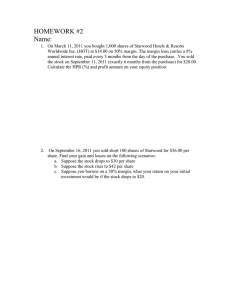

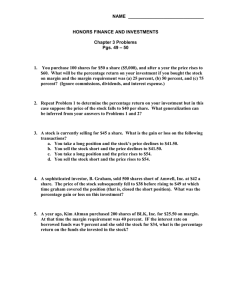

Financial Economics and Investments Short Squeeze Regulators • The Securities and Exchange Commission (SEC) registers and regulates securities exchanges, OTC trading, brokers, and dealers. • The Financial Industry Regulatory Authority (FINRA), which is the largest nongovernmental regulator of all securities firms in the United States. – It describes its broad mission as the fostering of investor protection and market integrity. It examines securities firms, writes and enforces rules concerning trading practices, and administers a disputeresolution forum for investors and registered firms. Contents 1. Buying on Margin 2. Short Sales 3. Short Squeeze Buying on Margin • When purchasing securities, investors have easy access to a source of debt financing called broker’s call loans. Taking advantage of these loans is called buying on margin. Purchasing stocks on margin means the investor borrows part of the purchase price. – The brokers in turn borrow money from banks at the call money rate to finance these purchases; they then charge their clients that rate, plus a service charge. – Leverage refers to using debt (borrowed funds) to amplify returns from an investment or project. – The margin in the account is the portion of the purchase price contributed by the investor; the remainder is borrowed from the broker. • The Fed limits the extent to which stock purchases can be financed using margin loans. The initial margin requirement is 50%, meaning that at least 50% of the purchase price must be paid for in cash, with the rest borrowed. • Investors buying on margin can achieve greater upside potential, but they also expose themselves to greater downside risk. Buying on Margin • In lending agreements, collateral is a borrower's pledge of specific property to a lender to secure repayment of a loan. – The collateral serves as the lender's protection against the borrower's default and can be used to offset the loan if the borrower fails to pay the principal and interest. • All securities purchased on margin must be maintained with the brokerage firm in street name, for the securities are collateral for the loan. – "Street name" refers to a method of holding securities in which the securities are registered in the name of a brokerage firm (or its nominee) rather than in the name of the individual investor who actually owns them. Buying on Margin Suppose an investor initially pays $6,000 toward the purchase of $10,000 worth of stock (100 shares at $100 per share), borrowing the remaining $4,000 from a broker. 1. Calculate the initial percentage margin. 2. Calculate the percentage margin if the price declines to $70 per share. 3. Calculate the percentage margin if the price falls below $40 per share. 4. If the maintenance margin is 30%, how far could the stock price fall before the investor would get a margin call? Buying on Margin • Maintenance margin is the minimum equity an investor must hold in the margin account after the purchase has been made. – It is currently set at 25% of the total value of the securities in a margin account as per Financial Industry Regulatory Authority (FINRA) requirements. – If the percentage margin falls below the maintenance level, the broker will issue a margin call, which requires the investor to add new cash or securities to the margin account. – If the investor does not act, the broker may sell securities from the account to pay off enough of the loan to restore the percentage margin to an acceptable level. Short Sales • Short selling is a trading strategy in which an investor borrows securities and sells them, hoping to repurchase the securities at a lower price in the future to return them to the lender. – A short sale allows investors to profit from a decline in a security’s price. • If an investor borrows a share of stock from a broker and sells it, the short-seller must later purchase a share of the same stock to replace the one that was borrowed. This is called covering the short position or closing the short position. – Short-sellers must not only replace the shares but also pay the lender of the security any dividends paid during the short sale Short Sales A step-by-step process for short selling • Step 1 - Open a margin account • Step 2 - Identify a stock to short • Step 3 - Borrow the Shares • Step 4 - Sell the Borrowed Shares • Step 5 - Monitor the position • Step 6 - Close the short position Step 1 - Open a margin account • Before they engage in short selling, traders open a margin account with a broker so that they will be able to borrow shares. • Short-sellers must also put up some extra money or collateral (like cash or other securities) with the broker. – It is a safety measure to ensure the broker doesn’t lose out if the short-seller can’t cover the losses. • Margin accounts require minimum balances, called the maintenance margin, which is used to cover potential losses. – It requires the trader to maintain a certain level of collateral, typically 150% of the short position's value, meaning the trader must provide 50% of the proceeds (the money from selling the borrowed stock) that would result from shorting a stock. Step 2 - Identify a stock to short • Short Float Percentage reveals the amount shares available to the public that is borrowed. 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑆ℎ𝑎𝑟𝑒𝑠 𝑆𝑜𝑙𝑑 𝑆ℎ𝑜𝑟𝑡 𝑆ℎ𝑜𝑟𝑡 𝐹𝑙𝑜𝑎𝑡 𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑆ℎ𝑎𝑟𝑒𝑠 𝑖𝑛 𝐹𝑙𝑜𝑎𝑡 • Short interest is the number of shares that have been sold short and are still outstanding. – It's a measure of how many investors are betting that a stock's price will fall. – A high short interest means that relatively more shares of a stock have been sold short than long. Investors who expect the stock price to decline are becoming more influential in the trading of that particular stock. – An increase in short interest often signals that investors have become more bearish, while a decrease in short interest signals that they have become more bullish. – Short interest is often expressed as a number or percentage. 𝑆ℎ𝑎𝑟𝑒𝑠 𝑆𝑜𝑙𝑑 𝑆ℎ𝑜𝑟𝑡 𝑆ℎ𝑜𝑟𝑡 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 (%) = × 100 𝑇𝑜𝑡𝑎𝑙 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝑆ℎ𝑎𝑟𝑒𝑠 Step 2 - Identify a stock to short The table below shows the highest and lowest percentages of short interest in the S&P 500 in August 2024. • A high short-interest ratio like the one for KMX suggests that many market participants are positioned for a decline in the stock's price, which could raise the potential for a short squeeze. • A low short-interest ratio, similar to TFX, may indicate a lack of bearish sentiment and a lower potential for a short squeeze, making the stock less likely to experience sudden, sharp price movements. • Both shares have a high float, meaning more than enough shares are available for trading. Short Interest • Short-interest information is typically reported biweekly by stock exchanges and can be found on financial platforms and FINRA's website. – FINRA: FINANCIAL INDUSTRY REGULATORY AUTHORITY is a not-for-profit self-regulatory organization that oversees US brokerdealers. • • • https://shortsqueeze.com/ https://finviz.com/ Short sale volume data is not the equivalent of short interest position data – For example, an investor might sell a security short and purchase shares to close the position on the same trade date. That position would not appear in the short interest data, though the short sale transaction would appear on the Short Sale Volume Daily File. – On the other hand, an investor might hold a short position open for days or weeks, perhaps as a hedge against another position. While the short sale transaction that established that short position would appear in the Short Sale Volume Daily File only on the date the short sale transaction occurred, the short position would continue to be reflected in the short interest data for as long as the position remained open. – https://www.finra.org/investors/insights/short-interest • How Does Short Interest Compare to the Put/Call Ratio? – Short interest and the put/call ratio are both indicators of market sentiment. Short interest focuses on the number of short shares outstanding. The put/call ratio uses the options market for its data. Put options are bearish bets, while calls are bullish bets. Not required for the exam Short Interest What are the Drawbacks of Using Short Interest for Trading? • Short interest is a valuable tool but should not be the sole determinant of an investment decision. Changes in short interest, and even extremes, may not lead to significant price changes promptly. A stock can stay at an extreme reading for long periods or a major price decline. • Short interest is published only monthly by most exchanges, so traders are using slightly outdated information, and the actual short interest may already be significantly different from what the report indicates. Not required for the exam Days to Cover • Days to cover, or short-interest ratio, is a measure of how many days it would take for all outstanding shorted shares to be closed out at the current rate of open-market buying. • Days to cover is calculated by taking the quantity of shares that are currently sold short and dividing that amount by the stock’s average daily trading volume. – It is a general indication of how much of a company’s stock is shorted relative to its trading volume. – A high days-to-cover measurement can signal a potential short squeeze. Not required for the exam Days to Cover • Days to cover can be useful to traders in the following ways: – Days to cover can be viewed as a proxy for how bearish or bullish traders are about that company, which can aid future investment decisions. – It thus gives investors an idea of potential future buying pressure. • In the event of a rally in the stock, short sellers must buy back shares on the open market to close out their positions. Understandably, they will seek to purchase the shares back for the lowest price possible, and this urgency to get out of their positions could translate into sharp moves higher. The longer the buyback process takes, as referenced by the days-to-cover metric, the longer the price rally may continue, based solely on the need of short sellers to close their positions. • Short interest can be used to indicate market sentiment for a company’s stock or the market as a whole, and some bullish investors see high short interest as an opportunity. – Usually people pick mid or low-cap company for shorting as large-cap company stock doesn’t fluctuate much with transactions. – What does Short Interest Ratio do? Identify potential short squeezes • Help to determine an entry point to the market for a short-squeeze and take advantage of market bouncing when short sales start buying back stocks Not required for the exam Days to Cover Not required for the exam Short Interest and Days To Cover Explained - Day and Swing Trading Step 3 - Borrow the Shares • The broker will locate shares of the target stock to borrow, typically from other investors' accounts or the brokerage's own inventory. – The U.S. Securities and Exchange Commission's (SEC) Regulation SHO requires broker-dealers to have "reasonable grounds" to believe that the security can be borrowed before effecting a short sale in any security. This is known as the “locate” requirement. • Naked short selling, where sellers sell securities they do not own or have not borrowed, is illegal. Step 3 - Borrow the Shares Unlike buying and holding stocks or investments, short selling involves significant costs in addition to the usual trading commissions paid to brokers. Some costs include: • A stock loan fee, or borrow fee, is a fee charged by a brokerage firm to a client for borrowing shares. – The broker charges interest on the borrowed shares while short positions remain open. – The more difficult it is to borrow, the higher the fee. – Shares that are difficult to borrow—because of high short interest, limited float, or any other reason—have “hard-to-borrow” fees that can be substantial. – The degree of short interest, therefore, provides an indication of the stock loan fee amount. Stocks with a high degree of short interest are more difficult to borrow than a stock with low short interest, as there are fewer shares to borrow. • Interest on Margin: the trader has to pay interest on the margin or cash borrowed for use as collateral against the borrowed stock. • Dividends: the borrower sends payments equal to the dividends and other returns back to the lender. For shorted bonds, they must pay the lender the coupon or interest owed. Step 3 - Borrow the Shares Borrow fee • The interest is typically calculated as an annual percentage rate (APR) but is charged on a daily basis. • The rate can vary depending on factors such as the demand for the stock and the availability of shares to borrow. • Stocks that are heavily shorted or have limited availability may have higher interest rates. • Suppose you short 100 shares of a stock priced at $50 per share. – – – If the annual interest rate is 5%, the daily interest rate would be approximately 0.0137% (5% divided by 365 days). The daily interest charge would be $5,000 * 0.0137% = $0.685. So, for each day your short position remains open, you would owe the broker $0.685 in interest. This interest accumulates daily until you close the short position by buying back the shares and returning them to the broker. Step 3 - Borrow the Shares • Short selling contracts typically do not specify a fixed date by which the borrowed shares must be returned. • While there is no fixed date, the broker has the right to recall the borrowed shares at any time. • If the broker needs the shares back (for example, if the original owner wants to sell them), the short seller must return them, sometimes on short notice. – In practice, the shares loaned out for a short sale are typically provided by the short-seller’s brokerage firm, which holds a wide variety of securities of its other investors in street name. The owner of the shares need not know that the shares have been lent to the short-seller. – If the owner wishes to sell the shares, the brokerage firm will simply borrow shares from another investor. Therefore, the short sale may have an indefinite term. However, if the brokerage firm cannot locate new shares to replace the ones sold, the short-seller will need to repay the loan immediately by purchasing shares in the market and turning them over to the brokerage house to close out the loan. • The short seller is at risk if the shares are not readily available, as shorts in GameStop painfully learned in 2021. Step 4 - Sell the Borrowed Shares • Proceeds from Short Sale: The money you get from selling the borrowed stock (the proceeds) must be kept in an account with your brokerage firm. You can’t use this money to make other investments to earn more income. – Income for Large Investors: While individual investors can’t use the proceeds to make more money, big investors or institutions might get some interest from the brokerage firm on the money being held. – https://www.interactivebrokers.com.hk/en/pricing/short-salecost.php Step 5 - Monitor the position • If the stock price rises significantly and the value of the trader's account falls below the maintenance margin level, the broker will issue a margin call. – This means the trader will need to deposit additional funds into their margin account to bring the account back to the required level. – If the trader fails to meet the margin call, the broker may close the position automatically to prevent further losses. • When short interest is high on a particular stock, it can signal a potential short squeeze. – If the stock rises sharply, many short sellers may be forced to cover their positions—so traders should keep an eye on a stock with a high short-tolong ratio. Step 5 - Monitor the position • Shorting is known as margin trading. Traders borrow money from the brokerage firm using the investment as collateral. Investors must meet the minimum maintenance requirement of 25%. If the account slips below this, traders are subject to a margin call and forced to put in more cash or liquidate their position • FINRA: Margin Regulation Step 6 - Close the short position • Collateral is returned to the borrower when the shares are returned to the lender. • Failure to deliver triggers daily penalties that continue until the shares needed to close out the short position are returned. The Risks of Short Sales • When a heavily shorted stock unexpectedly rises in price instead, the short sellers may have to act fast to limit their losses. • A short squeeze begins when the price of an asset unexpectedly jumps higher. It gains momentum as a significant number of the short sellers decide to cut losses and exit their positions. – The continued rapid rise in price also attracts buyers to the security. The combination of new buyers and panicked short sellers creates a rapid rise in price that can be stunning and unprecedented. • 2008 Volkswagen Short Squeeze • 2020 Tesla Short Squeeze • 2021 GameStop Short Squeeze The Risks of Short Sales • A trader who has shorted stock can lose much more than 100% of their original investment. – The risk comes because there is no ceiling for a stock’s price. • Also, while the stocks were held, the trader had to fund the margin account. • When it comes time to close a position, a short seller might have trouble finding enough shares to buy. – E.g., many other traders are shorting the stock or the stock is thinly traded. • Sellers can get trapped in a short squeeze if the market, or a specific stock, begins to rapidly increase in price. • When short-selling, the price of the securities changes, the value of the loan also changes. – In contrast, when buying on margin, the amount of the loan is independent of the price of the security. 2008 Volkswagen Short Squeeze In October 2008, due to a short squeeze, Volkswagen briefly became the most valuable publicly traded company. • In 2008, investors knew that Porsche was trying to build a position in Volkswagen and gain majority control. Short sellers expected that once Porsche had achieved control over the company, the stock would likely fall in value, so they heavily shorted the stock. • However, in a surprise announcement, Porsche revealed that they had secretly acquired more than 70% of the company using derivatives, which triggered a massive feedback loop of short sellers buying shares to close their position. • Short sellers were at a disadvantage because 20% of Volkswagen was owned by German government entity that wasn’t interested in selling, and Porsche controlled another 70%, so there were very few shares available on the market to buy back the stock. • Essentially, both the short interest and days-to-cover ratio exploded overnight, which caused the stock price to jump from the low €200s to more than €1,000. • According to International Banker: “Ultimately, those hedge funds that had shorted VW stock ended up losing an estimated $30 billion from their trades.” 2008 Volkswagen Short Squeeze 2020 Tesla Short Squeeze • Economic Times • Tesla short sellers lost $38 billion in 2020 as stock surged link – With shares up over 730%, Tesla bears have seen more than $38 billion in mark-tomarket losses this year, according to data from S3 Partners. – This “is not only the largest mark-to-market loss for any stock this year, it is the largest yearly mark-to-market loss I have ever seen,” said Ihor Dusaniwsky, a managing director at S3 Partners. – Many of Tesla’s short sellers have closed out their positions over the course of 2020, with short interest falling to less than 6% of the float from nearly 20% a year ago, according to S3 data. – Tesla’s shares soared this year as it notched five consecutive quarters of profits and amid growing sentiment on Wall Street that the shift toward electric vehicles is accelerating. The company was added to the S&P 500 Index on Dec. 21 and several smaller EV stocks have rallied along with it. The Most Unprofitable Short Sale In History GameStop skyrockets as retail investors force short squeeze 2021 GameStop Short Squeeze • A meme stock refers to the shares of a company that have gained viral popularity due to heightened social sentiment, particularly on social media platforms. WallStreetBets: has it changed retail investing? The Massive GameStop Short Squeeze, Explained How Reddit almost CRASHED the Economy with a meme Biased 2021 GameStop Short Squeeze • In October 2023, the SEC added regulations requiring investors to report their short positions to the SEC and companies that lend shares for short selling to report this activity to FINRA.4U.S. Securities and Exchange Commission. "Short Position and Short Activity Reporting by Institutional Investment Managers." • These new rules come after increased scrutiny of short selling, particularly following the GameStop (GME) meme stock saga in 2021, when retail investors drove up the stock price, causing losses for hedge funds that had shorted the company. • Meme stock activity was given a great boost from bored individuals stuck at home during COVID-19 lockdowns combined with zero-commission brokerage apps like Robinhood. The Robinhood app saw overwhelming trading volume in meme stocks at times, causing multiple trade delays, outages, and platform crashes. This led to user outrage along with class action lawsuits as well as regulatory fines and restitution of approximately $70 million. – https://www.finra.org/media-center/newsreleases/2021/finra-orders-record-financial-penalties-againstrobinhood-financial – Not required for the exam