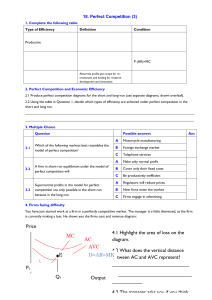

Microeconomics Lecture 4 Jona Linde https://sites.google.com/site/jonalinde/ j.linde@maastrichtuniversity.nl Course structure Part I Supply and demand Week 1 2 II Consumer theory 3 III Producer theory IV Perfect competition 4 5 6 V Market power and market structure 7 Task 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Subject Supply and demand Applying the supply and demand model Consumer choice Applying the model of the consumer Firms and production Short-run costs Long-run costs Perfect competition Markets and welfare Monopoly Government and welfare Pricing Oligopoly and monopolistic competition Game theory Chapter 1, 2 3 4 5 6 7 7 8 9 11 9, 11 12 13 14 Last week: Short run production • • 120 100 output Q Total production - Maximum output produced with a specific amount of labour ഥ - TPL = 𝑞 = 𝑓 𝐿, 𝐾 80 60 40 20 Average product of labour - Average output per unit of labour - APL = 𝑞Τ𝐿 0 0 2 4 6 8 10 12 14 labour L 24 20 16 Marginal Product of labour - “extra output from using one extra unit of labor” - MPL = Δ𝑞ൗΔ𝐿 = 𝑑𝑓 𝑞 ൗ𝑑𝐿 APL, MPL • 12 MPL 8 APL 4 0 -4 0 2 4 6 8 labour L 10 12 14 Last week: Long run production • • Both labour and capital are variable - 𝑞 = 𝑓 𝐿, 𝐾 (no bar over K!) Isoquant connecting input combinations that yield the same output (level curve) - 𝑞ത = 𝑓 𝐿, 𝐾 Marginal rate of technical substitution - Slope of isoquants Δ𝐾 𝑀𝑃 - MRTS= Δ𝐿 = − 𝑀𝑃 𝐿 - • 𝐾 diminishing marginal returns imply diminishing MRTS Returns to scale - Decreasing, increasing, or constant - 𝑓 2𝐿, 2𝐾 <? > 2𝑓 𝐿, 𝐾 7 6 capital input K • 5 4 3 2 1 0 0 1 2 3 4 labour input L 5 6 7 From production function to costs function • 7.1) What are “costs”? • 7.2) How do costs depend on output in the short run? • 7.3) How do costs depend on output in the long run? • 7.4) Lower costs in the long run • (skip section 7.5) 7.1 What are costs • Opening quote Task 6: “Me and my wife, we own the place, so we don’t pay any rent. We don’t need staff, so we don’t have any labour costs. We cannot complain, financially.” (innkeeper of a “pannenkoekenhuis” near Maastricht, spring 2001) • Economic costs accounting costs Economic profit accounting profit - Sometimes no conflict: buying materials which are used in production directly - Sometimes big difference: buying materials as stock that could be resold Economic costs = opportunity costs - “value of the best alternative use of an input” - “what you have to give up to use that input” Basic rule: for each input, ask yourself: “what is its value in its next most valuable use?” • • 7.1 What are costs • Labour costs - Hiring labour - Simple - but permanent contracts make accounting and opportunity costs diverge - Partly sunk costs - Sunk costs irrelevant to your decisions today - “bygones are bygones” - Own labour - Accounting: some payment in salary, some in profit - Economic/opportunity costs: best alternative use of time - Earn money working elsewhere - Value of leisure 7.1 What are costs • Capital costs - Rent - Simple, but can be (partly) sunk if in a long-term lease - Own - Accounting costs: Depreciated over several years (according to tax rules) - Economic costs: imputed rents - Next best use: rent it out, alternative use - Sell and invest money - Can be very different - Real estate boom - Specialized tools - Resale value and therefore opportunity costs 0 - Initial expense sunk cost 7.2 Short-run costs • • Not all inputs can be varied - Capital (K) fixed, price per unit r rental rate - Labour (L) variable, price per unit w wage rate If capital is fixed, are capital costs sunk? - Maybe, maybe not - Perhaps can avoid by stopping production - There can be alternative uses, but plausibly less valuable in the short run than in the long run - If so, economic fixed costs lower in the short run - Conversely, no costs are fixed in the long run 7.2 Short-run costs • • • • Three basic cost-level concepts and associated curves ഥ Fixed Costs costs of fixed inputs e.g. 𝐹𝐶 = 𝑟𝐾 FC does not depend on q Variable Costs costs of variable inputs e.g. 𝑉𝐶 = 𝑤𝐿 VC rises as q rises Total Costs costs of all inputs 𝑇𝐶 = 𝐹𝐶 + 𝑉𝐶 TC rises as q rises, through VC Four spin-offs: cost-per-unit concepts → curves Δ𝑇𝐶 Δ𝑉𝐶 Marginal Costs: extra costs of producing one extra unit 𝑀𝐶 = Δ𝑞 = Δ𝑞 • Aver. Fixed Costs: fixed costs per unit produced • Aver. Variable Costs: variable costs per unit produced • Average Costs: total costs per unit produced • • 𝐹𝐶 𝑞 𝑉𝐶 𝐴𝑉𝐶 = 𝑞 𝑇𝐶 𝐴𝐶 = 𝑞 = 𝐴𝐹𝐶 + 𝐴𝑉𝐶 𝐴𝐹𝐶 = 7.2 Short-run costs q FC VC TC MC AFC AVC AC 0 48 0 48 X X X X 1 48 25 73 25 48 25 73 2 48 46 94 21 24 23 47 3 48 66 114 20 16 22 38 4 48 82 130 16 12 20.5 32.5 5 48 100 148 18 9.6 20 29.6 6 48 120 168 20 8 20 28 7 48 141 189 21 6.9 20.1 27 8 48 168 216 27 6 21 27 9 48 198 246 30 5.3 22 27.3 7.2 Short-run costs 80 400 70 350 60 250 FC 200 VC TC 150 Cost-per-unit Cost level 300 50 MC AFC 40 AVC AC 30 20 100 10 50 0 0 0 2 4 6 Output Q 8 10 12 0 2 4 6 Output Q 8 10 12 7.2 Short-run costs • Specifics of / relations between these seven cost concepts • FC horizontal line • VC rising curve, starting at origin • TC vertical sum of FC and VC parallel to VC • MC slope of tangent TC = slope of tangent VC • AFC declines monotonically (“spreading out”) • AVC falls when MC < AVC, rises when MC > AVC MC intersects AVC at its minimum (compare APL MPL, last week) • AC falls when MC < AC, rises when MC > AC MC intersects AC at its minimum vertical sum of AFC and AVC AC ever closer to AVC minimum AC lies beyond minimum AVC 7.2 Short-run costs From production function to cost curves ഥ - Production function: 𝑞 = 𝑓 𝐿, 𝐾 ഥ (𝑟=rental rate), e.g. 𝑟 = 5, 𝐾 ഥ = 4→ FC=20 - Fixed costs: 𝑟𝐾 - Variable costs: w𝐿 (w=wage rate), more complex because L is a choice ഥ we want 𝐿 as a function of 𝑞 i.e. the inverse of 𝑓 - Have 𝑞 = 𝑓 𝐿, 𝐾 100 120 80 80 If w = 10 60 40 Variable Cost VC 100 output Q • 60 40 20 20 0 0 2 4 6 labour L 8 10 0 0 20 40 60 Output Q 80 100 120 7.2 Short-run costs • • • Short-run cost curve determined by short-run production function Relation between AVC and APL? 𝑉𝐶 𝑤𝐿 𝑤 𝑤 - 𝐴𝑉𝐶 = 𝑞 = 𝑞 = 𝑞ൗ = 𝐴𝑃 𝐿 𝐿 Relation between MC and MPL? 𝛥𝑉𝐶 𝑤𝛥𝐿 𝑤 𝑤 - 𝐴𝑉𝐶 = 𝛥𝑞 = 𝛥𝑞 = 𝛥𝑞 = 𝑀𝑃 ൗ𝛥𝐿 • 𝐿 Mathematical example ഥ=4 - Cobb-Douglas: 𝑞 = 𝐿0.5 𝐾 0.5 , with 𝑟 = 5 & 𝐾 - 𝑞 = 2𝐿0.5 → 𝐿 = 0.25𝑞 2 7.2 Short-run costs Mathematical example continued ഥ = 5 ∗ 4 = 20 - FC: 𝑟𝐾 - VC: 𝑤𝐿 = 10 ∗ 0.25𝑞 2 = 2.5𝑞 2 - TC: FC+VC= 20 + 2.5𝑞 2 - AFC: 20Τ𝑞; AVC: 2.5𝑞 20 →ATC: 2.5𝑞 + 𝑞 • - MC: 5𝑞 Note: - decreasing MPL → rising MC - MC > AVC → AVC rises - falling AFC and rising AVC generate U-shaped AC - MC hits AC at its minimum 50 40 Cost-per-unit • AFC 30 AVC AC 20 MC 10 0 0 1 2 3 4 5 6 Output Q 7 8 9 10 7.3 Long-run costs • Long run: • all inputs can be varied practically both capital and labour are variable inputs q = f(L,K) no “bar” over K ! all costs are avoidable/variable: (T)C = wL + rK - only one cost-level concept: - only two cost-per-unit concepts: TC = VC, say C AC and MC 7.3 Long-run costs Isoquants - Combinations of L & K that yield the same output level 𝑞ത = 𝑓 𝐿, 𝐾 Δ𝐾 𝑀𝑃 - Slope: Δ𝐿 = 𝑀𝑅𝑇𝑆 = − 𝑀𝑃 𝐿 7 6 𝐾 - “how much K can you replace by an extra L, with q constant” diminishing marginal returns imply diminishing MRTS convex isoquants capital input K • 5 4 3 2 1 0 0 1 2 3 4 labour input L 5 6 7 7.3 Long-run costs Isocost line: combinations of L and K that cost the same amount - Example: w=10 & r=5 Find isocost line of 30 Note: 7 - 6K, 0L or 0K, 3L 0r 1K, 2L • At given factor prices, isocost 6 - Mathematically: 𝑤𝐿 + 𝑟𝐾 = 𝐶ҧ lines are parallel 5 - Here: 10𝐿 + 5𝐾 = 30 • lines further from origin Δ𝐾 𝑤 mean higher cost 4 - Slope: Δ𝐿 = − 𝑟 →here: -2 • (e.g. try = 20 and = 40) 3 - “how much K do you have to give up for an extra L, 2 while costs C remain the same” capital input K • 1 0 0 1 2 3 4 labour input L 5 6 7 7.3 Long-run costs • • • What does this look like - Isoquants (see indifference curves) - Isocost lines (see budget lines) - But important difference: cost level is not fixed Cost minimization - Given factor prices find combination of inputs that minimizes costs required to produce a certain level of output - Graphically: hit relevant isoquant with lowest possible isocost line Note: - Cost minimization is necessary condition for profit maximization - All combinations on an isoquant are technologically efficient - But only the cheapest combination (given factor prices), i.e. combination on the lowest isocost line, is economically efficient 7.3 Long-run costs • Example: : w=10 & r=5; find the cheapest way to produce 24 Find the lowest possible cost line - C=30 clearly too low 7 q=24 - Shift right until you hit the isoquant 6 At optimal point 5 - Equal slopes: MRTS=ratio of prices - “rate at which inputs can be 4 substituted = rate at which they can 3 be traded” 𝑀𝑃 𝑤 𝑀𝑃 𝑀𝑃 2 - Formally: 𝐿 = → 𝐿 = 𝐾 capital input K • • - 𝑀𝑃𝐾 𝑟 𝑤 𝑟 ‘Last euro rule’ Counter example: 𝑀𝑃𝐿 = 𝑀𝑃𝐾 safe 5 by replacing one L by 1 K 1 C=35 C=30 0 0 1 2 3 4 labour input L 5 6 7 7.3 Long-run costs • Conclusion: our analysis gives the cheapest way to produce a specific output level, given specific factor prices • Three obvious questions: 1. What happens when factor prices change? 2. What is the cheapest way of producing other outputs? 3. What determines the shape of the long-run cost curve(s)? 7.3 Long-run costs capital input K 1. What happens when factor prices change? • with w = 10 and r = 5, use L = 2 and K = 3 to produce q = 24, at min. cost of C = 35 • Imagine w falls to 2.5 - same isoquant 7 - shallower isocost line 6 - Now tangency at 5 L=3, K=2, C=17.5 4 • Two reasons for lower C 3 1. Old bundle cheaper 2 2. Substitute to relatively Q=24 1 cheaper L 0 • Changing prices change 0 1 2 3 4 5 6 7 8 9 10 11 12 13 costs and input mix labour input L 14 7.3 Long-run costs q=48 capital input K 2. What is the cheapest way of producing other output levels? • Assume again w=10 and r=5 know for q=24 L=2, K=3, C=35 7 q=24 • Add new isoquant, e.g. q=48 6 - L=4, K=6, C=70 5 • Connect tangency points to find expansion path 4 - Cheapest input combinations for 3 different levels of q 2 • Plot associated C against q → long-run cost curve 1 C=35 - Minimum costs per output level 0 ceteris paribus: factor prices 0 1 2 3 C=708 4 labour input L 5 6 7 7.3 Long-run costs 3. What determines the shape of the long-run cost curve(s)? • Returns to scale • Ex.: take w = 10, r = 10 and draw some typical isoquants Constant r2s Increasing r2s 6 4 2 8 6 6 capital input K capital input K capital input K 8 4 2 0 2 4 6 0 8 2 4 6 0 8 80 80 60 40 20 0 15 Output Q 20 25 30 4 6 8 100 60 40 20 80 60 40 20 0 0 10 2 labour input L Long-run cost C 100 Long-run cost C 100 5 2 labour input L labour input L 0 4 0 0 0 Long-run cost C Decreasing r2s 8 0 5 10 15 Output Q 20 25 30 0 5 10 15 Output Q 20 25 30 7.3 Long-run costs • Conclusion: - Constant returns: output rises in proportion with inputs costs rise in proportion to output AC constant - Increasing returns: output rises faster than inputs costs rise less than output AC falling, “economies of scale” - Decreasing returns: output rises less than inputs costs rise faster than output AC rising, “diseconomies of scale” 7.3 Long-run costs • • 350 60 300 50 250 Cost-per-unit • Typical shape long-run cost curve for competitive firms: initially increasing returns, then decreasing returns U-shaped AC- and MC-curves Same geometrical relations as in the short run: MC: slope of tangent to C = derivative of C AC: falls when MC < AC, rises when MC > AC → MC intersects AC at its minimum Cost level • • 200 150 40 MC 30 AC 20 100 10 50 0 0 2 4 6 Output Q 8 10 0 12 0 2 4 6 Output Q 8 10 12 7.3 Long-run costs • • Mathematical approach I) App. 7C: the Lagrange method; “constrained maximization” II) Alternative: translate the graph into math mathematically equivalent: this is what we’ll do Ex.: derive the long-run cost function when 𝑞 = 10𝐿0.5 𝐾 0.5, with w = 20 and r = 5 - Note: this Cobb-Douglas production function has constant returns to scale 𝐾0.5 𝐿0.5 𝑀𝑃𝐿 = 5 𝐿0.5 , 𝑀𝑃𝐾 = 5 𝐾0.5 • Long-run cost function gives minimum costs for any level of q • This is achieved by choosing the cheapest input bundle (L,K) that can produce this q • • - 𝐶 = 𝑤𝐿 + 𝑟𝐾 → 𝐶 𝑞 = 𝑤𝐿 𝑞 + 𝑟𝐾 𝑞 i) The cheapest input bundle for producing amount q must lie on the q-isoquant ii) Isocost line through the cheapest input bundle for q must be tangent to the q-isoquant 7.3 Long-run costs • • i) The cheapest input bundle for producing amount q must lie on the q-isoquant - 𝑓 𝐿, 𝐾 = 𝑞 → 𝑞 = 10𝐿0.5 𝐾 0.5 ii) Isocost line through the cheapest input bundle for q must be tangent to the qisoquant 𝐾0.5 𝐿 𝐿0.5 5 0.5 𝐾 5 0.5 - 𝑀𝑃𝐿 𝑤 = → 𝑀𝑃𝐾 𝑟 20 𝐾 20 - 10𝐿0.5 (4𝐿)0.5 = 𝑞 20𝐿 = 𝑞 𝐿 𝑞 = 0.05𝑞, K 𝑞 = 0.20𝑞 𝐶 𝑞 = 𝑤𝐿 𝑞 + 𝑟𝐾 𝑞 = 20 ∗ 0.05𝑞 + 5 ∗ 0.2𝑞 = 2𝑞 - Constant returns to scale with MC=AC=2 = 5 → 𝐿 = 5 →𝐾 = 4𝐿 (expansion path) 7.4 Lower costs in the long-run • • • Relation between short-run and long-run costs Basic message: LRAC<SRAC at any q - K fixed in the short run - Equal if (short-run) K is at the optimal level - In the long-run firm chooses K so K is always at it’s optimal level - Note the ‘envelope property’ (Fig. 7.9) - Additional reasons - Technological progress - Learning by doing Read this at home Application • • Opportunity costs of government policy - Spending more on policy x either means higher taxes (which?) or less spending elsewhere - Costs of taxation usually larger than the tax revenue - Deadweight loss and bureaucracy - Benefits of spending equally difficult to measure - Not equal to the effect on GDP - Conversely cutting spending can have more costs than the raw number suggests - E.g. government spending may have induced others to spend Businesses might face similar difficulties - E.g. effect of reducing employee benefits on future recruitment Limitations and extensions • • Time dimension - Spend money now to make money later - Matters when costs occur - Interest rate as opportunity costs of spending now rather than later - Therefor work with net present value With more than 2 inputs we could get more than 1 optimum