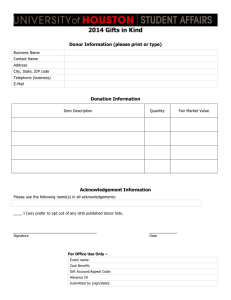

lOMoARcPSD|10025033 TAX-201 (Donor s Tax) - hope it'll help^^ Business Taxation (Polytechnic University of the Philippines) Scan to open on Studocu Studocu is not sponsored or endorsed by any college or university Downloaded by stowberi iii (lilichwandes@gmail.com) lOMoARcPSD|10025033 ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY CPA Review Batch 43 May 2022 CPA Licensure Examination Week No. 2 A. TAMAYO G. CAIGA C. LIM K. MANUEL E. BUEN TAXATION TAX-201: DONOR’S TAX A. Donor’s Tax Return (BIR Form No. 1800) See actual Donor’s Tax Return B. Donor’ Tax Rates 1. Under TRAIN (Effective January 1, 2018) The tax for each calendar year shall be six percent (6%) computed on the basis of the total gifts in excess of Two hundred fifty thousand pesos (P250,000) exempt gift made during the calendar year. Any contribution in cash or in kind to any candidate, political party or coalition of parties for campaign purposes shall be governed by the Election Code, as amended. C. Composition of Gross Gifts Resident or citizen donor Personal properties Real properties D. Rule of Reciprocity Properties covered by the rule Basic rules: Non-Resident Alien Donor Wherever situated Wherever situated Situated in the Philippines Situated in the Philippines Intangible personal properties situated in the Philippines given as gifts by non-resident alien donor. a. When there is reciprocity – The intangible personal properties situated in the Philippines given as gifts by a non-resident alien donor are not subject to donor’s tax. b. When there is no reciprocity – The intangible personal properties situated in the Philippines given as gifts by a non-resident alien donor are subject to donor’s tax. E. Transfer for Less Than Adequate and Full Consideration 1. The rule: Where property, other than a real property that has been subjected to the final capital gains tax, is transferred for less than an adequate and full consideration in money or money’s worth, then the amount by which the fair market value of the property at the time of the execution of the Contract to Sell or execution of the Deed of Sale which is not preceded by a Contract to Sell exceeded the value of the agreed or actual consideration or selling price shall be deemed a gift, and shall be included in computing the amount of gifts made during the calendar year. Ordinary assets Capital assets Tabular presentation of the rule on transfer for less than adequate and full consideration Personal properties Real properties Subject to donor’s tax Subject to donor’s tax Subject to donor’s tax Not subject to donor’s tax 2. A sale, exchange, or other transfer of property made in the ordinary course of business (a transaction which is a bona fide, at arm’s length, and free from any donative intent), will be considered as made for an adequate and full consideration in money or money’s worth.” 3. Exercises: Determine the amount to be included in the gross gifts (transfers inter vivos) FMV, time of Ordinary/Capital transfer a. Pieces of jewelry for personal use P 500,000 b. Car sold by a car dealer (bona fide at arm’s length) P 800,000 c. Furniture sold by furniture dealer P 500,000 d. Lot leased as parking space P1,000,000 e. Residential house and lot P1,500,000 F. Valuation of Gifts Made in Property Property Donated Gift is made in property Real property Deemed gift Valuation Fair market value at the time of the gift Provisions in estate tax shall apply to the valuation of said real property. G. Exemptions of Certain Gifts/Deductions from Gross Gifts 1. Found in the Tax Code Under TRAIN (Effective January 1, 2018) Resident/citizen donor a. Gifts made to or for the use of the National Government or any entity created by any of its agencies which is not conducted for profit, or to any political subdivision of the said Government Allowed as deduction b. Gifts in favor of an educational and/or charitable, religious, cultural or social welfare corporation, institution, accredited nongovernment organization, trust or philanthropic organization or research institution or organization. Allowed as deduction Page 1 of 5 Consideration received P300,000 P500,000 P600,000 P500,000 P800,000 Non-resident alien donor 0915-2303213 www.resacpareview.com Downloaded by stowberi iii (lilichwandes@gmail.com) lOMoARcPSD|10025033 TAX-201 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY Week 2: DONOR’S TAX Notes: 1) In case of gifts made to certain institutions (no. 1 c above), in order to be exempt, not more than 30% of said gifts shall be used by such donee for administration purposes. 2) For the purpose of the exemption, a 'non-profit educational and/or charitable corporation, institution, accredited nongovernment organization, trust or philanthropic organization and/or research institution or organization' is a school, college or university and/or charitable corporation, accredited nongovernment organization, trust or philanthropic organization and/or research institution or organization, incorporated as a nonstock entity, paying no dividends, governed by trustees who receive no compensation, and devoting all its income, whether students' fees or gifts, donation, subsidies or other forms of philanthropy, to the accomplishment and promotion of the purposes enumerated in its Articles of Incorporation. 2. Other deductions a. Encumbrance on the property donated if assumed by the donee b. Those specifically provided by the donor as a diminution from the property donated 3. Resident or Citizen Donor Allowed Non-Resident Alien Donor Allowed Allowed Allowed Gross gift Deduction Exercise a) Real property donated valued at P1,500,000 with unpaid mortgage of P300,000 assumed by the donee b) Real property donated valued at P1,200,000 with unpaid real estate tax of P150,000 not assumed by the donee c) Real property donated valued at P1,500,000, the donee agreed to assume the applicable donor’s tax of P450,000 d) Personal property donated valued at P100,000, the donor provided that P10,000 of the property donated be transferred by the donee to a social welfare organization e) Personal property donated valued at P120,000, the donor did not provide any diminution on the property donated 4. 1. 2. Exempt Donations Under Special Laws. – Donations to: a. International Rice Research Institute (IRRI); b. Philippine American Cultural Foundation; c. Ramon Magsaysay Award Foundation; d. Philippine Inventors Commission; e. Integrated Bar of the Philippines (IBP); f. Development Academy of the Philippines (DAP); g. National Social Action Council; h. Aquaculture Department of Southeast Asian Fisheries Development Center of the Philippines (SEAFDEC). H. The Law That Governs The Imposition Of Donor’s Tax 1. The donor’s tax is not a property tax, but is a tax imposed on the transfer of property by way of gift inter vivos. 2. The donor’s tax shall not apply unless and until there is a completed gift. 3. The transfer of property by gift is perfected from the moment the donor knows of the acceptance by the donee; it is completed by the delivery, either actually or constructively, of the donated property to the donee. 4. In order that the donation of an immovable may be valid: a. It must be made in a public document specifying therein the property donated. b. The acceptance may be made in the same Deed of Donation or in a separate public document, but it shall not take effect unless it is done during the lifetime of the donor. c. If the acceptance is made in a separate instrument, the donor shall be notified thereof in an authentic form, and this step shall be noted in both instruments. 5. A gift that is incomplete because of reserved powers, becomes complete when either: (1) the donor renounces the power; or (2) his right to exercise the reserved power ceases because of the happening of some event or contingency or the fulfilment of some condition, other than because of the donor’s death. 6. Renunciation by the surviving spouse of his/her share in the conjugal partnership or absolute community after the dissolution of the marriage in favor of the heirs of the deceased spouse or any other person/s is subject to donor’s tax. 7. General renunciation by an heir, including the surviving spouse, of his/her share in the hereditary estate left by the decedent is not subject to donor’s tax, unless specifically and categorically done in favor of identified heir/s to the exclusion or disadvantage of the other co-heirs in the hereditary estate. 8. The law in force at the time of the completion of the donation shall govern the imposition of donor’s tax. 9. For purposes of the donor’s tax, “NET GIFT” shall mean the net economic benefit from the transfer that accrues to the donee. 10. Accordingly, if a mortgaged property is transferred as a gift, but imposing upon the donee the obligation to pay the mortgage liability, then the net gift is measured by deducting from the fair market value of the property the amount of mortgage assumed. Page 2 of 5 0915-2303213 www.resacpareview.com Downloaded by stowberi iii (lilichwandes@gmail.com) lOMoARcPSD|10025033 TAX-201 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY Week 2: DONOR’S TAX Computation of Taxable Net Gift and the Donor’s Tax Due 1. Donations made on or after January I, 1998 shall be subject to the donor’s tax computed in accordance with the amended schedule of rates prescribed under Section 99 of the National Internal Revenue Code of 1997 (R.A. No. 8424). 2. Donations made on or after January 1, 2018 shall be subject to the donor’s tax under TRAIN (R.A. No. 10963). 3. The computation of the donor’s tax is on a cumulative basis over a period of one calendar year. 4. Husband and wife are considered as separate and distinct taxpayers for purposes of donor’s tax. 5. If what was donated is a conjugal or community property and only the husband signed the deed of donation, there is only one donor for donor’s tax purposes, without prejudice to the right of the wife to question the validity of the donation without her consent pursuant to the pertinent provisions of the Civil Code of the Philippines and the Family Code of the Philippines. 6. With the exception of moderate donations for charity or on occasions of family rejoicing, neither spouse may donate any community property or conjugal property without the consent of the other. 7. Every donation between the spouses during the marriage shall be void except for moderate gifts, which the spouse may give each other on the occasion of any family rejoicing, and donation mortis causa. 8. Any provision of law to the contrary notwithstanding, any contribution in cash or in kind to any candidate, political party or coalition of parties for campaign purposes, duly reported to the commission (COMELEC) shall not be subject to the payment of any gift tax (Sec. 13 R.A. No. 7166). I. Exercise: Determine whether or not the following is subject to donor’s tax (Y/N): Subject to donor’s tax? Reason a. Husband donated conjugal property with the consent of the wife to charity event (charitable institution’s administration expenses exceed 30% of the gifts) b. Wife donated community property without the consent of the husband on occasion of their legitimate child’s birthday (amount of gift is moderate) c. Husband donated conjugal property, only the husband signed the Deed of Donation d. Husband gifted his wife a diamond ring on occasion of her birthday e. Wife gifted her husband a branded shirt of account of his birthday (amount is moderate) f. Husband transferred some of his exclusive property to his wife, transfer to take effect after his death g. Surviving spouse renounced his share in the conjugal partnership in favor of the heirs of the deceased spouse h. An heir renounced his share in the hereditary estate in favor of no one in particular i. Taxpayer donated to the campaign fund of a candidate, duly reported to the COMELEC j. Donee failed to indicate his acceptances of the donation before the transferor died k. Donee signified his acceptance of the donated property known to the donor before he died, delivery of the donated property done after the transferor died J. Tax Credit for Donor’s Taxes Paid to a Foreign Country 1. One foreign Limit: country Net gift, foreign x Philippine donor’s tax due Total net gifts Actual foreign donor’s tax Allowed (lower between actual and limit) 2. Two or more Limit (a) – By country foreign Limit (b) – By total Limit [lower between limits (a) and (b)] countries Actual total foreign donor’s taxes Allowed tax credit (lower between allowed limit and actual total foreign donor’s taxes) xxx xxx xxx xxx xxx xxx xxx xxx 3. Exercise Micha is a citizen and resident of the Philippines. On July 8, 2021, she made donations to Queenie, a friend, of properties in Australia and USA. Donor’s taxes paid in Australia and USA amounted to P25,000 and P10,000, respectively. The property in Australia had a fair market value of P300,000 while the property in US had a market value of P200,000. On January 15, 2021, Micha donated property located in the Philippines valued P2,000,000 with P500,000 unpaid mortgage assumed by the donee. Compute the following using BIR Form 1800: a. Line 34 page 2 (Total net gifts in this return) b. Line 35 page 2 (Total prior net gifts during the calendar year) c. Line 16 page 1 (Total donor’s tax due) d. Line 17B page 1 (Foreign donor’s tax credit) e. Line 18 page 1 (Tax payable) Page 3 of 5 0915-2303213 www.resacpareview.com Downloaded by stowberi iii (lilichwandes@gmail.com) lOMoARcPSD|10025033 TAX-201 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY Week 2: DONOR’S TAX K. Filing of Return and Payment of Tax 1. Requirement Any individual who makes any transfer by gift (except those which are exempt from donor’s tax) shall, for the purpose of donor’s tax, make a return under oath at least in duplicate (triplicate per BIR Form No. 1800) 2. Contents of the The return shall set forth: donor’s tax return a. Each gift made during the calendar year which is to be included in computing net gifts; b. The deductions claimed and allowable; c. Any previous net gifts made during the same calendar year; d. The name of the donee; and e. Such other information as may be required by rules and regulations made pursuant to law. 3. Time for filing of return 4. Payment of donor’s tax 5. Modes of payment The donor’s tax return shall be filed within thirty (30) days after the date the gift is made or completed. The donor’s tax due shall be paid at the same time that the return is filed. 1) Payment through Authorized Agent Bank (AAB) (a) Over-the-counter cash payment – Maximum amount per tax payment not to exceed P10,000.00 (b) Bank debit system – taxpayer has bank account with AAB (c) Checks – indicate “PAY TO THE ORDER OF: 1) Presenting/collecting bank or the bank where the payment is to be coursed and 2) FAO (for account of) Bureau or Internal Revenue as payee; and 3) Under the “ACCOUNT NAME” of the taxpayer identification number (TIN) Notes: i. Accommodation checks, second endorsed checks, stale checks, postdated checks, unsigned checks and checks with alterations/erasures are not acceptable. ii. Checks to cover one tax type for one return period only 6. Place of filing of return 7. Notice of donation by a donor engaged in business 2) Payment through Tax Debit Memo (TDM) (not acceptable as payments for withholding taxes, fringe benefit tax, and for taxes, fees and charges collected under special schemes or procedures or programs of the Government or BIR) 3) Payment through E-Payment System 4) Payment directly to the BIR 5) Payment through creditable withholding taxes a. In case of resident donors: 1) Authorized agent bank; 2) Revenue District Officer; 3) Revenue Collection Officer; 4) Duly authorized Treasurer of the city or municipality where the donor was domiciled at the time of the transfer. b. In case of non-resident donors: 1) Philippine Embassy or Consulate where he is domiciled at the time of the transfer, or 2) Office of the Commissioner (RDO No. 39 –South Quezon City) Note: Returns filed with Philippine Embassy or Consulate shall be paid thereat. The donor engaged in business shall give a notice of donation on every donation worth at least P50,000 to the RDO which has jurisdiction over his place of business within 30 days after receipt of the qualified donee institution’s duly issued Certificate of Donation, which shall be attached to the said Notice of Donation, stating that not more than 30% of the said donations/gifts for the taxable year shall be used for administration purposes. L. Accomplishing Tax Returns and Forms 1. Separate return 1) A separate return shall be filed by each donor for each gift (donation) made on different dates during the year reflecting therein any previous net gifts made in the same calendar year. 2) Only one return shall be filed for several gifts (donations) by a donor to the different donees on the same date. 3) If the gift (donation) involves conjugal/community property, each spouse shall file separate return corresponding to his/her share in the conjugal/community property. This rule shall likewise apply in the case of co-ownership over the property being donated. 2. Payment and 1) Upon filing of Donor’s Tax Return, the total amount payable shall be paid to the Authorized issuance of Agent Bank (AAB) where the return is filed. Revenue Official 2) In places where there are no AABs, payment shall be made directly to the Revenue Collection Receipt Officer or duly authorized City or Municipal Treasurer who shall issue Revenue Official Receipt (BIR No. 2524). 3) Where the return is filed with an AAB, the lower portion of the return must be properly machine-validated and stamped by AAB to serve as the receipt of payment. 4) The machine validation shall reflect the date of payment, amount paid and transaction code, and the stamp mark shall show the name of the bank, branch code, teller’s name and teller’s initial. 5) The AAB shall also issue an official receipt or bank debit advice or credit document, whichever is applicable, as additional proof of payment. Page 4 of 5 0915-2303213 www.resacpareview.com Downloaded by stowberi iii (lilichwandes@gmail.com) lOMoARcPSD|10025033 TAX-201 ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY Week 2: DONOR’S TAX M. Cases 1. A resident alien donor donated to a Philippine domestic corporation a property located abroad valued at P500,000. The foreign donor’s tax on the donation was P100,000. A donation earlier within the same calendar year, was donated to a legitimate daughter, a property valued at P300,000. Compute the following using BIR Form 1800: a. Line 17B page 1 (Foreign donor’s tax credit) b. Line 20 page 1 (Tax payable) 2. Mr. Rodolfo Felix made the following gifts on December 14, 2021. Mr. Felix’s TIN is 143-345-678-900. His registered address is 18 R. Papa Street, Sampaloc, Manila (Zip Code 1008). His telephone number is 02-734-39-89. Sampaloc is under RDO 32. a. P250,000 cash to Ana, TIN 143-770-553-003, his acknowledged natural daughter on account of her marriage celebrated on January 2, 2021. b. Residential house and lot in Sampaloc, Manila (300 sq. m.) with fair market value per BIR of P2,500,000 (TCT No. 123456) to the same donee. Fair market value per Tax Declaration was P3,000,000 (TD No. 134990). Unpaid mortgage of P500,000, the donor imposed upon the donee the obligation to pay the mortgage liability which the latter did. Previous to December 14, 2021, he donated the following: April 15, 2021: Sold his residential house and lot (500 sq. m. with TCT No. 111012) to his brother for P1,500,000. The fair market value per BIR of the residential house and lot at the time of sale was P2,000,000. Fair market value per Tax Declaration was P1,500,000 Tax Declaration No. 143441). June 20, 2021: Sold personal car to Boy, his friend, for P500,000, value of the car at the time of sale was P900,000 July 15, 2021: P300,000 campaign contribution to a close friend who plans to run for an elective office Nov. 20, 2021: P800,000 cash donation to a legitimate daughter and P500,000 cash donation to a corporation he controls Dec. 10, 2021: P320,000 cash donation to the Hospicio de San Jose, a charitable institution. Prepare a Donor’s Tax Return and compute the following: a. Line 27 page 2 (Total gifts in this return) b. Line 33 page 2 (Total deductions allowed) c. Line 35 page 2 (Total prior net gifts during the calendar year) d. Line 14 page 1 (Total net gifts subject to tax) e. Line 18 page 1 (Tax payable) 3. A citizen-donor engaged in business in the Philippines and residing in Japan, with a legitimate son and a legitimate daughter, made the following donations: Dec. 11, 2021 Donation to another legitimate daughter who is getting married of property with FMV of P450,000, (indebtedness of P50,000 on the property is not assumed by the donee) Prior gifts made previously: April 2, 2021 Donation to a legitimate son on account of marriage on April 2, 2021 Donation to a legitimate daughter on account of marriage on Sept. 3, 2021 June 12, 2021 Donation to an accredited non-government organization Sept. 3, 2021 Donation to the legitimate daughter on account of marriage on Sept. 3, 2021 Oct. 6, 2021 Donation to another legitimate son on account of marriage on Dec. 2, 2021 P180,000 150,000 100,000 520,000 540,000 Prepare a Donor’s Tax Return and compute the following: a. Line 27 page 2 (Total gifts in this return) b. Line 33 page 2 (Total deductions allowed) c. Line 35 page 2 (Total prior net gifts during the calendar year) d. Line 14 page 1 (Total net gifts subject to tax) e. Line 18 page 1 (Tax payable) Additional questions: a. Which donation shall require notice of donation? Why? b. When shall the return be filed? 4. On January 15, 2021, Daisy gave a piece of land to her brother-in-law who is getting married on February 14, 2021. The assessed value and zonal value of the land were P750,000 and P1,000,000 respectively. The land had an unpaid mortgage of P200,000, which was assumed by the donee and an unpaid realty tax of P10,000 which was not assumed by the donee. Compute the following: a. Line 27 page 2 (Total gifts in this return) b. Line 33 page 2 (Total deductions allowed) c. Line 38 page 2/Line 14 page 1 (Total prior net gifts during the calendar year) d. Line 18 page 1 (Tax payable 5. A foreign corporation donated its own shares of stock in favor of resident employee in the Philippines. The value of the shares of stock was P500,000. Question 1 - Was the donation subject to Philippine donor’s tax? Why? 2 – How much was the donor’s tax due? 3 – Assuming the foreign shares have acquired business situs in the Philippines, was the donation subject to Philippine donor’s tax? Why? END THOT: The world belongs to the dreamers who dream big and work hard. - Tamthewise Page 5 of 5 0915-2303213 www.resacpareview.com Downloaded by stowberi iii (lilichwandes@gmail.com)