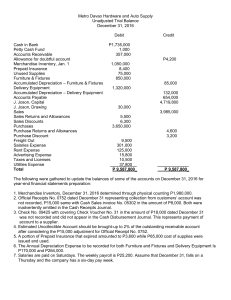

Cash Flows Tutorial Question 1 (34,5 marks, 52 minutes) DYNAMICS LIMITED buys and sells computer equipment. They have a year end of 31 March. You are the financial accountant of the company, and are busy preparing the annual financial statements for the year ended 31 March 2015. You have extracted the following trial balance from the accounting system on 31 March 2015: Debits Land Buildings at carrying value Equipment at cost Office furniture at cost Share investments at fair value Bank 32 Day Call Account Trade debtors Accrued interest income Inventories Pre-paid salaries Cost of sales Salaries and wages Donation Depreciation Sundry expenses Credit losses Interest expense Loss on the sale of office furniture Income tax expense Dividend expense 1 1 1 2 Credits Accumulated depreciation: Buildings Equipment Office furniture Mortgage Bond Trade creditors Commission income received in advance Current tax payable Shareholders for dividends Loan: Unity Bank Ordinary share capital Non-cumulative preference shares Retained earnings Revenue Commission income Gain on re-measurement of share investments to 1 1 3 2015 100 000 300 000 204 000 32 250 39 000 504 544 12 000 33 000 2 550 29 625 3 000 2 840 000 360 000 27 000 45 241 119 750 2 025 ? 1 300 48 338 47 750 ? 2014 100 000 170 000 121 500 24 750 16 500 276 438 19 500 27 000 1 350 36 000 4 000 2 560 000 327 273 24 545 33 957 108 700 1 841 13 640 2 523 43 711 22 500 3 935 728 31 386 93 300 12 500 84 000 43 500 1 350 12 750 7 500 ? 247 500 250 000 173 325 3 550 000 16 200 9 500 21 545 60 750 14 850 90 000 37 500 1 228 15 340 4 500 150 000 150 000 88 425 3 200 000 14 727 6 136 fair value Interest income 3 000 ? 2 2 727 3 935 728 Additional information: 1. The following relates to property, plant and equipment for the year ended 31 March 2015: 1.1 A loan from Unity Bank was taken out to finance the purchase of equipment on 1 October 2014. Repayments are made monthly in arrears over 5 years, and include interest at 8%. There were no other purchases or sales of equipment during the year. 1.2 Buildings depreciation for the year amounted to R9 841. 1.3 Office furniture was sold during the year for R1 500. This was the only property, plant and equipment that was sold during the current financial year. 2. Computers were donated to a school during the current financial year. This was the only donation that was made by the company during the current financial year. 3. Non-cumulative preference shares were issued in June 2013 at R1.50 each. These shares have a fixed preference dividend of R0.05 per share. On 30 June 2014 the additional shares were issued. 4. Interest on the long-term loan of R7 560 was paid during the current financial year. REQUIRED 1. Present only the investing and financing activities portions of the statement of cash flows of Dynamics Limited for the year ended 31 March 2015 in accordance with International Financial Reporting Standards (IFRS). (16.5) NOTE - Comparative amounts are not required. Round final amounts to the nearest Rand. Notes are not required 3 2. Prepare a reconciliation between the profit for the year and the cash generated from operations of Dynamics Limited for the year ended 31 March 2015. (18) NOTE - Round final amounts to the nearest Rand. 4