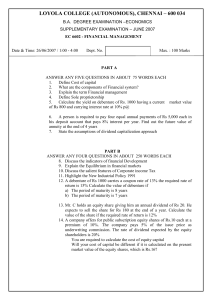

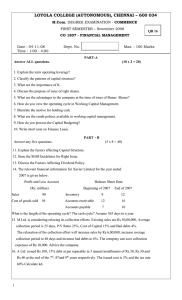

Cost of Capital Tutorial: WACC Calculation & Finance Questions

advertisement

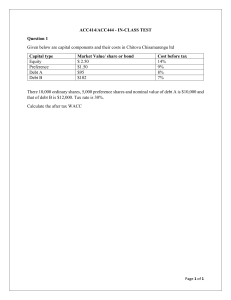

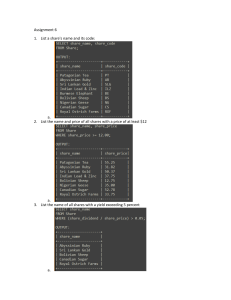

FIN311: Tutorial 1 Chapter 7: Cost of Capital (40 Marks) Question 1 [10 marks] J. Ross and Sons Inc. has a target capital structure that calls for 40% debt, 10% preferred stock, and 50% common equity. The firm's current after-tax cost of debt is 6%, and it can sell as much debt as it wishes at this rate. The firm's preferred stock currently sells for R90 per share and pays a dividend of R10. The firm will, however, only net R80 per share from the sale of new preferred stock. Ross's common share currently sells for R40 per share. The firm recently paid a dividend of R2 per share on its common stock, and investors expect the dividend to grow indefinitely at a constant rate of 10 percent per year. a. What is the firm's component cost of common shares, rS? (2) b. What is the firm's component cost of newly issued preferred shares, rPS? (3) c. What is the firm's weighted average cost of capital (WACC)? (5) Question 2 [10 marks] Big Limited is a company that manufactures toys. The company’s shares are listed on the JSE. An extract from the statement of financial position of Big Limited as at 30 June 20.11 is set out below. Statement of financial position as at 30 June 20.11 Notes ASSETS Non-current assets Current assets EQUITY AND LIABILITIES Ordinary shares Reserves 9% Preference shares (45 million) 14% Debentures (50 million) R'000 138 700 56 800 195 500 1 2 3 52 000 48 500 45 000 50 000 195 500 Notes to the financial statements: 1. The company has 104 million ordinary shares in issue. The ordinary shares are currently trading at 80 c per share. The company has recently paid a dividend of 3.57 c per share. Dividends are expected to grow by 12% per year indefinitely. 2. The company has 45 million non-redeemable preference shares in issue with a nominal value of R1 each. A market-related return on similar preference shares is 12.5%. 3. Debentures have a nominal value of R1 each and will be redeemed in four years’ time at par. The current yield to maturity on these debentures is 12%. The current company tax rate is 28%. The management of the company is evaluating investment in a major expansion program that includes a number of projects and will cost R3 million. Debentures will probably be issued to finance the proposed expansion. The company’s finance director has recommended that these projects be financed with debentures and that the after-tax interest rate on these debentures (rather than the company’s weighted current cost of capital) should serve as the cut-off rate for project acceptance. REQUIRED: a. Estimate the company’s weighted average cost of capital (WACC) using the respective market values. (8) b. Explain how the capital asset pricing model could be used as an alternative method for estimating the company’s cost of equity. Indicate what information would be required and how it could be obtained. (2) Question 3 [10 marks] Longfellow Limited (LL) has the following capital structure that it considers to be optimal: Equity (Ordinary share capital) Debentures Preference shares 60% 25% 15% 100% LL’s net profit for this year is expected to be R18 000. It has an established dividend payout ratio of 30%, tax is payable at 40% per annum and investors expect earnings and dividends to grow at a constant rate of 9% p.a. for the foreseeable future. LL paid a dividend of R3.60 per share last year and its current share price is R60 per share. The current government bond rate is 11% p.a. while the return on the market is 14% p.a. LL.’s beta is 1.51. The following costs will apply to any new issues: • Shares will attract flotation costs of 10% of the issue value per share. • New debentures can be issued at a coupon rate of 12%. • 11% R100 Preference shares can be issued. Flotation costs of R5 per preference share will be incurred. REQUIRED: a) Calculate the component cost of Equity Debentures and Preference shares. Note: calculate the cost of retained earnings using the Gordon Growth model and using the CAPM. (4) b) Calculate the WACC when LL meets its equity requirement with retained income. (6) Question 4 [10 marks] XYZ Limited has a beta of 1.2 and has R 30,000,000 worth of existing debt, 150,000 shares of preferred stock outstanding and 1,000,000 shares of common stock outstanding. The firm’s existing debt is comprised of 15 year, 10% quarterly bonds that were sold at R 1,200 each. The firm’s preferred stock current sells for R100 per share, has flotation costs of 5% and pays a dividend of R 15 per share. The firm’s common stock currently sells for R 55 per share and recently paid a dividend of R 5. Assuming the market has a rate of return of 15%, the risk-free proxy has a return of 6% and the tax rate is 30%: a) Calculate the firm’s cost of common stock. (1) b) Calculate the firm’s cost of newly issued preferred stock. (2) c) Calculate the firm’s cost of debt. (2) d) Calculate the firm’s weighted average cost of capital (WACC). (5) 4|Page