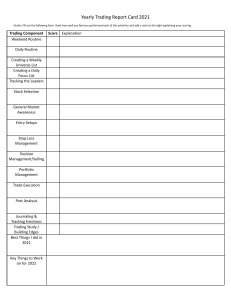

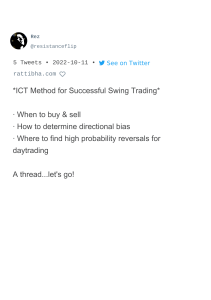

Rez @resistanceflip 17 Tweets • 2023-07-06 • See on rattibha.com I organized over 250 pages of my notes from ICT's "Premium Mentorship Core Content" series. I'll be publishing them here. In this first thread I've collected 15 of my favorite "lightbulb moments" from the mentorship. Enjoy! #ICT #innercircletrader #trader #trading #smc 1. ICT only has three entry patterns: liquidity voids, orderblocks, and stop runs. (Month 3 - Timeframe Selection & Defining Setups) 2. In bearish weeks, as long as price is below Sunday open, we only take shorts, until a HTF discount array is hit. (Month 8 - Essentials To ICT Daytrading) 3. You don't need an indicator for overbought and oversold. Look at the 60 40 20 day IPDA range. That will tell you if overbought or oversold. (Month 5 - Using IPDA Data Ranges) 4. Even if price doesn't go to a deep discount or premium, you can always reasonably expect it to go back to equilibrium. Even if you only aim for EQ, if you buy at a steep discount or a high premium, that's still a good trade. (Month 5 - Trade Conditions & Setup Progressions) 5. When to use the wick of an orderblock and when to use only the body? Use only the body when there is no FVG near the orderblock. (Month 5 - Trade Conditions & Setup Progressions) 6. Focus on the longterm trend and the market tide will carry your position into the winner's circle more often than not. (Month 6 - Ideal Swings Conditions For Any Market) 7. We do not buy at premium prices. We buy when the algorithm permits us to buy at discount prices. (Month 6 - Elements To Successful Swing Trading) 8. If you're having to convince yourself whether a trade is good or not, probably just don't take it. It should be obvious. (Month 6 - Elements To Successful Swing Trading) 9. Every trade must pass through a rule-based filtering method. The rules must be standardized. When trade ideas fail the filtering process, they're not taken. When they pass, they are taken, risk and equity management permitting. (Month 6 - Elements To Successful Swing Trading) 10. What you're looking for is which side of the marketplace has recently shown a displacement. Where has price moved away from? Has it moved away from the price levels aggressively? (Month 6 Classic Swing Trading Approach) 11. Avoid buying Weekly discount arrays if weekly has just posted a higher high and rejected, as a bearish breaker. (Month 6 - High Probability Swing Trade Setups In Bull Markets) 12. Weekly and monthly levels might be traded into multiple times because institutions require time to fill all of their orders. (Month 6 - High Probability Swing Trade Setups In Bear Markets) 13. Timing 4h entries on HTF (monthly, weekly levels) offers great RR trades. Wait for price to break 4h structure with displacement, and enter on rebalance. (Month 6 - Reducing Risk & Maximizing Potential Reward In Swing Setups) 14. In a bull market, Retracement can be seen Monday, Tuesday, and/or Wednesday. That is when it will drop down into a discount PD Array and give you a chance to get long. Important that it happens in a killzone. (Month 7 - Short Term Trading Using Monthly & Weekly Ranges) 15. Every setup is related to Time and Price. Time related to the IPDA period. Price according to PD Arrays. (Month 7 - Short Term Trading Low Resistance Liquidity Runs Part 1) This is the 1st of many threads I'll publish from my Core Content notes. Some will be "general tips" threads. Others will be focused on one topic, such as: PD Arrays, SMT, Entry Models, Timeframes, Ranges, and many more. Like and share this thread to show your support These pages were created and arranged by Rattibha services (https://www.rattibha.com) The contents of these pages, including all images, videos, attachments and external links published (collectively referred to as "this publication"), were created at the request of a user (s) from X. Rattibha provides an automated service, without human intervention, to copy the contents of tweets from X and publish them in an article style, and create PDF pages that can be printed and shared, at the request of X user (s). Please note that the views and all contents in this publication are those of the author and do not necessarily represent the views of Rattibha. Rattibha assumes no responsibility for any damage or breaches of any law resulting from the contents of this publication.

![Dear [fname]:](http://s2.studylib.net/store/data/015347363_1-a73ffec0d926f7c901482572529b752a-300x300.png)