as a current liability and should not be offset against other bank accounts with debit balances ▪ Exception to the rule: If an entity maintains two or more bank accounts in one bank and one account results in an overdraft, such overdraft can be offset against the other bank account with debit balance. – Credit balance in the cash account resulting from the issuance of checks in excess of the amount on deposit – Normally reported as a current liability (short term borrowing) – May be offset against other bank accounts if maintained within the same bank – If repayable on demand and integral part of cash management, included in cash and cash equivalents. (PAS 7.7-8) Compensating Balance- Generally takes the form minimum checking or demand deposit account balance that must be maintained in connection with a borrowing arrangement with a bank. Classification of Compensating Balance: a) If the deposit is not legally restricted as to withdrawal by the borrower because of an informal compensating balance agreement = part of cash b) If the deposit is legally restricted because of a formal compensating balance agreement = classified separately as “cash held as compensating balance” under current assets if the related loan is short-term c) If the related loan is long term = classify as noncurrent investment Restricted • • ▪ Presentation • Unrestricted Cash • Restricted: - Short term borrowing – OCA Long term borrowing – ONCA Undelivered checks – checks that is drawn and recorded but is not given to payees; it is still cash of the company. Pro-forma Entry Cash xxx Accounts payable xxx Post-dated checks delivered – checks that is sent to payees but has a date subsequent in the reporting period; it is still cash of the company. of postponements of the entries for the collection of receivables, possible because of poor internal control. Kitting - Occurs when a check is drawn against a first bank and depositing the same check in a second bank to cover the shortage in the latter bank. No entry is made for both transactions. Theft of cash - Stale checks – checks released by the company that has been expired Pro forma Entry Cash Unauthorized removal of misappropriation and etc. cash, malversation or Control of Cash xxx Miscellaneous income xxx (if immaterial) • • Imprest system • • • Utilization of Petty Cash Fund Cash xxx Accounts payable xxx (if material) Time Deposits - Deposits that are not immediately available for withdrawal or that have other restrictions. All cash and receipts are deposited all disbursements made by check. intact Segregation of duties Bank reconciliation Examples • • Certificates of deposit Money market savings certificates Presentation • • • Not more than 3 mos. – Cash equivalents 3 mos. but not > 1 yr. – Short Term Investment More than 1 year – Long Term Investment ILLUSTRATION – KIESO, ET AL IMPREST SYSTEM IMPREST SYSTEM - A system of control of cash which requires that all cash receipts should be deposited intact and all cash disbursements should be made by means of check. Petty Cash Fund- is money set aside to pay small expense which cannot be conveniently paid by means of check. There are two methods of handling the petty cash, namely I. IMPREST FUND SYSTEM Journal entries: 1. To establish the fund: Petty Cash fund Cash in bank xx xx 2. Payment of expenses out of the fund NO JOURNAL ENTRY (memo entries only) 3. Replenishment of petty cash payments: Expenses Cash in bank ISSUES IN CASH Window Dressing - Opening the accounts even after the reporting period. In a broad sense, WD is any deliberate misstatement of assets, liabilities, equity, income and expenses. Lapping - Used for concealing cash shortage. Practice used for concealing cash shortage, where it consists of misappropriating collections in customers. It consists of misappropriating a collection from one customer and concealing the defalcation by applying a subsequent collection made from another customer. Involves series xx xx 4. Year-end adjustment to adjust the unreplenished expenses in order to estate the correct petty cash balance: Expenses xx Petty Cash fund xx Note: The adjustment is to be reversed at the BEG of the next accounting period so that normal replenishment procedures may be followed. 5. An increase in the fund is recorded as follows: Petty Cash fund xx Cash in bank xx 6. A decrease in the fund is recorded as follows: Cash in Bank xx Petty Cash fund xx II. FLUCTUATING FUND SYSTEM ▪ ▪ Petty cash disbursements are immediately recorded. The checks drawn to replenish the fund do not necessarily equal the petty cash disbursements. 1. To establish the fund: Petty Cash fund Cash in bank 2. Payment of expenses out of the fund : Expenses Petty Cash fund ACCOUNTING FOR CASH SHORTAGE/OVERAGE Occasional errors may cause the petty cash fund to be out of balance. The sum of the cash and receipts will differ from the correct Petty Cash balance. This might be the result of simple mistakes, such as math errors in making change, or perhaps someone failed to provide a receipt for an appropriate expenditure. Whatever the cause, the available cash must be brought back to the appropriate level. Accounting for cash shortage/overage Cash count < balance per book = cash shortage Cash count > balance per book = cash overage xx xx xx Accounting for cash shortage The entry to record cash shortage is: Cash short or over Cash xx Note: The cash short or over account is only a temporary or suspense account. When financial statements are prepared, the same should be adjusted. Hence, xx 3. An increase in the fund is recorded as follows: Petty Cash fund xx Cash in bank 4. Year-end adjustment: NO adjustment necessary because the petty cash expenses are recorded outright. 5. A decrease in the fund is recorded as follows: Cash in Bank xx Petty Cash fund If the cashier is responsible for cash shortage, the adjustment is: Due from cashier Cash short or over xx xx xx If reasonable efforts fail to disclose the cause of the shortage, the adjustment is: Loss from cash shortage Cash short or over. Accounting for cash overage The entry to record cash overage is: Cash Cash short or over xx xx Note: Whether it is a cash shortage or cash overage, the offsetting account is cash short or over account. Such account should be adjusted when statements are prepared. The cash overage is treated as miscellaneous income if there is no claim on the same , the entry is: Cash short or over Miscellaneous income Where the cash overage is properly found to be the money of the cashier, the entry is: Cash short or over Payable to cashier BANK RECONCILIATIONS Bank reconciliation is a statement which brings into agreement the cash balance per book and cash balance per bank. The reconciliation compares the amount of cash shown on the monthly bank statement with the amount of cash reported in the general ledger. RECONCILING ITEMS: 1. Book Reconciling Items: a) Credit memos- refer to items not representing deposits credited by the bank to the account of the depositor but not yet recorded by the depositor as cash receipts. Examples: ▪ ▪ ▪ b) Debit memos- refer to items w/c are charged or debited by the bank to the account of the depositor but not yet recorded by the depositor as cash disbursements. Examples: ▪ ▪ ▪ ▪ c) 2. N/R collected by bank in favor of the depositor and credited to the account of the depositor Proceeds of bank loan credited to the account of the depositor Matured time deposits transferred by the bank to the current account of the depositor NSF checks Technically defective checks Bank service charges Reduction of loan- payment of loan Errors Bank Reconciling Items: a) Deposits in transit – are collections already recorded by the depositor as cash receipts but not yet reflected on the bank statement. b) Outstanding checks- already recorded by the depositor as cash disbursements but not yet reflected on the bank statement. Note: certified check should be deducted from outstanding check (if included therein) because they are no longer outstanding for bank recon purposes. c) Errors SEVERAL FACTORS BRING ABOUT THIS DIFFERENTIAL a. Deposits in transit = Funds sent by the depositor to the bank that have not been recorded by the bank and deposits made after the bank's cutoff date will not be included in the bank statement. In both cases, the balance per the depositor's records will be higher than those of the bank. b. Outstanding checks = Checks written for payment by the depositor that have not been presented to the bank will result in a higher balance per bank records than per depositor records. c. Service charges = Service charges are deducted by the bank. The depositor will not deduct this amount from its records until it is made aware of the charge, usually in the following month. Balance per books is overstated until this amount is subtracted. d. Bank collections = the bank may make collections on the depositor's behalf, increasing the depositor’s bank balance. If the depositor is not aware the collection was credited to its balance, the balance per depositor's records will be understated. Proforma Reconciliation: Adjusted Balance Method ABM means that the book balance and the book balance are adjusted to equal correct cash balance. Book Balance XX Add: Credit Memos XX Total XX Less: Debit Memos XX Adjusted Bank Balance XX Bank Balance XX Add: Deposits in transit XX Total XX Less: Outstanding Checks XX Adjusted Bank Balance XX Note: Errors will have to be analysed for proper treatment. But errors are reconciling items of the party which committed them. Problem No. 4 Practice Set Problem No. 1 On January 1, 2016, Tinoc Company borrows 2,000,000 from National Bank at 12% annual interest. In addition, Tinoc is required to keep a compensatory balance of 200,000 on deposit at National Bank which will earn interest at 4%. The effective interest that Tinoc pays on its 2,000,000 loan is: a. 10.0% b. 11.6% c. 12.0% d. 12.8% Problem No. 2 Cash in bank balance of William Co. on January 1, 2016 was 70,000 representing 35% paid-up Capital of its authorized share capital of 200,000. During the year you ascertained the following postings to some accounts, as follows: Debit Credit Petty Cash Fund 2,000 Accounts Receivable Trade 450,000 290,000 Subscription Receivable 60,000 50,000 Delivery Equipment 50,000 Accounts Payable Trade 280,000 430,000 Bank Loan 35,000 80,000 Accrued Expenses The petty cash fund of Guiguinto Company on December 31, 2016 is composed of the following: Coins and Currencies 14,000 Petty Cash Vouchers: Gasoline Payments 3,000 Supplies 1,000 Cash advances to employees 2,000 Employee’s check returned by bank marked NSF Check drawn by the company payable to the order of the petty cash custodian, representing her salary A sheet of paper with the names of employees together with contribution for a birthday gift of a co-employee in the amount of 5,000 20,000 8,000 53,000 The petty cash ledger account has an imprest balance of 50,000. What is the correct amount of petty cash on December 31, 2016? a. 34,000 b. 14,000 c. 39,000 d. 42,000 Theory Questions 1,500 Subscribed Share Capital 60,000 Authorized Share Capital 130,000 Unissued Share Capital 200,000 Sales 450,000 Purchases Expenses (including depreciation of 5,000 and accrued expense of 1,500) 430,000 2. Cash equivalents are 90,000 Cash in bank balance at December 31, 2016 was: a. 41,500 b. 33,000 c. 34,500 1. As defined in PAS 7, cash comprises a. Cash on hand b. Demand deposits c. Cash equivalents d. Both a and b a. Short term highly liquid investments d. 39,500 b. Readily convertible to known amounts of cash c. Subject to an insignificant risk of changes in value Problem No. 3 An office supplies enterprise, operating on a calendar year basis, has the following data in its accounting records: 01/01 12/31 Cash 47,000 Inventory 101,000 93,000 Accounts Receivable 82,000 116,000 Accounts Payable 68,000 63,000 Sales 1,150,000 Cost of Goods Sold 900,000 Operating Expenses 200,000 b. 66,000 c. 76,000 3. Which statement is true? a. Certificates of deposit are usually classified as cash on the statement of financial position. b. Companies include postdated checks and petty cash funds as cash. c. Cash equivalents are investments with original maturities of six months or less. d. Savings accounts are usually classified as cash on the statement of financial position. 4. The following statements relate to cash. Which statement is What is the expected cash balance for December 31? a. 50,000 d. All of the above d. 134,000 incorrect? a. The purpose of establishing a petty cash fund is to pay small expenses which cannot be paid conveniently by means of check. b. Classification of a restricted cash balance as current or noncurrent should parallel the classification of the related obligation for which the cash was restricted. c. Compensating balances required by a bank may be included in “cash and cash equivalent”. d. The term “cash equivalent” refers to demand credit instruments such as money order and bank drafts. 5. Which of the following is not considered cash for financial reporting purposes? a. b. c. d. Petty cash funds and change funds Money orders, certified checks, and personal checks Coin, currency, and available funds Postdated checks and I.O.U.'s 6. Which of the following is considered cash? a. Certificates of deposit (CDs) b. Money market savings certificates c. Postdated checks d. Money orders 7. In which account are post-dated checks received classified? a. Receivables b. Prepaid expenses c. Cash d. Payables 8. What is a compensating balance? a. Savings account balances. b. Margin accounts held with brokers. c. Temporary investments serving as collateral for outstanding loans. d. Minimum deposits required to be maintained in connection with a borrowing arrangement. 9. Under which section of the statement of financial position is "cash restricted for plant expansion" reported? a. Current assets b. Non-current assets c. Current liabilities d. Equity 10. Bank overdrafts generally should be a. Reported as a deduction from the current asset section. b. Reported as a deduction from cash. c. Netted against cash and a net cash amount reported. d. Reported as a current liability. 11. Which of the following is true regarding the imprest petty cash system? a. The imprest petty cash system in effect adheres to the rule of disbursement by check. b. Entries are made to the Petty Cash account only to increase or decrease the size of the fund. c. The Petty Cash account is debited when the fund is replenished. d. All of these are not true. 12. In most situations the petty cash fund is reimbursed just prior to the year end and an adjusting entry is made to avoid a. The overstatement of cash and the understatement of expenses b. The understatement of cash and the overstatement of expenses c. The misstatement of revenues d. The understatement of cash with the appropriate statement of expenses 13. The payments of accounts payable made subsequent to the close of the accounting period are recorded as if they were made at the end of the current period. a. Window dressing b. Lapping c. Kiting d. Imprest system 14. It consists of misappropriating a collection from one customer and concealing this defalcation by applying a subsequent collection made from another customer. a. Window dressing b. Lapping c. Kiting d. Imprest system 15. The cash receipts function should be separated from the related record keeping in an organization to a. Physically safeguard the cash receipts. b. Establish accountability when the cash is first received. c. Prevent paying cash disbursements from cash receipts. d. Minimize undetected misappropriations of cash receipts.