Subjectivity & Balanced Scorecard: Performance Measure Weighting

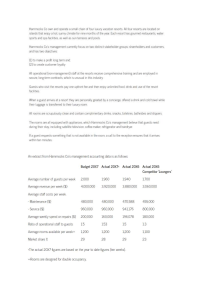

advertisement