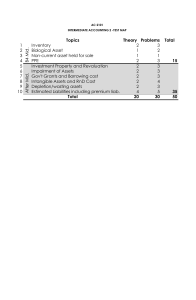

IAS 16: Property, Plant, and Equipment (PPE) 1. Scope and Objective IAS 16 applies to property, plant, and equipment (PPE) unless another standard requires or permits a different accounting treatment. The objective is to prescribe the accounting treatment for PPE so that users of financial statements can understand the entity’s investment in PPE and the changes in such investment. Key Definitions: Property, Plant, and Equipment (PPE): Tangible assets that: Are held for use in production, supply, rental, or administrative purposes.and Are expected to be used for more than one accounting period. Carrying Amount: The amount at which an asset is recognized after deducting accumulated depreciation and accumulated impairment losses. Depreciation: The systematic allocation of the depreciable amount of an asset over its useful life. Depreciable Amount: The cost of an asset less its residual value. Useful Life: The period over which an asset is expected to be used or the number of units it is expected to produce. Residual Value: The estimated amount recoverable at the end of the asset’s useful life. 2. Recognition of PPE An item of PPE is recognized as an asset if it meets the recognition criteria: Recognition Criteria: Future Economic Benefits are Probable: The asset must be expected to generate future economic benefits for the entity. These benefits could be in the form of: Revenue from the sale of goods or services. Cost savings (e.g., using machinery to reduce production costs). Other economic benefits (e.g., rental income from property). Cost Can Be Measured Reliably: The cost of the asset must be measurable with reliability. Cost includes: Purchase price. Directly attributable costs (e.g., delivery, installation, professional fees). Estimated costs of dismantling and removing the asset (IAS 37 provisions). Key Points: Capitalization of Costs: Only costs that meet the recognition criteria are capitalized. Repairs and Maintenance: These are expensed in the period incurred unless they meet the criteria for capitalization (e.g., they enhance the asset’s future economic benefits). Examples of Costs Included in PPE: Purchase price (net of discounts and rebates). Directly attributable costs (e.g., delivery, installation, professional fees). Estimated costs of dismantling and removing the asset (IAS 37 provisions). Examples of Costs Excluded from PPE: Administrative overheads. General operating costs. Costs incurred after the asset is ready for use (e.g., training costs). 3. Initial Measurement PPE is initially measured at cost, which includes: Purchase price (net of discounts and rebates). Directly attributable costs: Site preparation. Delivery and handling. Installation and assembly. Professional fees (e.g., architects, engineers). Estimated costs of dismantling and removing the asset (IAS 37 provisions). Borrowing costs (if capitalization criteria under IAS 23 are met). Example: A company purchases machinery for $100,000. Additional costs include: Delivery: $5,000 Installation: $10,000 Professional fees: $2,000 Dismantling costs (estimated): $3,000 solution Total Cost of Machinery: 100,000+100,000+5,000 + 10,000+10,000+2,000 + 3,000=∗∗3,000=∗∗120,000** Journal Entry: Dr. PPE (Machinery): 120,000 Cash/Payable: 120,000 CR 4. Subsequent Measurement After initial recognition, IAS 16 allows two models for subsequent measurement: Cost Model: Asset is carried at cost less accumulated depreciation and accumulated impairment losses. Revaluation Model: Asset is carried at fair value (revalued amount) less accumulated depreciation and accumulated impairment losses. Revaluations must be performed regularly to ensure the carrying amount does not differ materially from fair value. Revaluation Model: If an asset’s carrying amount increases (revaluation surplus), the increase is credited to other comprehensive income (OCI) and accumulated in equity under revaluation surplus. If the carrying amount decreases (revaluation deficit), it is recognized in profit or loss. Example: A building with a carrying amount of 500,000 is revalued to 600,000. The increase of $100,000 is recorded as follows: Dr. PPE (Building) 100,000 Cr. Revaluation Surplus (OCI) 100,000 If the revaluation decreases to $450,000: **Journal Entry:** - Debit: Revaluation Surplus (Other Comprehensive Income) $50,000 - Debit: Profit or Loss $50,000 Credit: Property, Plant, and Equipment (Building) $100,000 5. Depreciation Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Key Points: Depreciable Amount: Cost less residual value. Useful Life: The period over which the asset is expected to be used or the number of units it is expected to produce. Residual Value: Estimated amount recoverable at the end of the asset’s useful life. Depreciation Methods: Straight-line: Equal depreciation over useful life. Reducing balance: Higher depreciation in early years. Units of production: Based on actual usage or production. Example: A machine costs 120,000witharesidualvalueof120,000witharesidualvalueof20,000 and a useful life of 5 years. Straight-line Depreciation: (120,000−120,000−20,000) / 5 = $20,000 per year Journal Entry: Dr Depreciation Expense 20,000CrAccumulatedDepreciation20,000CrAccumulatedDepreciation2 0,000 6. Impairment PPE is subject to impairment testing under IAS 36: Impairment of Assets. If the carrying amount exceeds the recoverable amount (higher of fair value less costs to sell and value in use), an impairment loss is recognized. Example: A machine has a carrying amount of 50,000andarecoverableamountof50,000andarecoverableamountof40,000. The impairment loss is $10,000. Journal Entry: Dr Impairment Loss 10,000CrAccumulatedImpairmentLoss10,000CrAccumulatedImpairmentL oss10,000 7. Derecognition An item of PPE is derecognized: On disposal. When no future economic benefits are expected. Gain or Loss on Disposal: Calculated as the difference between the proceeds and the carrying amount. Recognized in profit or loss. Example: A machine with a carrying amount of 50,000issoldfor50,000issoldfor60,000. Journal Entry: Dr Cash 60,000DrAccumulatedDepreciation60,000DrAccumulatedDepreciation30,0 00 Cr PPE (Machine) 80,000CrGainonDisposal80,000CrGainonDisposal10,000 8. Disclosure Requirements IAS 16 requires extensive disclosures, including: Measurement bases (cost or revaluation model). Depreciation methods and useful lives. Carrying amounts at the beginning and end of the period. Reconciliation of changes in carrying amounts. Restrictions on title or pledged assets. Impairment losses (if any). 9. Impact on Financial Statements Balance Sheet: PPE is shown as a non-current asset. Revaluation affects equity (revaluation surplus). Income Statement: Depreciation and impairment losses reduce profit. Cash Flow Statement: Purchases of PPE are investing outflows; proceeds from sales are investing inflows. 10. Practical Example with Full Accounting Treatment Scenario: A company buys a delivery van for $50,000. Additional costs: Registration (2,000),Insurance(2,000),Insurance(1,000). Useful life: 5 years. Residual value: $5,000. Depreciation method: Straight-line. Step 1: Initial Recognition Total Cost = 50,000+50,000+2,000 + 1,000=∗∗1,000=∗∗53,000** Journal Entry: Dr PPE (Van) 53,000CrCash53,000CrCash53,000 Step 2: Annual Depreciation Depreciable Amount = 53,000−53,000−5,000 = $48,000 Annual Depreciation = 48,000/5=∗∗48,000/5=∗∗9,600** Journal Entry: Dr Depreciation Expense 9,600CrAccumulatedDepreciation9,600CrAccumulatedDepreciation9,60 0 Step 3: Disposal After 3 Years Carrying Amount = 53,000−(53,000−(9,600 x 3) = $24,200 Sold for $30,000. Gain on Disposal = 30,000−30,000−24,200 = $5,800 Journal Entry: Dr Cash 30,000DrAccumulatedDepreciation30,000DrAccumulatedDepreciation28,8 00 Cr PPE (Van) 53,000CrGainonDisposal53,000CrGainonDisposal5,800