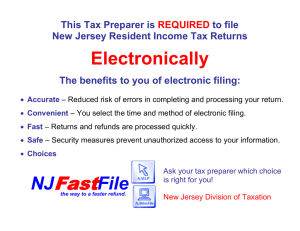

How to become a tax preparer What does a tax preparer do? Usually, a tax preparer prepares, files, or assists business owners and individuals with general tax forms. Beyond these basic services, a tax preparer can also defend taxpayers with the IRS, including audits and tax court issues. What do you need to become a tax preparer? The process of becoming a tax preparer is quite simple. There are just a few basic requirements, including: • Certification • Tech-savviness • Ability to attract clients • An identification number What exactly is IRS tax preparer certification? The basic IRS requirements for anyone offering tax preparation services in Orange County is to pass the suitability check and get issued a PTIN. However, once you start talking about the work of an enrolled agent, there will be additional requirements, such as state license or an electronic filing identification number (EFIN). Do you need a license to prepare tax returns? The starting point for any preparer will be the PTIN process, but it is not the same thing as earning a “license.” If you want to provide tax preparation services in Orange County, you do not need a specific license. Then again, you need to become an enrolled agent, attorney, or CPA to be able to represent clients in front of the IRS. What are the IRS e-file requirements for tax preparers? The IRS is very serious about maintaining the sanctity of the e-file system. Now, it has become an area of increased scrutiny, mainly because this is a high-risk area for potential fraud and hacking. As a result, it is a little more work for a preparer to complete this process. THANK YOU Visit: jarrarcpa.com