Accounting Basics: Users, Methods, and Environment

advertisement

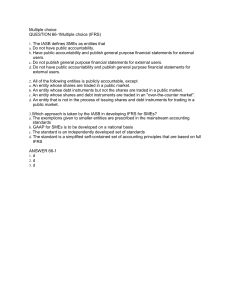

MODULE 1: ACCOUNTING INFORMATION – USERS AND USES (8/19/2024) BASICS OF ACCOUNTING • • Good decision-making depends on good information Accounting – “language of business” • Helps the business communicate its “financial health status” to various interested users, who in turn, use these information in their decisionmaking process. • • Economic/Quantitative/Financial information – the backbone of accounting is financial information. All accounting reports are based on the quantitative information applicable to a certain economic entity Economic Entity – may refer to a person, forprofit organization, non-profit organization, or governmental entity capable of transacting with other persons, for-profit organization, nonprofit organization, or governmental entity. NATURE OF BUSINESS • • GENERAL STEPS OF ACCOUNTING Business – organization in which basic resources are assembled and processed to provide goods and services to customers. Generally, most businesses’ objective is to earn profit BUSINESS ACTIVITIES 1. Operating Activities – generate revenues (selling, providing services) 2. Investing Activities – acquire long term assets (construction, investing in equipment needed) 3. Financing Activities – obtain funds FORMS OF BUSINESS ORGANIZATIONS 1. Single Proprietorship – single owner 2. Partnership – owned and managed by two or more - Creditors may go after the separate assets of partners 3. Corporation – owned by stockholders - Separate legal entity: liable for its own liabilities, therefore, creditors cannot go after the separate assets of stockholders - Have a lot more opportunities for funding - Life of corporation is separate to the life of owner 1. Identifying (business transactions) 2. Measuring (record, classify, summarize) 3. Communicating (provide information, accounting reports) prepare Identification – process of selecting economic events or transactions; may be internal (within the entity) or external (involves outsiders) events. Recording – process of inputting the financial information in the entity’s book of accounts and summarizing them. Communicating – involves the preparation of accounting reports, and analyzing and interpreting them for the users BOOKKEEPING • A more familiar term used by laymen in lieu of the word “accounting” is bookkeeping. • A step under the recording activity. • Involves journalizing of the transactions and posting to the respecting ledgers, up to the preparation of trial balances. BOOKKEEPING VS ACCOUNTING ➢ ➢ Bookkeeping - a routine recording process subsequent to transaction analysis - Relating only to the recording of transactions - A component of accounting Accounting - Involves the analysis of transactions - Includes providing information for decisionmaking and can affect the economic consequences USERS AND THE RELEVANT ACCOUNTING METHODS RELATIONSHIP OF ACCOUNTING TO BUSINESS • ACCOUNTING is the language of BUSINESS - Provides information for making informed decisions about how to best use the available resources of an organization - Products of the accounting process may be used by the users to determine the best use of the available resources of the organization and determine the best strategy in managing the organization’s obligations. - Accountants play two roles with regard to these activities: ➢ Measuring and reporting (through the accounting cycle) ➢ Advising • Managerial accounting produce reports that are available for use of internal users only since these may contain sensitive internal management strategies which, when released to outsiders, may compromise the entity’s competitive position against other parties. - ex. budgets, forecasts, variance reports, cost schedules, sales reports, procurement reports • Financial accounting focuses on producing reports for use of both internal and external users 1|ba 99.1 WHO USES ACCOUNTING INFORMATION? IASs are discontinued since the IASC was dissolved and replaced by the IASB. Hence, there is no existing conflict between IFRS and IAS. ORGANIZATIONS WHICH INFLUENCE THE ACCOUNTING PROFESSION • • Internal Users – the people who run/manage the organization (top management; HR, marketing, finance, sales, procurement, accounting departments) External Users – people outside the organization. - Considered interested users since these may have financial interests to the organization (investors and creditors), regulatory agencies (primarily government agencies), and others (labor unions) - Labor unions are considered external users because their interest focuses on themselves rather than the entity. ACCOUNTING ENVIRONMENT AND THE PROFESSION IMPORTANT FACTORS THAT INFLUENCE IN WHICH ACCOUNTING OPERATES 1. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP) • Common set of accounting standards that indicate how to report economic events • Compliance with GAAP ensures the consistency of the presentation of financial information so as not to mislead users • The Philippines adopts the accounting standards issued by the International Accounting Standards Board (IASB) • These standards are called International Financial Reporting Standards (IFRS), locally known as Philippine Financial Reporting Standards (PFRS). The IFRS comprise the following set of standards: 1. IFRS, as issued by the IASB 2. International Accounting Standards (IAS), as issued by the International Accounting Standards Council (IASC) 3. Official interpretations of the IFRS, as issued by the IFRS Interpretations Committee (IFRIC) • Securities and Exchange Commission (SEC) - provides protection to the general public by exercising supervisory powers over partnerships and corporations, capital market participants, and investment markets. • Philippine Institute of Certified Accountants (PICPA) - regulates the accountancy profession in the Philippines, and the PICPA serves as its arm in the implementation of the applicable laws and regulations. • Bureau of Internal Revenue (BIR) - as the tax administrator of the country, is mandated to implement the tax laws and ensure that the taxpayers pay correct taxes. Public 2. INTERNATIONAL BUSINESS • the international nature of business requires companies to be able to make their financial statements understandable to users all over the world. • Multinational businesses are required to adopt IFRS to ensure the compatibility of the financial statements worldwide • The way organizations conduct business may also open up opportunities in unexplored areas in the accounting profession. - Ex. Availability of cryptocurrency as a method of investment. (as a result of the said development, accounting standards were revisited to check where cryptocurrencies fit in, and new jobs such as crypto brokers were created. 3. ETHICS • the standards of conduct by which actions are judges as right or wrong, honest or dishonest, and/or fair or not fair. • Steps to analyze the ethical impact of the situation 1. Recognize an ethical situation and the ethical issues involved - Use your personal ethics 2. Identify and analyze the principal elements in the situation - Identify the stakeholders – persons or groups who may be harmed or benefited 3. Identify the alternatives, and weigh the impact of each alternative on various stakeholders. 4. TECHNOLOGY • • • Computer technology allows companies to easily gather information and compile large amounts of data quickly and accurately Lendors and investors are able to acquire and analyze financial information in an effective and efficient manner Technology has not replaced judgement 2|ba 99.1