The Challenger Sale: Taking Control of Customer Conversations

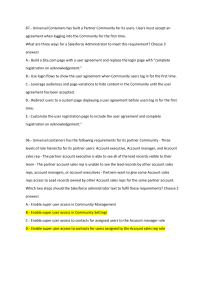

advertisement